Trading

Binance users support 0-fee trading despite CZ’s wash trading concerns

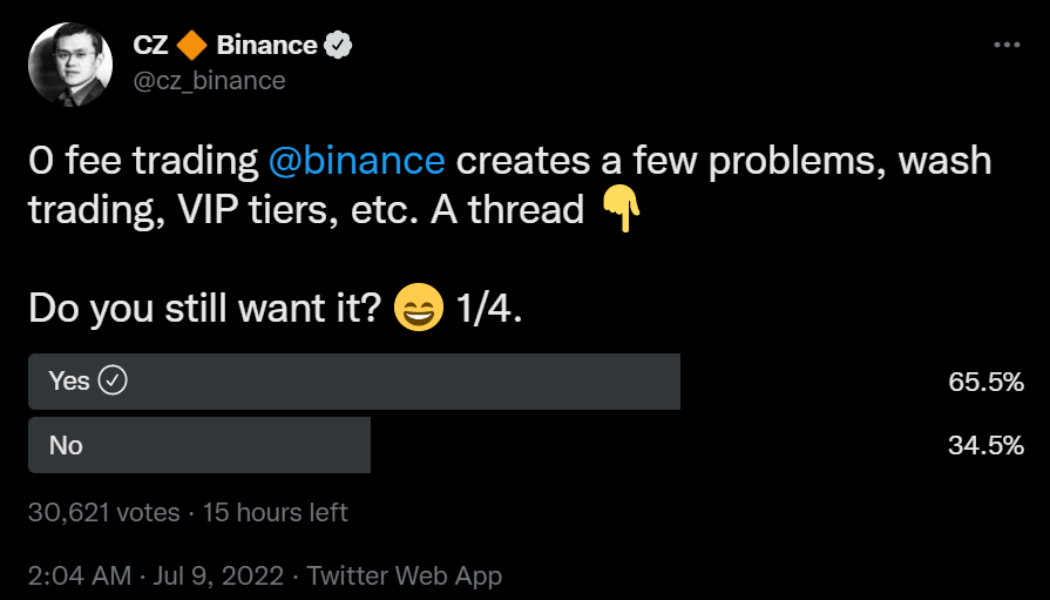

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

Hodlers and whales: Who owns the most Bitcoin in 2022?

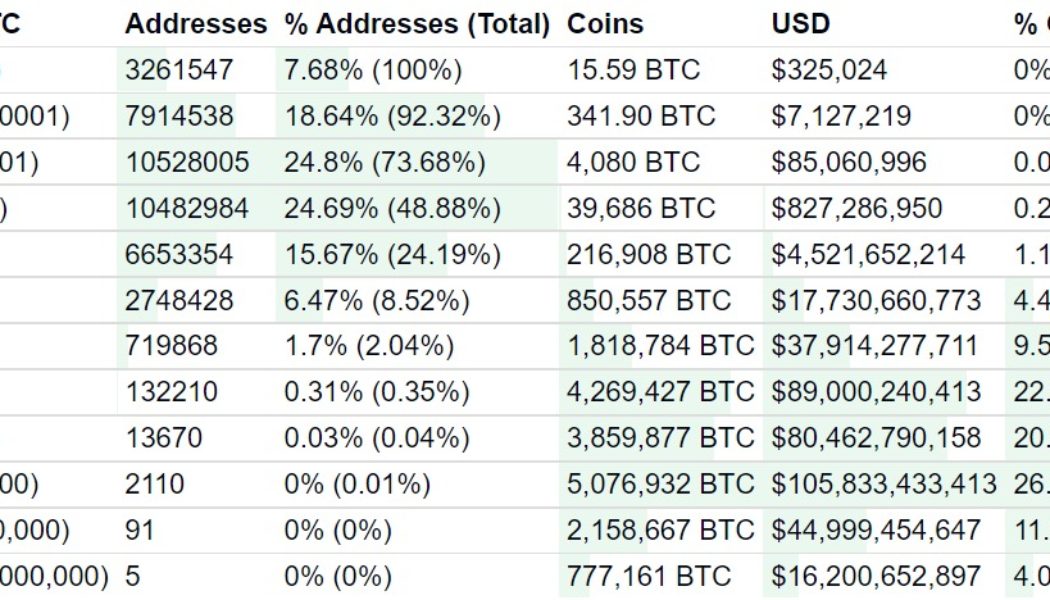

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

Hodlers and whales: Who owns the most Bitcoin in 2022?

