Transactions

Are Bitcoin transactions anonymous and traceable?

It can be difficult to track Bitcoin transactions when people use various wallets and Bitcoin mixers. These factors disrupt the search process and take up a lot of time. Despite the fact that it is challenging for users of a Bitcoin wallet to conduct transactions completely anonymously, there are several ways to get close to anonymity. For example, it is possible to use a cryptocurrency mixer. In this case, it is a Bitcoin mixer, which ensures that it is more difficult to make Bitcoin traceable. This is done by mixing BTC transactions from different people together in a pool, then sending the transactions to the intended addresses. In addition, wallets can also be very difficult to monitor. If someone does not want their activities on the Bitcoin network to be traceable, it is possible to ...

Who accepts Ethereum as payment?

Taking payment in Ethereum brings in a gamut of advantages for both users and entrepreneurs. Transitioning to a blockchain-based ecosystem brings in a string of advantages for users as well as entrepreneurs. Here is a drop-down detailing why accepting payment in Ethereum works well for the customers of an enterprise: Additional payment option In a world that is fast adopting cryptocurrencies, providing customers with an additional payment option gives businesses an advantage over their competitors. Cryptocurrency gateways enable merchants to accept digital payments and receive the amount in fiat. Transparency A decentralized ecosystem is inherently transparent, giving customers more confidence while making the purchase. Crypto transactions get executed on a blockchain where they are writte...

EU crypto community has two weeks to join conversation on crypto data

The European Union’s securities regulator continues to strengthen its focus on cryptocurrency regulation, initiating a move to implement increased scrutiny of crypto transactions. The European Securities and Markets Authority (ESMA) on Tuesday issued a public tender document aiming to collect additional information about trading data on crypto transactions. The regulator is specifically looking for “crypto off-chain data” or crypto-related transactions that do not originate from a blockchain. According to ESMA, such transactions include spot and derivatives trade at centralized exchanges or over-the-counter trading platforms. “The coverage should encompass all major exchanges and crypto assets so that it provides a fair representation of the crypto market landscape,” the document reads.&nb...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...

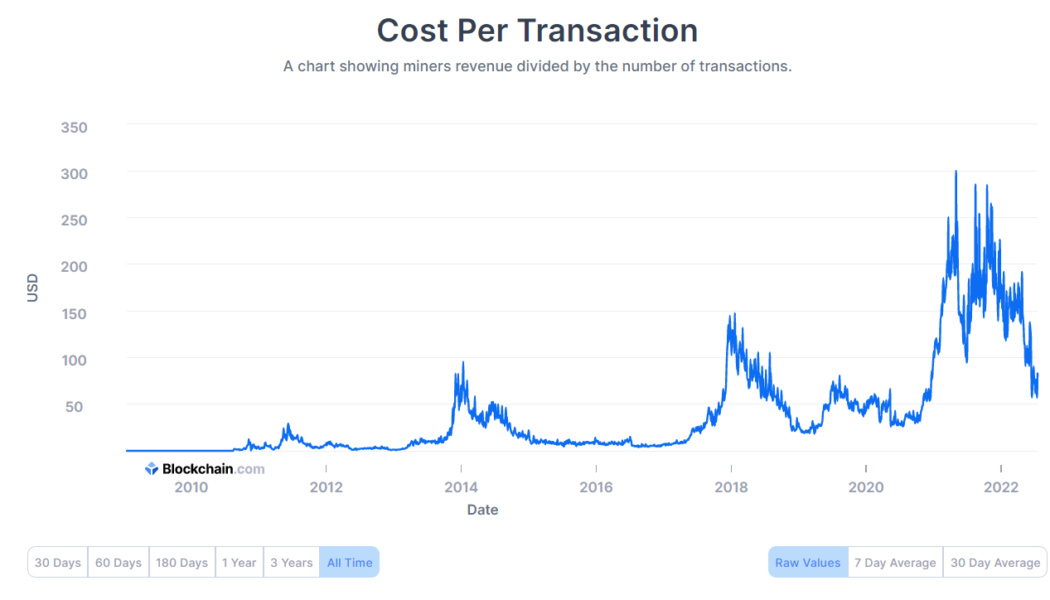

Bitcoin per transaction cost goes down every four years, coincidence?

Diving deep into the thirteen-year-old Bitcoin (BTC) ecosystem makes one come across interesting patterns powered organically by investor sentiment and market conditions. With BTC’s per transaction cost coming down to $56.846 on July 14, the ecosystem unveiled a cycle wherein the per transaction costs invariably fall every four years. The cost per Bitcoin transaction is calculated by dividing miners’ revenue by the number of transactions, thus implying an unpredictive trend — however, data from Blockchain.com reveals a pattern many would find satisfying. Bitcoin cost per transaction YTD. Source: blockchain.com The cost per transaction dropped over 81% in July 2022 from its all-time high of $300.331 in May 2021, factored by a combination of a prolonged bear market and fewer on-chain t...

