Uniswap

DeFi summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms

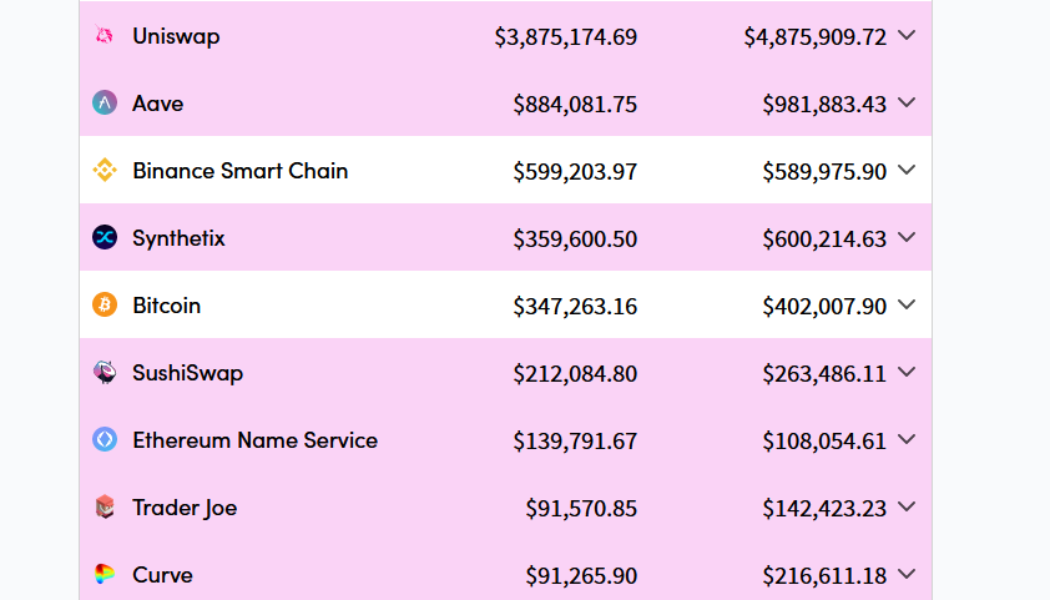

Decentralized exchange (DEX) Uniswap has overtaken its host blockchain Ethereum in terms of fees paid over a seven-day rolling average. The surge appears part of a recent spate of high demand for DeFi amid the current bear market. Decentralized finance (DeFi) platforms such as AAVE and Synthetix have seen surges in fees paid over the past seven days, while their native tokens, and others such as Compound (COMP) have also boomed in price too. According to data from Crypto Fees, traders on Uniswap accounted for an average daily total of $4.87 million worth of fees between June 15 and June 21, overtaking the average fees from Ethereum users which accounted for $4.58 million. Uniswap’s most advanced V3 protocol (based on the Ethereum mainnet) accounted for the lion’s share of the total f...

Uniswap acquires NFT marketplace aggregator Genie to further ‘universal ownership’ goals

Decentralized exchange Uniswap announced the acquisition of the NFT marketplace aggregator Genie on June 21st. Uniswap said this move is part of its mission to unlock universal ownership and exchange on its platform. Uniswap is now integrating NFTs into its product line beginning with the Uniswap web app and later integrations are said to include developer APIs and widgets. This isn’t the first time Uniswap has worked with NFTs. In the spring of 2019 it launched Unisocks which offered NFT liquidity pools backed by real-world assets. Uniswap said in the announcement, “We’re excited to bring what we’ve learned building DeFi products to NFTs.” In August Uniswap said it planned to airdrop USDC to historical Genie users in an effort to share the value of this acquisition and integration. Uniswa...

Former president of the New York Stock Exchange joins Uniswap Labs as an advisor

On Wednesday, Uniswap announced that former New York Stock Exchange president Stacey Cunningham will join the company as an advisor. Cunningham served as the first female president of the New York Stock Exchange after beginning her career as a trader on its floor. She said in a statement that she believes in the potential of Uniswap’s commitment to fairer markets.Uniswap is betting on her experience with TradFi translating over to DeFi to further help them evolve their place in Web3. Cunningham has also been listed as one of BBC’s 100 Women, and joined the NYSE board of directors in December 2021. 1/ We are beyond honored to welcome Stacey Cunningham @stacey_cunning, former president of the New York Stock Exchange @NYSE, as an Advisor to Uniswap Labs. — Uniswap Labs (@Uniswap) J...

