Tokens

Has New York State gone astray in its pursuit of crypto fraud?

The Empire State made two appearances on the regulatory stage last week, and neither was entirely reassuring. On April 25, bill S8839 was proposed in the New York State (NYS) Senate that would criminalize “rug pulls” and other crypto frauds, while two days later, the state’s Assembly passed a ban on non-green Bitcoin (BTC) mining. The first event was met with some ire from industry representatives, while the second drew negative reviews, too. However, this may have been more of a reflex response given that the “ban” was temporary and principally aimed at energy providers. The fraud bill, sponsored by State Senator Kevin Thomas, looked to steer a middle course between protecting the public from scam artists while encouraging continued innovation in the crypto and blockchain sector. It...

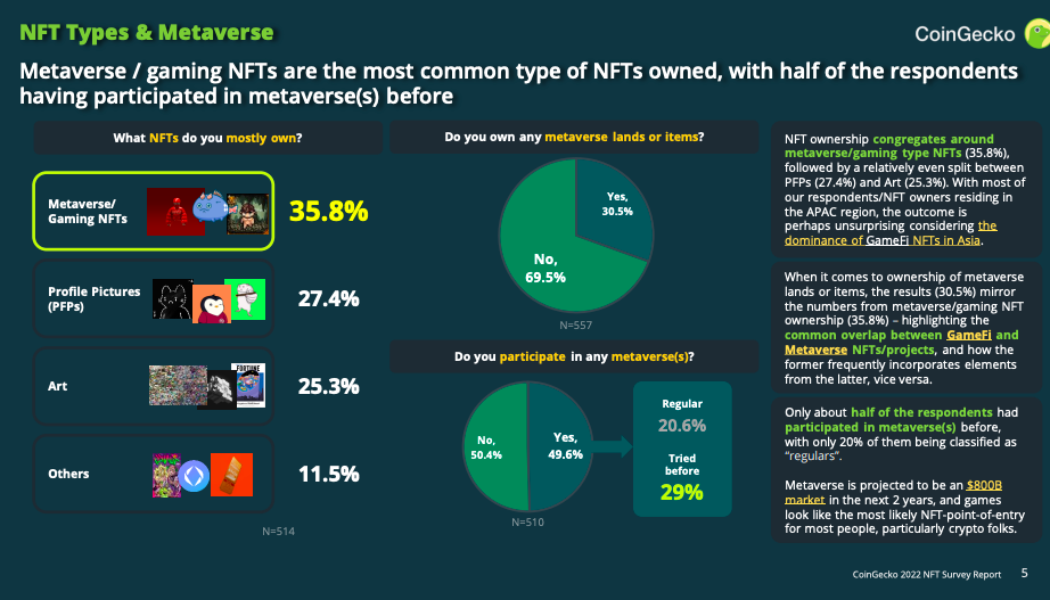

The NFT sector is projected to move around $800 billion over next 2 years: Report

Although NFTs have been a part of the cryptocurrency market since 2014, interest and adoption ha risen rapidly over the last two years. At their height in August 2021, the total trading volume of NFTs rose to over $5 billion, kickstarting what briefly came be to known as “NFT Summer”. According to a report by Coingecko, the NFT market is now expected to move more than $800 billion in the coming two years. The report, which mostly utilized investors from Asia and the Pacific, highlighted that of 871 respondents, around 72% of them already own NFT(s), with more than 50% of them declaring that they had 5 or more. As for investors, the report indicated a balance between the generations, suggesting 43.6% of NFT investors surveyed were between 18-30 years old and 45.2% are between 30-50 yea...

