Trading

How Bitcoin whales make a splash in markets and move prices

Deriving their names from the size of the massive mammals swimming around the earth’s oceans, cryptocurrency whales refer to individuals or entities that hold large amounts of cryptocurrency. In the case of Bitcoin (BTC), someone can be considered a whale if they hold over 1,000 BTC, and there are less than 2,500 of them out there. As Bitcoin addresses are pseudonymous, it is ofte difficult to ascertain who owns any wallet. While many associates the term “whale” with some lucky early adopters of Bitcoin, not all whales are the same, indeed. There are several different categories: Exchanges: Since the mass adoption of cryptocurrencies, crypto exchanges have become some of the biggest whale wallets as they hold large amounts of crypto on their order books. Institutions and corpor...

Decentralized finance faces multiple barriers to mainstream adoption

Decentralized finance (DeFi) is a growing market popular with experienced crypto users. However, there are some roadblocks regarding mass adoption when it comes to the average non-technical investor. DeFi is a blockchain-based approach to delivering financial services that don’t rely on centralized intermediaries but instead use automated programs. These automated programs are known as smart contracts, enabling users to automatically trade and move assets on the blockchain. Protocols in the DeFi space include decentralized exchanges (DEXs), lending and borrowing platforms and yield farms. Since there are no centralized intermediaries, it’s easier for users to get involved in the DeFi ecosystem, but there are also increased risks. These risks include vulnerabilities in a protocol’s co...

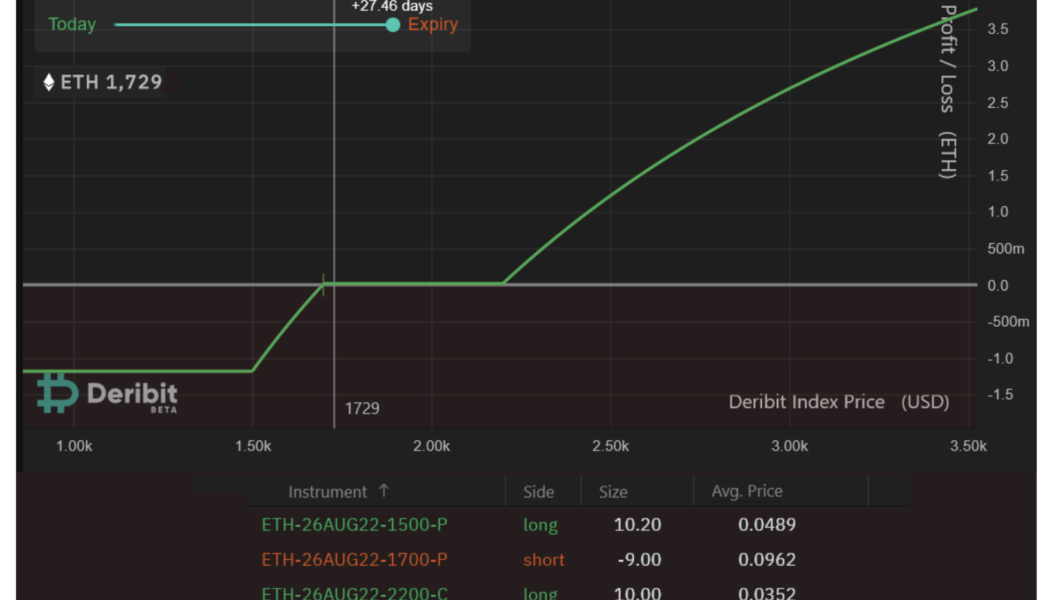

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

3AC: A $10B hedge fund gone bust with founders on the run

Three Arrow Capital (3AC), a Singapore-based crypto hedge fund that at one point managed over $10 billion worth of assets, became one of the many crypto firms that went bankrupt in this bear market. However, the fall of 3AC wasn’t purely a market-driven phenomenon. As more information surfaced, the collapse looked more like a self-inflicted crisis brought upon by an unchecked decision-making process. To put it concisely, the hedge fund made a series of large directional trades in Grayscale Bitcoin Trust (GBTC), Luna Classic (LUNC) and Staked Ether (stETH) and borrowed funds from over 20 large institutions. The May crypto crash led to a series of spiral investment collapse for the hedge fund. The firm went bust and the loan defaults have led to mass contagion in crypto. The first hint...

Sentiment and inflation: Factors putting pressure on Bitcoin price

Subsequently, there are fears that Bitcoin prices will take longer to recover. Bitcoin (BTC) has been hovering around the $20,000 range for several weeks now after the coin lost over 60% of its value from its peak in November. The recent plunge wiped out over $600 million from its market cap and caused rising concerns of a bubble burst. Negative investor sentiment Cryptocurrency investors have been on edge since Bitcoin’s fall to around $20,000. Many of them fear that more unprecedented selloffs by key players could precipitate a bigger downtrend. Further declines are likely to amplify losses and make it harder for the market to recover in the medium term. As such, many investors are holding off additional investments. Besides the fall of cryptocurrencies, the decimation of linchpin crypto...

