Tokens

Blockchain-based fintech company prepares to enter $500B freight settlement market

The world is quick to blame inflation for the rising prices at grocery stores and retailers. This was the #1 political issue for recent Election Day voters in the United States. For example, media sources recently reported poll data that 85% of Americans could not afford to spend $200 on a Thanksgiving meal in November 2022, and only 25% could afford $100. However, few recognize inflation is only part of the problem. Higher costs for products and services are also directly attributable to settlement fees paid by transportation providers who are forced to take out the equivalent of payday loans against their freight invoices. Shipper payment terms in the transportation industry are known to be egregious, and most transportation carriers cannot afford to wait 30–180 days to get paid. Wh...

Shiba Inu developer says WEF wants to work with project to ‘help shape’ metaverse global policy

The volunteer project lead and developer for Shiba Inu known only as ‘Shytoshi Kusama’ has reported on social media that the World Economic Forum, or WEF, wants to work with the meme-based cryptocurrency on global policy. In a poll posted to Twitter on Nov. 22, Kusama said the WEF had “kindly invited” the Shiba Inu (SHIB) project to collaborate on “MV global policy.” The Shiba Inu developer seemed to be referring to policy on the metaverse. Crypto and blockchain have sometimes been under discussion at WEF events, but partnering with a popular meme token would seemingly be a first for the organization. “Yes I am serious,” said Kusama. “We would be at the table with policy makers and would help shape global policy for the MV alongside other giants like FB (bye Zuck), Sand, Decentraland etc.”...

Is DOGE really worth the hype even after Musk’s Twitter buyout?

2022 continues to be a year of surprises, with one of the biggest so far being Elon Musk’s decision to acquire social media juggernaut Twitter for a whopping $44 billion. While the takeover has set into motion a whole host of debates — particularly those pertaining to Big Tech censorship — it has also called into question the future of Dogecoin (DOGE), a digital currency of which the billionaire has been a big proponent over the last couple of years. To put things into perspective, just hours before Musk tweeted that “the bird is freed” on Oct. 27, the price of DOGE was hovering around $0.07. However, by Nov. 1, it had surged to $0.16, bringing the total market capitalization of the so-called memecoin to a sizable $21 billion. And while DOGE is currently trading close to $0.08, its 30-day ...

South Korea investigates crypto exchanges for listing native tokens

Native cryptocurrencies turned out to be the biggest factor contributing to the demise of numerous exchanges and ecosystems this year, most recently during the FTX collapse. Korea’s financial authority, Korea Financial Intelligence Unit (KoFIU), took notice of the same as it launched a probe into crypto exchanges in relation to listing their in-house, self-issued tokens. Crypto exchange FTX and its 130 affiliate firms recently filed for bankruptcy due to a price crash of its in-house token, FTX Token (FTT). While Korean crypto exchanges are barred from issuing native tokens, KoFIU’s probe into the same is to ensure regulatory adherence for investor’s safety, according to a local report. Initial investigations revealed that all crypto exchanges performed lawful operations across South...

South Korea seizes $104M from Terra co-founder suspecting unfair profits

While crypto exchange FTX stole the limelight from other fallen ecosystems, South Korean authorities continue their efforts to bring closure to the victims of the year’s first crypto crash — Terraform Labs. Nearly six months after the Terra (LUNA) blockchain was officially halted, South Korean authorities froze approximately $104.4 million (140 billion won) from co-founder Shin Hyun-seong based on suspicion of unfair profits. The decision to freeze Shin’s asset worth over $104 million was approved by the Seoul Southern District Court, which was based on a request from the prosecutors. The claim related to Shin’s involvement in selling pre-issued Terra (LUNA) tokens to unwary investors. Based on suspicion of profiting from unwarranted LUNA sales, the district court froze the allegedly stole...

