umg

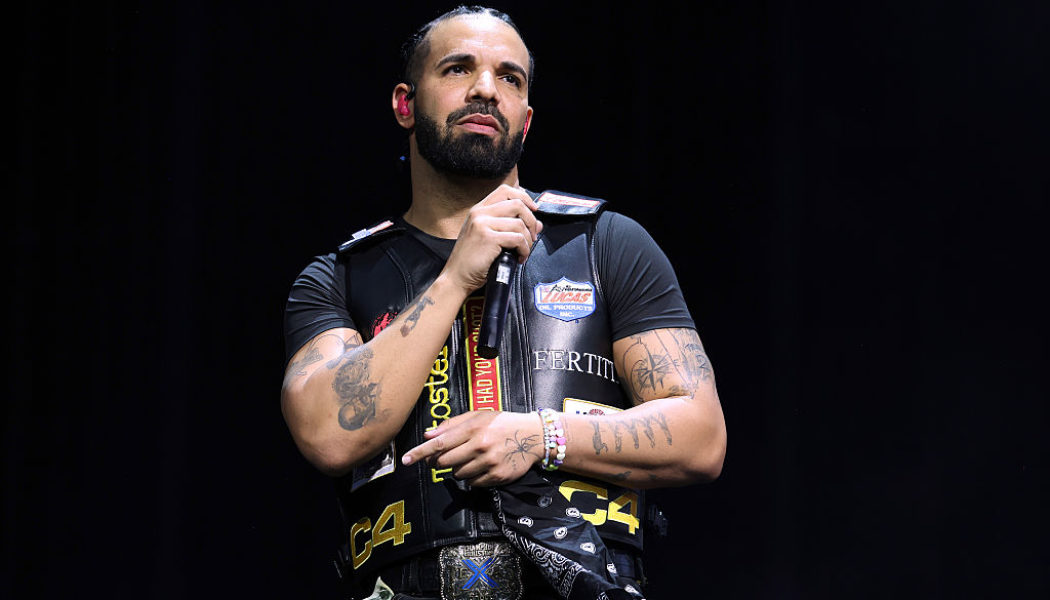

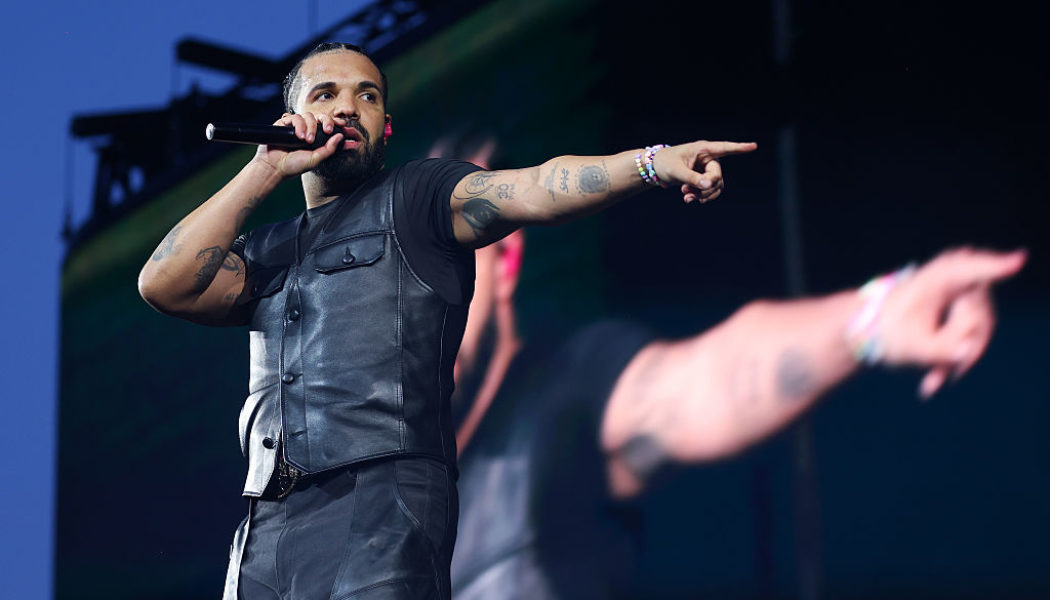

Drake To Appeal UMG Lawsuit Dismissal Over “Not Like Us”

Drake is continuing his legal fight against UMG after the record label won a legal victory earlier this year regarding Kendrick Lamar's hit.

