Tether

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years. Numerous unconfirmed reports surfaced on June 11, claiming Kwon’s participation in draining liquidity out of LUNA and UST before the crash to purchase US dollar-pegged stablecoin such as Tether (USDT). Rumors about Kwon cashing out LUNA and UST reserves surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity. Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: th...

The total crypto market cap drops under $1.2T, but data show traders are less inclined to sell

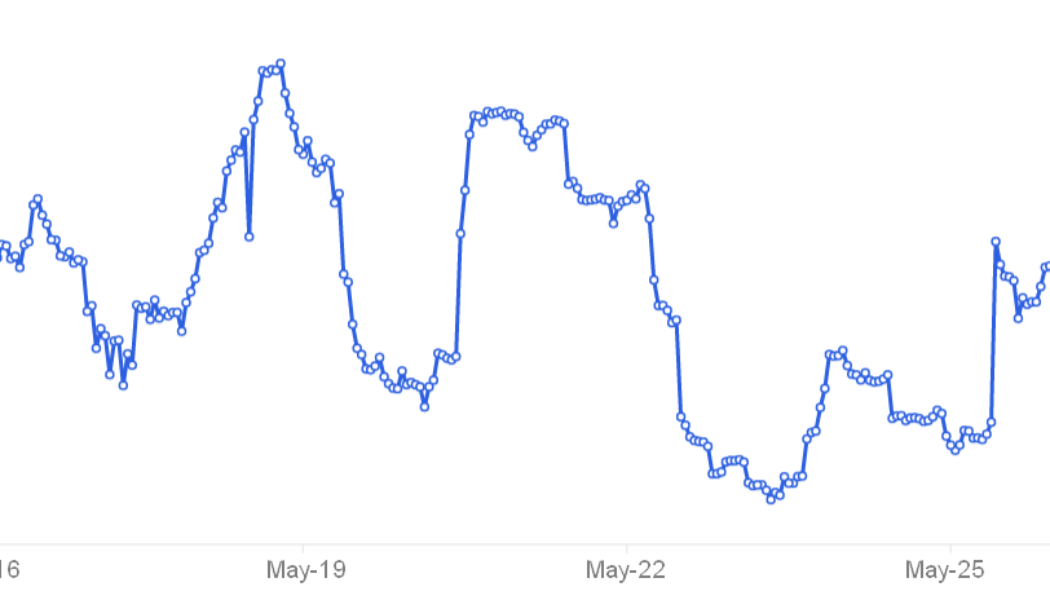

An improving Tether discount in Asian markets and positive futures premiums for BTC and ETH suggest a slight recovery is in the making. The total crypto market capitalization has been trading in a descending channel for the past 29 days and currently displays support at the $1.17 trillion level. In the past 7 days, Bitcoin (BTC) presented a modest 2% drop and Ether (ETH) faced a 5% correction. Total crypto market cap, USD billion. Source: TradingView The June 10 consumer price index (CPI) report showed an 8.6% year-on-year increase and crypto and stock markets immediately felt the impact, but it’s not certain whether the figure will convince the U.S. Federal Reserve to hesitate in future interest rate hikes. Mid-cap altcoins dropped further, sentiment is still bearish The generalized beari...

Tether is ‘instrument of freedom’ and ‘Bitcoin onramp,’ says Bitfinex CTO

On a sun-splashed day in the Swiss Alps, the chief technology officer of Bitfinex and Tether, Paolo Ardoino, shed light on the Plan B Lugano strategy, Tether as an onramp into Bitcoin (BTC) and —crucially — his favorite pizza toppings. Fresh off the plane from Norway, where Ardoino attended an increasingly Bitcoiner-friendly event, the Oslo Freedom Forum, the Italian explained that, in contrast to the WEF,there was no “shilling” in Norway. Tether was invited to speak at the Oslo Freedom Forum as the stablecoin is increasingly considered an “instrument of freedom.” Tether has been adopted by the Myanmar government while the Ukrainian government has accepted crypto donations, including Tether, since the onset of the Russia-Ukraine war. “Tether is one of the tools to be used by di...

