Tether

Doubts mount over Huobi’s future as harsh layoff rumors denied

Speculation on Twitter that crypto exchange Huobi has laid off staff and shuttered internal communications have prompted the community to advise users to withdraw funds, despite an adviser to the exchange denying the rumors. In a Jan. 5 tweet, Huobi adviser Justin Sun addressed rumors of purported insolvency, saying the business development of the exchange was “good” and the “security of users’ assets will always be fully protected.” Sun also seemingly brushed off speculation around disgruntled staff, saying Huobi will “fully respect the legal demands of local employees.” Earlier, on Jan. 3, crypto journalist Colin Wu reported that Sun changed Huobi employee salaries from being paid in fiat to being paid in either Tether (USDT) or USD Coin (USDC). Wu claimed the staff who disagreed with th...

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

Winners and losers of 2022: A disastrous year that saw few winners among a sea of losers

2022 was supposed to be the year crypto went mainstream, with a significant chunk of traditional venture capital firms betting heavily on the ecosystem in 2021. However, with one disaster after another, 2022 turned out to be a catastrophic year for the nascent crypto ecosystem. Some of the biggest names touted as pivotal to taking the crypto ecosystem forward turned out to be the orchestrators of its worst year in recent memory. That said, quite a few protagonists rose to the occasion. These winners proved that crypto is not just about a few select individuals and companies but a vibrant ecosystem that can survive significant setbacks. Let’s start with some of the biggest winners of the crypto ecosystem in 2022. The list includes individuals, companies and anonymous groups working for the ...

SBF tried to destabilize crypto market to save FTX: Report

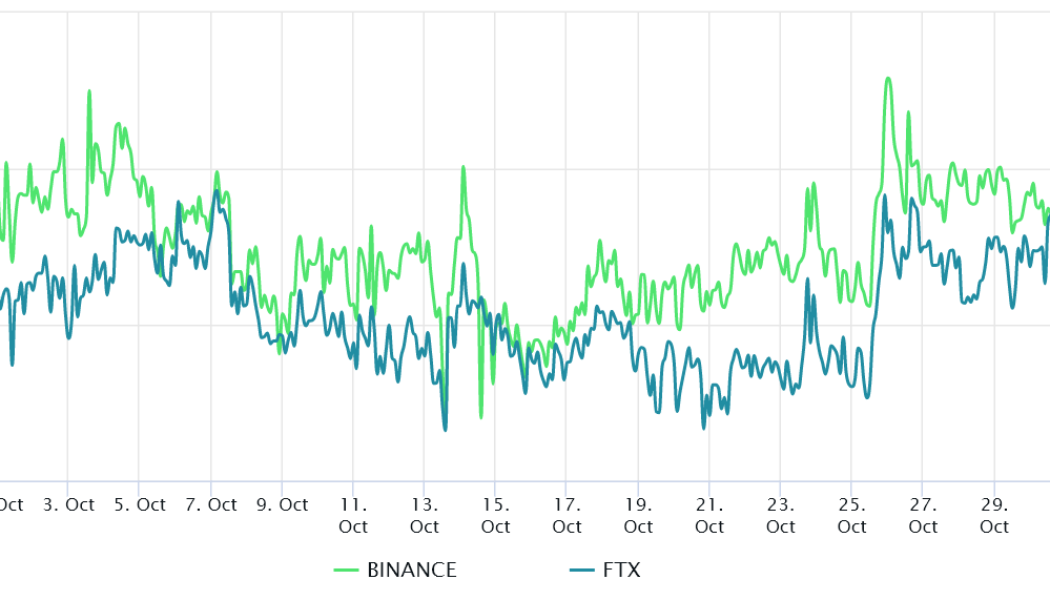

Tether executives and Binance CEO Changpeng “CZ” Zhao worried that Sam Bankman-Fried (SBF), former FTX CEO, was attempting to destabilize the crypto market aiming to save the now-bankrupt exchange, according to reports on Dec. 9. Messages seen by The Wall Street Journal of a Signal group chat named “Exchange coordination” reveals an argument between CZ and SBF on Nov. 10 about Tether’s stablecoin USDT. According to the report, CZ and others in the group worried that trades made by Alameda Research were focusing on depeg the stablecoin, which would have a ripple effect in crypto prices. Binance CEO reportedly confronted SBF: “Stop trying to depeg stablecoins. And stop doing anything. Stop now, don’t cause more damage.” SBF denied the claims in a statement to the WSJ....

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

Ethereum price weakens near key support, but traders are afraid to open short positions

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...

