Transactions

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Silvergate Bank revenue soar in Q1 as institutional crypto trading activity falls

On Tuesday, Silvergate Bank, a crypto-fiat gateway network designed for financial institutions, announced its results for the first quarter of 2022. During this period, its revenue and net income grew by 93% and 94% year-over-year, respectively, to $59.9 million and $24.7 million. The company is most notable for its Silvergate Exchange Network, or SEN, which facilitates U.S. dollar and euro transfers between cryptocurrency exchanges and institutional investors. Despite its growth, however, institutional interest in crypto took a significant hit in Q1 due to the ongoing bear market. As told by Silvergate, the amount of SEN transfers it facilitated decreased from $167 billion in Q1 2021 to $142 billion in Q1 2022. Simultaneously, as part of broader industry trends, Bitcoin (BTC) and Ethereum...

Crypto mixers’ relevance wanes as regulators take aim

Cryptocurrency mixers have been an interesting topic of discussion ever since the advent of cryptocurrencies and their adoption by retail investors around the world. Cryptocurrency mixers are services that essentially focus on one feature of a blockchain network: privacy. Cryptocurrency mixers, also known as tumblers, provide anonymity so no one can trace the sender or receiver of a transaction. This can help protect the identity of individuals who want to be completely anonymous and non-traceable. How cryptocurrency mixers work is that they break down the funds sent using the mixer and scramble them with other transactions. They break the link which associates the holder’s identity to the crypto they own. A process used to anonymize cryptocurrency transactions is known as Coin...

The evolution of blockchain: Transactions, contracts and applications

Blockchain networks run on permission-based consensus methods, enabling various levels of use depending on a user’s needs and permission level. Aside from the blockchain generations, there are also different types of blockchain when viewed from a permission-based angle. Some of those permission types are public, permissioned or private blockchains. Each of these types offers a different use case for a company or user’s needs. When asked to list the three types of blockchain, you’ll now know the answer. Public blockchain A public blockchain is the most basic form of a blockchain ecosystem. A public blockchain is available to anyone who wishes to utilize the database. Bitcoin and Ethereum are considered public blockchains, for instance. On top of being open to a...

Central Bank of Russia tightens P2P transactions monitoring, including those in crypto

The Central Bank of Russia (CBR) recommended that the nation’s commercial banks ramp up monitoring users’ transactions that could be aimed at circumventing CBR’s “special economic measures to counter the outflow of foreign currency abroad,” local media reported on Thursday. The recommendation includes closer oversight over crypto trading, which is named among the vehicles for withdrawing capital from Russia. The letter, sent to the banking organizations by CBR’s vice chairman Yuri Isaev on Wednesday, directs them to pay closer attention to the instances of their clients’ “unusual behavior.” This includes “abnormal” transactional activity and uncommon patterns of expenditures. Any withdrawals of money via digital currencies should also attract increased attention, the letter spec...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

What is the importance of blockchain in the RegTech ecosystem?

Financial regulators and service providers are looking for the best and most cost-effective solutions to help the banks and other financial institutions comply with the rules and do business in a compliant regulatory environment. As blockchain is already disrupting the conventional ways of doing businesses, thanks to its benefits in terms of enhanced transparency, faster procedures, decentralized and most importantly, cost-effective nature. In essence, blockchain provides the solutions for the existing problems faced by financial institutions in terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. As the transactions in the blockchain system are immutable, they cannot be changed and altered, providing transparency regarding AML and KYC compliance. Customer onboard...

