Trust Wallet Token

Top five crypto winners (and losers) of 2022

Cointelegraph looks back on the best and worst-performing cryptocurrencies of 2022 among the top 100 assets by market capitalization. We used the highest and the lowest year-to-date (YTD) returns through the close of Dec. 25, 2022. Overall, Cryptoindex.com 100 (CIX100), an index that tracks the 100 best-performing cryptocurrencies, fell nearly 68% YTD, suggesting most top coins underperformed in 2022. CIX100 weekly price chart. Source: TradingView Stablecoins are naturally omitted from the list below. Similarly, coins tracking the value of gold and similar mainstream assets have also been ignored. Instead, the coins mentioned below include decentralized currencies, smart contract tokens, exchange tokens and others. Top five crypto of 2022 1. GMX (GMX) YTD return: 111% Sector: Decentralized...

Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

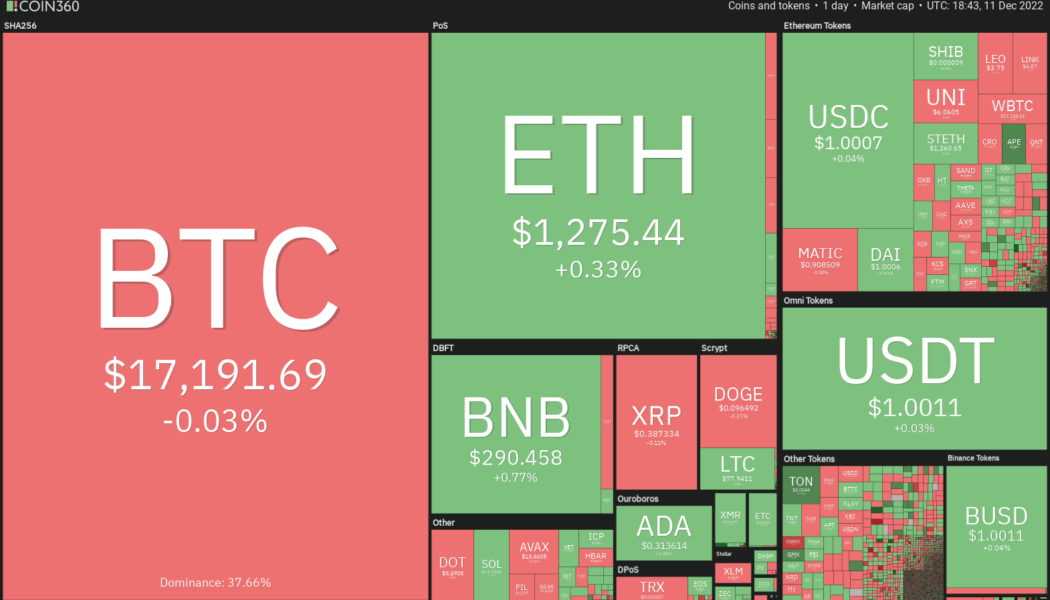

The relief rally in the United States equities markets took a breather this week as all major averages closed in the red. Traders seem to have booked profits before the busy economic calendar next week. The S&P 500 index dropped 3.37%, but a minor positive for the cryptocurrency markets is that Bitcoin (BTC) has not followed the equities markets lower. This suggests that crypto traders are not panicking and dumping their positions with every downtick in equities. Crypto market data daily view. Source: Coin360 The range-bound action in Bitcoin suggests that traders are avoiding large bets before the Federal Reserve’s rate hike decision on Dec. 14. However, that has not stopped the action in select altcoins, which are showing promise in the near term. Let’s look at the charts of Bitcoin ...

Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data. Although the FTX crisis broke the positive correlation between the U.S. equities markets and Bitcoin (BTC), the recent strength in equities shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers. Crypto market data daily view. Source: Coin360 The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused by FTX’s collapse. Until then, bullish price action may be limited to select cryptocurrencies. Let’s lo...