Finance Redefined: Uniswap breaches $1T volume, WEF 2022 discussion on Terra, and more

The decentralized finance (DeFi) ecosystem continues to struggle with the ongoing market volatility and after-effects of the Terra ecosystem collapse. Over the past week, major DeFi protocols showed signs of increased trading activity, with Uniswap breaching the $1 trillion trading volume mark. Terra remained the focus of most of the discussions around blockchain and crypto at the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to pay out millions after Terra collapse, while interest in Ethereum Name Services (ENS) shattered new records. Top DeFi tokens by market cap had a mixed week of price action, with several tokens in the top 100 registering double-digit gains over the past week, while many others continue to trade ...

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

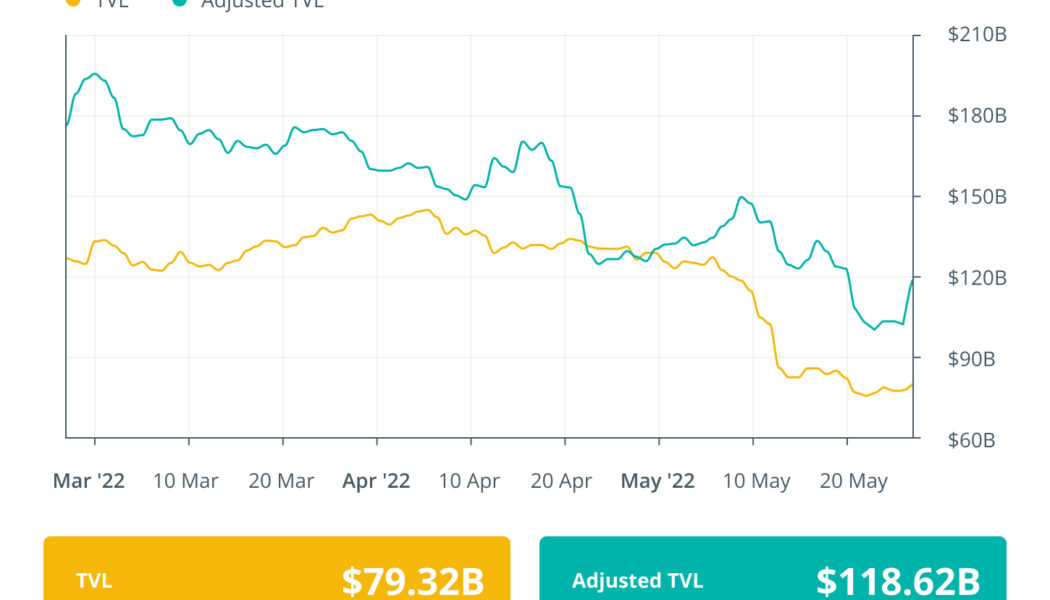

Weak stocks and declining DeFi use continue to weigh on Ethereum price

Ether’s (ETH) 12-hour closing price has been respecting a tight $1,910 to $2,150 range for twelve days, but oddly enough, these 13% oscillations have been enough to liquidate an aggregate of $495 million in futures contracts since May 13, according to data from Coinglass. Ether/USD 12-hour price at Kraken. Source: TradingView The worsening market conditions were also reflected in digital asset investment products. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, crypto funds and investment products saw a $141 million outflow during the week ending on May 20. In this instance, Bitcoin (BTC) was the investors’ focus after experiencing a $154 weekly net redemption. Russian regulation and crumbling U.S. tech stocks escalate the situation Regula...

Luno Secures 10-Million Customers in over 40 Countries

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Uniswap launches venture capital wing for Web3 investments

Popular decentralized exchange (DEX) Uniswap has announced the formation of Uniswap Labs Ventures (ULV), a venture capital fund focused on investing in Web3 companies and projects. The firm will invest at any stage of development into various projects or technologies related to Web3, infrastructure, developer tools, and consumer-facing applications as areas of interest according to the announcement on Monday, April 11. The firm has already invested in 11 companies and Web3 protocols, including decentralized money market Aave, the decentralized autonomous organization (DAO) behind the DAI stablecoin, MakerDAO, and blockchain bridging protocol LayerZero. In the announcement, Uniswap expressed what it looked for in other projects it was interested in funding, but did not reveal any further pr...

Celo foundation proposes to deploy Uniswap V3 on its native blockchain

A new community proposal was introduced in the Uniswap governance forum to deploy the protocol on the Celo blockchain, which is a mobile-first, carbon-negative and Ethereum Virtual Machine-compatible network. The new proposal was created on behalf of Blockchain at Michigan, and in partnership with the Celo Foundation and the Celo Climate Collective. Once passed, Uniswap will be accessible to nearly six billion mobile phone users. Currently, MetaMask mobile app enables using Uniswap or other decentralized exchanges via an in-app browser. The Celo foundation will commit $10 million of CELO in Uniswap-specific user incentives and grants along with $10 million in financial incentives for Uniswap specifically, The main focus of deployment would be the introduction of green asset liquidity pools...