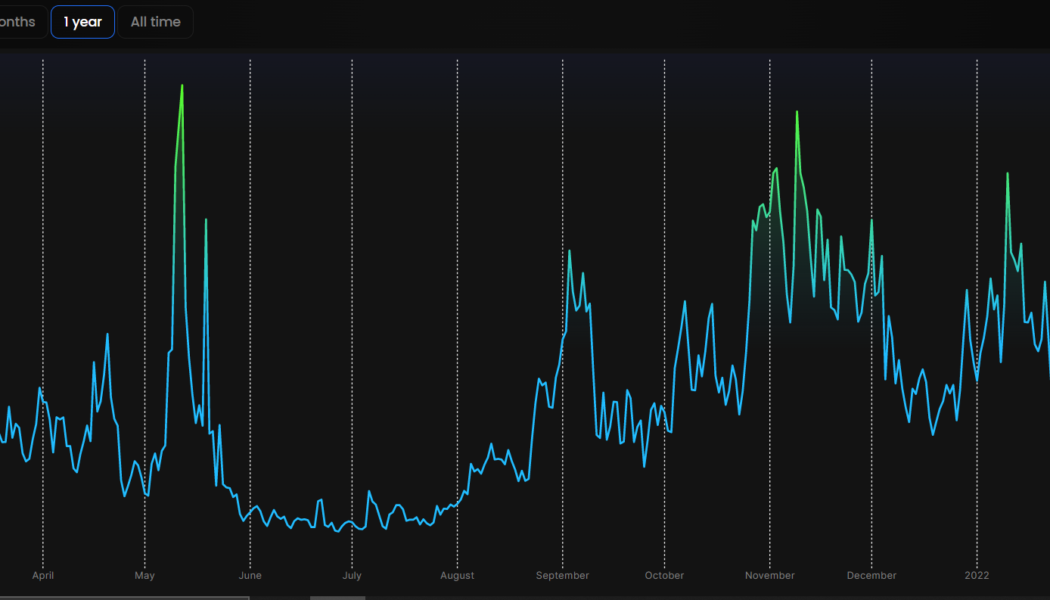

Ethereum’s average and median transaction fee slip, lowest in six months

The infamous transaction fees of the Ethereum (ETH) ecosystem underwent a decremental phase from Jan. 10 to record the lowest average and median fees of $14.17 and $5.67 — lowest since September 2021. Data from Blockchair shows that the average transaction fee of ETH in January was $53.03, which at its peak was $70.83 back in May 2021. Just within a month, the average fees saw an almost 73.3% decline as evidenced by the following chart. Additionally, the resultant median transaction fee also witnessed an 81.02% drop from January’s $29.88. In the last six months, ETH’s median transaction fee was seen lowest in September at $6.26. Interestingly enough, the transaction count of the Ethereum network has also come down to numbers that were last seen back in early 2019. Blockchair data sho...

Ethereum price holds above $3K but network data suggests bulls may get trapped

When analyzing Ether’s (ETH) price chart, one could conclude that the 3-month long bearish trend has been broken for a few reasons. The current $3,100 price range represents a 43% recovery in 15 days and, more importantly, the descending channel resistance was ruptured on Feb. 7. Should Ether bulls start celebrating and calling for $4,000 and higher? That largely depends on how retail traders are positioned, along with the Ethereum network’s on-chain metrics. For instance, is the $30-plus transaction fee impacting the use of decentralized applications (dApps), or are there any other factors that will prohibit Ether’s price growth? Ether (ETH) price at FTX, in USD. Source: TradingView Since the 55.6% correction from the $4,870 all-time high to the cycle bottom at $2,...

Why is my Bitcoin transaction unconfirmed?

Transaction costs are calculated based on the transaction’s data volume and network congestion. As a block can only hold 4 MB of data, the number of transactions that can be executed in one block is limited. Therefore, more block data is required for a larger transaction. As a result, more significant transactions are usually charged on a per-byte basis. When you use a BTC wallet to send a transaction, the wallet will typically provide you with the option to choose your Bitcoin fee rate. This charge will be determined in satoshis per unit of data (there are 100,000,000 satoshis in one Bitcoin) consumed on the blockchain by your transaction, abbreviated as sats/vByte. This rate will then be multiplied by the size of your transaction to get the total fee you’ll pay. If you want y...