One of the main features of the Bitcoin blockchain is its transparency. Bitcoin lets anyone see every transaction that has ever been made on its network and check the balance of every address out there. Because of this transparency, we’re able to know who owns the most Bitcoin (BTC) in 2022. It’s important to look at who owns the most BTC, as the cryptocurrency’s supply is limited to 21 million coins. In February, Kim Grauer, director of research at blockchain forensics firm Chainalysis, told Cointelegraph that an estimated 3.7 million BTC have been lost, effectively deflating the cryptocurrency’s circulating supply. Experts estimate that as Bitcoin’s adoption rises, demand for it will skyrocket. As 3.7 million coins are estimated to be lost and a significant amount is being held on-chain ...

What is a bull trap, and how to identify it?

Here’s how to spot a bull trap with some tell-tale indicators that one is on the way: RSI divergence A high RSI might be an indication of a potential bull or bear trap. A relative strength index (RSI) calculation may be used to identify a possible bull or bear trap. The RSI is a technical indicator, which can help determine whether a stock or cryptocurrency asset is overbought, underbought or neither. The RSI follows this formula: The calculation generally covers 14-days, although it may also be applied to other timeframes. The period has no consequence in the calculation since it is removed in the formula. In the instance of a probable bull trap, a high RSI and overbought circumstances suggest that selling pressure is increasing. Traders are eager to pocket their gains and will ...

Crypto conspiracy theories abound, but prop traders are just doing their job

Alameda Research is a cryptocurrency trading firm and liquidity provider founded by crypto billionaire Sam Bankman-Fried (SBF). Before founding his firm in 2017, SBF spent three years as a trader at the quantitative proprietary trading giant Jane Street Capital, which specializes in equity and bonds. In 2019, SBF founded the crypto derivatives and exchange FTX, which has quickly grown to become the fifth-largest by open interest. The Bahamas-based exchange raised $400 million in January 2022 and was valued at $32 billion. FTX’s global derivatives exchange business is separate from FTX US, another entity controlled by SBF, which raised another $400 million from investors including the Ontario Teachers Pension and SoftBank. The self-made billionaire has big dreams, like purchasing ...

XRP price rally stalls near key level that last time triggered a 65% crash

Ripple’s (XRP) ongoing upside retracement risks exhaustion as its price tests a resistance level with a history of triggering a 65% price crash. XRP price rebounds 30% XRP’s price gained nearly 30%, rising to $0.36 on June 24, four days after rebounding from $0.28, its lowest level since January 2021. The token’s retracement rally could extend to $0.41 next, according to its cup-and-handle pattern shown in the chart below. XRP/USD four-hour price chart featuring “cup and handle” pattern. Source: TradingView Interestingly, the indicator’s profit target is the same as XRP’s 50-day exponential moving average (50-day EMA; the red wave). XRP/USD daily price chart featuring 50-day EMA upside target. Source: TradingView Major resistance hurdle The cup-and-handle bullis...

