Trading

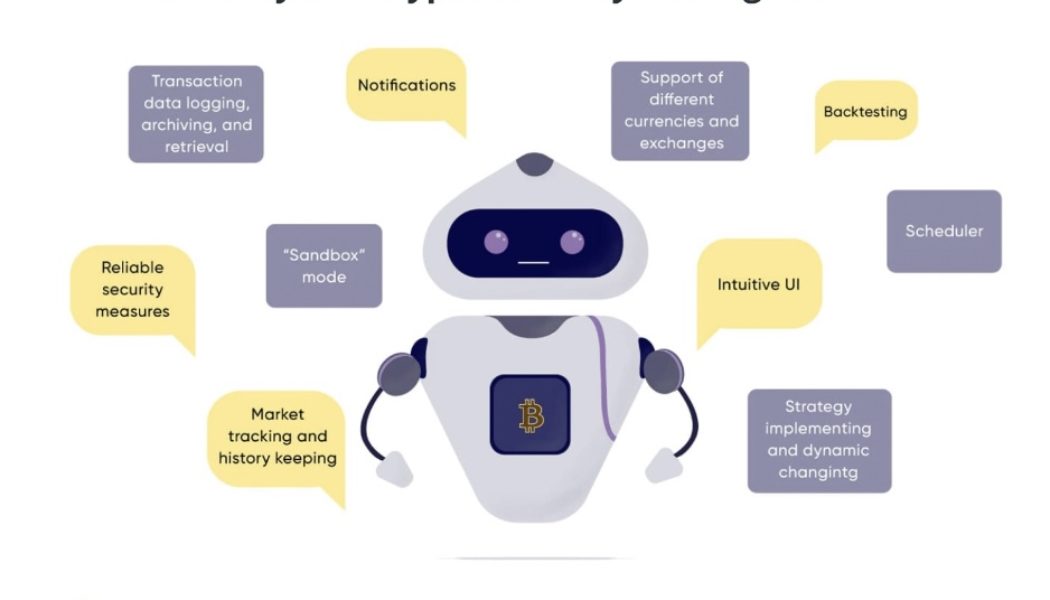

Opinion: Bots are a critical tool for retail investors

The thing about the future, where robotic super traders battle over micromovements in stock price, is that it’s already here. With access to algorithmic trading bots a click away, we could be seeing the fall of human investors and the triumph of artificial intelligence. Algorithmic trading bots are programmed to buy and sell when they detect preprogrammed conditions and can execute pretty much any trading strategy. They have been used by professional traders for two decades, and these firms have taken them into the crypto markets too. Now, a new crop of accessible crypto trading tools has hit the market, made with retail clients in mind. I know — I have built several of them. Currently, I’m working on a system that helps neophyte investors find their own risk preferences based on the...

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

Putting carbon credits on blockchain won’t solve the problem alone: Davos

Simply trading carbon credits on the blockchain won’t solve much for the environment. Carbon blockchain executives argue that companies must understand why they’re using them and how to make a real impact. During a panel session in Davos, Switzerland, moderated by Cointelegraph’s editor-in-chief, Kristina Lucrezia Cornèr on Jan. 16, several executives from carbon blockchain platforms spoke about the increasing interest from companies in carbon trading. Karen Zapata, the chief operating officer of carbon blockchain platform ClimateTrade, said that sustainability had been a “trending topic” with many companies keen to get involved, but noted that many still don’t understand it. She recalled talking to a sustainability manager of a “big, big company” who told her he doesn’t know what a carbon...

Alameda Research liquidators lost $72K during fund consolidation attempt

The liquidators of Alameda Research continue to encounter obstacles in their efforts to recover funds for creditors. Crypto analytics firm Arkham disclosed on Twitter that the liquidators lost $72,000 worth of digital assets on the decentralized finance (DeFi) lending platform Aave while trying to consolidate funds into a single multisignature wallet. The liquidators were attempting to close a borrow position on Aave but instead removed extra collateral used for the position, putting the assets at risk of liquidation. Arkham reported that over nine days, the loan was liquidated twice for a total of 4.05 Wrapped Bitcoin (WBTC), which creditors will now not be able to recoup. This resulted in the liquidation of around 4 WBTC, $72K at current prices. When positions are forcibly closed on...

