The Ledger

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

The Ledger: What to Expect From Next Week’s Q3 2022 Earnings Calls

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Music companies face a multitude of pressures as 2022 comes to an end: crippling inflation, a tight labor market, a chaotic environment for breaking new artists, interest rates that are dampening catalog valuations, and high costs of touring amidst a crush of artists on the road, among other challenges. The upcoming slate of corporate earnings provides an opportunity to hear about these opportunities and challenges from leaders of publicly traded music companies who rarely go on the record. Spotify reports third-quarter earnings after the close of trading on Tuesday (Oct. 25). Universal Music Group and Deez...

The Ledger: How Streaming Platforms Are Looking Beyond Music to Boost Their Margins

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. The 2004 documentary Super Size Me took a humorous look at the health consequences of fast-food restaurants’ practice of up-selling customers to higher-priced, larger-portioned items – a super-sized cup of Coca-Cola rather than a large, for example. To the customer, up-selling looked like a good deal: the additional soda or food cost only a few cents more. For restaurants, the tactic padded margins because the difference in price dwarfed the cost of goods. Super Size Me comes to mind when looking at music subscription services and their quest to improve their margins. Those services have the equivalent of a super...

The Ledger: How Do Music Executives’ Pay Compare to Other Entertainment Leaders?

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Music industry executives at publicly traded companies are paid well – but they’re not the only ones. As Billboard reported in the inaugural Money Makers list of music’s highest-paid executives and stockholders at publicly traded companies, 10 business leaders earned nearly or more than $9 million in 2021. Of those, most of their compensation came from stock awards and stock options, not base salary or performance bonuses. For example, only 5% of SiriusXM CEO Jennifer Witz’s $32.6 million total compensation came from a guaranteed salary. As is common practice among publicly traded corporations, SiriusXM tied most of Wit...

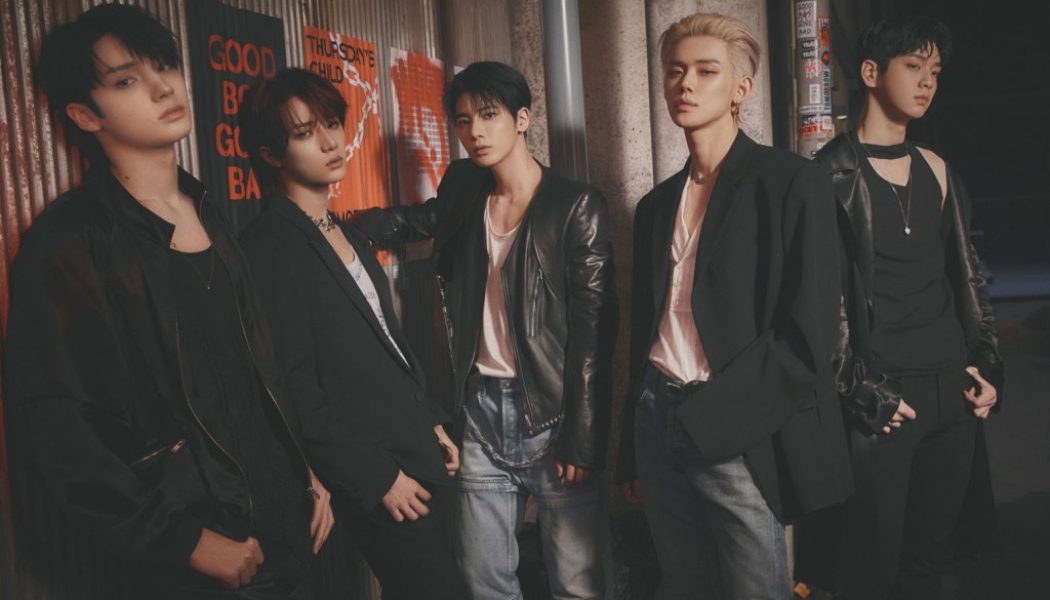

The Ledger: Buying Into the K-Pop Craze Just Got Less Risky for US Investors

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. An exchange-traded fund, or ETF, focused on Korean music started trading on the NYSE Arca exchange on Thursday, giving American investors a means to buy shares of companies that trade on exchanges in South Korea. But the ETF stands out for another reason: a bundle of K-pop stocks will carry less risk than standalone companies that rely on dozens of labels, each with a handful of top artists as well as deep catalogs. Trading under the aptly named ticker KPOP, the ETF includes the stocks of 30 corporations, including several music companies: HYBE, the home of K-pop megastars BTS and up-and-coming acts Tomorrow X Together ...

