Tether

Tether daily active addresses down to a two-year low: Santiment

Tether whales account for almost 80% of the current USDT supply, as per data from Santiment Bitcoin mega whales have accumulated a significant chunk of the cryptocurrency since the last week of December Data from market behaviour analysis platform Santiment paints a picture of whale domination in the Tether and USD Coin stablecoin markets. It also shows that the number of Tether daily active addresses has crashed to lows last recorded over two years ago. Tether and USD Coin whale dominance Tether, the world’s largest stablecoin, currently has a market capital closing in on $78 billion (roughly 3.8% of the entire cryptocurrency market capital). Only Bitcoin and Ethereum have a higher market circulating value among crypto tokens and other digital assets. Tether addresses with a valuati...

Circle’s USDC stablecoin gobbles Tether’s market share with 50B milestone

The world’s second-largest stablecoin by market capitalization keeps on growing as it erodes the dominance of the current leader, Tether. The stablecoin landscape is a constantly-shifting dynamic but one trend has become clear over the past year or so — Tether’s dominance is diminishing. Its main rival, Circle, has just reached a milestone of 50 billion USDC in circulation according to CoinGecko and a Feb. 1 tweet by company co-founder and CEO, Jeremy Allaire. 50 BILLION USDC (w/ thread below) pic.twitter.com/5FEaPmXjup — Jeremy Allaire (@jerallaire) February 1, 2022 Allaire said that while this is a massive number, “it’s the massive growth and ecosystem around it that tells the broader story.” He added that USDC has seen 10,000% growth over the past two years. The total stablecoin s...

USDC flips Tether on the Ethereum network

Circle’s USD Coin (USDC) has reached a major milestone by surpassing Tether (USDT) in total supply on the Ethereum network. USDC’s current supply on Ethereum as of writing is 40.06 billion tokens, just ahead of USDT’s supply of 39.82 billion. Tether has been the most popular stablecoin since at least 2016, after originally sharing the market with BitUSD and NuBits (USNBT) stablecoins when it launched in late 2014. At that time, USDT ran on Omni. As the latter two fell into obscurity due to losing their dollar peg and shedding users, USDC emerged in 2018 as a more transparent and more regulated competitor to Tether, which has been under a cloud for years due to doubts over its backing. Although USDT is still the most popular stablecoin with a total supply of 78.5 billion, nearly 50% of the ...

Strike wallet is 5th most popular finance app in Argentina, but where’s the BTC?

Strike’s digital wallet has become the fifth most popular finance app in Argentina within a week of its launch. The firm, led by hoodie-wearing CEO Jack Mallers, rolled out its crypto payment services for the Argentinian market on Jan 12. Strike is famed for enabling Bitcoin (BTC) payments via the Lightning network, particularly in El Salvador. However, according to local media and user reports, the firm’s app in Argentina reportedly currently only supports the use of Tether’s stable coin USDT for transfers via Lightning. Users are able to purchase Bitcoin via the app though, and send it to a third party wallet. Mallers tweeted on Jan. 18 that Strike’s app is currently ranked as the fifth-highest finance app and the top new app overall on the Argentinian Apple app store, as he emphasized t...

Bitcoin price can’t find its footing, but BTC fundamentals inspire confidence in traders

