Toncoin

Bitcoin and these 4 altcoins are showing bullish signs

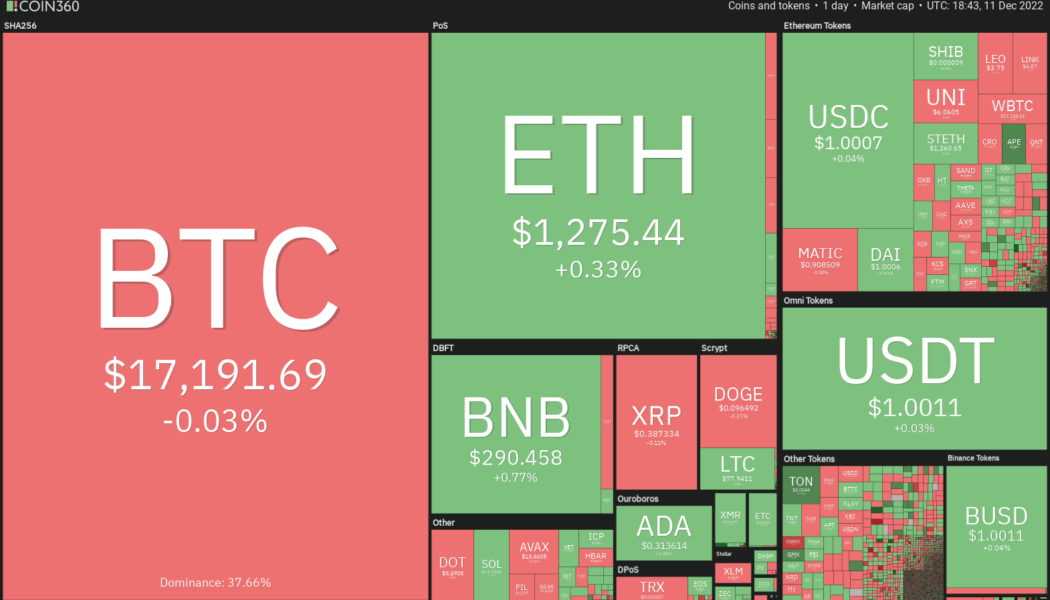

Cryptocurrency markets lack any signs of volatility going into the year-end holiday season. This suggests that both the bulls and the bears are playing it safe and are not waging large bets due to the uncertainty regarding the next directional move. This indecisive phase is unlikely to continue for long because periods of low volatility are generally followed by an increase in volatility. Willy Woo, creator of on-chain analytics resource Woobull, anticipates that the duration of the current bear market may “be longer than 2018 but shorter than 2015.” Crypto market data daily view. Source: Coin360 The crypto winter has resulted in a loss of more than $116 billion to the personal equity of 17 investors and founders in the cryptocurrency space, according to estimates by Forbes. The carnage ha...

Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

The relief rally in the United States equities markets took a breather this week as all major averages closed in the red. Traders seem to have booked profits before the busy economic calendar next week. The S&P 500 index dropped 3.37%, but a minor positive for the cryptocurrency markets is that Bitcoin (BTC) has not followed the equities markets lower. This suggests that crypto traders are not panicking and dumping their positions with every downtick in equities. Crypto market data daily view. Source: Coin360 The range-bound action in Bitcoin suggests that traders are avoiding large bets before the Federal Reserve’s rate hike decision on Dec. 14. However, that has not stopped the action in select altcoins, which are showing promise in the near term. Let’s look at the charts of Bitcoin ...

Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data. Although the FTX crisis broke the positive correlation between the U.S. equities markets and Bitcoin (BTC), the recent strength in equities shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers. Crypto market data daily view. Source: Coin360 The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused by FTX’s collapse. Until then, bullish price action may be limited to select cryptocurrencies. Let’s lo...