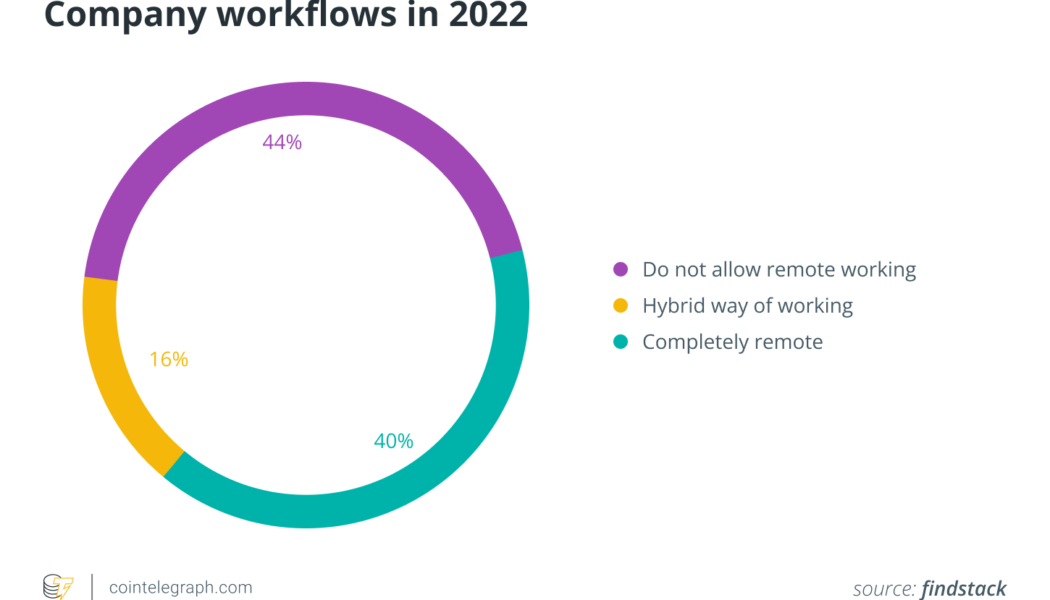

Remote work could redefine the global workforce for good

As the global economy continues to reel from the devastation caused by the COVID-19 pandemic, there is increasing data suggesting that more and more people are now favoring a remote work-based lifestyle. In this regard, a survey sample of working United States citizens shows that Millennial and Generation Z workers prefer joining a remote workforce and decentralized autonomous organizations (DAOs) as opposed to going to an office. As part of the study, more than 1,100 U.S. citizens were asked to provide their preferences regarding remote work and the emergence of DAOs in recent years. Using research pertaining to DAOs published by the Harvard Law School, the survey showed how DAOs have seen their coffers grow from a respectable $400 million to a whopping $16 billion over the course of 2021...

Crypto in 2023 — Do bulls have a chance? Watch Market Talks on Cointelegraph

On this week’s episode of Market Talks, Cointelegraph welcomes Mohit Sorout, co-founder of Bitazu Capital, a proprietary algorithmic trading and investment management platform. This week, to kick things off, we get to know a little bit about Sorout, his background in finance and trading. We also dive into his skillset, trading style and unique approach to the crypto markets. We get his view on the current Bitcoin (BTC) market sentiment and price action. Is Bitcoin finally shifting toward a bullish trend? Volatility has been low across the board as things have been pretty boring, but Ether (ETH) and BTC both have reported record-low volatility. What does this mean, and is this a positive sign or a negative one? What about altcoins, should traders be paying close attentio...

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

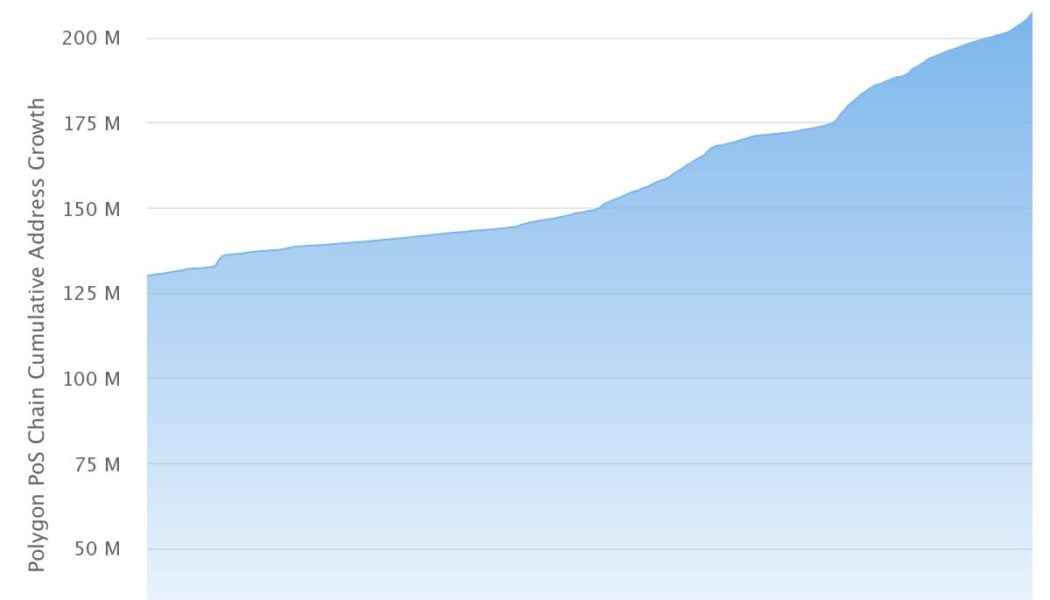

Crypto adoption in 2022: What events moved the industry forward?

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Models and fundamentals: Where will Bitcoin price go in 2023?

