The fallout from the collapse of FTX has led to calls for greater regulatory oversight of the crypto market.

Proof-of-reserves: Can reserve audits avoid another FTX-like moment?

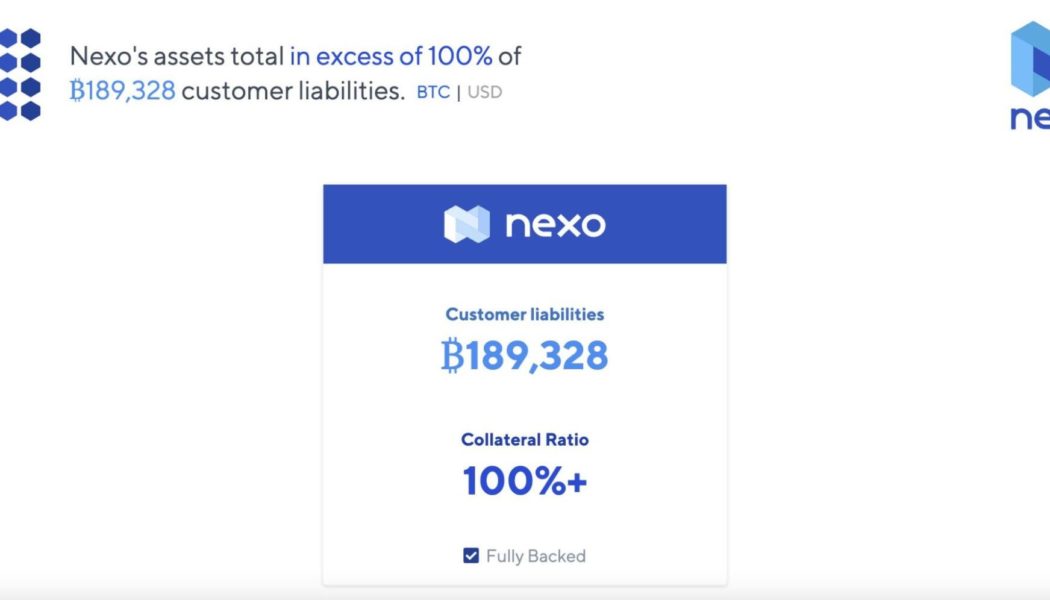

In the wake of the FTX collapse that came about as a result of the now-bankrupt cryptocurrency exchange funneling user funds to mitigate its own risks, crypto exchanges came up with a transparency solution called proof-of-reserves. A practice, which was recently endorsed by Binance CEO Changpeng Zhao, offers a way for exchanges to show provide transparency to users in the absence of clear regulations. All crypto exchanges should do merkle-tree proof-of-reserves. Banks run on fractional reserves. Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency. — CZ Binance (@cz_binance) November 8, 2022 Proof of reserves (PoR) is an independent audit conducted by a third party that seeks to ensure that a custodian holds the assets it claims to own on be...