UMG CEO Sir Lucian Grainge Swats Down Drake’s Latest Legal Move

In a sworn declaration, UMG CEO Sir Lucian Grainge called Drake's latest legal claims "groundless and indeed ridiculous."

Drake Demands UMG Reveal Kendrick Lamar “Not Like Us” Contract Details

Drake believes UMG signed off on "Not Like Us" being released with the controversial and brand-damaging "pedophile" lyric.

Drake & Kendrick Lamar Could Faceoff In Court As Testifying Witnesses In UMG “Not Like Us” Lawsuit

Drake's federal lawsuit has taken an interesting turn, with UMG allegedly seeking to subpoena both Drake and Kendrick Lamar to testify.

UMG Files Motion To Dismiss Drake’s Amended Lawsuit

Drake filed a complaint against UMG (Universal Music Group) over Kendrick Lamar's "Not Like Us" and the lyrics within.

UMG Calls Deposition Drake’s Lawsuit “Illogical” and “Frivolous”

Most rappers would just take the loss and move on with their life (See Ja Rule). Not Drake though.

Joe Budden Kicks Drake’s Back In Over Lawsuit Against UMG & Not “Not Like Us” Claims

Joe Budden took aim at Drake on episode 779 of his popular broadcast in the wake of the UMG lawsuit filed by the Canadian superstar.

Drake Accuses UMG Of Defamation In 2nd Legal Filing

Drake is doubling down. After initially accusing Universal Music Group (UMG) and Spotify of boosting Kendrick Lamar’s “Not Like Us” to his detriment, in a second filing, Drizzy claims that UMG and iHeartRadio defamed him in the process of making the song massive. According to Billboard, Drake filed this latest petition in Texas, and he […]

What Music Has Been Removed From TikTok After UMG Fallout?

Your music selection for your TikTok posts took a serious hit.

UMG Partners With Music Wellness App Vera to Help People With Dementia

Universal Music Group has been named the exclusive launch partner for Vera, a mobile application created by music wellness and technology company Music Health. Vera is an AI-driven music app designed specifically for people suffering with dementia. The technology used in the Vera application “allows Vera to curate the perfect song at the right time for every individual listener.” According to UMG, the venture took Music Health three years of rigorous research and development. The research included more than 20,000 hours of observation and analysis to effectively conclude that Vera had a positive impact on the quality of life of people with BPSD, or the Behavioural and Psychological Symptoms of Dementia. “We’ve built Vera to know and find the music that mea...

Why UMG’s Public Debut Boosted Warner & Other Music Stocks Too

Demand for UMG shares may have helped two more music companies: the share prices of French music distributor Believe SA and U.S. music rights company Reservoir Media increased 3.1% and 11.6%, respectively, on Tuesday. Investors also appeared hungry enough for UMG to purchase shares of Pershing Square Holdings, which has a 10% stake in UMG, and drive its share price up 5%. Sensing an opportunity, WMG’s owner, Access Industries, sold 2.34 million shares to Morgan Stanley & Co. on Tuesday for an unspecified amount. WMG could benefit from the added liquidity to the market. Although the shares represent less than 0.5% of WMG’s outstanding shares, WMG’s float – shares available for trading – represent about 19% of its shares, according to multiple financial sources. (UMG says its float is 42...

Universal Music’s Going Public: Here Are Your Options for Buying a Share

But U.S. investors won’t have easy access to UMG shares because they’re trading on the Euronext Amsterdam stock exchange, not a U.S. exchange such as the New York Stock Exchange or Nasdaq. So, besides Tuesday’s listing starting at 3 a.m. EST, U.S.-based investors will have other complications getting in on the action. Some brokerage accounts that cater to international trading, such as Interactive Brokers and Charles Schwab, provide access to exchanges in dozens of countries. However, these accounts are good for frequent, serious investors, not casual investors who might be burdened by tax issues, fees and currency fluctuations. Alternatively, a U.S. individual can eventually buy shares of a mutual fund that owns shares of UMG, or an exchange traded fund that includes UMG. The benefit is a...

- 1

- 2