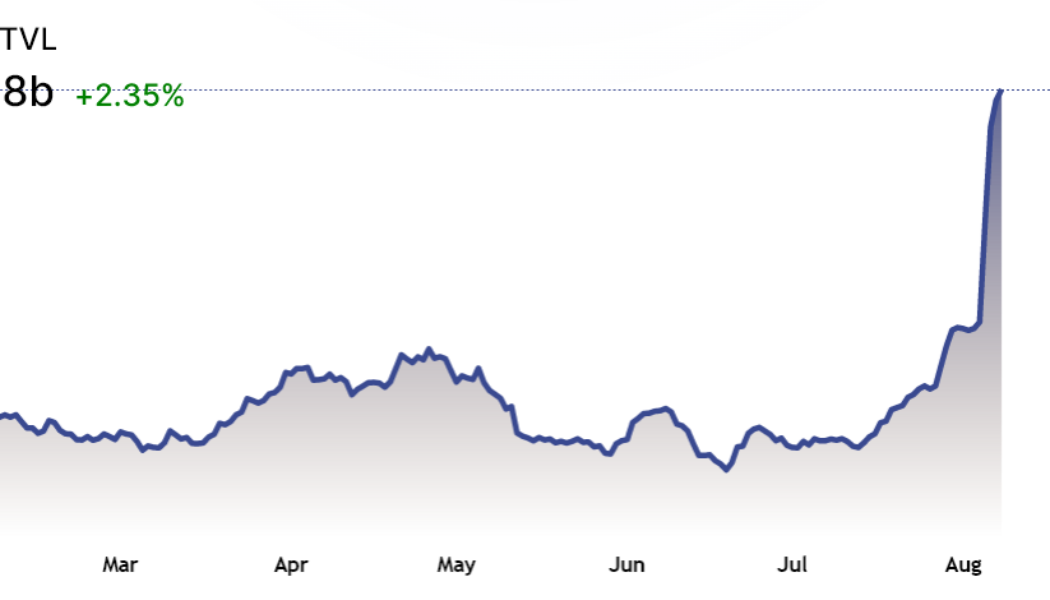

TVL

Total value locked in DeFi dropped by 66%, but multiple metrics reflect steady growth

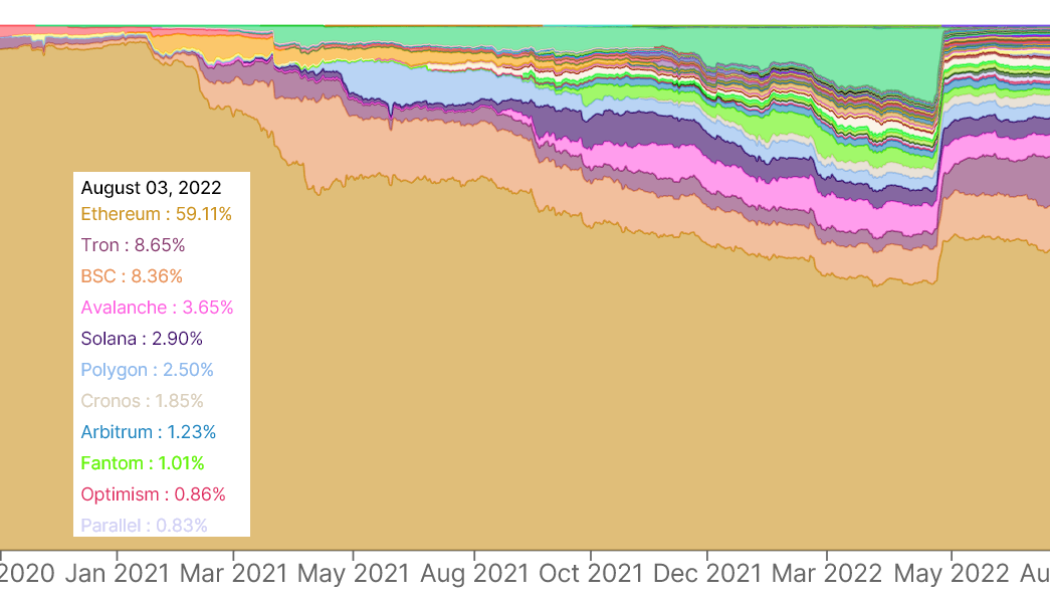

The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient. The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric. In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning...

BNB rallies 39% despite smart contract deposits dropping 28% — Should investors be worried?

