Transactions

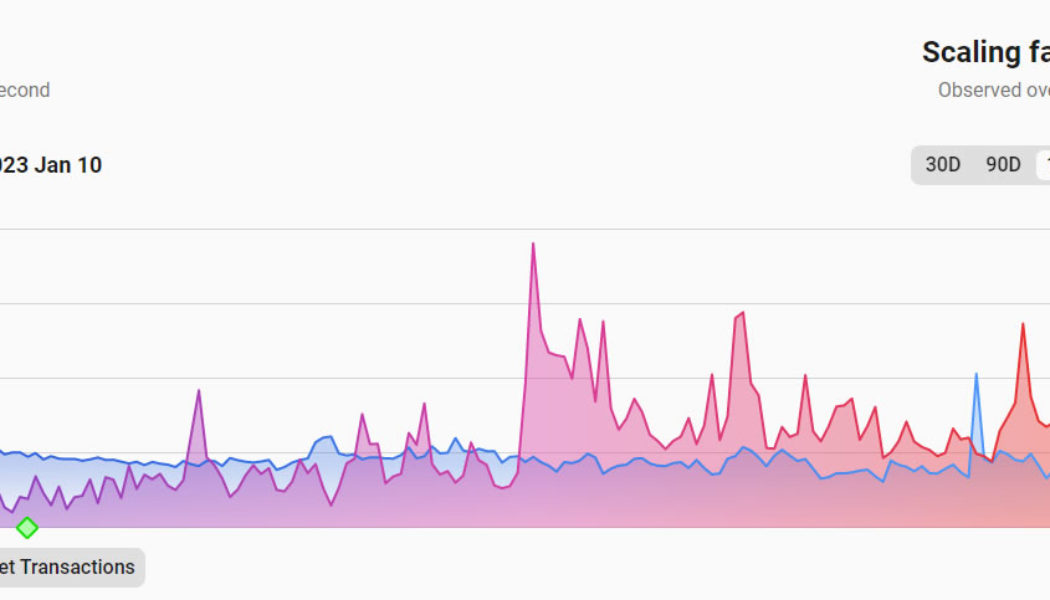

Optimism and Arbitrum flip Ethereum in combined transaction volume

Ethereum layer-2 on-chain activity has been increasing to the extent that the leading two networks now process more transaction volume than mainnet Ethereum. Layer-2 networks Arbitrum and Optimism have seen an increase in transactions over the past three months. Comparatively, aside from a few spikes, transactions on the Ethereum network have declined by around 33% since late October, according to Etherscan. This has enabled the two L2s combined to flip Ethereum for this metric, according to Dune Analytics data. The chart shows Ethereum processed over 1.06 million transactions on Jan. 10, whereas Arbitrum and Optimism combined processed over 1.12 million transactions. Additionally, Optimism has now surpassed Arbitrum in terms of daily transactions following a steady uptrend in activity sin...

Corporate America has finally taken notice of Web3 — US trademark lawyer

This year saw an influx of trademark applications filed by various companies looking to get in on the Web3 action. By November, a total of 4,999 trademark applications had been filed in the United States for cryptocurrencies and digital-related goods and services — according to United States Patent and Trademark Office-licensed trademark attorney Mike Kondoudis. Kondoudis believes the future of the Web3 ecosystem looks “bright” and “mainstream adoption is inevitable.” To learn more about the impact of Web3 trademark applications filed on the future of the Web3 ecosystem, Cointelegraph interviewed Kondoudis. Cointelegraph has covered a wide range of trademark application stories in 2022, ranging from luxury brands such as Hermès to car brands like Ford, all making a bid for ...

Coinbase launches tool to recover ‘mistakenly sent’ ERC-20 tokens

Major cryptocurrency platform Coinbase has offered an asset recovery tool for users who “mistakenly send unsupported tokens” to exchange addresses. In a Dec. 15 announcement, Coinbase said users who sent any of roughly 4,000 ERC-20 tokens to a Coinbase address could recover their previously unrecoverable funds by providing “the Ethereum TXID for the transaction where the asset was lost and the contract address of the lost asset.” The exchange said certain ETC-20 tokens including Wrapped Ether (wETH), TrueUSD (TUSD), and staked Ether (STETH) would be eligible for recovery, with a 5% charge on transactions of more than $100. “Our recovery tool is able to move unsupported assets directly from your inbound address to your self-custodial wallet without exposing private keys at any point,” said ...

