Trading

New York-based forex broker Oanda launches crypto trading services in US

New York-based multi-asset trading services Oanda has launched a new cryptocurrency trading service in the United States. This latest addition, developed in partnership with regulated blockchain infrastructure provider Paxos Trust Company, is designed to give investors easy access to crypto alongside their existing forex portfolios in a secure environment. The collaboration will enable U.S.-based investors to spot-trade cryptocurrencies on Paxos’s itBit exchange through Oanda’s mobile platform, the broker said. Investors will be able open and fund trading accounts, as well as access major cryptocurrencies such as Bitcoin (BTC) and Ether (ETH). According to Oanda, users will benefit from the company’s long track record in the forex and derivatives markets. Oanda’s partner Paxos is a r...

Not like China: Hong Kong reportedly wants to legalize crypto trading

Hong Kong is taking action to regain its status as a global cryptocurrency hub by launching several legal initiatives related to the crypto industry. A city and special administrative region of China, Hong Kong is willing to distinguish its crypto regulation approach from the blanket crypto ban in mainland China. The government of Hong Kong is considering introducing its own bill to regulate crypto in its own China-free way, according to Elizabeth Wong, head of the fintech unit at the Securities and Futures Commission (SFC). One of the SFC’s initiatives is allowing retail investors to “directly invest into virtual assets,” Wong said during a panel held by InvestHK, the South China Morning Post reported on Oct. 17. Such an initiative would mark a significant shift from the SFC’s stance over...

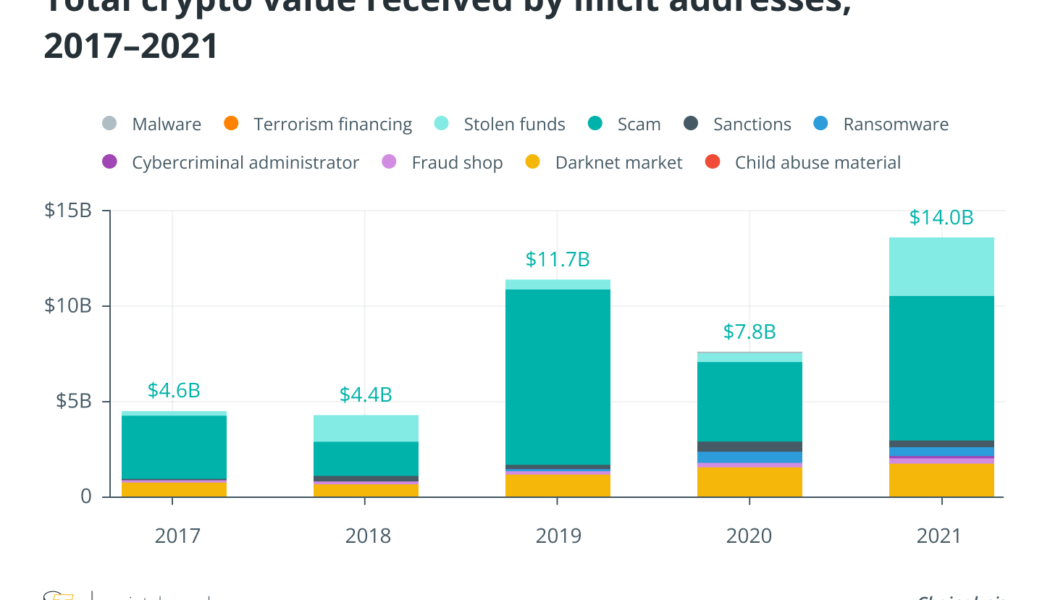

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Why crypto remittance companies are flocking to Mexico

Mexico is the second-largest recipient of remittances in the world, according to 2021 World Bank statistics. Remittances to the nation jumped to a record $5.3 billion in July, which is a 16.5% increase year-over-year compared to the same period last year. The steady growth presents myriad opportunities for fintech companies. Not surprisingly, droves of crypto companies are setting up shop in Mexico to claim a share of the burgeoning remittance market. Over the past year alone, about half a dozen crypto giants, including Coinbase, have set up operations in the country. In February, Coinbase unveiled a crypto transfer service tailored to United States-based clients looking to send crypto remittances to Mexico. The product enabled recipients in Mexico to withdraw their money in pesos. Other c...

What remains in the NFT market now that the dust has settled?

Over the last two years, nonfungible tokens (NFTs) have emerged as one of the most active and noticeable aspects of Web3. The data stored on blockchains by NFTs may be connected with files that include various forms of media, such as photographs, videos and audio. In certain instances, it can even be related to physical items. The owner of an NFT will often have ownership rights over the data, material or item connected with the token, and these tokens are typically purchased and traded on specialized markets. The rise of NFTs was meteoric in 2021, but it hasn’t been very steady since then, and it seems to have fallen sharply in 2022. Why NFTs exploded in popularity in 2021 In 2021, two of the most active markets for NFTs were collectible art projects and the video game industry. NFT...

