Trading

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

What is the Crypto Fear and Greed Index?

Various Crypto Fear and Greed Index signals that influence the behavior of traders and investors include Google trends, surveys, market momentum, market dominance, social media and market volatility. To determine how much greed is trending in the market, examine trending search phrases. For instance, a high volume of Bitcoin-related searches means a high degree of greed among investors. This factor accounts for 10% of the index value. Historically, increases in Bitcoin-specific Google searches have been correlated with an extreme volatility in crypto prices. To calculate the number each day, the Bitcoin Fear and Greed Index considers a few other factors, such as surveys, which account for 15% of the index value. Surveys with participants of over 2000 drive the index value higher, indicatin...

Bitcoin rebounds over $41K after painting a ‘bullish hammer’ — Can BTC hit $64K next?

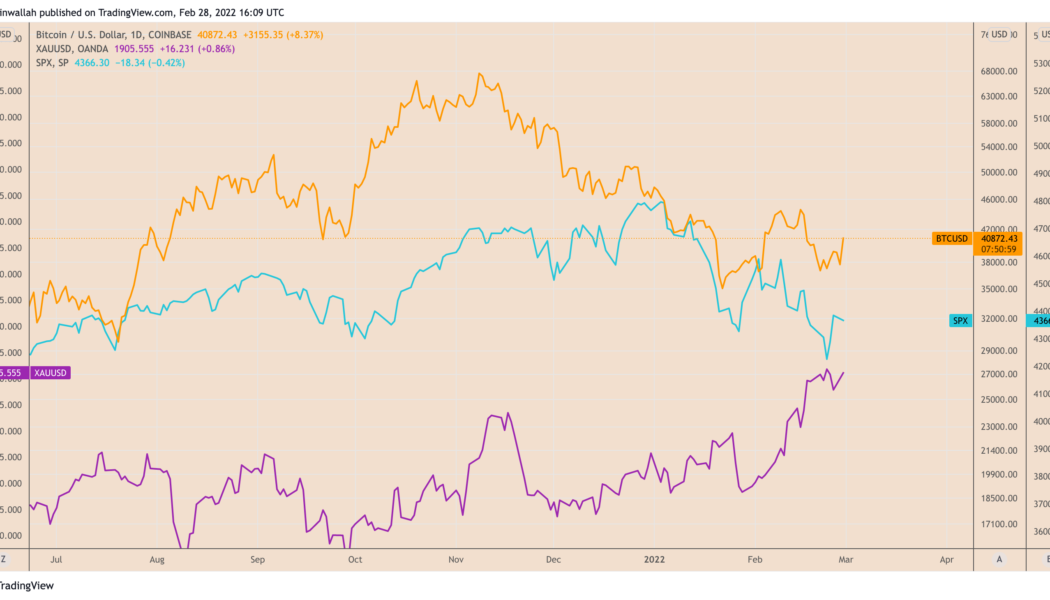

Bitcoin (BTC) rallied above $41,000 on Feb. 28 in a new sign of buying sentiment returning after last week’s brutal selloff across the risk-on markets, including the S&P 500. BTC’s price jumped by over 9% to reach $41,300, in part, as traders reacted to the ongoing development in the Russia-Ukraine crisis. In doing so, the cryptocurrency briefly broke its correlation with the U.S. stock market indexes to perform more like safe-haven gold, whose price also went higher in early trading on Feb. 28. BTC/USD versus XAUUSD and S&P 500 daily price chart. Source: TradingView Bitcoin downtrend exhausting — analyst Johal Miles, an independent market analyst, spotted “significant buying pressure” in the market, adding that its downtrend might be heading towards exhaust...

How to trade crypto using BTC dominance?

