Tokens

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

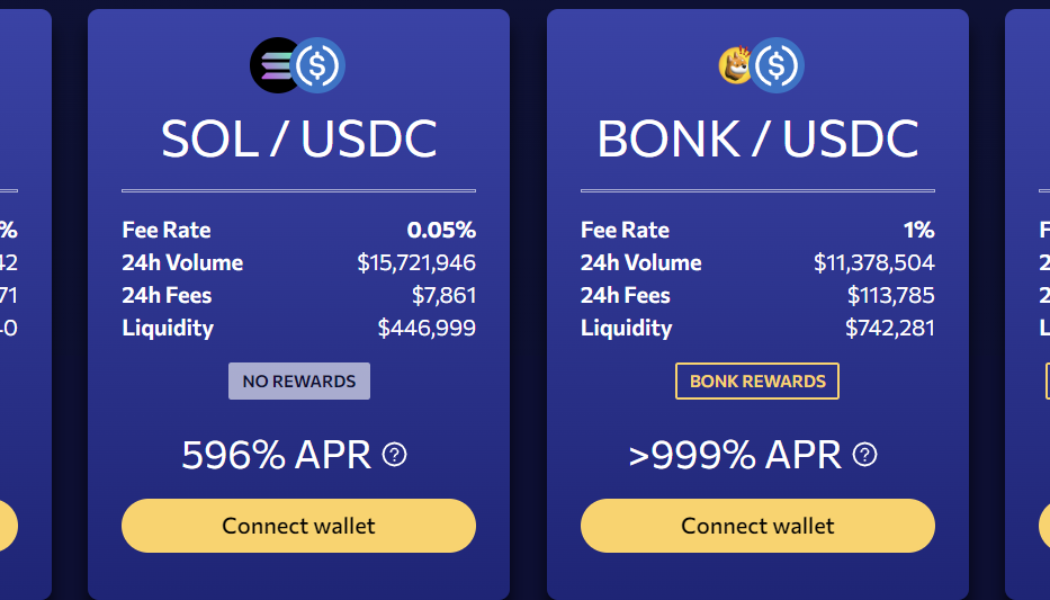

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

Crypto adoption in 2022: What events moved the industry forward?

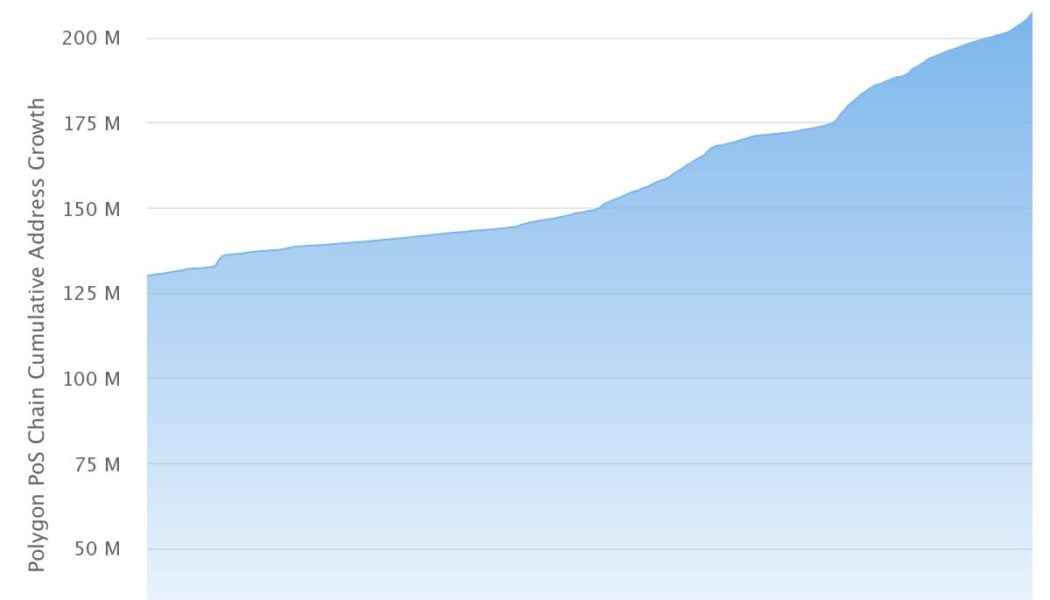

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Models and fundamentals: Where will Bitcoin price go in 2023?

Bitcoin (BTC) had a bumpy ride throughout 2022, along with the rest of the digital asset market. The cryptocurrency began the year exchanging hands around $46,700 and is currently trading over 64% down at $16,560 at the time of writing. Consequently, the coin’s market capitalization took a tumble from around $900 billion on Jan. 1, 2022 to end the year at around $320 billion. Bitcoin Price Trend in 2022 While Bitcoin’s drop in price could be attributed to the extraordinary circumstances that the entire cryptocurrency market has been through this year, it is important to reevaluate the 2022 price predictions made by various market entities. One of the most popular predictions was that of analyst PlanB’s Bitcoin Stock-to-Flow (S2F) model. The S2F model predicted BTC to be at nearly $11...

