Tether

KuCoin crypto exchange debuts USDT-dominated NFT ETF

Seychelles-headquartered cryptocurrency exchange KuCoin has launched an exchange-traded fund (ETF) tied to major nonfungible token (NFT) assets like Bored Ape Yacht Club (BAYC). KuCoin’s NFT ETF Trading Zone went live on Friday, the firm announced. The new investment product is launched in collaboration with NFT infrastructure provider Fracton Protocol. The KuCoin NFT ETF is a Tether (USDT)-dominated product that marks particular underlying NFT assets like Bored Ape Yacht Club. BAYC is one of five NFT ETFs that KuCoin is launching. Trading under the symbol hiBAYC, the asset is an ERC-20 token representing 1/1,000,000 ownership of the target BAYC in the BAYC meta-swap of Fracton Protocol. The ETF aims to increase liquidity as it enables exposure to NFTs via the USDT stablecoin instead of Et...

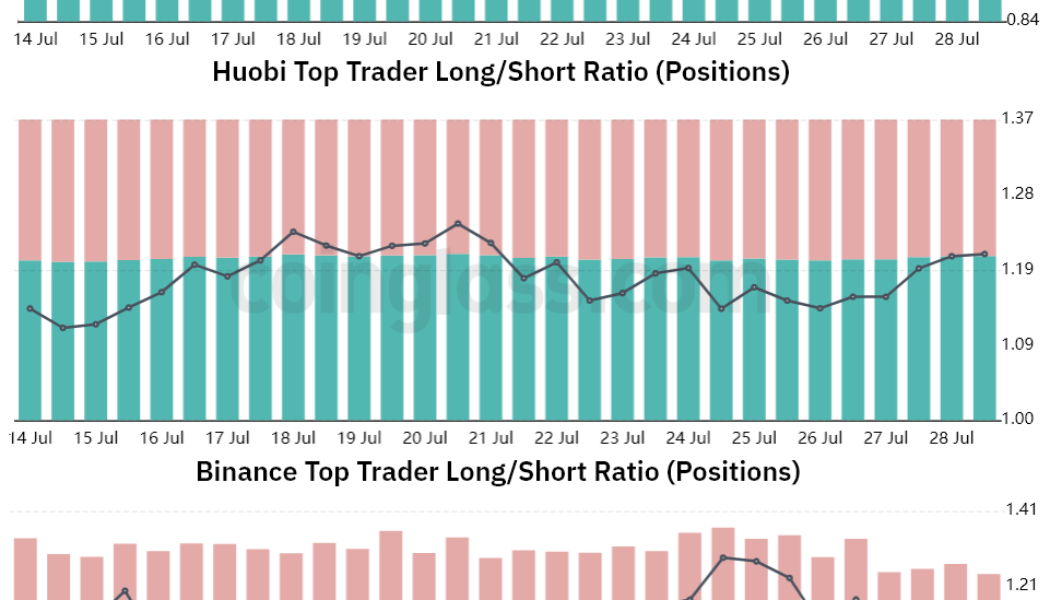

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

Tether, Bitfinex, Hypercore collab to launch encrypted P2P apps

Staying true to the “bear market is for building” motto, crypto exchange Bitfinex along with Tether (USDT) and Hypercore announced the launch of a fully encrypted platform, Holepunch, for building peer-to-peer applications. As part of the initiative, the trio launched Keet, an encrypted application capable of facilitating real-time audio and video calls, text chat and file sharing. Partners aim to bestow control over data while breaking technology monopolies with Holepunch, according to the announcement. Tether and Bitfinex funded the development of the Holepunch platform. Paolo Ardoino, the chief technology officer of Tether and Bitfinex, will lead the new initiative as the chief strategy officer. Speaking on behalf of Tether and Bitfinex, Ardoino highlighted the need to address the growi...

Fed policy and crumbling market sentiment could send the total crypto market cap back under $1T

The total crypto market capitalization broke above $1 trillion on July 18 after an agonizing thirty-five-day stint below the key psychological level. Over the next seven days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a 0.5% correction to $1,560. Total crypto market cap, USD billion. Source: TradingView The total crypto capitalization closed July 24 at $1.03 trillion, a modest 0.5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and the $150 billion value of stablecoins. The broader data hides the fact that seven out of the top-80 coins dropped 9% or more in the period. Even though the chart shows support at the $1 trillion level, it will take some time until investors regain confidence to invest in cryptocurrenc...