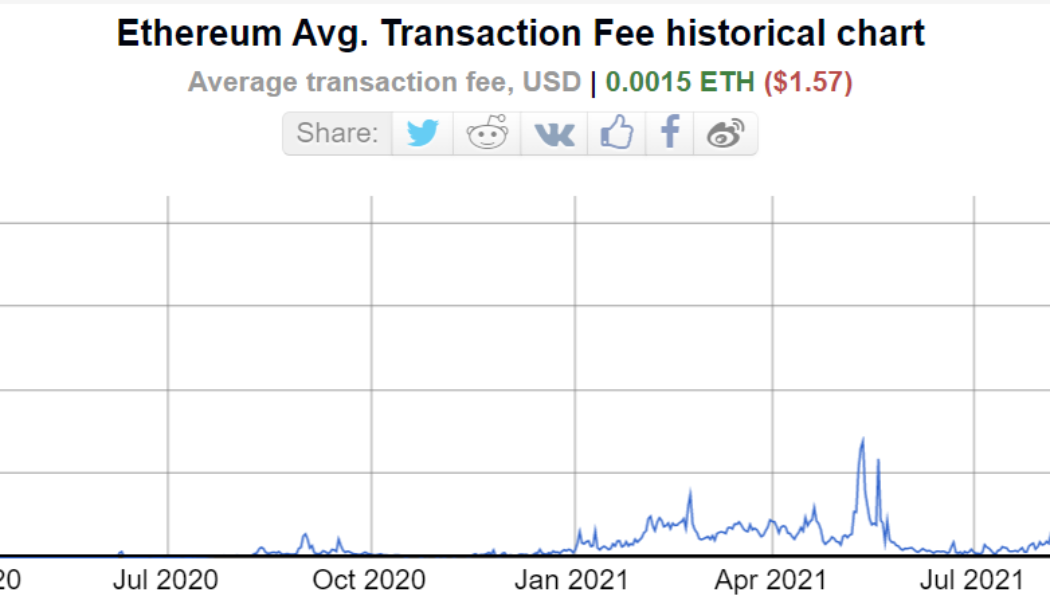

Ethereum average gas fee falls down to $1.57, the lowest since 2020

The Ethereum (ETH) ecosystem’s biggest roadblock to mainstream dominance is often attributed to the extremely high transaction fees or gas fees it requires to complete a transaction. However, with Ethereum’s average gas fees coming down to 0.0015 ETH, the narrative is set to change. The average transaction fee on the Ethereum blockchain fell down to 0.0015 ETH or $1.57 — a number previously seen in December 2020. However, starting in January 2021, Ethereum’s gas fees surged owing to the hype around nonfungible tokens (NFT), decentralized finance (DeFi) and a promising bull market. Ethereum average transaction fee YTD. Source: BitInfoCharts For nearly two years, between Jan. 2021 and May 2022, the average gas fee required by the Ethereum network was roughly $40, with May 1, 2022 recor...

Binance suspends Bitcoin withdrawals: CZ says funds are ‘SAFU’

Crypto’s Black Monday continues to wreak havoc. Changpeng Zhao, the CEO of crypto exchange Binance, tweeted that there would be a temporary pause on Bitcoin (BTC) withdrawals. Temporary pause of $BTC withdrawals on #Binance due to a stuck transaction causing a backlog. Should be fixed in ~30 minutes. Will update. Funds are SAFU. — CZ Binance (@cz_binance) June 13, 2022 CZ, who often lends his opinion to projects and the market, regularly tweets on behalf of Binance to his 6.4 million followers. He quickly updated the tweet to show: This is only impacting the Bitcoin network. You can still withdraw Bitcoin on other networks like BEP-20. SAFU is a meme that plays on the word ‘safe,’ first appearing in a Youtube video three years ago, while it also refers to Binance’s ...

Corporate evolution: How adoption is changing crypto company structures

Crypto-focused companies have come a long way since their beginnings in terms of corporate structure, employee motivation, decision-making systems, compliance and other aspects of their operations. While the early 2010s saw startups founded by small groups of crypto enthusiasts, the space has since grown to become home to large institutional businesses. Still, crypto companies are engaged in business, and business is alien to anarchy. The rapid growth of the cryptocurrency industry in the 2010s transformed small, independent businesses into huge conglomerates with thousands of employees and offices worldwide. Investment funds and professional investors own shares of them, many have functioning boards of directors, and their corporate structures have dozens of departments and divisions. But...