SushiSwap CEO proposes new tokenomics for liquidity, decentralization

Jared Grey, CEO of the decentralized exchange Sushiswap, has plans to redesign the tokenomics of the SUSHI token, according to a proposal introduced on Dec. 30 in the Sushi’s forum. As part of the new proposed tokenomics model, time-lock tiers will be introduced for emission-based rewards, as well as a token burning mechanism and a liquidity lock for price support. The new tokenomics aims to boost liquidity and decentralization in the platform, along with strengthening “treasury reserves to ensure continual operation and development,” noted Grey. In the proposed model, Liquidity Providers (LPs) would receive 0.05% of swap fees revenue, with higher volume pools receiving the biggest share. LPs will also be able to lock their liquidity to earn boosted, emissions-based rewar...

Nifty News: Building bridges in the Metaverse, elaborate Apes scam and more

South Korea’s Gyeongbuk Province has announced plans to use Web3 technology to expand its economic relations with Vietnam. In a Dec. 19 announcement, the province’s governor Lee Cheol-woo said the metaverse project would focus on “growing economic, cultural, commercial, and people-centered contacts with Vietnam.” Back in June, the province announced it would invest $13.8 million to establish itself as a hub for metaverse innovation in the hope of growing the local economy. South Korea has been very active in metaverse development since the beginning of 2022 and it aims to become the fifth most metaverse-ready country in the world. It has allocated $186.7 million to create an all-encompassing metaverse platform known as the Expanded Virtual World. 14 Bored Apes stolen in phishing scam ...

Coinbase launches tool to recover ‘mistakenly sent’ ERC-20 tokens

Major cryptocurrency platform Coinbase has offered an asset recovery tool for users who “mistakenly send unsupported tokens” to exchange addresses. In a Dec. 15 announcement, Coinbase said users who sent any of roughly 4,000 ERC-20 tokens to a Coinbase address could recover their previously unrecoverable funds by providing “the Ethereum TXID for the transaction where the asset was lost and the contract address of the lost asset.” The exchange said certain ETC-20 tokens including Wrapped Ether (wETH), TrueUSD (TUSD), and staked Ether (STETH) would be eligible for recovery, with a 5% charge on transactions of more than $100. “Our recovery tool is able to move unsupported assets directly from your inbound address to your self-custodial wallet without exposing private keys at any point,” said ...

Japan’s Sumitomo Mitsui to issue soulbound tokens to explore Web3

The Japanese financial group Sumitomo Mitsui Financial Group (SMBC) is moving to explore the benefits of Web3 by issuing soulbond tokens (SBTs). Proposed by Ethereum creator Vitalik Buterin, SBTs refer to digital identity tokens that represent the characteristics or reputation of a person or entity, or a “soul.” Such tokens are non-transferable and are designed for the decentralized society and Web3. SMBC officially announced on Dec. 8 an initiative focused on the practical use of SBTs in partnership with the digital asset firm HashPort. The companies plan to conduct research on SBTs to find out their practical uses for communities, jobs, knowledge sharing services and decentralized autonomous organizations (DAOs). According to SMBC, the development could specifically be useful for individ...