Coinsquare acquires publicly traded crypto exchange CoinSmart

Canada’s crypto exchange landscape appears to be consolidating after Coinsquare, one of the largest digital asset trading platforms in the country, acquired CoinSmart for an undisclosed amount. On Thursday, Coinsquare announced that it had entered into a definitive agreement to purchase all issued and outstanding shares of CoinSmart’s wholly-owned subsidiary Simply Digital. Once the deal becomes final, CoinSmart will hold a roughly 12% ownership stake in Coinsquare on a pro-forma basis. Shares of the CoinSmart crypto exchange, which trade on the NEO Exchange, were up 67% on Friday, largely in response to the news. The acquisition makes Coinsquare one of Canada’s largest crypto exchanges and expands its operational and business capabilities. Founded in 2014, Coinsquare has expanded it...

What is scalping in crypto, and how does scalp trading work?

Although cryptocurrencies are known for their volatility, they give traders various opportunities to pocket and reinvest the gains. Scalp trading is a crypto strategy that helps scalpers to take risks and make the most of frequent price fluctuations by observing price movements. This article will discuss scalping, how it works in cryptocurrency, the advantages and disadvantages of scalp trading in crypto, whether it is complicated and how much money you need to engage in it. What is scalp trading? Crypto scalp traders target small profits by placing multiple trades over a short period, leading to a considerable yield generated from small gains. Scalpers step in for highly liquid and significant volume assets that result in greater interest owing to the news. Scalping strategies require kno...

Framework to ban members of Congress and SCOTUS from trading stocks includes crypto provision

Members of the United States House of Representatives and Senate as well as Supreme Court justices currently trading cryptocurrencies may have to stop HODLing while in office should a bill get enough votes. According to a framework released on Thursday, chair Zoe Lofgren of the Committee on House Administration — responsible for the day-to-day operations of the House — said she had a “meaningful and effective plan to combat financial conflicts of interest” in the U.S. Congress by restricting the financial activities of lawmakers and SCOTUS justices, as well as those of their spouses and children. The bill, if passed according to the framework, would suggest a change in policy following the 2012 passage of the Stop Trading on Congressional Knowledge Act, or STOCK Act, allowing members of Co...

Coinbase counters WSJ claim its Risk Solutions group engaged in $100M proprietary trade

The Wall Street Journal and Coinbase are having a difference in definitions. The newspaper published an alleged account of the digital asset exchange’s trading activities earlier this year that it claims amount to proprietary trading. Coinbase responded in a blog post that it had done no such thing. Relying on information supplied by “people at the company,” the WSJ wrote on Thursday that Coinbase made a $100-million transaction that was viewed inside the company as a test trade by the company’s Risk Solutions group, which had been formed for the purpose of proprietary trading. Proprietary trading is the practice by banks and financial institutions of trading their own money for their own gain, rather than doing so to earn a commission from a client. It would not have been illegal for Coin...

Blurring the line between crypto and TradFi could redefine global finance

Despite the current struggle in the global economy, the gap between traditional finance (TradFi) and crypto seems to be closing with each passing day. For example, earlier this month, Vienna-based fintech unicorn Bitpanda announced that it was adding commodities to its list of investment options, thus allowing investors to rake in profits from short-term price fluctuations related to traditional instruments such as oil, natural gas and wheat. In a recent interview with Cointelegraph, the company’s CEO, Eric Demuth, noted that the bear market had had no major impact on investor demand. He claims that more people are now looking for solutions that can bring the world of TradFi and decentralized finance (DeFi) together. Not only that, there are lessons to be learned about what works out...

Golden cross vs. death cross explained

Compared to the golden cross, a death cross involves a downside MA crossover. This marks a definitive market downturn and typically occurs when the short-term MA trends down, crossing the long-term MA. Simply put, it’s the exact opposite of the golden cross. A death cross is usually read as a bearish signal. The 50-day MA typically crosses below the 200-day MA, signaling a downtrend. Three phases mark a death cross. The first occurs during an uptrend when the short-term MA is still above the long-term MA. The second phase is characterized by a reversal, during which the short-term MA crosses below the long-term MA. This is followed by the start of a downtrend as the short-term MA continues to move downward, staying below the long-term MA. Like golden crosses, ...

Tired of losing money? Here are 2 reasons why retail investors always lose

A quick flick through Twitter, any social media investing club, or investing-themed Reddit will quickly allow one to find handfuls of traders who have vastly excelled throughout a month, semester, or even a year. Believe it or not, most successful traders cherry-pick periods or use different accounts simultaneously to ensure there’s always a winning position to display. On the other hand, millions of traders blow up their portfolios and turn out empty-handed, especially when using leverage. Take, for example, the United Kingdom’s Financial Conduct Authority (FCA) which requires that brokers disclose the percentage of their accounts in the region that are unprofitably trading derivatives. According to the data, 69% to 84% of retail investors lose money. Similarly, a study by the U.S. ...