Bitcoin fails to break the $21K support, but bears remain shy

Bitcoin (BTC) rallied on the back of the United States stock market’s 3.4% gains on Oct. 28, with the S&P 500 index rising to its highest level in 44 days. In addition, recently released data showed that inflation might be slowing down, which gave investors hope that the Federal Reserve might break its pattern of 75 basis-point rate hikes after its November meeting. In September, the U.S. core personal consumption expenditures price index rose 0.5% from the previous month. Although still an increase, it was in line with expectations. This data is the Federal Reserve’s primary inflation measure for interest rate modeling. Additional positive news came from tech giant Apple, which reported weak iPhone revenues on Oct. 27 but beat Wall Street estimates for quarterly earnings and margin. M...

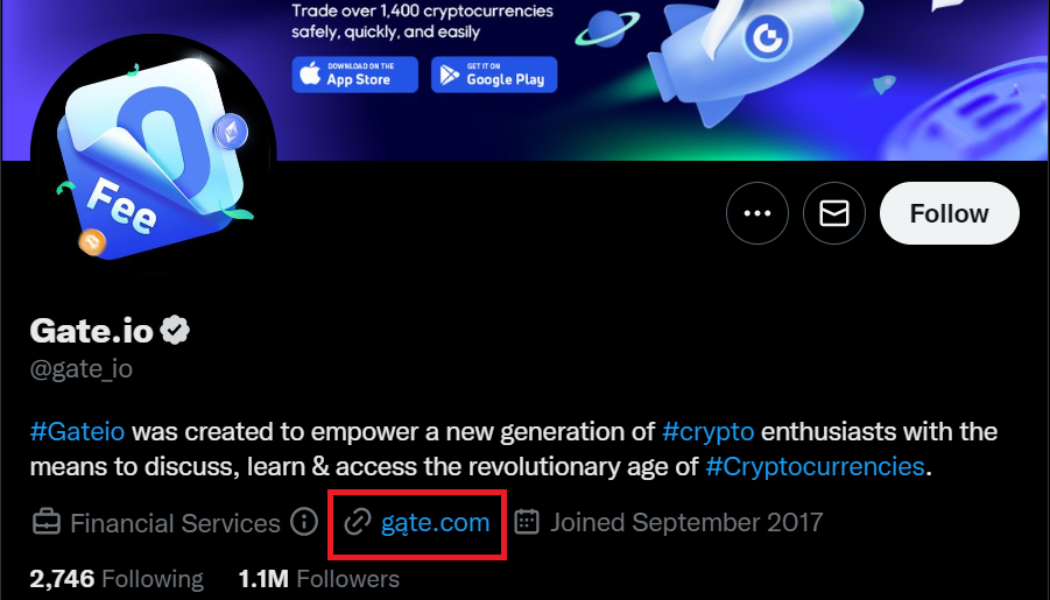

Gate.io users at risk as scammers fake giveaway on hacked Twitter account

Hackers took over the official Twitter account of crypto exchange Gate.io, putting over 1 million users at risk of losing funds to an ongoing fraudulent Tether (USDT) giveaway. Social media platform Twitter serves as the most effective medium to reach the crypto community. As a result, the trend of hacking into official Twitter handles of verified accounts to promote scams is on the rise. Hackers of unknown origin took over Gate.io’s Twitter account and changed the website URL from Gate.io to gąte.com (https://xn--gte-ipa.com/) — a fraudulent website impersonating the exchange. The fake website is actively promoting a fake giveaway of 500,000 USDT while asking users to connect their wallets (such as MetaMask) to claim the rewards. Once a user connects their wallet to the fake website, the ...

US regulator touts to ‘aggressively police’ crypto in new report

The U.S. commodities regulator certainly doesn’t want to look like it’s going easy on crypto, revealing it was behind 18 separate enforcement actions targeting digital assets in the 2022 fiscal year. In an Oct. 20 report from the Commodity Futures Trading Commission (CFTC), a total of 82 enforcement actions were filed in 2022’s fiscal year, imposing $2.5 billion in “restitution, disgorgement and civil monetary penalties either through settlement or litigation.” The CFTC said that 20% of the enforcements were aimed at digital asset businesses, with chairman Rostin Behnam stating: “This FY 2022 enforcement report shows the CFTC continues to aggressively police new digital commodity asset markets with all of its available tools.” One of the more recent CFTC enforcement actions tha...