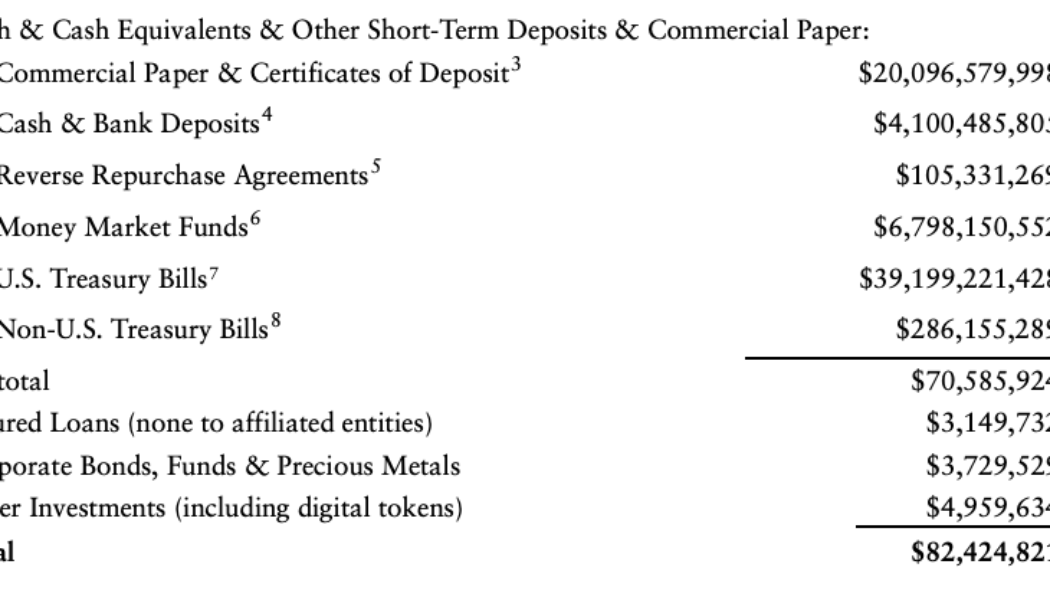

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Weekly Report: India mulls 28% GST on crypto, Tether to launch Pound Sterling-backed stablecoin, FalconX secures $150M raise and more

Here are all the exciting headlines you missed in the NFT, DeFi and crypto niches across regulations and business verticals. Crypto broker FalconX raises $150 million, reaching an $8 billion valuation US-based firm digital assets brokerage on Wednesday disclosed it had raised $150 million in the latest financing round led by Singaporean wealth group GIC and Swiss firm B Capital. Other investors that took part include private equity firm Thoma Bravo, Tiger Global Management, and investment manager Adams Street. Notably, the series D funding round comes when crypto entities suffer losses and try to stay afloat. Falcon X’s total funding now stands at $430 million, having secured a massive $210 million from its Series C funding. Its valuation has more than doubled from $3.75 billion to $8...