What is Bitcoin whale watching and how to track Bitcoin whales?

Whales are held responsible for sudden price fluctuations in the crypto and traditional markets every so often. Given their capability to manipulate market prices, it becomes paramount for the general Bitcoin (BTC) investors to understand the nuances that make one a whale and their overall impact on trading. Wallet addresses that contain large amounts of BTC are identified as Bitcoin whales. Dumping or transferring large amounts of BTC from one wallet to another negatively impacts the prices, resulting in losses for the smaller traders. As a result, tracking Bitcoin whales in real-time allows small-time traders to make profitable trades amid a fluctuating market. Despite Bitcoin’s global and decentralized nature, tracking down and monitoring whales simply boils down to accessing read...

Ethereum traders gauge fakeout risks after 40% ETH price rally

Ethereum’s native token Ether (ETH) saw a modest pullback on July 17 after ramming into a critical technical resistance confluence. Merge-led Ethereum price breakout ETH’s price dropped by 1.8% to $1,328 after struggling to move above two strong resistance levels: the 50-day exponential moving average (5-day EMA; the red wave) and a descending trendline (black) serving as a price ceiling since May. ETH/USD daily price chart. Source: TradingView Previously, Ether rallied by over 40% from $1,000 on July 13 to over $1,400 on July 16. The jump appeared partly due to euphoria surrounding “the Merge” slated for September. Meanwhile, a golden cross’s appearance on Ethereum’s four-hour chart also boosted Ether’s upside sentiment among technical a...

Why is there so much uncertainty in the crypto market right now? | Market Talks with Crypto Jebb and Crypto Wendy O

In the fourth episode of Market Talks, we welcome YouTube media creator and crypto educator Crypto Wendy O. Crypto Wendy O is a YouTube media creator and crypto educator. Wendy became interested in cryptocurrency and blockchain technology in November of 2017. She has been into crypto full-time since the summer of 2018 and focuses on providing transparent marketing & media solutions for blockchain companies globally. Wendy also provides free education via YouTube and Twitter to her growing audience of over 170 thousand, giving her the largest following of any female crypto influencer in the world. Some of the topics up for discussion with Wendy are the new consumer price index (CPI) numbers and how they might impact the crypto market going forward, and why there is so much uncertai...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

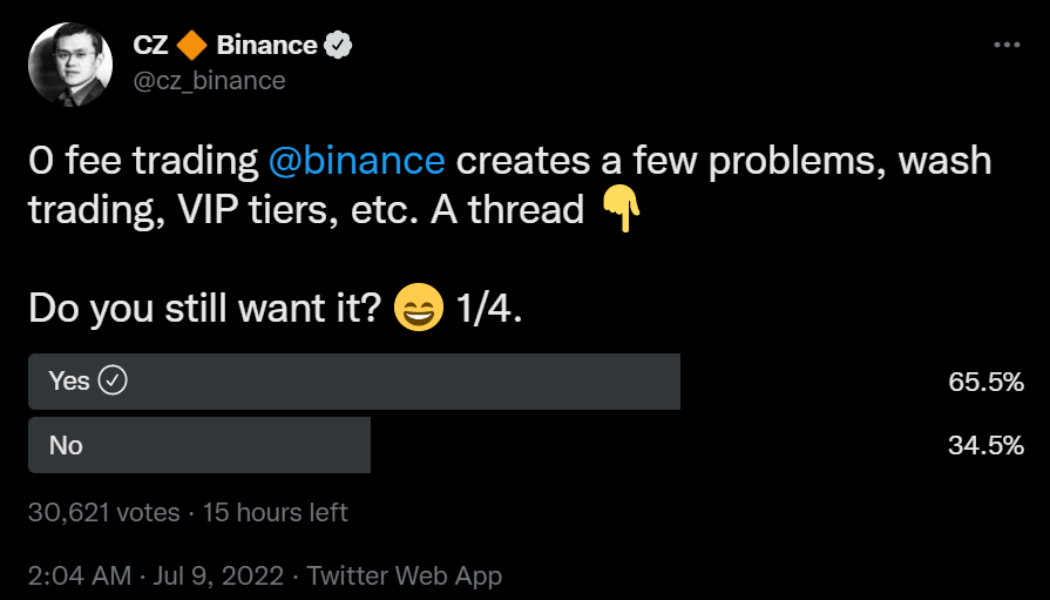

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...