TVL

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

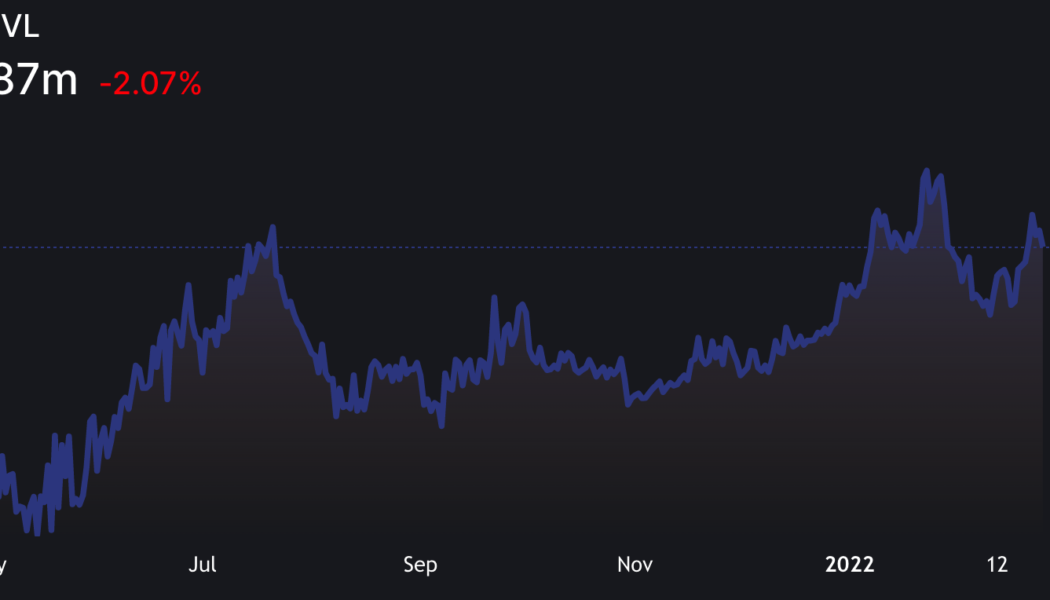

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

Klaytn token down 15% in a month, but network’s TVL shows resilience

Klaytn (KLAY) had a promising start in March 2021, reaching an impressive $11 billion market capitalization following its debut. However, investors have exaggerated their expectations as the token’s current total value stands at $3 billion, down roughly 70%. KLAY/USD on Binance. Source: TradingView Although not as well known as the leading smart contract blockchains, Klaytn remains a top-35 token by capitalization rank. Moreover, the network holds $1.2 billion worth of deposits locked on smart contracts. Capital locked on smart contracts is known in the industry as total value locked, or TVL. Real use cases and strong backing Klaytn is a flexible modular network architecture created by Kakao, a publicly-traded South Korean internet giant. The Asian tech group’s shares are value...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

