Tether

Stablecoins are the perfect trojan horse for Bitcoin, says Tether CTO

As one of a number of Cointelegraph representatives attending the Paris Blockchain Week Summit (PBWS) at the historic Palais Brongniart — a neoclassical building previously serving as the headquarters for the Parisian stock exchange from 1826 to 1987 — European news reporter, Joe Hall sat down for an in-depth interview with the Chief technology officer of Bitfinex and Tether, Paolo Ardoino. Previously ranked 88th in Cointelegraph’s prestigious Top 100 2021 for his influential impact on the growth of the decentralized finance (DeFi) ecosystem, Ardoino spoke on an array of topics including the adoption of Bitcoin and Tether as de facto legal tender in the Swiss city of Lugano, the scalability concerns of popular blockchain networks, as well as the potential for new countries to accept Bitcoi...

Crypto portfolios: How much of a stablecoin allocation is too much?

Cryptocurrencies are well-known for being volatile assets, which means that experienced traders have plenty of opportunities in the space. Investors can expect to be taken on a wild ride if they plan on holding for a long time. Stablecoins, a class of cryptocurrencies that offers investors price stability pegged to the value of fiat currencies, offer investors a safe haven when market turbulence hits but may represent missed opportunities over time. Speaking to Cointelegraph, several experts have stated that retail investors should approach cryptocurrencies with a “pay yourself first” attitude and that an allocation of up to 5% in crypto should be relatively “safe” while allowing for “marginal return.” Stablecoins are entirely different: No “marginal return” can be expected from simply hol...

‘I’ve never paid with crypto before’: How digital assets make a difference amid a war

The ongoing conflict in Ukraine has become a stress test for crypto in many tangible ways. Digital assets have emerged as an effective means of directly supporting humanitarian efforts, and the crypto industry, despite enormous pressure, has largely proved itself a mature community — one ready to comply with international policies without compromising the core principles of decentralization. But there is another vital role that crypto has filled during these tragic events: It is becoming more and more familiar to those who have found themselves cut off from the payment systems that had once seemed unfailing. Traditional financial infrastructures don’t usually work well during military confrontations and humanitarian crises. From hyperinflation and cash shortages to the destruction of ATMs,...

Neutrino Dollar breaks peg, falls to $0.82 amid WAVES price ‘manipulation’ accusations

Neutrino Dollar (USDN), a stablecoin issued through Waves-backed Neutrino protocol, lost its U.S. dollar-peg on April 4 amid speculations that it could become “insolvent” in the future. USDN plunges 15% despite WAVES backing USDN dropped to as low as $0.822 on Monday with its market capitalization also diving to $824.25 million, down 14% from its year-to-date high of $960.25 million. Interestingly, the stablecoin’s plunge occurred despite Neutrino’s claims of backing its $1-peg via what’s called “over collateral,” i.e., when the total value of Waves (WAVES) tokens locked inside its smart contract is higher than the total USDN minted, also called the “backing ratio.” Neutrino Dollar price performance in the last 24 hours. Source: Co...

Bitcoin’s got 3 strikes, but investors remain calm despite price drop

After Bitcoin (BTC) faced its third consecutive rejection, investors became more confident in adding altcoin positions. For the leading cryptocurrency, the path to $50,000 appears more challenging than previously expected. According to Euronews Next, on March 14, the European Union rejected a proposed rule that could have banned the energy-intensive proof-of-work (PoW) mining algorithm used by Bitcoin and other cryptocurrencies. Several EU parliamentarians have been pushing to ban PoW mining over energy concerns. BTC/USD price at FTX. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptos was relatively flat over the past seven days, registering a modest 0.4% gain to $1.77 trillion. However, the apparent lack of performance in the overall market doe...

Stablecoins will remain relevant even with the dawn of the CBDCs era, says Tether CTO

CBDCs will leverage private blockchains for tech infrastructure They, however, won’t be issued on private chains like stablecoins are at present Chief Technology Officer at Tether, Paolo Ardoino, has dismissed concerns that central bank digital currencies (CBDCs) will affect the currently offered private stablecoins. Ardoino was speaking in regards to the debate that has been happening in recent months, as more countries are declaring ambitions in CBDCs. CBDCs will power bank activities Explaining his view, Ardoino engaged his Twitter followers with the perspective that CBDCs are not built to digitise fiat currencies since most transactions in the modern day are already digital. Rather, he argued that these government-controlled digital currencies would essentially replace legacy pay...