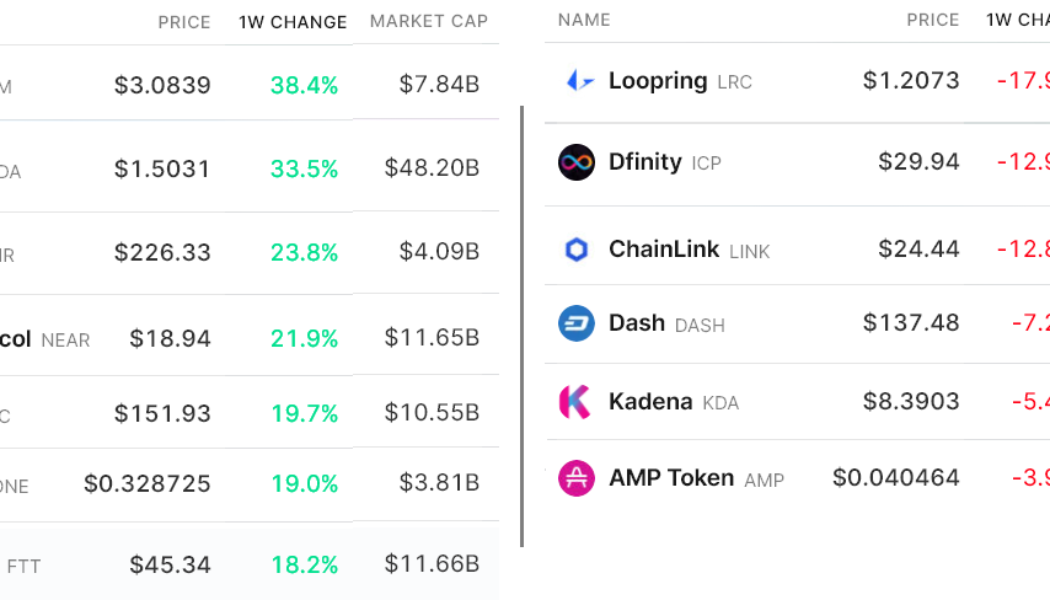

Bitcoin’s (BTC) sudden crash on Jan. 10 caused the price to trade below $40,000 for the first time in 110 days and this was a wake-up call to leveraged traders. $1.9 billion worth of long (buy) futures contracts were liquidated that week, causing the morale among traders to plunge. The crypto “Fear & Greed” index, which ranges from 0 “extreme fear” to 100 “greed” reached 10 on Jan. 10, the lowest level it has been since the Mar. 2020 crash. The indicator measures traders’ sentiment using historical volatility, market momentum, volume, Bitcoin dominance and social media. As usual, the panic turned out to be a buying opportunity because the total crypto market capitalization rose by 13.5%, going from a $1.85 trillion bottom to $2.1 trillion in le...

Ethereum white paper predicted DeFi but missed NFTs: Vitalik Buterin

Rounding up the last decade, Ethereum co-founder Vitalik Buterin revisited his predictions made over the years, showcasing a knack for being right about abstract ideas than on-production software development issues. Buterin started the Twitter thread by addressing his article dated Jul. 23, 2013 in which he highlighted Bitcoin’s (BTC) key benefits — internationality and censorship resistance. Buterin foresaw Bitcoin’s potential in protecting the citizens’ buying power in countries such as Iran, Argentina, China and Africa. However, Buterin also noticed a rise in stablecoin adoption as he saw Argentinian businesses operating in Tether (USDT). He backed up his decade-old ideas around the negative impacts of Bitcoin regulation. My views today: sure, Bitcoin’s decentralizatio...