Crypto adoption via regulation: Setting rules for centralized exchanges

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

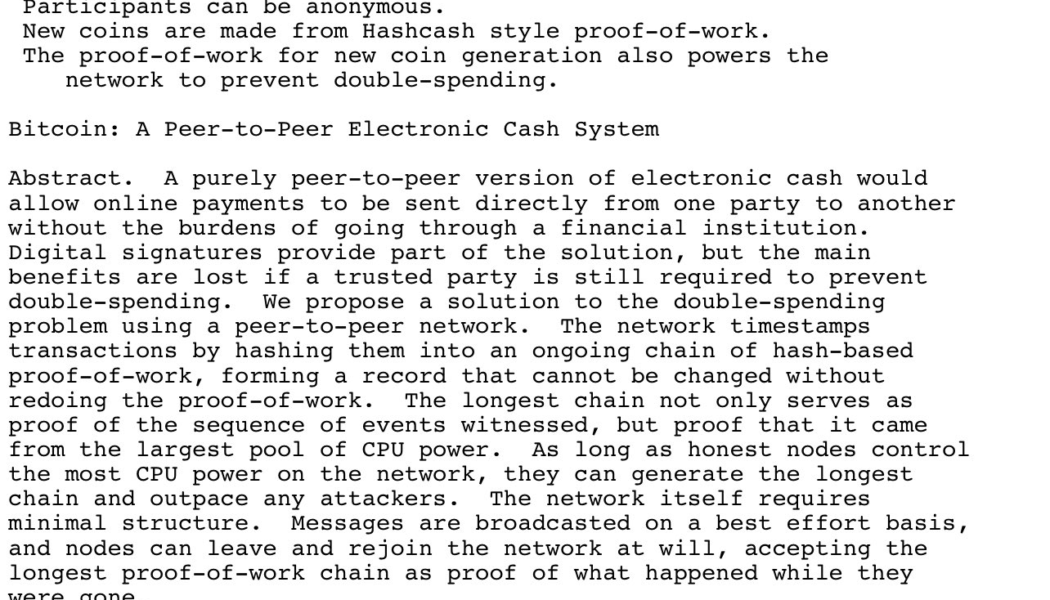

14 years since the Bitcoin white paper: Why it matters

Happy white paper day, Bitcoin. It’s been 14 years since Satoshi Nakamoto first sent an email to the Cypherpunk mailing list with the subject line, “Bitcoin P2P e-cash Paper.” The email included a link to the white paper, an outline of what would soon become a one trillion-dollar market. The first sentence of the email has become iconic among the Bitcoin community: “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” Over the past 14 years, Bitcoin (BTC) has morphed from a hobbyist pastime into a globally recognized brand. Bitcoin has been adopted as legal tender in regions of the global south such as El Salvador and the Central African Republic. It is used by freedom fighters and campaigners while being a tool for financial eman...

Boo! Halloween-themed shitcoins materialize to haunt crypto Twitter

The crypto community never shies away from deploying new cryptocurrencies that are themed on current events, and Halloween was no exception. The industry saw an influx of Halloween-themed cryptocurrencies hoping to cash in on the hype around the festivities. Halloween-themed cryptocurrencies have taken over the crypto ecosystem on Twitter, typically offering no real use case or future for investors. Projects like these have a track record of being sourced as an off-the-shelf product, which can be quickly renamed and deployed in the free market for trading. Our target is 50 millions market cap an 0.01$ price — Halloween Token (@CyberMetaWorld) October 28, 2022 Projects like Halloween Token, as shown above, came up just days before the occasion with the sole purpose of amassing $5...

After Mango Markets exploit, Compound pauses 4 tokens to protect against price manipulation

Decentralized lending protocol Compound has paused the supply of four tokens as lending collateral on its platform, aiming to protect users against potential attacks involving price manipulation, similar to the recent $117 million exploit of Mango Markets, according to a proposal on Compound’s governance forum that was recently passed. With the pause, users will not be able to deposit Yearn.finance’s YFI (YFI), 0x’s ZRX, Basic Attention Token (BAT) and Maker’s MKR (MKR) as collateral to take loans. The proposal passed on Oct. 25 with 99% of all voters in favor. It stated: “An oracle manipulation-based attack analogous to the one that cost Mango Markets $117m is much less likely to occur on Compound due to collateral assets having much deeper liquidity than MNGO and Compound requiring loans...