USDT records new all-time high against Russian ruble as inflation hits

United States dollar-pegged stablecoin Tether (USDT) witnessed a spike of over 30% in five days against the Russian ruble — highlighting the negative and immediate impact of the ongoing war on the traditional financial system. Data from Cointelegraph Markets Pro and crypto exchange Binance show that the ruble is undergoing inflation as the USDT/RUB trading pair — for the first time in history — crossed 105 rubles. USDT/RUB price performance. Source: TradingView Prior to the spike, the USDT/RUB pair maintained a comparatively steady market price below 80 rubles. However, the ruble’s market price against USDT surged on Thursday, momentarily exceeding 90 rubles. As tensions escalated, on Sunday, the European Commission announced plans to remove Russian banks from the Society for Worldwid...

Crypto Biz: Stablecoins are serious business, Feb. 17–24

Stablecoins used to be a sort of taboo subject in the crypto community after it became common practice to criticize Tether’s reserve backing. Are you really a seasoned crypto investor if you haven’t gone down the Tether (USDT) rabbit hole? Some of those concerns were finally quelled in May 2021 when Tether passed an assurance test by disclosing its reserves for the first time. For some onlookers, the reserve breakdown created more questions than answers due to the stablecoin issuer’s oversized exposure to commercial paper. The stablecoin market has grown leaps and bounds over the past four years. While Tether remains firmly in the lead, Circle Internet Financial has surged through the rankings with the success of USDC Coin (USDC). TerraUSD (UST) is also a top player, having just received s...

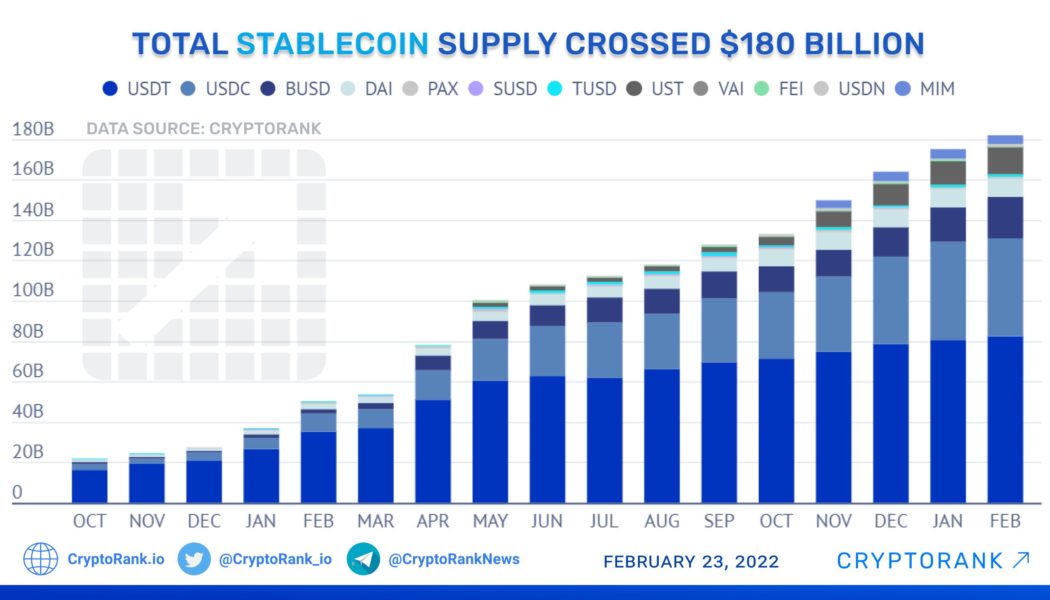

Total stablecoin supply hits $180 billion: Report

Move aside Bitcoin (BTC), stablecoins are holding the spotlight. Crypto research outlets Arcane Research and CryptoRank confirm that the stablecoin supply has hit the milestone amount of $180 billion. The growth in stablecoins continues to outpace the rest of the market, up 6% in the past 30 days. In times of market volatility, stablecoins can offer price stability, backed by specific assets or algorithms. Source: CryptoRank Over the month of February, three stablecoins entered the top 10 coins by market capitalization as Binance USD (BUSD) briefly entered. According to Arcane Research, the three largest stablecoins, Tether (USDT), USD Coin (USDC) and BUSD now account for a total of “9% of the total crypto market cap.” Plus, while volatility reigns proud, the stablecoin sup...