Crypto regulation is coming, but Bitcoin traders are still buying the dip

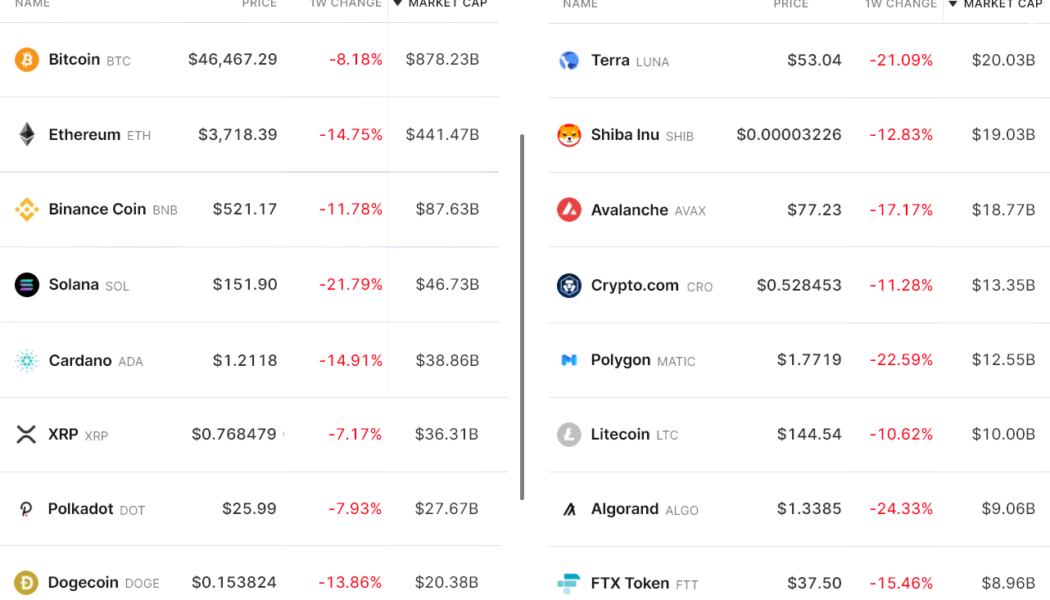

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...

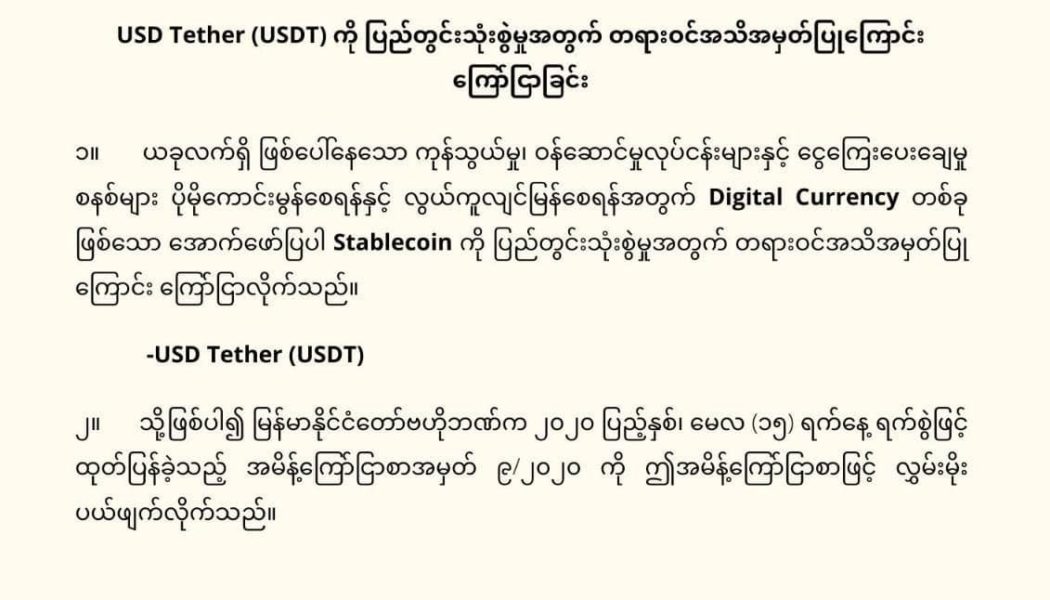

Myanmar shadow government declares stablecoin USDT an official currency

Myanmar’s shadow government, the National Unity Government (NUG), led by the supporters of jailed leader Aung San Suu Kyi, has declared United States dollar-based stablecoin Tether (USDT) as an official currency for local use. Per a report published in Bloomberg, the NUG will accept Tether for its ongoing fundraising campaign seeking to topple the current military regime in Myanmar. The shadow government also raised $9.5 million through the sale of “Spring Revolution Special Treasury Bonds” offered to the Myanmar diaspora across the world. The group aims to raise $1 billion through the sale of NUG-issued bonds. The NUG Ministry of Planning, Finance, and Investment posted an announcement regarding the move on Facebook on Monday. Announcement regarding NUG acceptance of Tether. Source:...