The impact of CBDCs on stablecoins with Bitget’s Gracy Chen

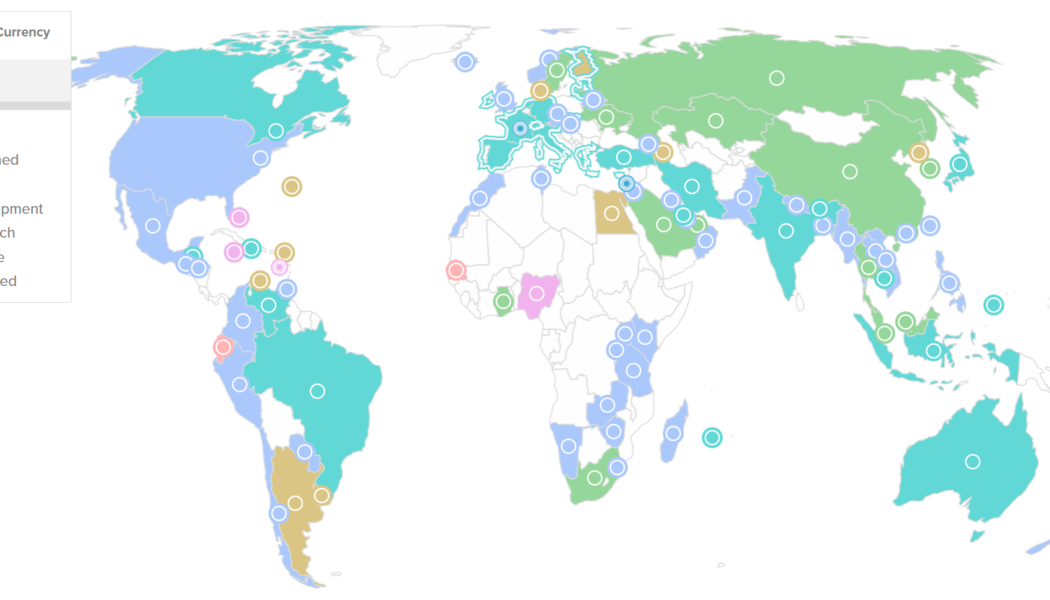

For over 14 years, central banks worldwide have seen blockchain technology deliver highly secure, immutable, verifiable and transparent financial ecosystems, starting with the Bitcoin network. Central bank digital currencies (CBDCs) stood out as one of the ways for fiat currency to harness a part of what cryptocurrencies achieve today. To not only keep up with rising inflation and cut down on operational costs but also to counter money laundering and related concerns, 98 of 195 countries — representing over 95% of global GDP — have either launched or are researching and developing their own versions of CBDC. Global CBDC initiatives overview. Source: Atlantic Council With CBDCs joining the race to dominate the future of finance, the relevance of the stablecoin ecosystem — cryptocurrencies b...

Ankr says no one should trade aBNBc, only LPs ‘caught off guard’ will be compensated

Following yesterday’s confirmed multi-million dollar exploit, BNB Chain based protocol Ankr took to its company blog on Dec. 2 to relay its next steps to users. The team said it was identifying liquidity providers to decentralized exchanges as well as protocols supporting aBNBc or aBNBb LP. The group also said it is assessing aBNBc collateral pools, such as Midas and Helio. According to the post, Ankr intends to purchase $5 million worth of BNB, which it will use to compensate liquidity providers affected by the exploit. Some users speculatively traded diluted aBNBc after the exploit had occurred as well, but the company indicated that these traders won’t be included in the protocol’s recompense measures stating, “we are only able to compensate LP’s caught off...

MATIC attack: How smart crypto traders “got out” before a 35% price drop

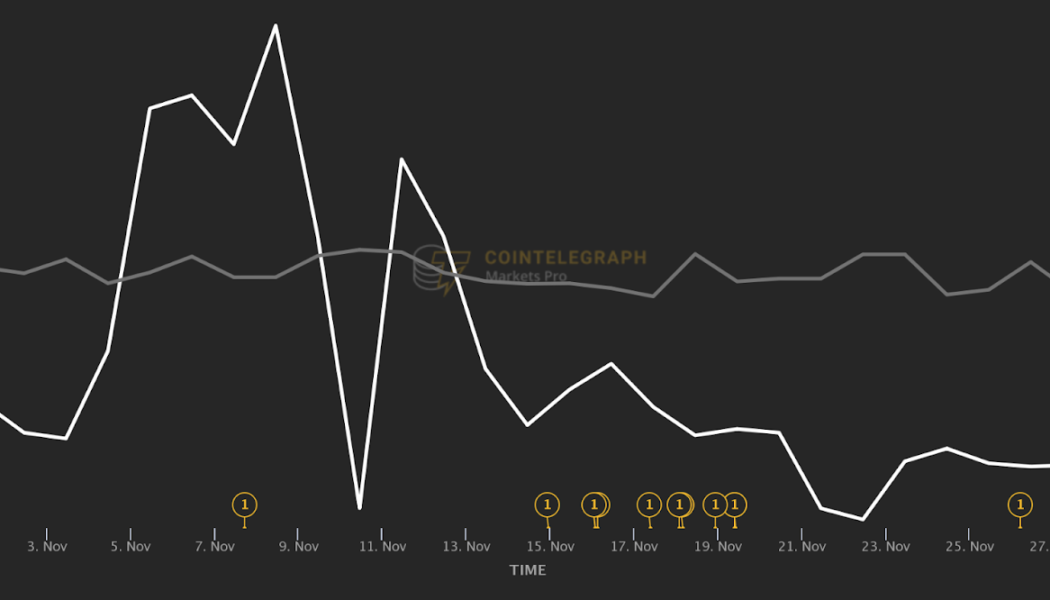

Disparities in information access and data analytics technology are what give institutional players an edge over regular retail investors in the digital asset space. The core idea behind Markets Pro, Cointelegraph’s crypto-intelligence platform powered by data analytics firm The Tie, is to equalize the information asymmetries present in the cryptocurrency market. Markets Pro bridges the gap of these asymmetries with its world-class functionality: the quant-style VORTECS™ Score. The VORTECS™ Score is an algorithmic comparison of several key market metrics for each coin utilizing years of historical data that assesses whether the outlook for an asset is bullish, bearish or neutral at any given moment based on the historical record of price action. The VORTECS™ Score is d...

What is tokenization and how are banks tapping into its design principles?

Tokenization is the process of converting something with tangible or intangible value into digital tokens. Tangible assets like real estate, stocks or art can be tokenized. In a similar vein, intangible assets like voting rights and loyalty points can be tokenized, too. We see Avios as an example of tokenized loyalty points by the traditional credit card industry. However, when tokens are created on a blockchain, they add a level of transparency that previous iterations of tokens couldn’t achieve. There are several banks that are experimenting with tokenization. But, before diving into the use cases in banking, it would be useful to understand the qualitative advantages that tokenization brings to financial services. As major financial institutions enter the crypto space, they pay spe...