Tether slashes commercial paper by 21% in latest reserves attestation

USDT stablecoin issuer Tether cut its reserves allocation to commercial paper by more than one fifth between September and December last year, dropping from around $30.5 billion to $24.16 billion. Tether is legally required to disclose its reserves every quarter as part of an $18.5 million court settlement with the Office of the New York Attorney General from February 2021. The firm was alleged to have misrepresented the specific amount of fiat backing USDT in 2017 and 2018. The latest attestation was conducted by Cayman Islands-based Accountants MHA Cayman and provides a breakdown of Tether’s reserves as of 31 December 2021. The report states that Tether’s “consolidated assets exceed its consolidated liabilities,” however the difference is minimal with total assets tallied $78.67 billion ...

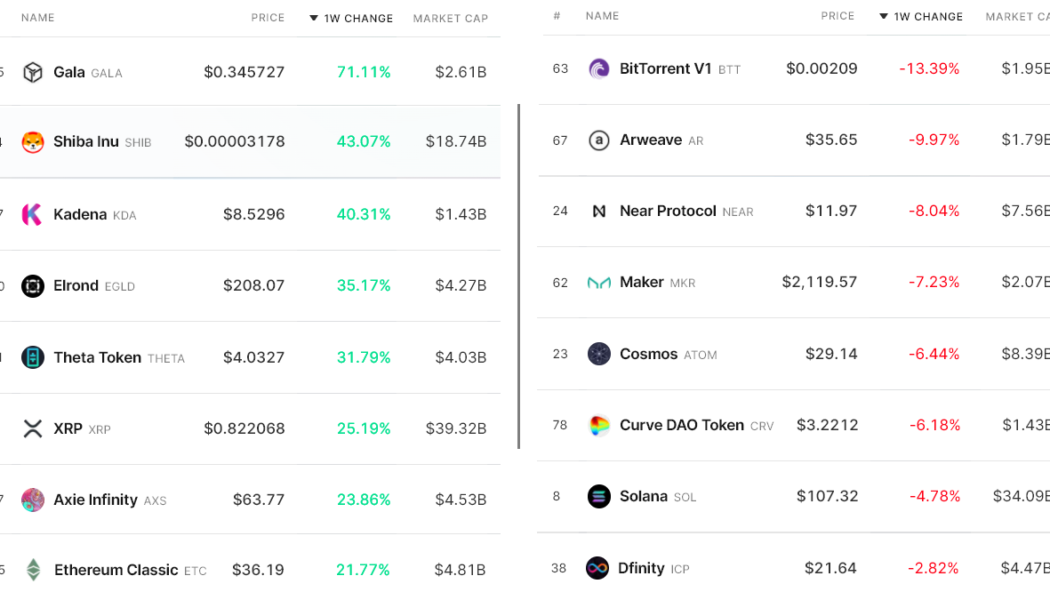

2 key indicators cast doubt on the strength of the current crypto market recovery

Analyzing the aggregate cryptocurrency market performance over the past 7 days could give investors the impression that the total market capitalization grew by a mere 4% to $2.03 trillion, but this data is heavily impacted by the top 5 coins, which happen to include two stablecoins. Excluding Bitcoin (BTC), Ether (ETH), Binance Coin (BNB) and stablecoins reflects a 9.3% market capitalization increase to $418 billion from $382 billion on Feb 4. This explains why so many of the top-80 altcoins hiked 25% or more while very few presented a negative performance. Winners and losers among the top-80 coins. Source: Nomics Gala Games (GALA) announced on Feb. 9 a partnership with world renowned hip-hop star Snoop Dogg to launch his new album and exclusive non-fungible token (NFT) campaign. Gala Game...