Tether deploys new USDT token on the Tezos blockchain

Leading cryptocurrency stablecoin Tether has announced the launch of a new asset, Tether (USDT) tokens built on the Tezos blockchain, and with the ambition of expanding their digital footprint across the digital payments and decentralized finance (DeFi) sector. According to the press release, “USDT on Tezos will power revolutionary applications across payments, DeFi, and more.” In conversation with a Tether representative, greater context was provided as to the intended utility of Tether tokens: “Tether tokens are not an investment but a utility for engaging in internet commerce, combating volatility, and providing a safe haven for remittances. Tether tokens can be securely stored, sent, and received across the blockchain and are redeemable for the underlying asset, subjec...

Total crypto market cap risks a dip below $1 trillion if these 3 metrics don’t improve

The total crypto market capitalization has ranged from $1.19 trillion to $1.36 trillion for the past 23 days, which is a relatively tight 13% range. During the same time, Bitcoin’s (BTC) 3.5% and Ether’s (ETH) 1.6% gains for the week are far from encouraging. To date, the total crypto market is down 43% in just two months, so investors are unlikely to celebrate even if the descending triangle formation breaks to the upside. Total crypto market cap, USD billion. Source: TradingView Regulation worries continue to weigh investor sentiment, a prime example being Japan’s swift decision to enforce new laws after the Terra USD (UST) — now known as TerraUSD Classic (USTC) — collapse. On June 3, Japan’s parliament passed a bill to limit stablecoin issuing to licensed banks, registered money t...