Cryptocurrencies’ total market capitalization bounced from $860 billion on June 30 to the current $1.03 trillion, a 20.6% relief in five weeks. Ether (ETH) might have been the absolute leader among the largest smart contract chains, but BNB managed to gain 39% over that period. BNB (blue) vs. Ether (orange), AVAX (cyan), SOL (yellow). Source: TradingView BNB token’s year-to-date performance remains negative by 43%, but the current $49.5 billion market capitalization ranks it the third largest, excluding stablecoins. Furthermore, the leading decentralized application (DApp) is PancakeSwap — 843,630 active addresses in the past seven days — which runs on BNB Chain. The token serves primarily as a utility asset within the Binance exchange ecosystem, enabling traders to earn discounts or ...

Polygon gains 83% in a month, but data show project has been losing traction

Polygon (MATIC) had a promising July, gaining an impressive 83% in 30 days. The smart contract platform uses layer-2 scaling and aims to become an essential Web3 infrastructure solution. However, investors question whether the recovery is sustainable, considering lackluster deposits and active addresses data. MATIC/USD on FTX. Source: TradingView According to Cointelegraph, Polygon rallied after being selected for the Walt Disney Company’s accelerator program to build augmented reality, nonfungible token (NFT) and artificial intelligence solutions. Polygon announced on July 20 plans to implement a zero-knowledge Ethereum Virtual Machine (zkEVM), which bundles multiple transactions before relaying them to the Ethereum (ETH) blockchain. In a recent interview with Cointelegraph, Polygon...

Avalanche (AVAX) price drops 45% in a month and data points to further downside

Avalanche (AVAX) is down 45% in 30 days and in the same time the cryptocurrencies’ total market capitalization shrank by 29%. Despite the recent downturn, this decentralized application (DApp) platform remains a top contender in the layer1 and layer2 race and it ranks high in terms of smart contract deposits and active addresses. Yet, the lackluster token price is still causing investors to rethink whether the network remains a “serious” competitor. AVAX token/USD at FTX. Source: TradingView The brutal sell-off on risk assets caused AVAX to test the $14.80 support multiple times, while the current market capitalization stands at $4.8 billion. It’s important to also note that the network’s total value locked (TVL) holds an impressive $3.2 billion. As a comparison, Solana (SOL) o...

Ethereum price falls below $1.1K and data suggests the bottom is still a ways away

Ether (ETH) price nosedived below $1,100 in the early hours of June 14 to prices not seen since January 2021. The downside move marks a 78% correction since the $4,870 all-time high on Nov. 10, 2021. More importantly, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and the last time a similar event happened was mid-2021. ETH/BTC price at Binance, 2021. Source: TradingView Even though Bitcoin oscillated in a narrow range two weeks before the 0.082 ETH/BTC peak, this period marked the “DeFi summer” peak when Ethereum’s total value locked (TVL) catapulted to $93 billion from $42 billion two months earlier. What’s behind Ether’s 2021 underperformance? Before jumping to conclusions, a broader set of data is needed to understand what led to the 3...

3 reasons why Ethereum price is pinned below $2,000

Ether’s (ETH) market structure continues to be bearish despite the failed attempt to break the descending channel resistance at $2,000 on May 31. This three-week-long price formation could mean that an eventual retest of the $1,700 support is underway. Ether/USD 4-hour price at Bitstamp. Source: TradingView On the non-crypto side, a number of equities-related factors are translating to negative sentiment in the crypto market. This week Microsoft (MSFT) lowered its profit and revenue outlook, citing challenging macroeconomic conditions. The U.S. Federal Reserve signalled in its periodic “Beige Book” that economic activity may have cooled in some parts of the country and the Fed is about to reduce its $9 trillion asset portfolio to combat persistent inflation. On the bright ...

Avalanche (AVAX) loses 30%+ in April, but its DeFi footprint leaves room to be bullish

Avalanche (AVAX) price is down more than 30% in April, but despite the negative price move, the smart contract platform remains a top contender for decentralized applications due to its scalability, low-cost transactions and its large footprint in the decentralized finance (DeFi) landscape. AVAX token/USD at FTX. Source: TradingView The network is compatible with the Ethereum Virtual Machine (EVM) and unique in that it does not face the same operational bottlenecks of high transaction fees and network congestion. Avalanche was able to amass over $9 billion in total value locked (TVL) by offering a proof-of-stake (PoS) layer-1 scaling solution. This indicator is extremely relevant because it measures the deposits on the network’s smart contracts. For instance, the BNB Chain, running since S...

Ethereum on-chain data hints at further downside for ETH price

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

- 1

- 2