U.S. dollar

USD stablecoin premiums surge in Argentina following economy minister’s resignation

Argentina, a country with one of the highest crypto adoption rates in the world, saw the price of dollar-pegged stablecoins surge across exchanges on Saturday after the abrupt resignation of its Economy Minister, Martin Guzman. The minister’s shock exit, confirmed on his Twitter account on July 3 via a seven-page letter, threatens to further destabilize a struggling economy battling high inflation and a depreciating national currency. According to data from Criptoya, the cost of buying Tether (USDT) using Argentinian pesos (ARS) is currently 271.4 ARS through the Binance exchange, which is around a 12% premium from before the resignation announcement, and a 116.25% premium compared to the current fiat exchange rate of USD/ARS. The local crypto price tracking website has also revealed...

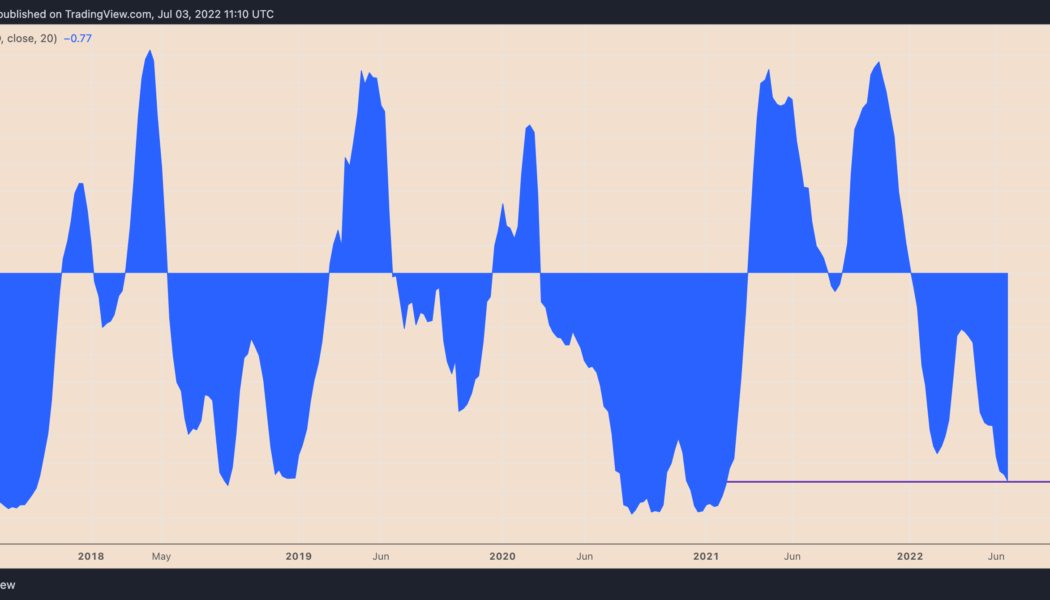

Bitcoin’s inverse correlation with US dollar hits 17-month highs — what’s next for BTC?

Bitcoin (BTC) has been moving in the opposite direction of the U.S. dollar since the beginning of 2022 — and now that inverse relationship is more extreme than ever. Bitcoin and the dollar go in opposite ways Notably, the weekly correlation coefficient between BTC and the dollar dropped to 0.77 below zero in the week ending July 3, its lowest in seventeen months. Meanwhile, Bitcoin’s correlation with the tech-heavy Nasdaq Composite reached 0.78 above zero in the same weekly session, data from TradingView shows. BTC/USD and U.S. dollar correlation coefficient. Source: TradingView That is primarily because of these markets’ year-to-date performances amid the fears of recession, led by the Federal Reserve’s benchmark rate hikes to curb rising inflation. Bitcoin, for example,...

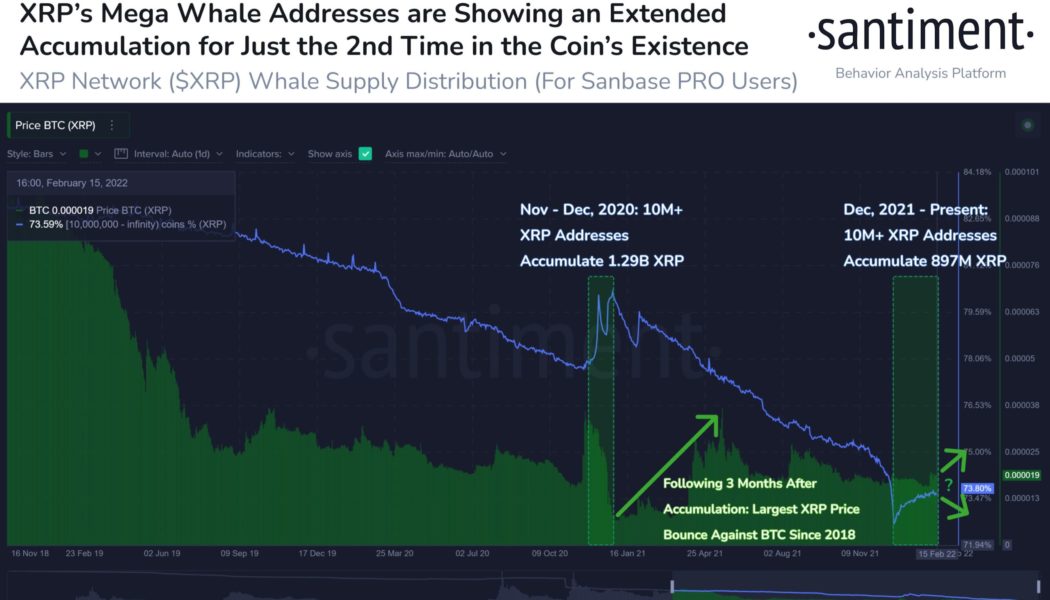

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

Naira stable at parallel, official market

Nigeria’s naira remained stable against the U.S. dollar at the unofficial market on Friday, data posted on abokiFX .com, a website that collates parallel market rates in Lagos showed. The data posted showed that the naira closed at N485.00 at the black market, the same rate it exchanged hands with the greenback in the previous session on Thursday. Similarly, the local unit remained stable at the official market. Data posted on the FMDQ Security Exchange window where forex is officially traded showed that the domestic unit again closed at N410.00 at the trading session of the NAFEX window on Friday. Friday’s performance came to be as forex supply slumped significantly. The naira experienced an intraday high of N394.00 and a low of N436.40 before closing at N410.00 on Friday, the same rate i...