These are the least ‘stable’ stablecoins not named TerraUSD

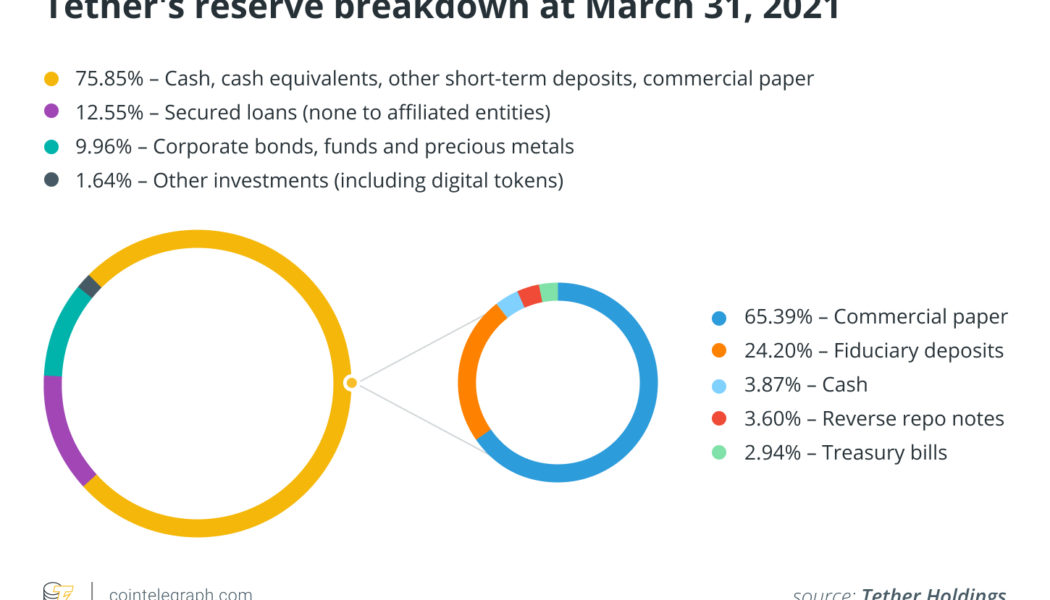

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

Binance’s CZ says he is ‘skeptical’ about the Terra relaunch

Binance CEO Changpeng Zhao, also known as CZ, expressed skepticism around the revival plan for the Terra ecosystem and the launch of the new LUNA token. “I try not to predict what the community will do. […] Many are skeptical. I’m one of those guys,” said CZ in an exclusive interview with Cointelegraph. Following the collapse of TerraUSD (USD), the Terra ecosystem’s stablecoin, CZ criticized its team for not handling the crisis properly and pointed at the project’s flaws that led to the crash. Still, Binance is now actively participating in Terra’s revival plan by hosting the airdrop of its new LUNA token. As CZ pointed out, despite the widespread skepticism around the Terra relaunch, Binance has a responsibility to help users affected by the crash of LUNA. “We still need to ensure c...

Tether’s reported bank partner Capital Union shares its crypto strategy

Capital Union, a Bahamas-based bank that reportedly holds a portion of reserves by the Tether (USDT) stablecoin issuer, has been itself actively involved in the cryptocurrency industry. The banking institution has rolled out crypto trading and custody services to its professional clients as part of the bank’s trading desk, a spokesperson for Capital Union told Cointelegraph on May 31. “We work with a few selected trading venues and liquidity providers and a handful of custodians and technology providers, which allows us to support a large variety of digital assets as part of our trading and custody services,” the firm’s representative said. Capital Union’s crypto-related services still represent a “fairly small portion” of its business, which is mainly focused on providing...

‘Other flavors of Tether’ will bridge users to USDT: Paolo Ardoino

Tether’s decision to launch a new digital asset pegged to the Mexican peso will be a boon to crypto adoption in the Latin American country by providing more onramps to the USDT stablecoin, according to Paolo Ardoino. In an exclusive interview with Cointelegraph on the sidelines of the World Economic Forum summit, the Tether and Bitfinex chief technology officer said the reason he came to Davos was to showcase the utility of cryptocurrencies. “I didn’t participate in Davos to meet CEOs of big banks,” he said. “We are here to send our message [that] there is a big world out there that needs crypto in a safe way.” Tether CTO Paolo Ardoino said that the increase in crypto demand in the Latin America region pushed their decision to expand. https://t.co/Ig7Y524VT2 — Cointelegraph (@Cointel...

Do you have the right to redeem your stablecoin?

Stablecoins are often discussed with regard to their “stability.” It is usually questioned whether a stablecoin is sufficiently backed with money or other assets. Undoubtedly, it is a very important aspect of stablecoin value. But, does it make sense if the legal terms of a stablecoin do not give you, the stablecoin holder, the legal right to redeem that digital record on blockchain for fiat currency? This article aims to look into the legal terms of the two largest stablecoins — Tether (USDT) by Tether and USD Coin (USDC) by Centre Consortium, established by Coinbase and Circle — to answer the question: Do they owe you anything? Related: Stablecoins will have to reflect and evolve to live up to their name Tether Article 3 of Tether’s Terms of Service explicitly states: “Tether reserves th...

Tether launches crypto and blockchain education program in Switzerland

Switzerland’s southern city of Lugano will host a blockchain- and cryptocurrency-focused school as part of a partnership between the local government and Tether (USDT). In a Thursday announcement, Tether and Lugano said they will be launching the Plan ₿ Summer School in an effort “to bring blockchain and crypto education to the masses.” The education center is part of Tether’s “Plan ₿” initiatives with the Swiss city, which have included making Bitcoin (BTC), Tether (USDT) and the LVGA token legal tender in the area. @luganomycity @Tether_to @FranklinSwitz @USI_university announced today the launch of @LuganoPlanB Summer School, 3-16 July 2022. Apply now #Lugano @LuganoLivingLab https://t.co/PI0USZpA96 — Lugano (@luganomycity) May 19, 2022 According to the school’s website...