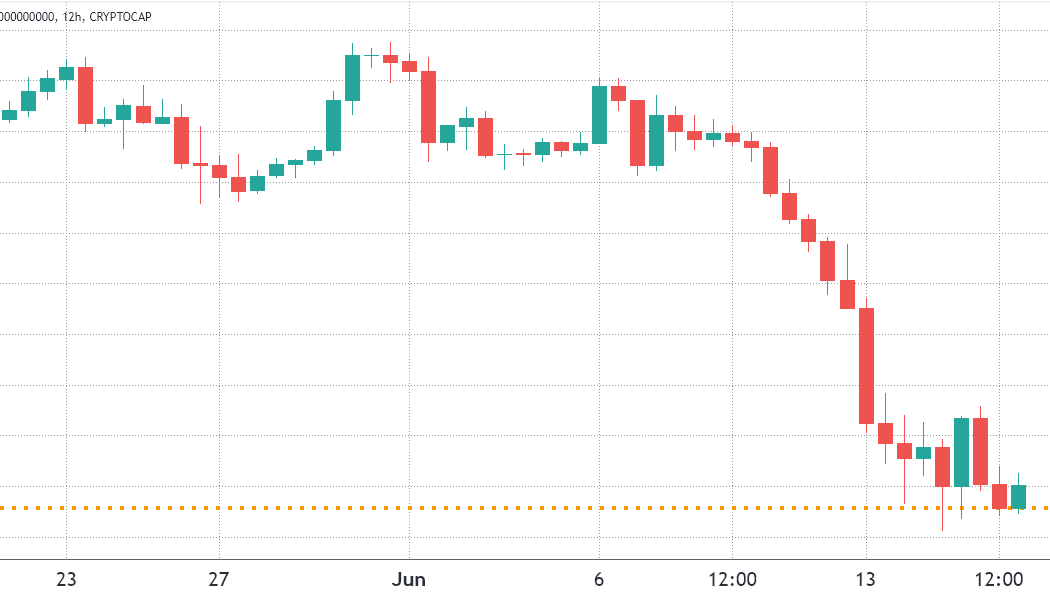

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

Crypto Biz: Crypto carnage pushes Celsius, Three Arrows Capital closer to insolvency, June 9-16

The 2022 version of crypto winter has been unlike anything we’ve seen before. As I warned last month, the meltdown of the Terra ecosystem didn’t end with Luna Classic (LUNC) hitting zero. The biggest threat was contagion. As the dust began to settle, we finally got a glimpse of who was left holding the bag. Crypto lender Celsius and Singapore-based venture firm Three Arrows Capital suffered heavy losses during the debacle. These firms, once a staple of the budding crypto industry, now risk demise following weeks of massive selloffs in the market. Celsius reportedly seeks advice from lawyers on restructuring Alex Mashinsky’s Celsius dominated headlines this week after the popular crypto lender paused withdrawals due to “extreme market conditions.” During the freeze, the firm unstaked ...

Tether’s USDT market cap dips below $70B for an 8-month low

Tether (USDT), the biggest stablecoin and the third largest digital currency by market capitalization, continues losing its market value amid the current market downturn. On June 16, USDT’s market cap dropped below $70 billion for the first time since October 2021. The drop followed a cascade of repeated declines shortly after the USDT market value reached its all-time high above $80 billion in May. At the time of writing, Tether USDT’s market capitalization stands at $69.3 billion, up around $300 million from the multi-month low, according to data from CoinGecko. USDT 90-day market capitalization chart. Source: CoinGecko Tether’s biggest rival, USDC, is the second-largest U.S. dollar-pegged stablecoin backed by the peer-to-peer payments technology company Circle. The stablecoin reached $5...

Inverse Finance exploited again for $1.2M in flashloan oracle attack

Just two months after losing $15.6 million in a price oracle manipulation exploit, Inverse Finance has again been hit with a flashloan exploit that saw the attackers make off with $1.26 million in Tether (USDT) and Wrapped Bitcoin (WBTC). Inverse Finance is an Ethereum based decentralized finance (DeFi) protocol and a flashloan is a type of crypto loan that is usually borrowed and returned within a single transaction. Oracles report outside pricing information. The latest exploit worked by using a flashloan to manipulate the price oracle for a liquidity provider (LP) token used by the protocol’s money market application. This allowed the attacker to borrow a larger amount of the protocol’s stablecoin DOLA than the amount of collateral they posted, letting them pocket the difference. The at...

Tether aims to decrease commercial paper backing of USDT to zero

The major stablecoin company Tether is looking to eventually get rid of commercial paper backing for its U.S. dollar-based stablecoin Tether (USDT). Tether issued an official statement on Wednesday to deny reports alleging that Tether’s commercial paper portfolio is 85% backed by Chinese or Asian commercial papers and is being traded at a 30% discount. The stablecoin firm called such allegations “completely false,” reiterating that more than 47% of total USDT reserves are now the “United States Treasuries.” In its latest assurance opinion issued in May, Tether reported that commercial paper makes up less than 25% of USDT’s backing, amounting to around $21 billion as of March 31. USDT’s backing asset breakdown. Source: Tether’s assurance opinion released in May 2022 According to the latest ...