Tether

Accused ‘shadow banker’ Reggie Fowler seeks a 6-month sentencing delay

Reggie Fowler, a former NFL team owner and alleged “shadow banker” who might face up to 30 years of imprisonment, asked the court of the Southern District of New York for a six-month adjournment. Technically, it was Fowler’s lawyer Ed Sapone who requested an “unusually long adjournment,” justifying it with his “serious medical condition” as well as with the necessity to obtain information relevant to the case from financial institutions, entities and individuals located in Europe. According to independent journalist Amy Castor, who reported this development, Sapone made his request on Saturday — three days before the scheduled sentencing. As the prosecutors didn’t protest the adjournment, it will grant Fowler at least six months of freedom. He now resides in Arizona on ba...

Aave devs look set to receive $16.3M via retroactive funding

The DAO behind the decentralized finance (DeFi) platform Aave has accepted a proposal to reward members from Aave Companies with $16.28 million in retroactive funding for their role in the development of Aave Protocol V3. Voting for the proposal began on Sept. 6, and at the time of writing has already passed 667,000 votes in favor of the funding, more than doubling the 320,000 required. The vote is set to end on Sept. 8. According to the initial proposal, which was first pitched on Aug. 10, the Aave Request for Comment (ARC) seeked “retroactive funding” for work in developing the V3 protocol. The $16.28 million consists of $15 million for work performed by the developers over the course of more than one year and $1.28 million for costs paid to third-party auditors. The money will be given ...

Crypto Biz: You can’t stop the Tether FUD

In the world of crypto, FUD stands for fear, uncertainty and doubt. It’s often evoked intentionally to draw negative attention to a particular project or business. One of crypto’s most enduring legacies has been the constant FUD surrounding Tether, whose USDT stablecoin commands a market capitalization of nearly $68 billion. Whether intentional or not, The Wall Street Journal ran a story this week claiming that Tether was on the edge of technical insolvency and that it wouldn’t take much to push the stablecoin issuer into financial peril. Of course, Tether didn’t take it lying down and immediately issued a response to what it considered to be a “disinformation” campaign by the Journal. Regardless of which side of the debate you’re on, it’s becoming clear that there is a strong media ...

El Salvador Bitcoin bond delayed due to security concerns: Tether CTO

El Salvador, the Central American nation that adopted Bitcoin (BTC) as a legal tender in September last year, has delayed the launch of its billion-dollar Bitcoin bond again. The Bitcoin bond, also known as the “Volcanic bond” or Volcanic token, was first announced in November 2021 as a way to issue tokenized bonds and raise $1 billion in return from investors. The fundraiser will then be used to build a “Bitcoin City” and buy more BTC. The bond was set to be issued in the first quarter of 2022 but was postponed to September in the wake of unfavorable market conditions and geopolitical crises. However, earlier this week, Bitfinex and Tether chief technology officer Paolo Ardoino revealed that the Bitcoin bond will be delayed again to the end of the year. Ardoino, in...

Tether says it would not freeze sanctioned Tornado Cash addresses unless instructed by law enforcement

On Wednesday, U.S. dollar stablecoin issuer Tether (USDT) said that it would not freeze smart contract addresses sanctioned by the U.S. Office of Foreign Assets (OFAC) Control’s Specially Designated Nationals and Blocked Persons (SDN) list for cryptocurrency trail-mixer Tornado Cash. In explaining the decision, Tether said: “So far, OFAC has not indicated that a stablecoin issuer is expected to freeze secondary market addresses that are published on OFAC’s SDN List or that are operated by persons and entities that have been sanctioned by OFAC. Further, no U.S. law enforcement agency or regulator has made such a request despite our near-daily contact with U.S. law enforcement whose requests always provide precise details.” Tether pointed out that unilaterally f...

Data shows Bitcoin and altcoins at risk of a 20% drop to new yearly lows

After the rising wedge formation was broken on Aug. 17, the total crypto market capitalization quickly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion support, last seen on June 10, became even more distant. Total crypto market cap, USD billion. Source: TradingView The worsening conditions are not exclusive to crypto markets. The price of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the trend and is now trading at 3.16%. These are all signs that investors are feeling less confident about the central bank’s policies of requesting more money to hold those debt instruments. Recently, Goldman Sachs chief U.S. equity strategist David Ko...

