United Kingdom

Law Decoded: The long waves in the aftermath of UST’s crash, May 16-23

It’s been two weeks since the shock of the TerraUSD (UST) depegging, but the long waves of this event are still coming in. The Congressional Research Service described the UST crash as a “run-like” scenario and claimed that the crypto industry has not reached the same level of “adequate regulating” as the traditional finance market. Michael Barr, former advisory board member of Ripple Labs and United States President Joe Biden’s pick for a vice chair for supervision at the Federal Reserve, definitely agrees with that. During the confirmation hearing, he mentioned “some significant risks” that innovative technologies and cryptocurrencies, in particular, bring along. It’s not only in the U.S. where the regulators got concerned about stablecoins. The executive director of markets ...

FCA will ‘absolutely’ consider recent stablecoin depegging when drafting crypto rules: Report

Sarah Pritchard, the executive director of markets at the United Kingdom’s Financial Conduct Authority, or FCA, reportedly said the regulator will look at the recent volatility in the crypto markets when creating rules for the space in 2022. According to a Friday Bloomberg report, Pritchard said the financial regulator will “absolutely” take into account stablecoins like TerraUSD (UST) and Tether (USDT) depegging from the U.S. dollar in drafting regulatory guidelines with Her Majesty’s Treasury for release later this year. While the USDT price only briefly dropped to $0.97 on May 12, UST’s has fallen more than 93% since May 9 to reach roughly $0.06 at the time of publication. “It really shows at front of mind the really significant issues that exist here, both in terms of a well-func...

UK Treasury en route to legalizing stablecoins amid Terra’s UST crash

United Kingdom’s Department of Treasury, or Her Majesty’s Treasury, has reportedly decided to go ahead with regulating stablecoins as legal tender. While welcomed by the crypto community, the decision comes as a shocker due to its proximity to the recent fall of one of the most popular algorithmic stablecoin, TerraUSD (UST). A local report from The Telegraph highlighted the Treasury’s intent to regulate stablecoins across Britain, which was revealed during the Queen’s Speech. During the speech, Prince Charles announced the introductions of new legislation across various sectors, including measures to drive economic growth to improve living standards in the region, adding: “A bill will be brought forward to further strengthen powers to tackle illicit finance, reduce economic crim...

Major Labels Bolster Diversity of Music Teams With ‘A&R Academies’

LONDON — Growing up in the town of Watford, located 15 miles outside of London, Zara Stewart dreamed of pursuing a music career. But she felt she lacked the connections or background to make it a reality. “I assumed it was an industry where it was all about who you know,” says Stewart. “And I didn’t know anybody.” Believing music wasn’t a viable option, Stewart focused her education on languages, studying Spanish and Portuguese at Leeds University. After graduating in 2019, she briefly worked in fashion retail and medical recruitment, but still found herself pining for a job in the record business. Now Stewart, 25, has landed her dream job as a paid A&R intern at Sony Music UK imprint Dream Life Records. She joined the company earlier this year as part of its A&R Academy – one of s...

UK government targets crypto in latest legislative agenda

The United Kingdom has introduced two bills, both concerning the seizure of and support for cryptocurrencies as part of Prince Charles’ remarks at the State Opening of Parliament. In a Tuesday publication released by the U.K. Prime Minister’s Office, the government said it will address crypto regulation in the country with the introduction of the Financial Services and Markets Bill and theEconomic Crime and Corporate Transparency Bill. The former aims to strengthen the country’s financial services industry, including by supporting “the safe adoption of cryptocurrencies.” According to the proposed financial services law, the measure will “[cut] red tape in the financial sector” in an effort to attract investors to the United Kingdom. The crime bill proposed “creating powers to more qu...

