Uniswap

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

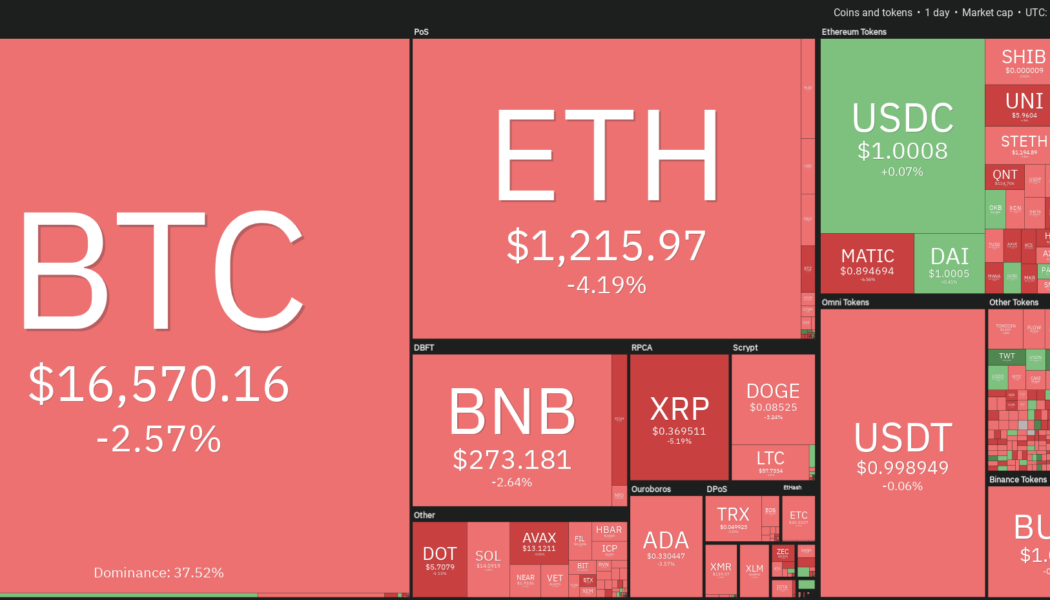

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

UNI tokens delegation was a ‘misunderstood situation,’ according to Binance’s CZ

The millions of UNI (UNI) tokens delegated by Binance were a “misunderstood situation,” said Binance CEO Changpeng “CZ” Zhao in a Twitter post, in response to questions about 13.2 million UNI tokens delegated on Oct. 18 that made Binance the second-largest entity by voting power in the Uniswap DAO. According to CZ, a UNI transfer between internal wallets caused the automatic delegation. He denie allegations about the crypto exchange using users’ tokens to vote. UNI transferred between internal Binance wallets, causing the UNI to be automatically delegated. This is part of their protocol, not “we intended”. Binance don’t vote with user’s tokens. Uniswap misunderstood the situation. Tokens come to popular platforms. #Binance https://t.co/KYPqFx5GrW — CZ Bi...

DEX dev Uniswap Labs looks for new funding at unicorn valuation: Report

Major decentralized exchange (DEX) Uniswap is in the early stages of raising significant funds to further expand its decentralized finance (DeFi) offerings, according to a new report. Uniswap Labs, a DeFi startup contributing to the Uniswap Protocol, is engaging with a number of investors to raise an equity round of $100 million to $200 million, TechCrunch reported on Sept. 30. The startup is working with investors like Polychain and one of Singapore’s sovereign funds as part of the upcoming funding round, the report notes, citing two anonymous people familiar with the matter. According to the report, Uniswap would be valued at $1 billion, but the terms of the deal are subject to changes as the discussions around the round have not been finalized. The new funding reportedly aims to bring m...

Uniswap eyes NFT financialization, in talks with lending protocols

Crypto exchange Uniswap engaged in talks with multiple nonfungible token (NFT) lending protocols, according to a social media post from Uniswap’s head of NFT product Scott Lewis. In the tweet, Lewis highlights the company’s interest in tackling both liquidity issues and “information asymmetry” surrounding NFTs. uniswap is the interface for all nft liquidity. we are now in talks with 7 nft lending protocols. we will be working with each one to solve for liquidity fragmentation and information asymmetry. this is the first step to building nft financialization. — Scott (@Scott_eth) August 23, 2022 While Uniswap’s goal of these talks and potential collaborations with lending protocols is NFT financialization, the crowd on Twitter came back with a double-sided response. Some users deemed ...