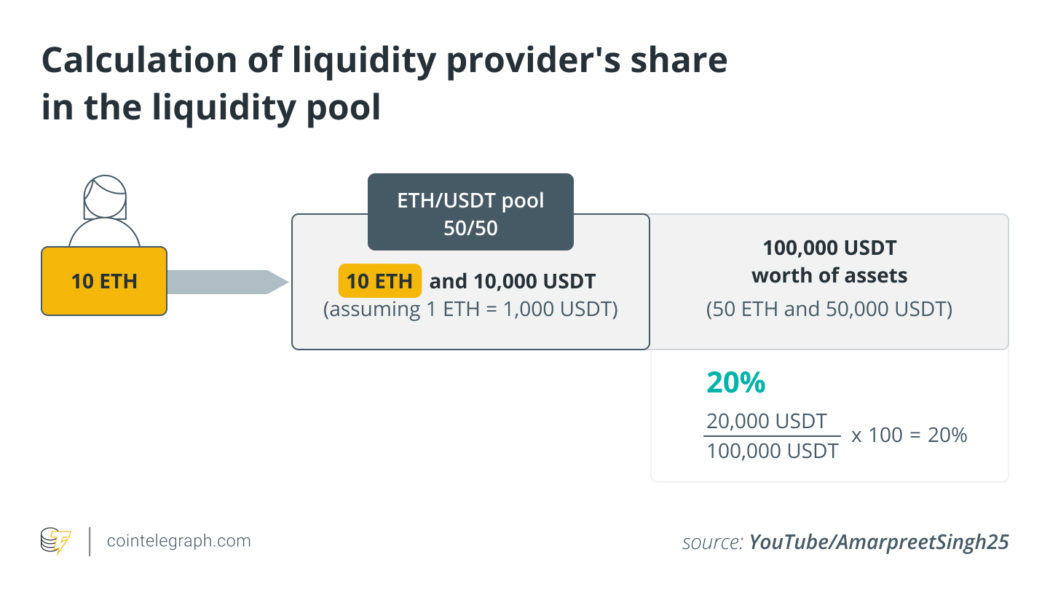

What is impermanent loss and how to avoid it?

The difference between the LP tokens’ value and the underlying tokens’ theoretical value if they hadn’t been paired leads to IL. Let’s look at a hypothetical situation to see how impermanent/temporary loss occurs. Suppose a liquidity provider with 10 ETH wants to offer liquidity to a 50/50 ETH/USDT pool. They’ll need to deposit 10 ETH and 10,000 USDT in this scenario (assuming 1ETH = 1,000 USDT). If the pool they commit to has a total asset value of 100,000 USDT (50 ETH and 50,000 USDT), their share will be equivalent to 20% using this simple equation = (20,000 USDT/ 100,000 USDT)*100 = 20% The percentage of a liquidity provider’s participation in a pool is also substantial because when a liquidity provider commits or deposits their assets to a pool via ...

Wildlife conservation efforts turn to NFT-funded initiatives

Digital twin nonfungible tokens, or NFTs, aren’t just reserved for consumer products anymore. Netherlands-based decentralized carbon credit exchange Coorest and conservation consulting firm PLCnetwork of the Southern Hemisphere teamed up to tokenize individual real-world endangered animals at game reserves and privately owned conservation areas in Africa. These wildlife NFTs enable holders to sponsor an elephant, lion, cheetah or rhino. Profits from the sales will go toward food, shelter and security for the animals they represent. Cointelegraph spoke to William ten Zijthoff, founder and chief executive officer of Coorest, to learn more about combining blockchain and sustainability with wildlife preservation. Coorest is best known for operating an NFTrees CO2 compensat...

Cointelegraph’s experts reveal their crypto portfolios | Watch now on The Market Report

On this week’s show, Cointelegraph’s resident experts reveal exactly what percentages of their portfolios are allocated to what coins and why. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they reveal their crypto portfolios. We kick things off with Bourgi, whose top holdings are BTC with 67%, ETH with 20%. No surprise there but what about the rest? It’s an interesting mix, to say the least so make sure you stick around to find out. Next, we have Yuan, whose top three holdings are 35% BTC, 28% Terra...

China-based regulatory and trade associations target NFTs in latest risk notice

The China Banking Association, the China Internet Finance Association and the Securities Association of China issued a joint statement warning the public about the “hidden risks” of investing in nonfungible tokens, or NFTs. In a Wednesday notice, the three associations launched initiatives aimed at encouraging innovation in the crypto and blockchain space focused on NFTs as well as “resolutely curb[ing] the tendency of NFT financialization and securitization” to reduce the risks around illicit activities. The China Banking Association said member institutions should not consider NFTs assets like securities, precious metals, and other financial products. In addition, cryptocurrencies including Bitcoin (BTC), Ether (ETH) and Tether (USDT) should not be used for the pricing and settlement of ...

What are the worst crypto mistakes to avoid in 2022? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the worst mistakes you should avoid making in crypto. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they talk about the worst crypto mistakes to avoid making in 2022. First up, we have Bourgi, who thinks investors should avoid “analysis paralysis.” In other words, don’t overanalyze. Make decisions based on firm conviction. Don’t just look at the price of a coin or token you’re interested...