Bitcoin (BTC) is both the first and the most prominent cryptocurrency in the world when it comes to market capitalization as well as trading volume. These factors are quite significant, considering that all cryptocurrencies trade against Bitcoin and Bitcoin’s dominance can actually serve as a valuable indicator when trading all different types of cryptocurrencies. This post will offer insight on how to trade cryptocurrency while utilizing the Bitcoin dominance indicator and how to read the Bitcoin dominance index chart overall. What is the BTC dominance chart? Bitcoin dominance is uncovered by comparing Bitcoin’s market capitalization to the capitalization of the entire crypto market. The higher Bitcoin’s market capitalization the more Bitcoin dominance is at play, and we have the answer t...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

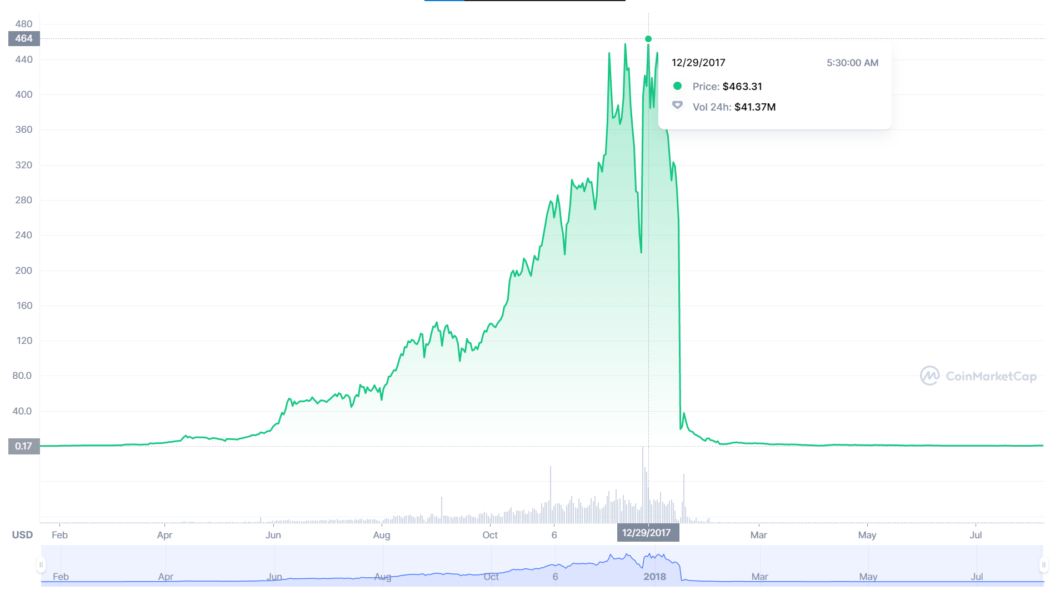

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

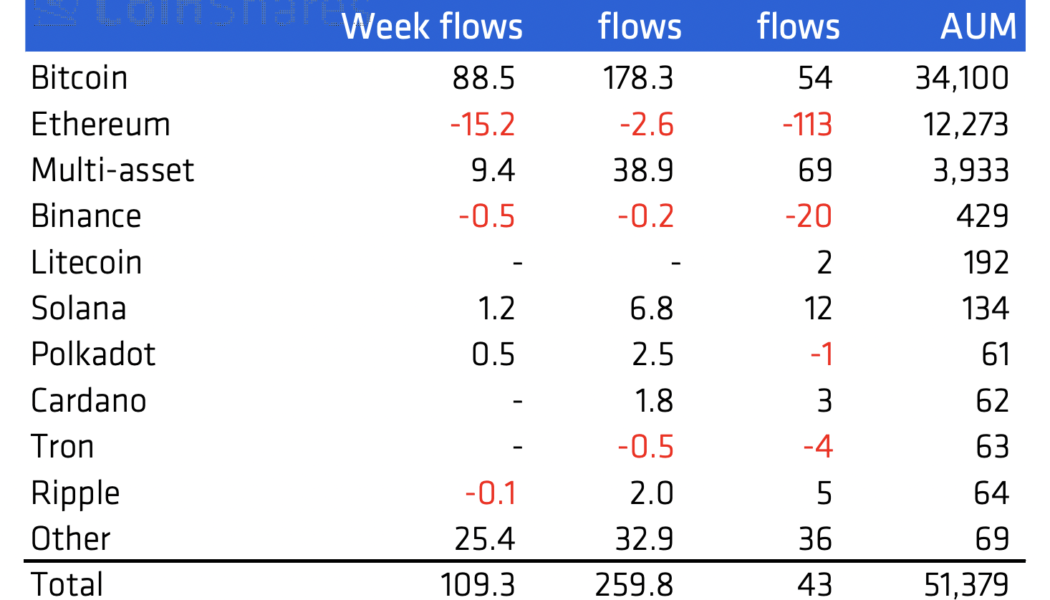

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Ethereum to $10K? Classic bullish reversal pattern hints at potential ETH price rally