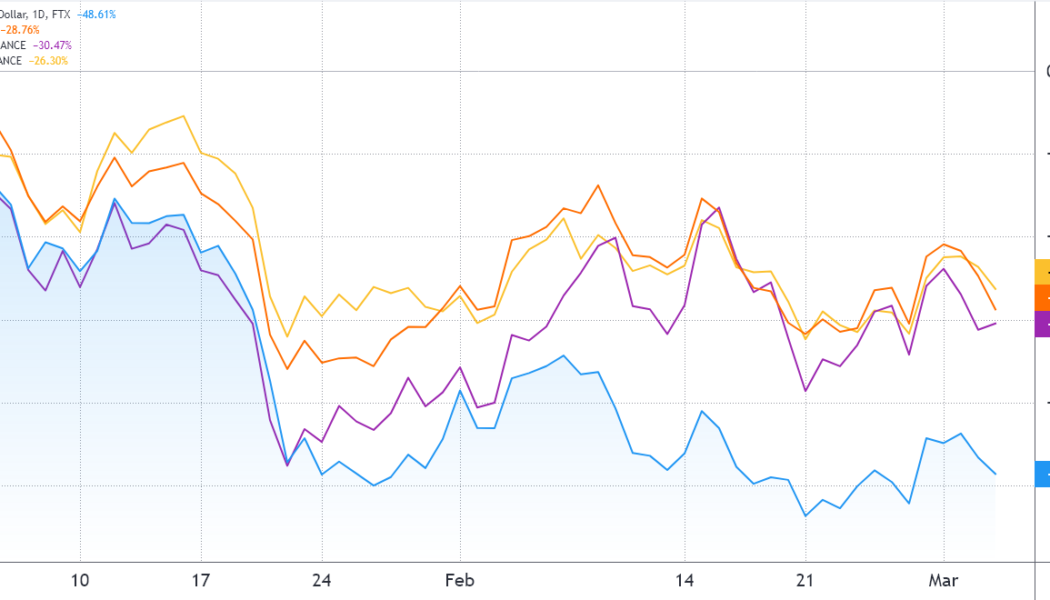

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...

Ethereum futures premium hits a 7-month low as ETH tests the $2,400 support

Ether (ETH) reached a $3,280 local high on Feb. 10, marking a 51.5% recovery from the $2,160 cycle low on Jan. 24. That price was the lowest in six months, and it partially explains why derivatives traders’ main sentiment gauge plummeted to bearish levels. Ether’s futures contract annualized premium, or basis, reached 2.5% on Feb. 25, reflecting bearishness despite the 11% rally to $2,700. The worsening conditions depict investors’ doubts regarding the Ethereum network’s shift to a proof-of-stake (PoS) mechanism. As reported by Cointelegraph, the much-anticipated sharding upgrade that will significantly boost processing capacity should come into effect in late 2022 or early 2023. Analyzing Ether’s performance from a longer-term perspective provides a more appealing sentiment, as the crypto...

A key Ethereum price metric hits a 6 month low as ETH falls below $3K

Ether (ETH) price lost the $3,600 support on Jan. 5 as minutes from the Federal Reserve’s December FOMC meeting showed that the regulator was committed to decreasing its balance sheet and increasing interest rates in 2022. Even with that looming overhead, Ether has problems of its own, more specifically, the ongoing $40 and higher average transaction fees. On Jan. 3 Vitalik Buterin said that Ethereum needs to be more lightweight in terms of blockchain data so that more people can manage and use it. The concerning part of Vitalik’s interview was the status of the Ethereum 2.0 upgrade, which is merely halfway implemented after six years. The subsequent roadmap phases include the “merge” and “surge” phases, followed by “full sharding implementation.&#...

Here’s why Binance Coin is 33% down from its all-time high

Binance Coin (BNB) holders enjoyed a 1,760% rally from $37 to $692 between January and May 2021, but as is customary in crypto, this surge was followed by a 69% correction two weeks later. From there, it’s been a bit of a rough patch to regain investors’ confidence and BNB failed to produce another all-time high in November even though the aggregate cryptocurrency market capitalization peaked at $3 trillion. Binance Coin / USDT at Binance. Source: TradingView In addition to being 33% down from its all-time high, BNB investors have other reasons to question whether the current $465 price is sustainable. Especially since traders were recently paying up to 3% per week to keep futures’ short positions open, betting on the downside. Traders flipped bearish on January 10 Unlike...

DAO treasuries surged 40X in 2021: DeepDAO

The total combined value of treasuries, or assets under management (AUM) for the use of decentralized autonomous organizations, increased by around 40 times between January and September of 2021. According to data from DAO stats platform DeepDAO, the total AUM for DAO treasuries listed on the platform increased from around $380 million in January to a peak of roughly $16 billion in mid-September. Looking ahead at 2022: ✍️How far and how deep will DAOs go into the mainstream, and into which use cases? ✍️(When) will DAO treasuries exceed $100B? Lots of interesting questions, but together we can BUIDL this! pic.twitter.com/JDEC9JBuHC — DeepDAO.io (@DeepDAO_io) December 30, 2021 As of mid-December, the total AUM has decreased by 28.1% since the high water mark to si...

- 1

- 2