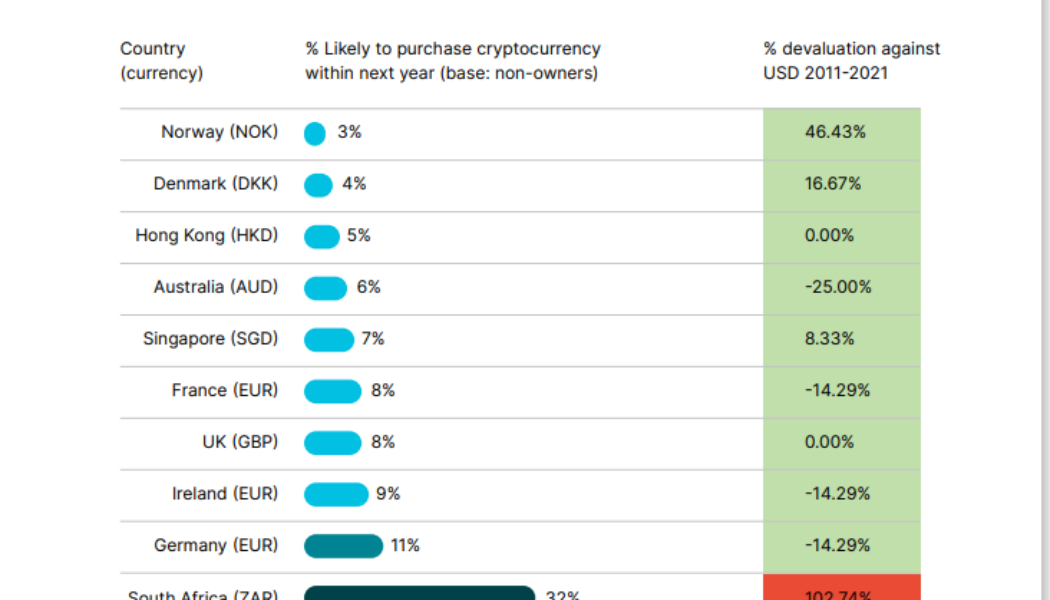

Crypto seen as the ‘future of money’ in inflation-mired countries

Last year, cryptocurrencies reached a “tipping point,” according to Gemini’s 2022 Global State of Crypto report, “evolving from what many considered a niche investment into an established asset class.” According to the report, 41% of crypto owners surveyed globally purchased crypto for the first time in 2021, including more than half of crypto owners in Brazil at 51%, Hong Kong at 51% and India at 54%. The study, based on a survey of 30,000 adults in 20 countries over six continents, also made a strong case that inflation and currency devaluation are powerful drivers of crypto adoption, especially in emerging market (EM) countries: “Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as...

Celebrity tokens: Signs of rising crypto adoption in Indonesia

Cryptocurrency investments in Indonesia have seen considerable growth between 2020-2022, with 4% of the country’s population having invested in crypto. In 2021, crypto transaction volumes surpassed $34 billion, according to Indonesia’s Commodity Futures Trading Regulatory Agency. This growth has formed a new mindset toward crypto investment, especially in the mainstream media. One example of cryptocurrencies’ growing appeal in the mainstream is the participation of Indonesian celebrities and influencers. Crypto adoption among celebrities Celebrities and influencers in Indonesia seem to have become much more involved in Indonesia’s crypto investment industry since 2021. Many have become brand ambassadors for exchanges and crypto projects to help promote them and essentially raise the tradin...

Indonesia’s cryptocurrency community in 2022: An overview

Crypto is the next big thing in Indonesia. According to the Ministry of Trade, transactions for currencies like Bitcoin (BTC) grew over 14 times from a total of 60 trillion rupiahs ($4.1 billion) in 2020 to a total of 859 trillion rupiahs ($59.83 billion) in 2021. It’s getting to the point where crypto is becoming more popular than traditional stock. Vice Minister of Trade Jerry Sambuaga stated that more than 11 million Indonesians bought or sold crypto in 2021. In comparison, according to the Indonesian Central Securities Depository, the total number of portfolio investors — indicated by the number of single investor identities — reached 7.35 million in 2021. Even so, 11 million crypto investors is still only about 4% of Indonesia’s total population, meaning there’s still plenty of room t...

How ambitious young projects are connecting Distributed Ledger Technology and music

Blockchain is simple to understand at a basic level, existing as a distributed database, where different devices distributed across the network must verify the entries posted. As a result, blockchain is most well-known for decentralization, anonymity and security, all of which are evident in the first cryptocurrency, Bitcoin (BTC). While many are quick to associate Bitcoin with blockchain, this is only one of the possible use cases for the technology. One of the most notable use cases right now is the music industry, where creators have gained new opportunities to connect with their fans directly, further eliminating the need for an intermediary. Today, the music industry is plagued with several overarching concerns, including the burden that record labels seem to place on the musicians th...