Ethereum’s native token, Ether (ETH), could reach above $10,000 in the coming weeks as it paints what appears to be an “ascending triangle” technical pattern. Ether’s price technicals: Bullish signs Ascending triangles are bullish continuation setups that appear during an uptrend. Analysts confirm their presence after the price rises upward inside a rising right-angle triangle structure, thus forming a sequence of lower highs on the lower trendline with resistance in place at the upper one. As the pattern develops, volumes typically drop. So far, Ether has been forming a similar upside pattern on its weekly chart. In detail, the triangle’s lower trendline has been acting as an accumulation range since the beginning of 2021, with high selling pressure at the upper trendline, as shown b...

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

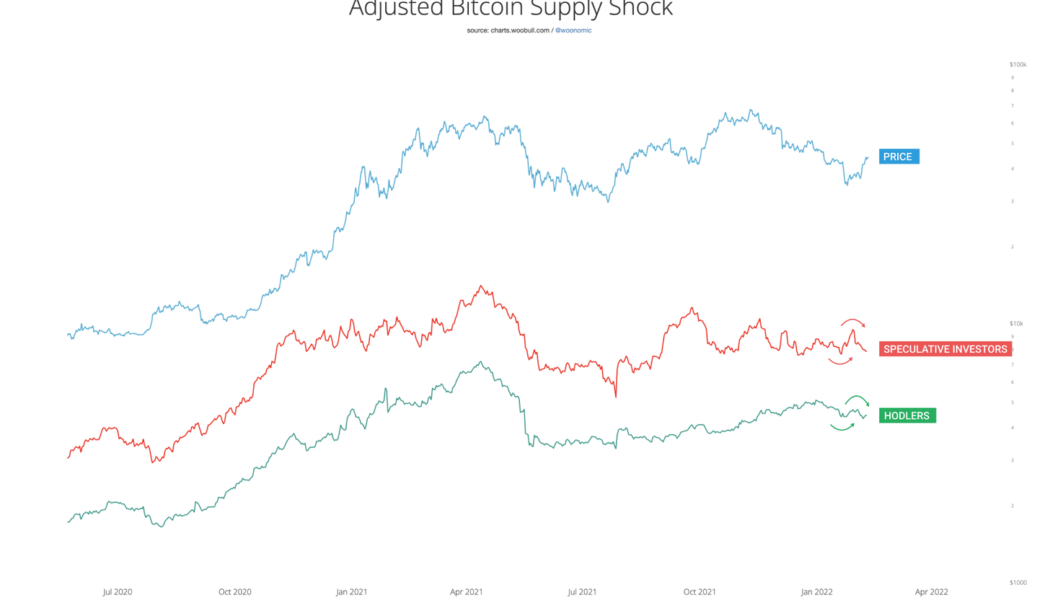

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

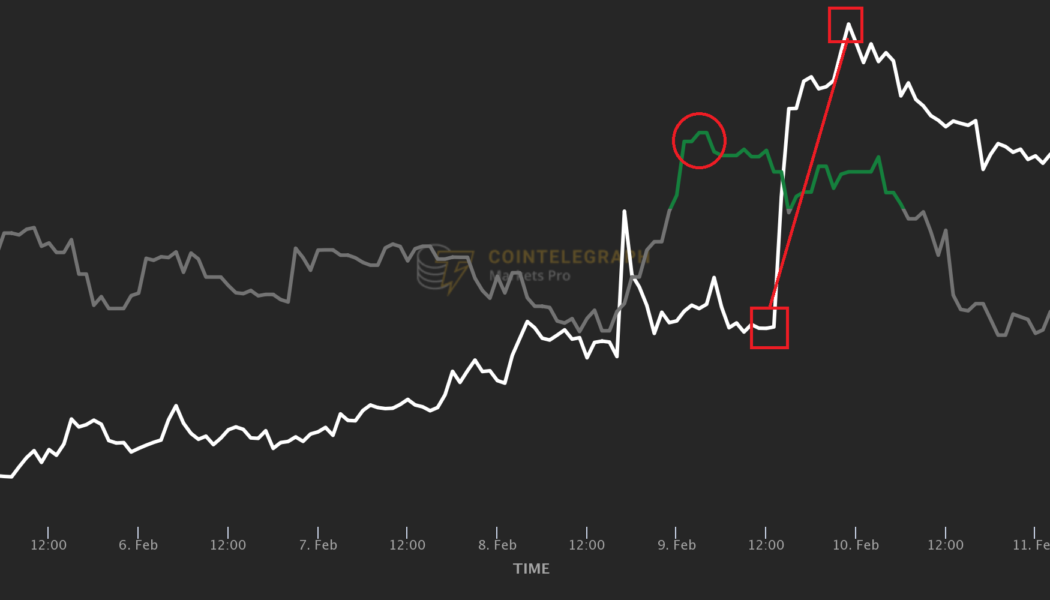

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...

House members call for an end to lawmakers trading stocks — is crypto next?

Congresspeople currently HODLing or actively trading in crypto may have to stop doing so while in office if recent pushes to ban lawmakers from investing in stocks gain enough support. In a Monday letter addressed to Speaker Nancy Pelosi and Minority Leader Kevin McCarthy, 27 members of the