Treasuries

Fed reverse repo reaches $2.3T, but what does it mean for crypto investors?

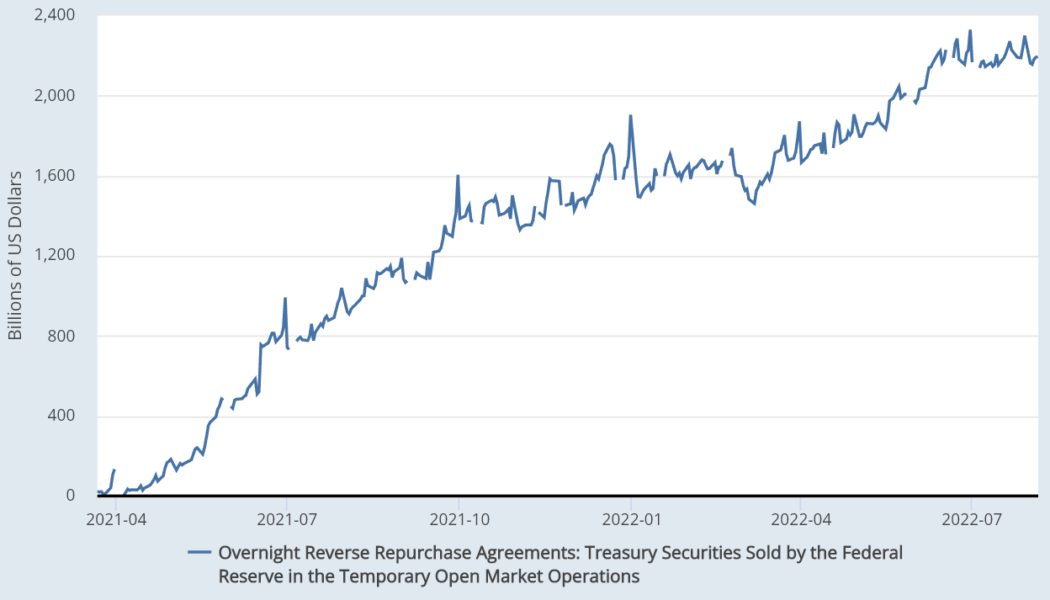

The U.S. Federal Reserve (FED) recently initiated an attempt to reduce its $8.9 trillion balance sheet by halting billions of dollars worth of treasuries and bond purchases. The measures were implemented in June 2022 and coincided with the total crypto market capitalization falling below $1.2 trillion, the lowest level seen since January 2021. A similar movement happened to the Russell 2000, which reached 1,650 points on June 16, levels unseen since November 2020. Since this drop, the index has gained 16.5%, while the total crypto market capitalization has not been able to reclaim the $1.2 trillion level. This apparent disconnection between crypto and stock markets has caused investors to question whether the Federal Reserve’s growing balance sheet could lead to a longer than expecte...