Bitcoin (BTC) had a bumpy ride throughout 2022, along with the rest of the digital asset market. The cryptocurrency began the year exchanging hands around $46,700 and is currently trading over 64% down at $16,560 at the time of writing. Consequently, the coin’s market capitalization took a tumble from around $900 billion on Jan. 1, 2022 to end the year at around $320 billion. Bitcoin Price Trend in 2022 While Bitcoin’s drop in price could be attributed to the extraordinary circumstances that the entire cryptocurrency market has been through this year, it is important to reevaluate the 2022 price predictions made by various market entities. One of the most popular predictions was that of analyst PlanB’s Bitcoin Stock-to-Flow (S2F) model. The S2F model predicted BTC to be at nearly $11...

Bitcoin Jack’s BTC trading is based on a list of risks and components

Well-known Twitter personality Bitcoin Jack, who tweets as @BTC_JackSparrow, joined Cointelegraph’s Crypto Trading Secrets podcast for an interview, which was recorded on Dec. 19. Jack covers many topics in the episode, including how he looks at the crypto space and prioritizes timing over price levels — “when” over “where.” Jack analyzes the crypto market based on a self-made list of possible risk factors. “When I look at ‘when,’ I’m trying to figure out what’s going on and what I want to see in the market to happen before I kind of think that the list of risks dissipate out of the market enough,” he explained when answering a question about Bitcoin’s (BTC) price at the time of recording. Jack mentioned that he maintains a personal list that includes crypto industry entities, global...

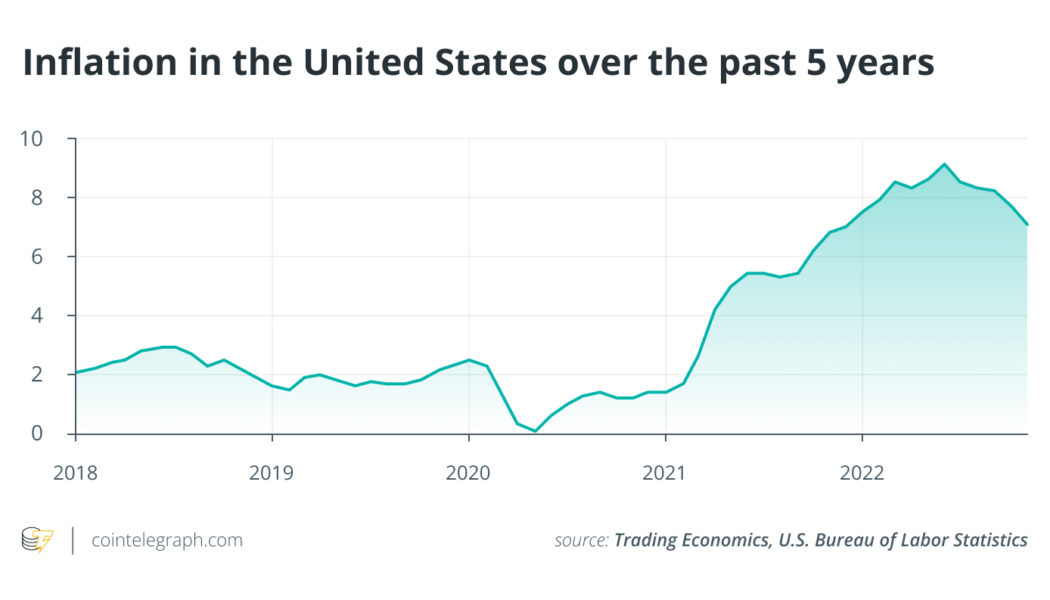

Time in the market: Ways to approach crypto investing in 2023

2022 was brutal for cryptocurrency and nonfungible token (NFT) investors. Bitcoin (BTC) hit its yearly low on Nov. 21, almost exactly a year after it reached its all-time high price of $69,044. After such a tumultuous year, how should crypto investors plan for 2023? Firstly, this space has critical risks worth considering before investing. Macroeconomic risks Investors must recognize the macro and systemic risks impacting the crypto industry as 2023 draws near. The war in Ukraine has led to an energy crisis caused by sanctions on Russian energy. The United States Federal Reserve’s monetary policy response to inflation continues to unsettle markets. The crypto contagion from recent bankruptcies continues injecting volatility into the market, with increasing regulatory pressure and miner cap...

U.S. delays crypto tax reporting rules, as it still can’t define what a ‘broker’ is

A key set of crypto tax reporting rules is being delayed until further notice under a decision made by the United States Treasury Department. The rules were supposed to be effective in the 2023 tax filing year, in accordance with the Infrastructure Investment and Jobs Act passed in November, 2021. The new law requires that the Internal Revenue Service (IRS) develop a standard definition of what a “cryptocurrency broker” is, and any business that falls under this definition is required to issue a Form 1099-B to every customer detailing their profits and losses from trades. It also requires these firms to provide this same information to the IRS so that it will be aware of customers’ incomes from trading. However, more than 12 months have passed since the infrastructure bill became law, but ...