Top 5 cryptocurrencies to watch this week: BTC, ADA, UNI, LINK, CHZ

The S&P 500 rose for the fourth successive week as investors cheered on signs that inflation may have peaked. Bitcoin (BTC) and select altcoins also extended their recovery, suggesting that investors are increasing their exposure to risk assets. A similar trend has played out in the cryptocurrency markets. Altcoins, led by Ether (ETH), have outperformed Bitcoin after clarity on Ethereum’s Merge, according to analysts at Glassnode. Crypto market data daily view. Source: Coin360 However, trading firm QCP Capital is cautious about the momentum in the altcoin market. They highlighted that the open interest on Ether options had surged to $8 billion, exceeding Bitcoin option OI which was at $5 billion. Glassnode suggested that traders have been booking profits on the spread between their spo...

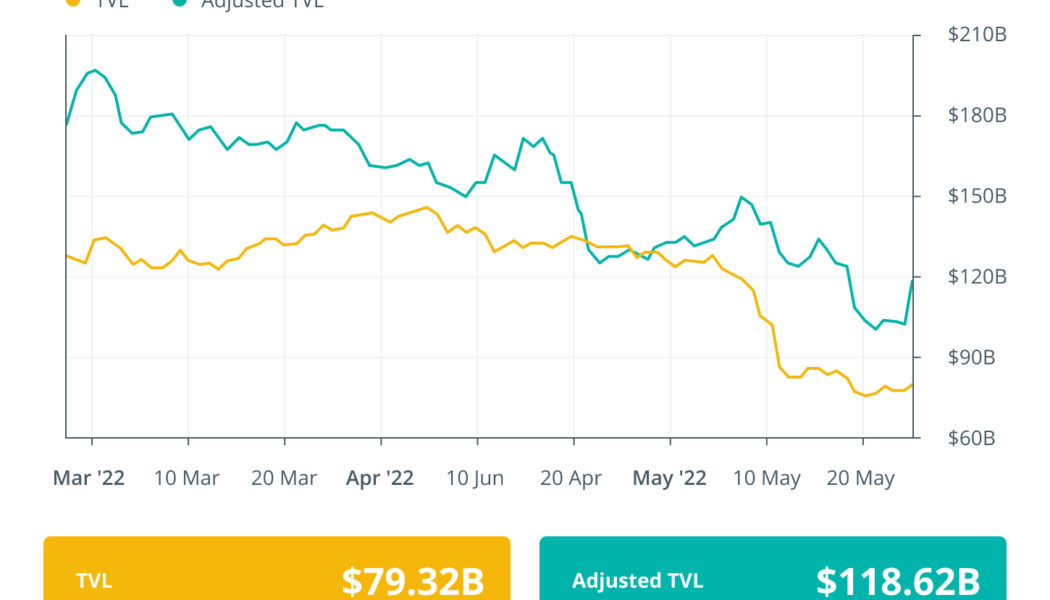

Finance Redefined: Solana and Nomad bridge fall prey to exploits losing millions

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, the DeFi ecosystem saw two exploits, one after another, resulting in the loss of millions of dollars. First, cross-bridge token platform Nomad became a victim of what many deemed a decentralized robbery, which saw almost $190 million drained out of their wallets. Solana ecosystem became the victim of a widespread unknown attack that saw thousands of wallets getting drained out of all the funds. Apart from a series of exploits, Nansen admitted their negligence toward the DeFi market during the NFT boom. The top-100 DeFi tokens had a mixed price action over the past week, with many seeing a downturn ...

Top 5 cryptocurrencies to watch this week: BTC, BNB, UNI, FIL, THETA

Bitcoin (BTC) has made a strong comeback in the month of July and is on track for its best monthly gains since October 2021. The sharp recovery in Bitcoin and several altcoins pushed the Crypto Fear and Greed Index to 42/100 on July 30, its highest level since April 6. Investors seem to be making the most of the depressed levels in Bitcoin. Data from on-chain analytics firm Glassnode shows that Bitcoin in exchange wallets has dropped to 2.4 million Bitcoin in July, down from the March 2020 levels of 3.15 million Bitcoin. This has sent the metric to its lowest level since July 2018. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodity strategist Mike McGlone highlighted that the United States Federal Reserve’s indication to consider rate hikes on a “meeting...