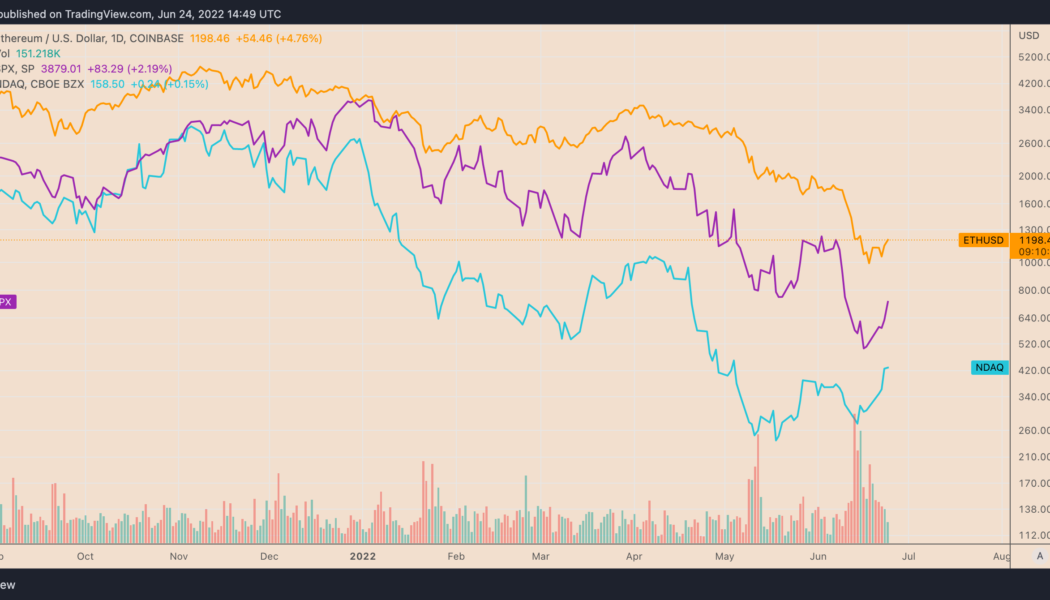

Ethereum price breaks out as ‘bad news is good news’ for stocks

Ethereum’s native token, Ether (ETH), gained alongside riskier assets as investors assessed weak U.S. economic data and its potential to cool down rate hike fears. Ether mirrors risk-on recovery ETH’s price climbed up to 8.31% on June 24 to $1,225, six days after falling below $880, its lowest level since January 2021. Overall, the upside retracement brought bulls 40% in gains, raising anticipation about an extended recovery in the future while alleviating fears of a “clean fakeout.” For instance, independent market analyst “PostyXBT” projected ETH’s price to close above $1,300 by the end of June. In contrast, analyst “Wolf” feared that bears would attempt to “push price back to $1,047,” albeit anticipating a run-up to...

Synthetix racks up over $1M in daily fees as SNX token value surges 100%

Layer-2 scaling solution Synthetix recently collaborated with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC, & sUSD/3CRV, allowing investors to cheaply convert synths such as sETH to Ether (ETH). Given the investors’ willingness to hold tokens instead of synths, the protocol racked up over $1.02 million in trading fees — overshadowing Bitcoin’s (BTC) daily performance by five times. Synthetix, Ethereum-based decentralized finance (DeFi) protocol, created a buzz across the crypto ecosystem after witnessing a sudden increase in trading activities and an unprecedented comeback of its in-house token, SNX, during an unforgiving bear market. Crypto fees of popular projects. Source: cryptofees.info As a direct result of the massive trading volumes, the SNX...

What is a bear trap in trading and how to avoid it?

As a difficult proposition for novice traders, a bear trap can be recognized by using charting tools available on most trading platforms and demands caution to be exercised. In most cases, identifying a bear trap requires the use of trading indicators and technical analysis tools such as RSI, Fibonacci levels, and volume indicators, and they are likely to confirm whether the trend reversal after a period of consistent upward price movement is genuine or merely meant to invite shorts. Any downtrend must be driven by high trading volumes to rule out the chances of a bear trap being set up. Generally speaking, a combination of factors, including the retracement of price just below a key support level, failure to close below critical Fibonacci levels and low volumes, are signs of a b...

What is an Iceberg order and how to use it?

An iceberg trade is most often executed by large institutional investors. Iceberg orders, also known as reverse orders, are mostly used by market makers, which is another word for an individual or firm who is providing offers and bids. When it comes to such big crypto transactions, we mostly talk about institutional crypto investors. They often trade in big amounts of cryptocurrencies, which may have a huge impact on the market. As a watcher, it’s possible to look up the order in the order books, but only a small part of the market maker iceberg orders is visible on level-2 order books. Level-2 order books, in the crypto world, contain all bids and asks on an exchange including price, volume and timestamp — real-time data collection it is. They call ...