Crypto community members discuss bank run on Binance

Within the past 24 hours, cryptocurrency exchange Binance has seen outflows of over $1.14 billion due to rising FUD — or fear, uncertainty and doubt — within the crypto ecosystem. According to Binance CEO Changpeng “CZ” Zhao, the exchange has seen this before, and he believes “it is a good idea to ‘stress test withdrawals’ on each CEX [centralized exchange] on a rotating basis”. We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us. I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 1/2 https://t.co/uF9lLPDSyS — CZ Binance (@cz_binance) December 13, 2022 The bank run on Binance comes a month after CZ triggered a bank ...

BlockFi employees were discouraged from describing risks in internal communications: Report

Following BlockFi’s Chapter 11 bankruptcy filing at the United States Bankruptcy Court for the District of New Jersey, reports have surfaced about the crypto lending company’s risk assessment and management culture. According to Forbes, as early as 2020, the company culture discouraged employees from “describing risks in written internal communications to avoid liability, “ as reported by a former employee at BlockFi. Although BlockFi claimed risk management was core to their DNA and central to their mission, reports surfacing paint a different picture of the company. BlockFi executives appear to have prioritized aggressive growth, while dismissing risk management professionals who attempted to do their job. According to a former employee, an internal team at BlockFi raise...

UK bank Starling bans crypto-related purchases and deposits citing high risk

Starling — a digital bank based in the United Kingdom — is the latest financial institution to ban crypto-related transfers and activities for its cardholders. Starling customers will no longer be able to purchase cryptocurrencies like Bitcoin (BTC) or receive incoming transfers from crypto exchanges or merchants. The online bank announced the news in a statement to customers as well as on Twitter, citing the perceived high risks of crypto trading. Hi there We always review our position in relation to financial crime. We consider crypto activity to be high risk. We’ve taken the decision to prevent all card payments to crypto merchants and to implement further restrictions on outgoing and incoming transfers. — Starling Bank (@StarlingBank) November 22, 2022 The bank also described cryptocur...

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

How not to Bitcoin: User pays 1,000x fee to send 4 BTC

Fat fingers? A Bitcoin (BTC) user spent over $200 to make a transaction, paying astronomically above the average fee. In a transaction that entered Bitcoin block 760,077, a user paid 1,136,000 satoshis, (0.0136 BTC or $220.52) to move 3.8 BTC ($63,000). This extraordinarily high fee is a whopping 1,000 times the usual Bitcoin transaction fee, as at block height 760,077, the average transaction fee was roughly $0.20. Twitter user Bitcoin QnA first spotted the out-of-the-ordinary transaction, asking, “Y tho?” The Bitcoin educator told Cointelegraph that “Ultimately, we’ll never know [why they paid high], but there are a few possible answers.” QnA listed the following: “1. Using a wallet with terrible fee estimations 2. A user making a typo when manually entering their fee rat...

Downsides of Proof-of-Work and Proof-of-Stake, explained

Proof-of-Work and Proof-of-Stake are arguably the best-known consensus mechanisms — but new ones are continually emerging. PoW blockchains have long dominated the cryptocurrency landscape, with both Bitcoin and Ethereum using this model. This means miners are responsible for securing the network and validating transactions — and they get rewarded with new coins as a result. However, a common criticism surrounding Proof-of-Work relates to how much energy it uses, and the impact such blockchains have on the environment. Miners need to use vast amounts of computing power to solve arbitrary mathematical equations. More advanced hardware has been required as the industry matured, with electricity usage surging too. This has led Proof-of-Stake to be regarded as a mo...

ETH Merge will change the way enterprises view Ethereum for business

A recent report from the Ethereum Enterprise Alliance (EEA) highlights how the Ethereum ecosystem has matured to a point where the network can be used by businesses to solve real-world problems. From supply chain management use cases to payment solutions utilized by companies like Visa and PayPal, the report demonstrates how the Ethereum network has grown to become one of the most valued public blockchains. Although notable, the EEA report also points out that the rapid growth of the Ethereum ecosystem has created a number of challenges for companies, specifically regarding energy consumption, scalability and privacy. For example, the document states that “sustainability was cited as one of the main concerns, along with transaction fees, in relation to using the Ethereum Mainnet.” Th...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...