Independent Tether attestation reveals 58% decrease in commercial paper holdings

An announcement from USDT issuer Tether Holdings Limited revealed information from an independent attestation about the company’s previous quarter’s performance. The reviewer, top accounting firm BDO Italia, assessed Tether’s assets as of June 30, 2022. Tether had previously announced a commitment to decreasing its commercial paper holdings by the end of August 2022. Data from the report revealed a 58% decrease in commercial paper exposure since the previous quarter from $20 billion to $8.5 billion. The chief technology officer of Tether, Paolo Ardoino, tweeted that Tether has plans to continue to decrease its commercial paper holdings to $200 million by the end of August and zero them out by the following October. As of June 30th, more than 58% decrease in Tether’s commer...

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

2 metrics signal the $1.1T crypto market cap resistance will hold

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally. Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading. Total crypto market cap, USD billions. Source: TradingView While the two leading cryptoassets were unable to print weekly gains, traders’ appetite...

Vitalik: Centralized USDC could decide the future of contentious ETH hard forks

Ethereum co-founder Vitalik Buterin says that centralized stablecoins such as Tether (USDT) and Circle USD (USDC) could become “a significant decider in future contentious hard forks.” Buterin was speaking at the BUIDL Asia conference in Seoul on Aug. 3, along with Illia Polosukhin, the co-founder of Near Protocol (NEAR) to discuss Ethereum’s upcoming Merge. The Ethereum co-founder argued that centralized stablecoins could be a “significant” decider of which blockchain protocol the industry would “respect” in hard forks. A hard fork occurs when there is a radical change to the protocol of a blockchain network that effectively results in two versions. Usually, one chain ends up being preferred over another. “At the moment of the merge, you will have two [separate] networks […] and then you ...

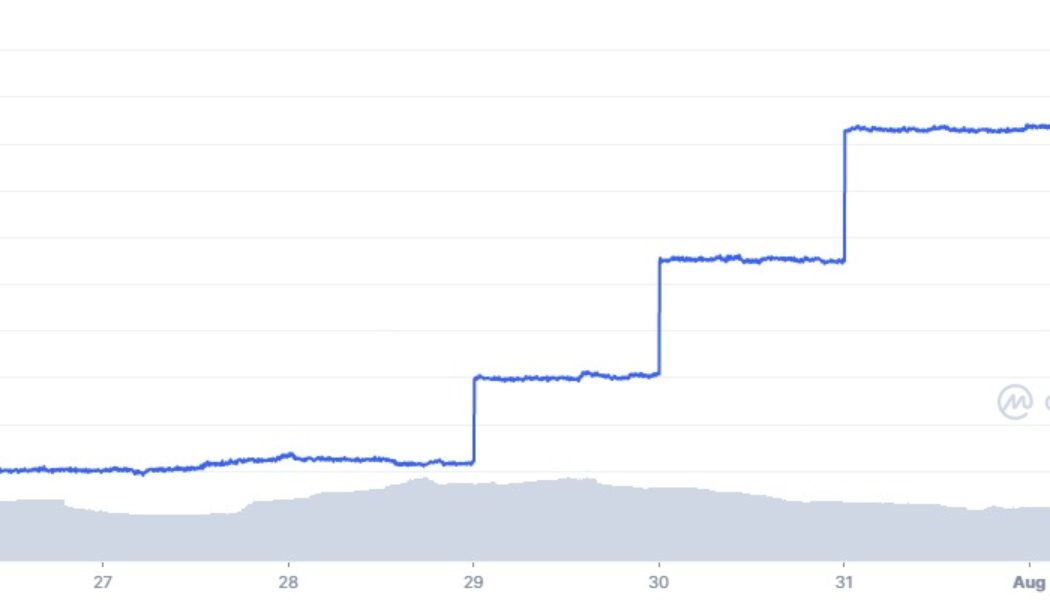

Tether supply starts to increase after three-month decline

The world’s largest stablecoin, Tether (USDT) has expanded its circulating supply following almost three months of reductions, in what could be a sign the crypto markets are slowly recovering. The first mint in almost three months occurred on July 29, and there have been three more, with the latest on August 2, according to CoinMarketCap. The USDT injections have been small, however, lifting Tether’s market cap by just 0.7% or just under $500 million. USDT market cap 7D – Coinmarketcap.com According to the Tether transparency report, there is now 66.3 billion USDT in circulation. This gives the stablecoin a total market share of around 43%. Tether supply reached an all-time high in early May when it topped 83 billion USDT. The collapse of the Terra ecosystem, resultant crypto c...