Uniswap

Market changes suggest SOL, UNI, AAVE, and MANA are ripe to buy, Santiment analyst says

A Santiment analyst has said these tokens are in a good zone for investors who want to buy into trader pain. Optimism on Solana grows as development activity continues to rise. In a recent YouTube video, the director of marketing at crypto analytics firm Santiment Brian Quinlivan highlighted a few altcoin ecosystems whose metrics show that they are set for a surge. The metric in question is market value to realized value (MVRV). MVRV shows the average loss or profit of a crypto token’s coins in circulation at the current price. It helps indicate to willing buyers when the time is right to do so. Uniswap (UNI) Despite the number of daily active addresses on the ecosystem falling sharply (from 3,259 on October 29, up to a recent 836 active ones), Quinlivan reviewed the asset’s 30-day long MV...

Santiment analysis indicates XRP and Uniswap are entering an opportunity zone

On-chain data shows several altcoins could be set for an upturn as they approach historical opportunity zones Uniswap has recently hit an all-time negative low in MVRV, and XRP is on an eight-month low in this metric Blockchain analytics firm Santiment today reviewed the top altcoins that investors should look to after the sour January they have experienced with the markets. Over the course of the month, the markets have neither spared short-term nor mid-term investors, with the majority seeing trading losses at differing degrees. Advising traders to jump on the opportunity to buy low while others sulk, Santiment reviewed MVRVs of crypto assets and came up with a list of 150 assets that are prime for investment. The analytics firm justified the selection, noting that the tokens show “...

Users flock to Curve amid lack of stablecoin liquidity on major DEXs

In a Tweet posted by user @cryptotutor Friday, a screenshot appears to show a 27% spread between stablecoin Magic Internet Money (MIM) and USD Coin (USDC) trading pair on decentralized exchange, or DEX, Uniswap (UNI). Both have a theoretical peg of 1:1 against the U.S. Dollar. “Magic Internet Money,” joked cryptotutor, as he attempted to swap approximately $1 million in MIM but received a quote for only 728.6k USDC. Others quickly took to social media to complain as well. In another screenshot, user @DeFiDownsin allegedly received a quote to swap $984k worth of MIM for just 4,173 in USDT on SushiSwap (SUSHI). Swapping $1M in $MIM gives $730K in $USDC on Uniswap ‘Magic Internet Money’ pic.twitter.com/CKowe6dwJR — Tutor (@cryptotutor) January 27, 2022 Curve, a popular...