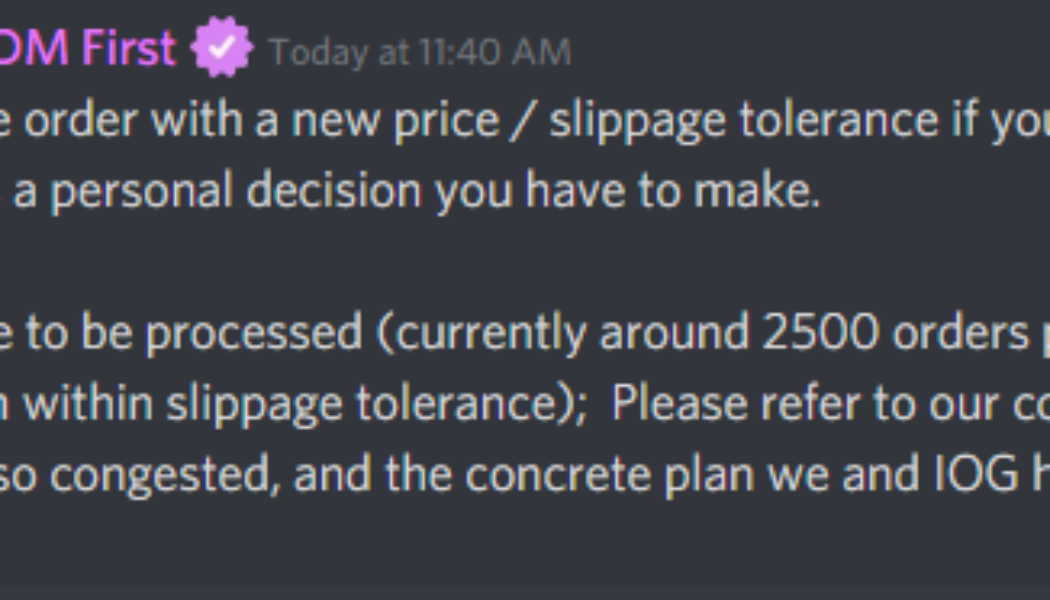

SundaeSwap launches on Cardano but users report failing transactions

Cardano’s first decentralized app (DApp) SundaeSwap has launched but is causing a frustration among users due to congestion, platform errors and failed transactions. Is it just a case of expected teething troubles under an influx of excited users or is there more to it? SundaeSwap is a decentralized exchange (DEX) and token staking platform. It’s mainnet launch today marks a milestone in the Cardano (ADA) ecosystem by being the first DApp of to utilize its smart contracts. The ADA price climbed 50% over the past week leading up to the launch of SundaeSwap, meaning a successful launch is a high stakes game for Cardano. Trading on the DEX started at 9:45pm UTC on Jan. 20. It took less than two minutes for users on the project’s Discord server to begin complaining about failed transactions an...

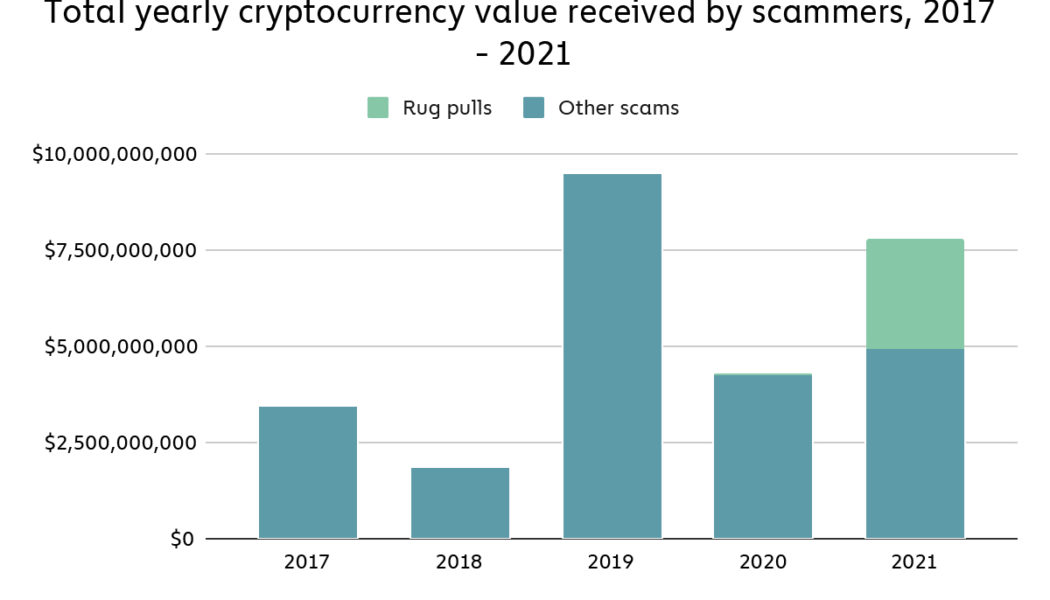

Beware of sophisticated scams and rug pulls, as thugs target crypto users

This year has been monumental for the cryptocurrency sector in terms of mainstream adoption. A recent report published by Grayscale Investments found that more than one-quarter of United States investors (26%) surveyed own Bitcoin (BTC), up from 23% in 2020. With the holidays around the corner, financial services provider MagnifyMoney also found that nearly two-thirds of surveyed Americans hope to receive cryptocurrency as a gift this year. While crypto’s growth is notable, there has also been an increase in the number of scams associated with digital assets. A Chainalysis blog post highlighting the company’s “2022 Crypto Crime Report” revealed that scams were the dominant form of cryptocurrency-based crimes by transaction volume this year. The post notes that over $7.7 billion ...