U.S. House of Representatives called for action “to prohibit members of Congress from owning or trading stocks.” Among the bipartisan group of lawmakers who signed onto the letter was Illinois congressperson Bill Foster, who is also a member of the Congressional Blockchain Caucus. In addition, the letter seems to have support from politicians diametrically opposed on major issues like Progressive Democrat Rashida Tlaib and Republican Matt Gaetz, who is reportedly under investigation by the Justice Depar...

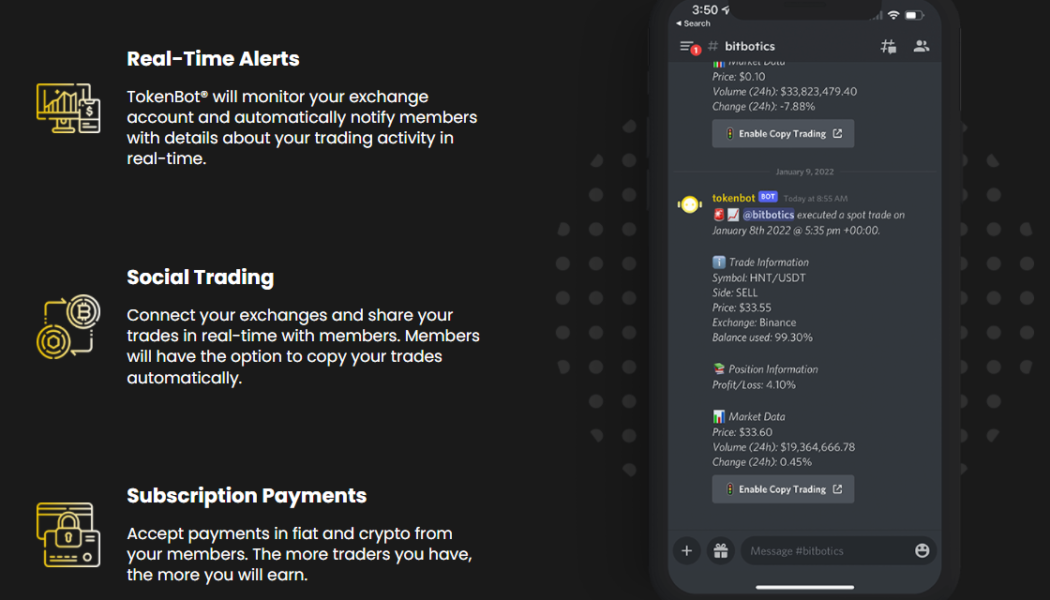

TokenBot helps crypto traders build social communities and monetize market knowledge

There are many advantages to automating one’s trading tactics instead of pointing and clicking with a mouse. For starters, bots can execute trading decisions free of emotion, are lighting fast and have far fewer margins of error. According to CNBC estimates, crypto trading bots account for 70% to 80% of the overall trading volume. TokenBot is an automated copy-trading platform designed for social trading groups and communities within messaging apps such as Discord, Telegram and Slack. Once added to a social media group, TokenBot monitors the admin’s account on an exchange and automatically notifies members of their trading activity details in real-time. The bot has more than 8,000 daily active users and streams close to $100 million per day in trading volume. In an exclus...