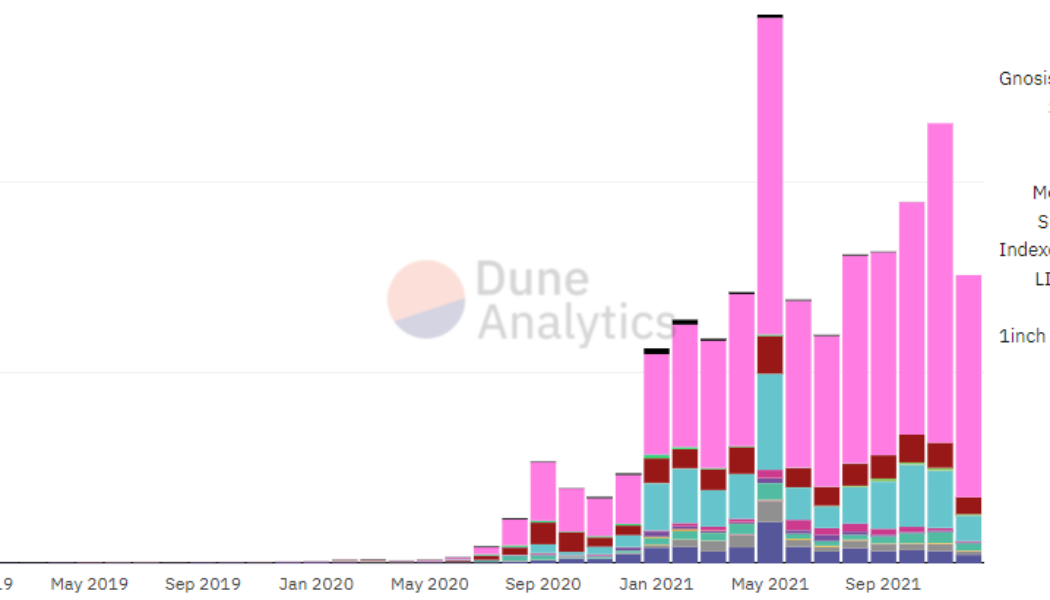

5 cryptocurrency projects that made waves in 2021

2021 was a breakout year for the cryptocurrency market in many respects and most investors are absolutely thrilled that Bitcoin (BTC) price established a new all-time high of $68,789. In the same timeframe, Ether (ETH) went on a parabolic rally which saw its price gain 565% from Jan. 1 to hit a record high at $4,859 on Nov. 10. While it was a banner year for large cap cryptocurrencies, some of the biggest gains and most impactful developments came from the altcoin market where decentralized finance (DeFi) and nonfungible tokens (NFTs) rallied by thousands of percent and helped to usher in a new level of awareness and adoption for blockchain technology and cryptocurrencies. Here’s a look at five altcoin projects that made significant contributions to the cryptocurrency ecosystem in 2021. Un...

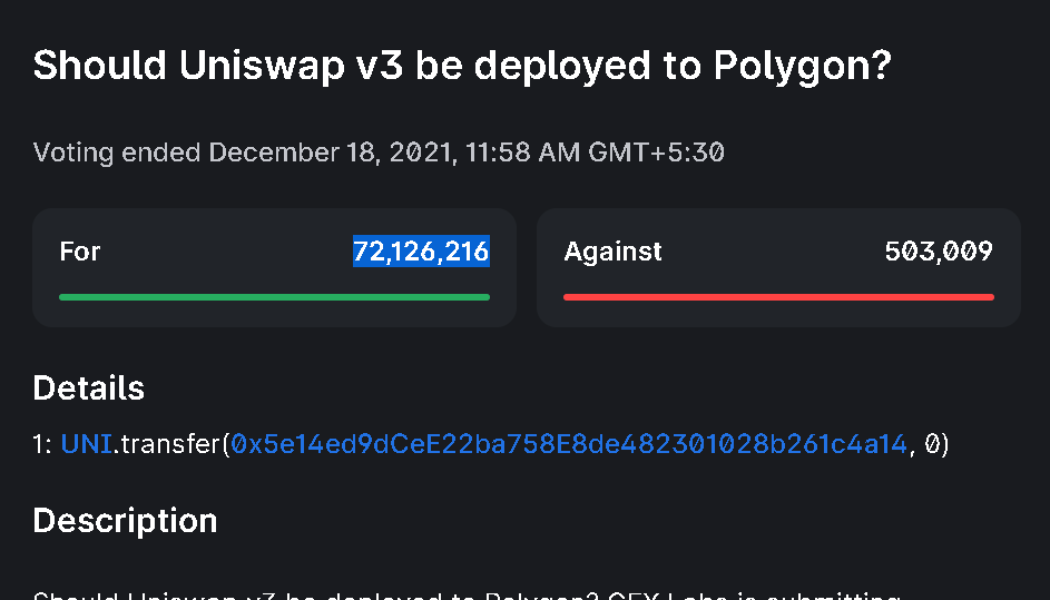

Uniswap v3 contracts deployment on Polygon approved with 99.3% consensus

The Uniswap community has approved the governance proposal that sought deployment of Uniswap v3 contracts over the Polygon PoS Chain. The approval comes in the form of an on-chain vote that saw the participation of over 72.6 million users from the community. Uniswap Labs announced to deploy Uniswap v3 contracts based on the votes that reflected over 99.3% approval consensus and will be supported by a $20 million fund — $15 million for long-term liquidity mining campaign and $5 million for the overall adoption of Uniswap on Polygon (MATIC). The Uniswap community has voted to deploy v3 on @0xPolygon through the governance process. ⚡️ Uniswap Labs will deploy Uniswap v3 contracts within a few days. Stay tuned. pic.twitter.com/LwVLwEngPl — Uniswap Labs (@Uniswap) December 18, 202...