Senators join chorus of disapproval of ‘backdoor regulation’ in SEC staff accounting bulletin

United States Senator Bill Hagerty has sent a letter, cosigned by four other Republican senators, to Securities and Exchange (SEC) Commission chair Gary Gensler urging the withdrawal of a staff accounting bulletin, referred to as SAB 121, issued by the agency March 31. According to the senators, the bulletin amounts to “regulation disguised as staff guidance” and does not adhere to the Administrative Procedure Act. SAB 121 provides guidance on accounting and disclosure for companies that safeguard clients’ crypto assets and allow them to perform transactions with them. The bulletin said those companies, which include platforms such as Coinbase and Robinhood, should list digital assets as liabilities on their balance sheets at fair value. The need for the new accounting procedure was chalke...

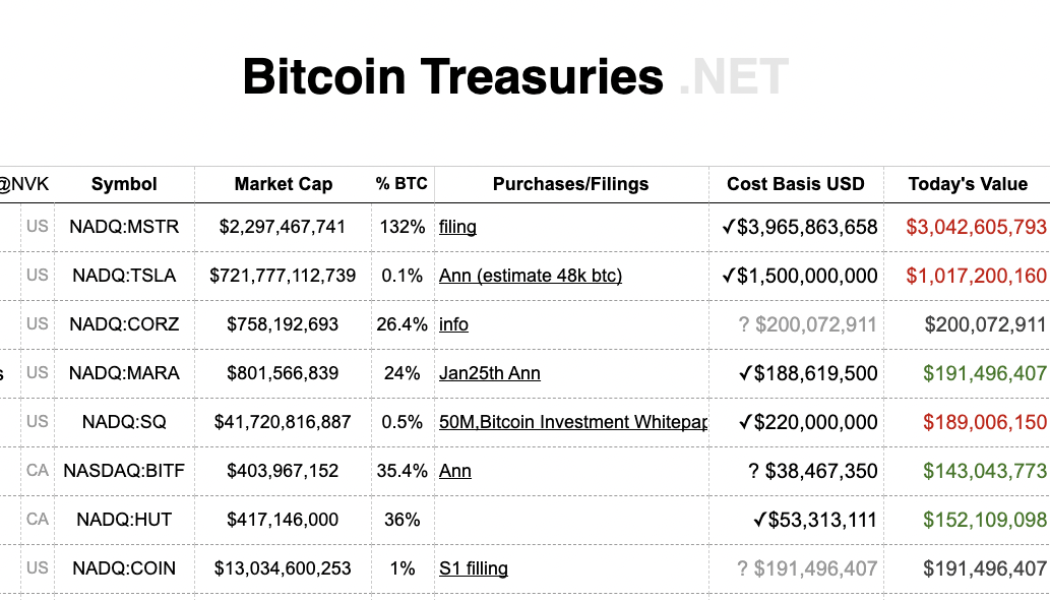

In this together: Musk and Saylor down a combined $1.5B on Bitcoin buys

As the bear market bites, holding crypto investments can be a tough pill to swallow. Consider two of the largest bag holders of publicly traded companies. They are down by almost $2 billion dollars on their Bitcoin buys. According to Bitcointreasuries.net, the 130,000 and 43,00 Bitcoin (BTC) held by Microstrategy and Tesla respectively are worth considerable sums less. The top “Hodlers” of Bitcoin according to Bitcointreasuries.net For Microstrategy, Michael Saylor splashed out almost $4 billion ($3,965,863,658) on 129,218 BTC, approximately 0.615% of the 21 million total supply. The Bitcoin price nosedive has ripped away earlier gains: the investment is worth $3.1 billion ($3,074,987,824), a loss of $900 million. Plus, in premarket trading on June 13, Microstrategy ...