Uniswap’s 80% gains in July are in danger with UNI price painting a classic bearish pattern

Uniswap (UNI) looks ready to post its best monthly performance in more than a year as it rallied approximately 80% in July, but signs of an extended pullback in the near term are emerging. Uniswap price nearly doubles in July UNI’s price is having one of its best months ever, reaching nearly $9 on July 30 versus nearly $5 at the beginning of the month, best returns since January 2021’s 250% price rally. UNI/USD monthly price chart. Source: TradingView Merge FOMO an UNI “fee switch” proposal Uniswap’s gains primarily surfaced due to similar upside moves in a broader crypto market. But they turned out to be relatively massive due to an ongoing euphoria surrounding “the Merge.” Notably, the Ethereum blockchain’s potential transition ...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM

Cryptocurrency exchange Unizen has scored a $200 million investment from private equity group Global Emerging Markets (GEM) which it will use to expand its business and its ecosystem. Rather than receiving the $200 million in funding all at once, Unizen noted on June 27 that the investment will come in the form of a “capital commitment’, with part of the funding released upfront and the rest will be provided later based on achieved milestones. Unizen did not disclose what particular criteria it had to achieve to receive the funding. Unizen calls itself a “CeDeFi” exchange mixing features of both centralized exchanges (CEXs) and decentralized exchanges (DEXs), it runs on the BNB Chain, formerly called the Binance Smart Chain. It aims to attract both retail and institutional investors by fin...

Top 5 cryptocurrencies to watch this week: BTC, UNI, XLM, THETA, HNT

The United States equities markets witnessed a sharp comeback last week, led by the Nasdaq Composite which gained 7.5%. The S&P was up about 6.5% for the week while the Dow Jones Industrial Average managed a gain of 5.4%. Continuing its tight correlation with the equities market, the crypto markets are also attempting a relief rally. Bitcoin (BTC) has seen a modest recovery but some altcoins have risen sharply in the past week. This suggests that investors are taking advantage of the sharp fall in the price to accumulate altcoins at lower levels. Crypto market data daily view. Source: Coin360 Smaller-sized investors have been using the decline in Bitcoin to build their position to at least one Bitcoin. Glassnode data shows that the number of Bitcoin wallet addresses having more than on...

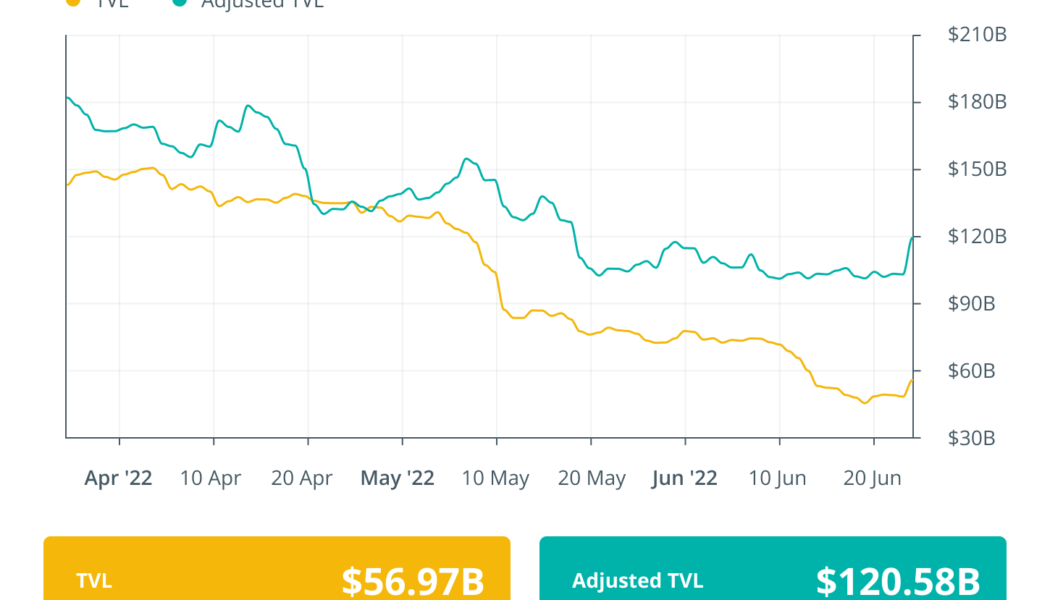

Finance Redefined: Uniswap goes against the bearish trends, overtakes Ethereum

This past week, the decentralized finance (DeFi) ecosystem tried gaining some momentum amid the bear market crash. Uniswap saw a trend reversal and overtook Ethereum regarding network fees paid. However, not all DeFi protocols were as lucky, as Bancor had to pause its “impermanent loss protection” in the wake of a hostile market. DappRadar’s report shows that the GameFi ecosystem continues to thrive despite the current downturn in the market. Solend invalidates Solana whale wallet takeover plan with second governance vote. The top 100 DeFi tokens showed signs of recovery after last week’s mayhem, and several of the tokens registered double-digit gains. DeFi Summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms Decentralized exchange (DEX) Uniswap has overtaken its host blockchai...