The Ledger: When Should Subscription Services Raise Prices?

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Over the last decade, streaming platforms have mostly held prices steady while racking up over half a billion subscribers globally. But for years, music executives have questioned subscription services’ decision to sacrifice higher prices — and with them higher royalties to labels and artists — to gain more subscribers. Music streaming is following an age-old business tactic: launch at an affordable price, gain customers and, once people are hooked, raise prices. The question is when to raise prices. Too early a raise could risk alienating subscribers, while one that’s too late risks leaving revenue on the table once su...

The Ledger: Spotify’s Paul Vogel Is Cautiously Optimistic on Growth

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Music executives are balancing optimism about streaming growth with caution about the state of the economy and future growth. As we reported Wednesday, Spotify had a solid second quarter, finishing with 188 million subscribers — 1 million ahead of its guidance., It also reached 433 million total monthly listeners — 5 million above its guidance. Beating guidance helped Spotify shares climb 12.2% to $116.61 on Wednesday, its highest mark since June 24. In the second quarter, Spotify’s subscription growth was led by Europe and Latin America, while emerging markets such as India, Indonesia and the Philippines were standouts...

The Ledger: Royalty Growth Requires Changing More Than How They’re Calculated

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. If The Beatles wrote a song about music royalties, the band would sing about a “Long and Winding Road” to higher subscription fees and better pay for artists and labels. The music subscription business model has become the record industry’s main breadwinner since launching in the early 2000s. But for two decades, many artists and rights holders have bristled at the royalty rates paid by streaming services. Some rates have improved: ad-supported royalties grew as online advertising matured. Royalties from subscription services have less wiggle room for change, however. The biggest innovation is a change in how to divvy a...

The Ledger: There’s Still Room for Consolidation in the Festival Market

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. For all the consolidation in the concert industry in the last decade, the festival business remains a diverse array of events operated by independent companies rather than the corporate behemoths. That’s one takeaway from Billboard’s new list of the top 50 music festivals of 2022 that considers the quality, size and cultural impact of the biggest and best events around the globe. The top 50 list is filled with potential mergers and acquisitions for growth-minded promoters: 35 of the top 50 festivals are owned by either independent promoters or, in a handful of cases, non-profit organizations. Some festivals are fewer th...

The Ledger: Music Companies That Didn’t Go Public Missed a Crucial Window

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. If a music company was thinking about going public last year and didn’t, it may have already missed its opportunity – at least for the foreseeable future. Since Universal Music Group went public on Sept. 21, 2021, the S&P 500 is down 5.9% and the tech-heavy Nasdaq is down 18.5%. From that date to the end of 2021, the markets rose 9.4% and 6.3%, respectively, and it looked like UMG might have left money on the table. But in 2022, stock prices turned south due to a combination of factors – namely rising interest rates and high inflation – and recession fears have multiplied. With the U.S. and other major economies on ...

The Ledger: Sony Music’s Cautious Catalog Approach & Other Investor Call Highlights

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Sony’s annual investor presentation was a rare opportunity for Rob Stringer, chairman of Sony Music Group and CEO of Sony Music Entertainment, to go on record on the important financial issues of the day. Any analyst or investor listening in got some helpful insight into Stringer’s thinking about how Sony spends money and what will account for future revenue growth. Stringer’s presentation recapped Sony Music’s fiscal year ended March 31, 2022, as well as its double-digit growth over the previous five years. Revenues were up $3 billion since 2017, profit margins have improved and streaming now accounts for 70% of total ...

- 1

- 2