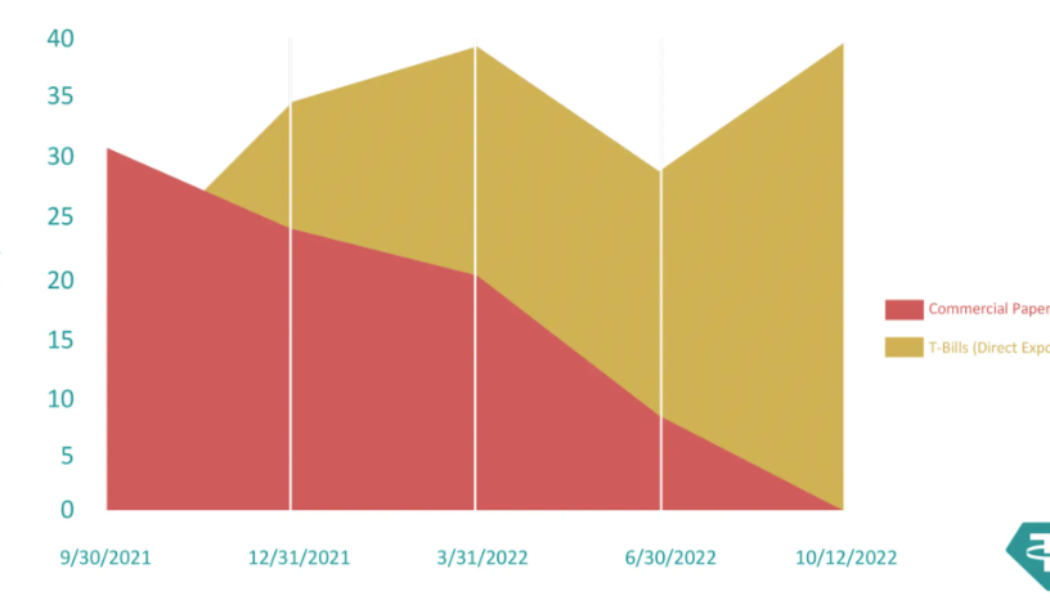

Tether reduces commercial paper exposure to zero, replaces investments with T-Bills

Stablecoin issuer Tether Holdings Limited has unwound its exposure to commercial paper, addressing a long-standing item of contention among detractors who’ve criticized the quality of its reserves. In addition to removing commercial paper from its reserves, Tether announced on Oct. 13 that it had replaced those investments with United States Treasury Bills. “Reducing commercial papers to zero demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market,” the company said. From roughly $30 billion down to zero, Tether has replaced its commercial paper holdings with more secure U.S. T-Bills. Source: Tether. While Tether has long been subjected to public scrutiny about its reserves detractors have focused on the composition of its assets for t...

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

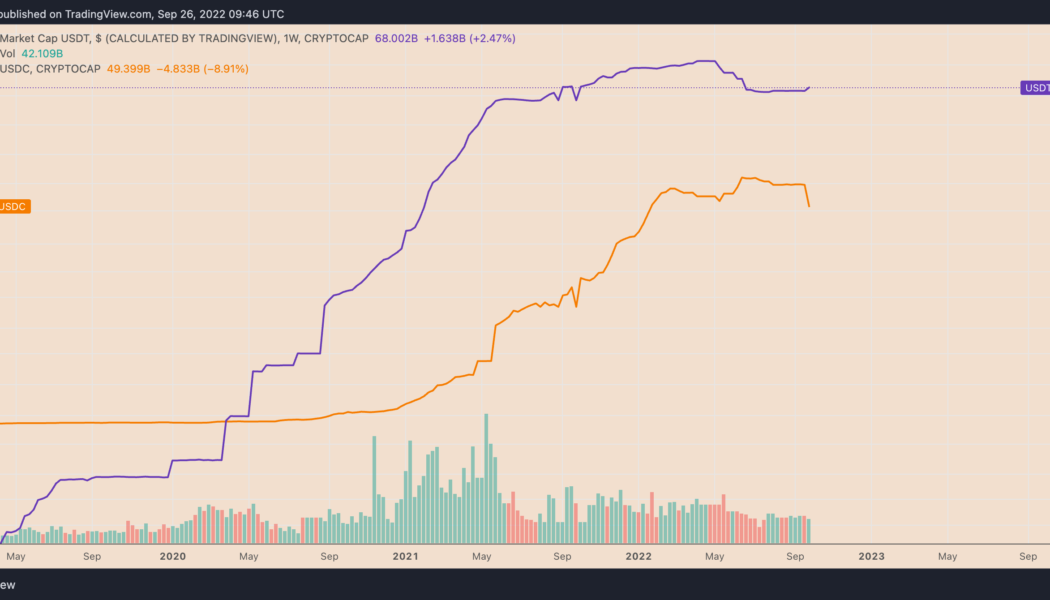

3 reasons why USDC stablecoin dropping below $50B market cap is Tether’s gain

The market capitalization of USD Coin (USDC), a stablecoin issued by U.S.-based payment tech firm Circle, has dropped below $50 billion for the first time since January 2022. On the weekly chart, USDC’s market cap, which reflects the number of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, down almost 12% from its record high of $55.88 billion, established merely three months ago. USDC versus USDT weekly market cap chart. Source: TradingView In contrast, the market cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, crossed above $68 billion on Sep. 26, albeit still down 17.4% from its record high of $82.33 billion in May 2022. The divergence between USDT and USDC shows investors’ renewed preference...