The new HM Treasury regulations: The good, the bad and the ugly

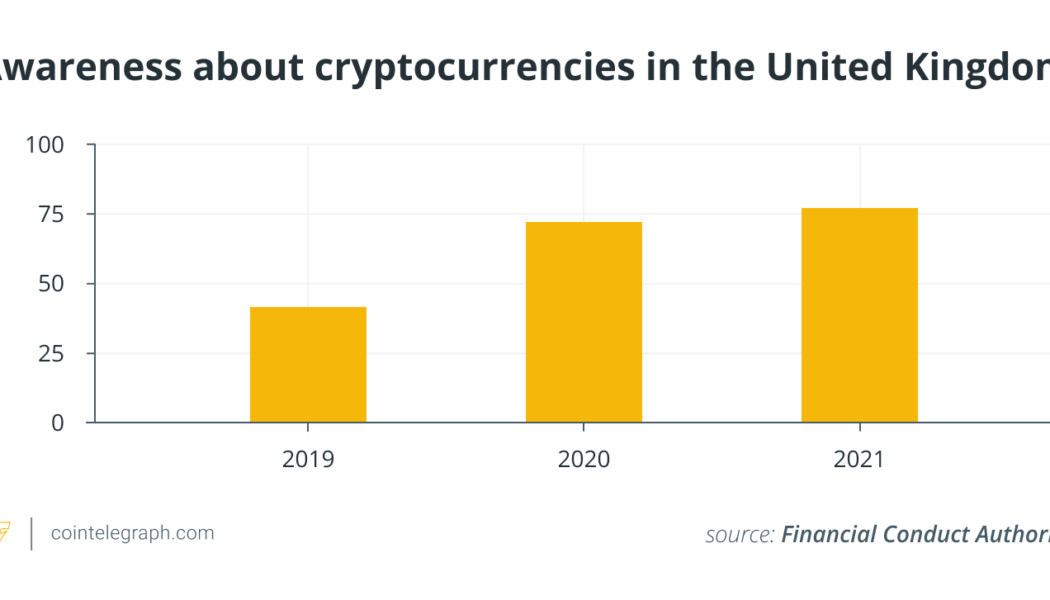

As the 2021-2022 United Kingdom tax year finished on April 5, 2022, Her Majesty’s Treasury announced they were paving the way for the U.K. to become a global crypto asset technology hub. This could mean that the previously not particularly crypto-friendly U.K. is changing its strategy and trying its hand at making crypto investments more attractive. But what are the potential scenarios at play? The Financial Conduct Authority (FCA), a financial regulatory body in the U.K., in its “Cryptoasset consumer research 2021” report, shows that approximately 2.3. million adult U.K. citizens held crypto in 2021, a 21% rise year-over-year. It seems natural that with rising interest and potential crypto mass adoption, HM Treasury would revisit its crypto regulations. This is especially true when ...

Top universities have added crypto to the curriculum

The world of digital assets saw a significant rise last year. The total cryptocurrency market cap reached $3 trillion, making more people, governments and universities take a closer look at the asset class. The presence of crypto in the world’s major economies has created a big opportunity for diverse startups in the industry, leading to a massive demand for digital assets. This newly born market has helped develop more working and educational opportunities, among other things. Furthermore, some of the world’s top universities and educational institutions including MIT, the University of Oxford and Harvard University, have added pieces of the burgeoning technology to their curriculums. Here are some of the top universities that have added blockchain-related subjects to their syllabus...

Number of UK crypto firms operating under FCA temporary registration status drops

The number of firms permitted to offer crypto services to U.K. residents under temporary registration status from the Financial Conduct Authority has dropped from 12 to five. According to a Thursday update to its list of “Cryptoasset firms with Temporary Registration,” the United Kingdom’s financial regulator named CEX.IO, Revolut, Copper, Globalblock and Moneybrain as companies in the crypto space allowed to operate in the country in addition to the 34 registered crypto asset firms the FCA has approved since August 2020. The FCA said on March 30 that it would be extending the temporary registration status for “a small number of firms where it is strictly necessary,” which included 12 companies at the time. In the United Kingdom, firms permitted to “carry out crypto ...

UK financial watchdog extends registration deadline for some crypto firms

The Financial Conduct Authority, the United Kingdom’s financial regulator, has extended the temporary registration status of some firms offering crypto services beyond its Friday deadline. In a Tuesday statement, the FCA said “a small number of firms” in the crypto space will continue to have temporary registration status in the United Kingdom “where it is strictly necessary.” The financial regulator reiterated that temporarily exempting the crypto firms from its previously announced Friday deadline “does not mean that the FCA has assessed them as fit and proper” but included situations in which a company “may be pursuing an appeal” or was still in the process of winding down operations. “Only firms that are registered with us or on our list of firms with temporary registration can continu...

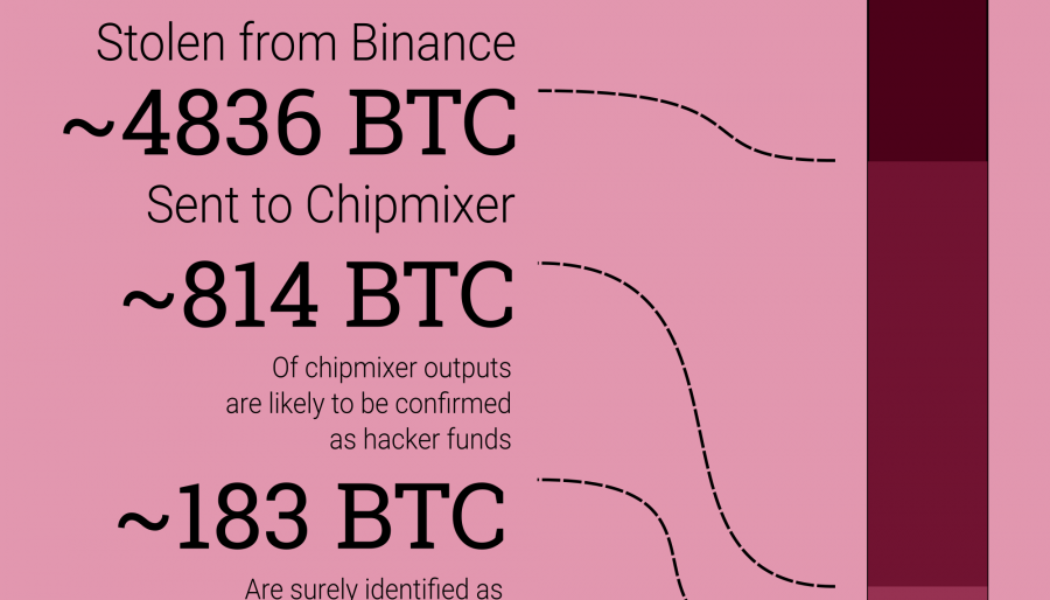

NCA wants regulation for coin mixers, but the crypto industry is already one step ahead

The United Kingdom’s National Crime Agency (NCA) seeks to regulate the crypto coin mixers under the country’s laws against money laundering. Coin mixing tools are popular in the decentralized world as they maintain the privacy of transactions. These tools often mix several transactions to obscure the origin of a particular transaction. Then the recipient receives the transactions from a mixing “black box” comprised of hundreds of transactions from various wallets. While privacy-focused, these tools often face regulators’ ire as they are also a known way for hackers and criminals to wash their funds. Gary Cathcart, the NCA’s head of financial investigation, claimed that these transaction mixing tools offer a layer of anonymity to criminals that can be use...