What directional liquidity pooling brings to DeFi

Modern decentralized exchanges (DEXs) mainly rely on liquidity providers (LP) to provide the tokens that are being traded. These liquidity providers are rewarded by receiving a portion of the trading fees generated on the DEX. Unfortunately, while liquidity providers earn an income via fees, they’re exposed to impermanent loss if the price of their deposited assets changes. Directional liquidity pooling is a new method that is different from the traditional system used by DEXs and aims to reduce the risk of impermanent loss for liquidity providers. What is directional liquidity pooling? Directional liquidity pooling is a system developed by Maverick automated market maker (AMM). The system lets liquidity providers control how their capital is used based on predicted price changes. In the t...

UNI tokens delegation was a ‘misunderstood situation,’ according to Binance’s CZ

The millions of UNI (UNI) tokens delegated by Binance were a “misunderstood situation,” said Binance CEO Changpeng “CZ” Zhao in a Twitter post, in response to questions about 13.2 million UNI tokens delegated on Oct. 18 that made Binance the second-largest entity by voting power in the Uniswap DAO. According to CZ, a UNI transfer between internal wallets caused the automatic delegation. He denie allegations about the crypto exchange using users’ tokens to vote. UNI transferred between internal Binance wallets, causing the UNI to be automatically delegated. This is part of their protocol, not “we intended”. Binance don’t vote with user’s tokens. Uniswap misunderstood the situation. Tokens come to popular platforms. #Binance https://t.co/KYPqFx5GrW — CZ Bi...

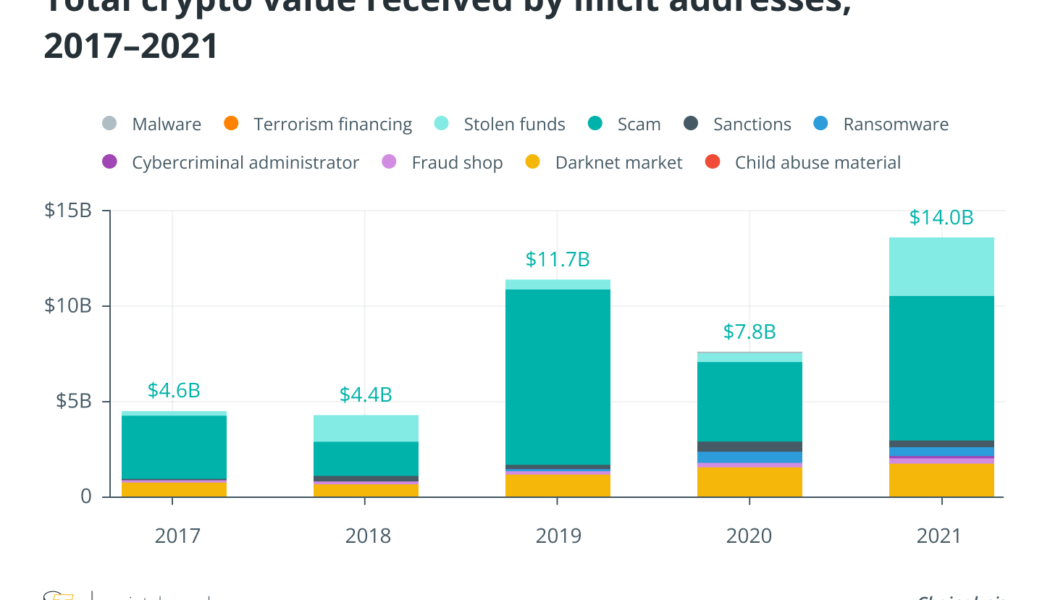

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...