Brazil’s Federal Revenue now requires citizens to pay taxes on like-kind crypto trades

Brazil’s Federal Reserve (RFB) has declared that Brazilian investors in the crypto-asset market must pay income tax on transactions that involve the like-kind exchange of cryptocurrencies; for example, Bitcoin (BTC) for Ethereum (ETH). The RFB’s declaration was published in the Diário Oficial da União and was the result of a consultation made by a citizen of the country to the regulator. At the end of last year, the group issued an opinion in which it claimed that trading between cryptocurrency pairs is taxable even if there is no conversion to the real (Brazil’s national currency). Although it does not specify what can be understood as “profit,” since in the exchange of one crypto asset for another there is no capital gain in fiat currency, it points out...

Fed report finds most Americans who own crypto tend to be high income hodlers

The United States Federal Reserve Board has included data on cryptocurrency in its new Economic Well-Being of U.S. Households in the 2021 report. The Fed’s ninth annual report looked at survey results from 11,000 people questioned in October and November 2021. The report indicated financial wellbeing is the highest it has been since reporting began, with 78% of U.S. adults “doing okay or living comfortably financially.” That is an increase of 3% over the last three years. As a diagnostic of financial fitness, the report cites the 68% of Americans who say they could cover a $400 emergency expense using cash or its equivalent alone. The report looked at cryptocurrency usage for the first time. It found that 12% of U.S. adults held or used crypto in 2020, with 11% holding it as an inves...

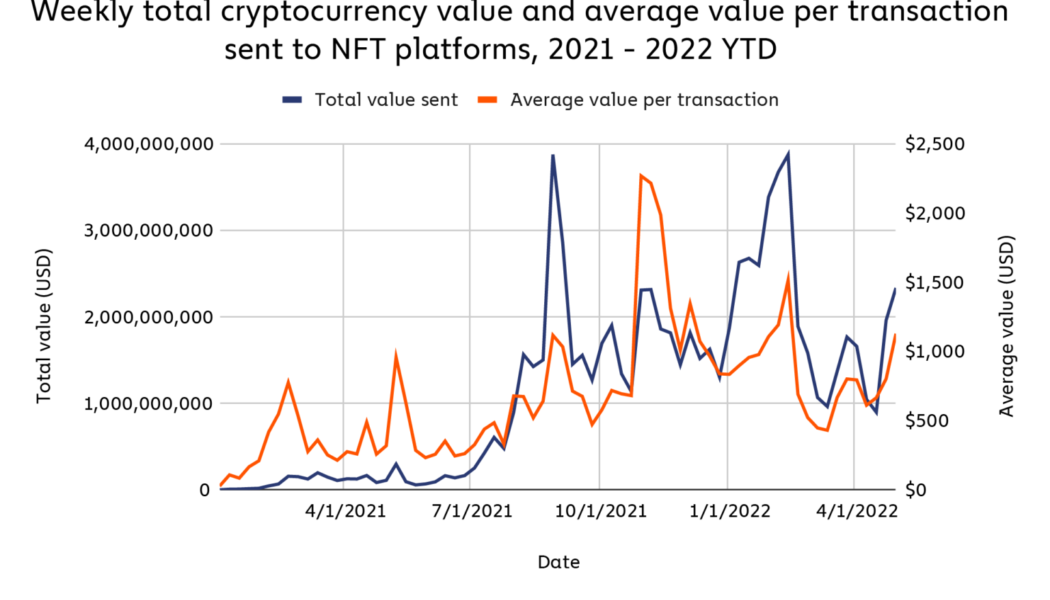

NFT collectors sent $37B to marketplaces in 2022, nearly equaling 2021 already

Collectors of nonfungible tokens (NFTs) have already sent more than $37 billion in value to NFT marketplaces this year as of Sunday, a figure that nearly exceeds the total amount in all of 2021. According to a report from Chainalysis, investors sent $40 billion worth of cryptocurrency to smart contracts associated with NFT collections and marketplaces throughout 2021. Source: Chainalysis Since the beginning of last year, NFT transaction volume has grown considerably, but the overall growth of the industry has been inconsistent. The report outlines that NFT transaction volume occurs sporadically and has been in a downturn since mid-February. The NFT market has since made a brief recovery as of mid-April — most likely due to the recent hype around Moonbirds and the Bored Ape Yacht Club...

The birth of ‘Ethereum killers’: Can they take Ethereum’s throne?

Ethereum has proven to be a formidable force. While its major issues have spawned other coins aimed at addressing them, Ethereum looks to shed its old skin with the release of Ethereum 2.0. Despite the fact that Ethereum was created six years after Bitcoin (BTC) and the introduction of blockchain technology, the digital asset Ether (ETH) has grown to be the second most valuable cryptocurrency in terms of market capitalization, surpassing coins such as Litecoin (LTC), Ripple (XRP), Dash (DASH) and Monero (XMR), which were launched before it. The technology behind the Ethereum blockchain is the primary reason for its meteoric rise. Vitalik Buterin, the Canadian-Russian programmer and co-founder of Ethereum, explained to Business Insider that the Ethereum blockchain is intended to address Bit...