Finance Redefined: Uniswap builds token-swap feature for Ukraine, LUNA surpasses Ether, and more

The crypto community has emerged as one of the leading aid providers for Ukrainians, as crypto donations surged over $50 million. This week, many in the decentralized finance, or DeFi, community have come forward to donate and make it simpler for other people to donate to Ukraine. LUNA continued its price dominance with another double-digit surge over the past week and also flipped Ether to become the most staked altcoin. 1Inch launched a new secure peer-to-peer, or P2P, swap that the firm claimed could open the gates to several new use cases. Uniswap builds an interface to swap altcoins into ETH donations for Ukraine On Tuesday, decentralized exchange, or DEX, Uniswap launched an interface which directly converts ERC-20 tokens into Ether (ETH) and sends them to the official crypto w...

Altcoin Roundup: 3 portfolio trackers NFT and DeFi investors can use to stay organized

The cryptocurrency ecosystem has seen a tremendous amount of growth over the past couple of years, as the introduction of decentralized finance (DeFi) and the popularity of nonfungible tokens (NFT) have led to an explosion of projects on more than a dozen blockchain networks. The rapidly growing ecosystem means investors have to keep track of multiple wallet addresses, making portfolio trackers a popular option for traders needing to manage a diverse multichain portfolio. Here are three portfolio-tracking decentralized applications, or DApps, crypto traders can use to help monitor their investments. Zapper Zapper supports the basic management of cryptocurrencies held on 11 different networks including Ethereum, Polygon, BNB Chain, Fantom, Avalanche and Optimism. The basic layout of t...

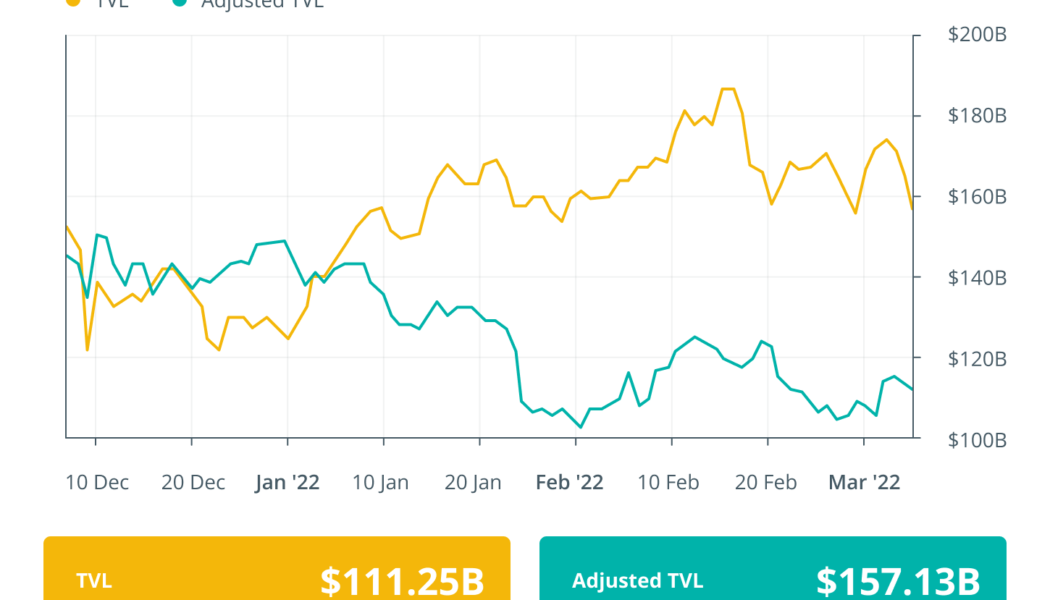

Ethereum price holds above $3K but network data suggests bulls may get trapped

When analyzing Ether’s (ETH) price chart, one could conclude that the 3-month long bearish trend has been broken for a few reasons. The current $3,100 price range represents a 43% recovery in 15 days and, more importantly, the descending channel resistance was ruptured on Feb. 7. Should Ether bulls start celebrating and calling for $4,000 and higher? That largely depends on how retail traders are positioned, along with the Ethereum network’s on-chain metrics. For instance, is the $30-plus transaction fee impacting the use of decentralized applications (dApps), or are there any other factors that will prohibit Ether’s price growth? Ether (ETH) price at FTX, in USD. Source: TradingView Since the 55.6% correction from the $4,870 all-time high to the cycle bottom at $2,...