Trading Volume

Nifty News: ‘Degen’ season returns with feet NFTs, disappointing Game of Thrones NFTs and more

‘Degen’ season smells like pixelated feet Feetpix.wtf’s newly launched nonfungible token (NFT) collection, “Feetpix,” has seemingly taken the NFT community by storm with surging trading volumes, prompting some to suggest the return of “degen” season. Feetpix.wtf’s collection soared ahead of Bored Ape Yacht Club (BAYC) on Jan. 11 with the fifth-highest trading volume recorded on NFT marketplace OpenSea. Feetpix NFTs come in different skin tones, nail colors, shoes and backgrounds. Image: OpenSea. The project — which released 10,000 Feetpix NFTs — has traded over 825 Ether (ETH) ($1,157,000) across nearly 18,000 transactions since its release on Jan. 8. Crypto Twitter is still split on what inspired the surge in foot fetish-NFT trading volumes. However, Feetpix noted the absence of a roadmap...

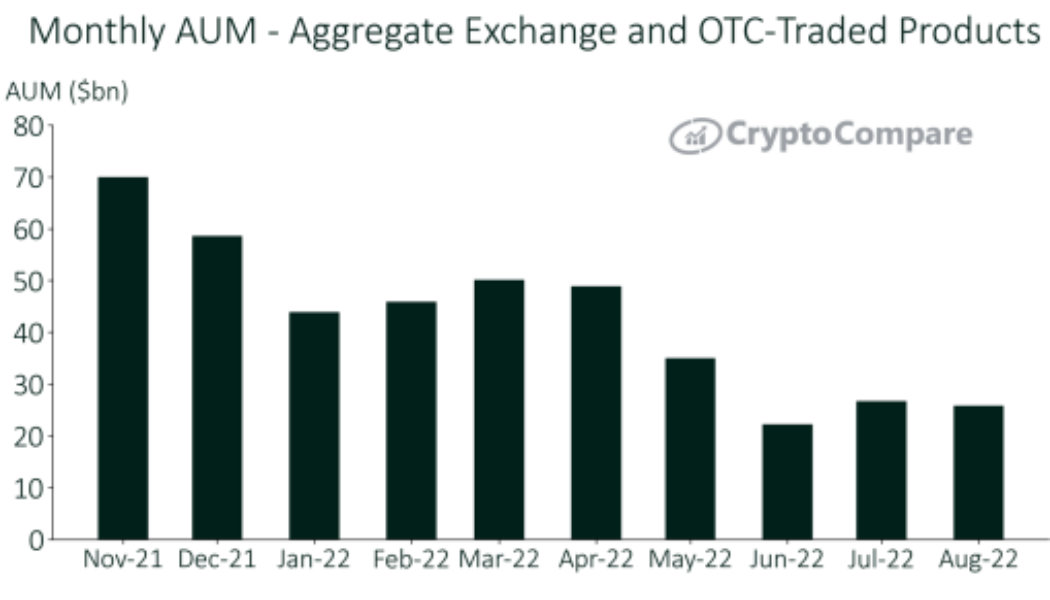

ETH products grow in August as BTC products dip: CryptoCompare report

Ethereum investment products increased by 2.36% to $6.81 billion in assets under management (AUM) throughout August, outperforming Bitcoin products which saw a 7.16% drop off to $17.4 billion. The figures were contained in a new report by CryptoCompare. This was also reflected in the Bitcoin (BTC) and Ethereum (ETH)-product trading volumes, with Grayscale’s most notable Bitcoin product, GBTC experiencing a 24.4% drop in volume, while its Ethereum product, GETH actually increased 23.2%. CryptoCompare’s report suggeste the highly anticipated Ethereum Merge was the cause behind the change in trading volumes: Indeed, even at a more granular level, no Bitcoin products covered in this report saw AUM or volume gains in the month of August. We could be seeing interest move away from Bi...

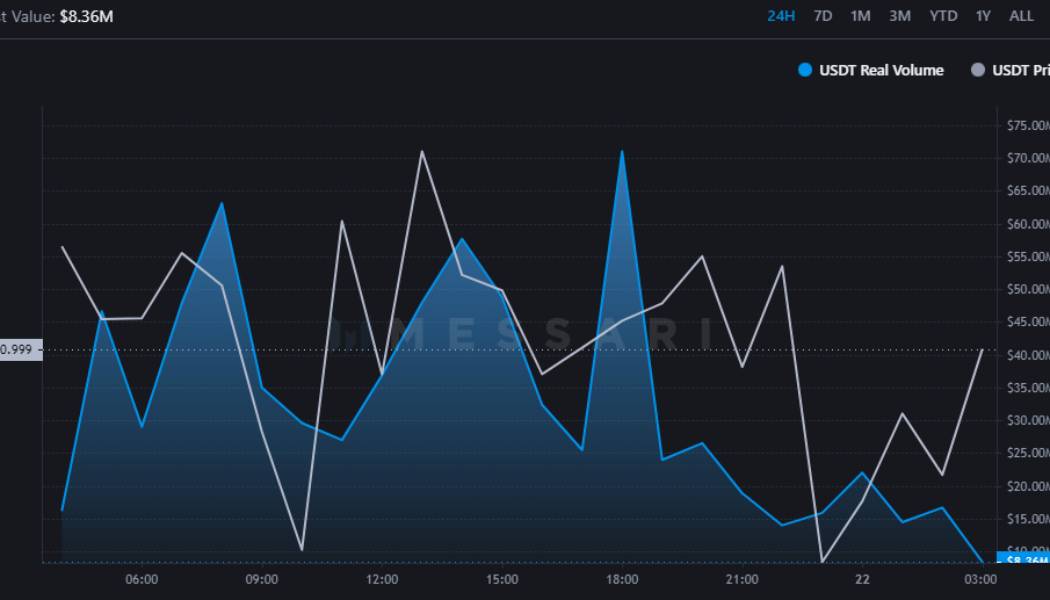

USDC’s ‘real volume’ flips Tether on Ethereum as total supply hits 55.9B

USD Coin is taking a run at the title of the top stablecoin in crypto after its daily ‘real volume’ on the Ethereum network doubled that of Tether’s USDT on Tuesday. According to crypto market data tool Messari, Circle’s USDC posted $1.1 billion in daily real volume on the Ethereum network on June 21, which was double USDT’s real volume of $579 million. Messari’s real volume metric is calculated by compiling data only from exchanges that it believes have “significant and legitimate crypto trading volumes” and thus differs to the more-commonly seen “total volume” metric. Exchanges included in Messari’s Real Volume metric include Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex, and those tracked on OnChainFX. 24 hr R...