TerraUSD

WSJ: Terraform Labs claims case against Do Kwon is ‘highly politicized’

Terraform Labs, the company behind the development of the Terra (LUNA) blockchain said South Korea’s case against its co-founder Do Kwon has become political, alleging prosecutors expanded the definition of a security in response to public pressure. “We believe that this case has become highly politicized, and that the actions of the Korean prosecutors demonstrate unfairness and a failure to uphold basic rights guaranteed under Korean law,” a Terraform Labs spokesman said to The Wall Street Journal on Sept. 28. South Korean prosecutors issued an arrest warrant for Kwon on Sept. 14 for violations of the countries capital markets laws, but Terraform Labs laid out a defense arguing Terra (now known as Terra Luna Classic (LUNC)) isn’t legally a security, meaning it isn’t covered by capital mar...

Breaking: Interpol ‘Red Notice’ issued for Do Kwon — South Korea prosecutors

Interpol has reportedly issued a “Red Notice” to law enforcement worldwide for the arrest of Terraform Labs co-founder Do Kwon. South Korean prosecutors in Seoul on Monday told Bloomberg the international policing organization issued the notice in response to charges Kwon faces in South Korea related to the collapse of the Terra ecosystem. The news comes only a week after South Korean prosecutors reportedly asked Interpol to issue a “Red Notice” for Kwon on Sept. 19. A Red notice is a “request to law enforcement worldwide to locate and provisionally arrest a person pending extradition, surrender, or similar legal action” according to the Interpol website. It also comes less than two weeks after South Korean authorities issued an arrest warrant for Kwon and five other associates for alleged...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

Investors dumping on Terra as LUNA 2 tanks 70% in two days

The price of Terra (LUNA) has tanked around 70% since the re-launch of the Terra ecosystem via Terra 2.0 on May 28. Under the revival plan of Terraform Labs founder Do Kwon, new LUNA tokens, also referred to as LUNA 2, are being airdropped to investors that previously held Luna Classic (LUNC), TerraUSD Classic (USTC) and Anchor Protocol UST (aUST). The only reason to buy $LUNA 2.0 is to qualify for the next airdrop of $LUNA 3.0 after it goes to zero like $LUNA 1.0 — Luke Martin (@VentureCoinist) May 29, 2022 According to data from CoinGecko, LUNA has dropped roughly 69% since its opening of $18.87 on Saturday to sit at around $5.71 at the time of writing. LUNA/USD chart: CoinGecko At this stage, the sharp plummet seems to suggest a relative lack of faith in Do Kwon’s revamp moving for...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

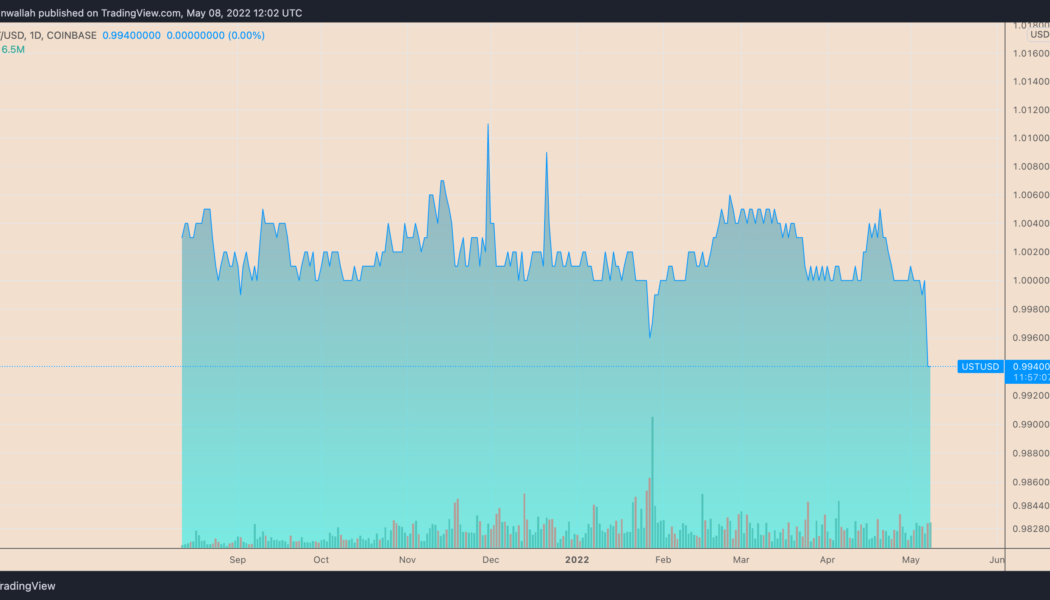

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

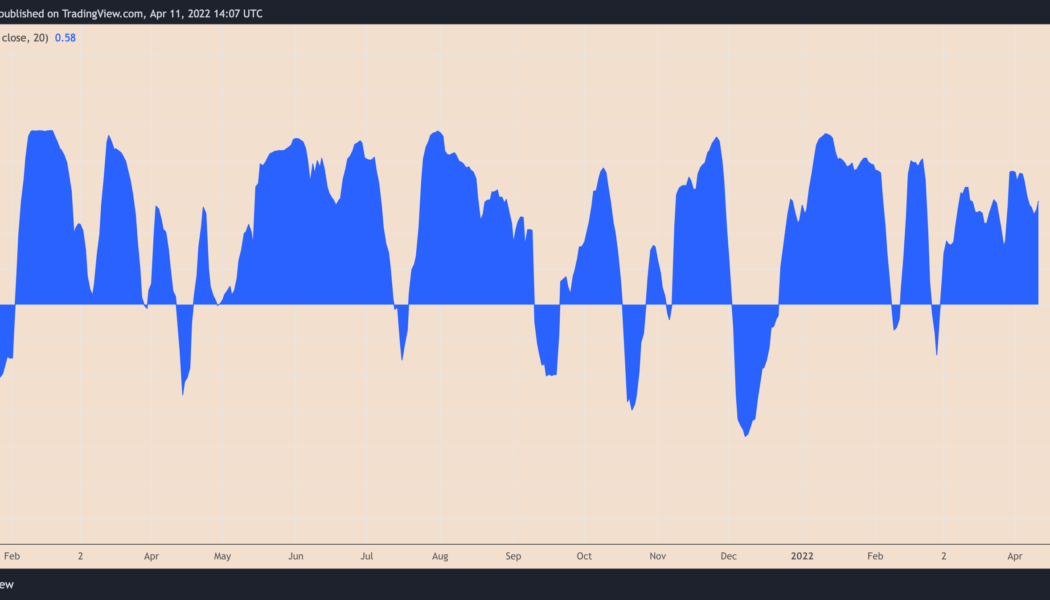

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

THORChain quietly outperforms crypto market in Q1 — Can RUNE price break $10 next?

THORChain (RUNE) could continue its upward momentum in the coming weeks even as it treads inside a classic bearish reversal structure. RUNE’s price has rebounded strongly by over 165% four weeks after testing its multi-month horizontal level support near $3.15. What’s more, its upside retracement has opened up possibilities about an extended bull run toward $11.50, about 45% above the current price level near $7.89, as shown in the chart below. RUNE/USD weekly price chart featuring descending triangle setup. Source: TradingView The $11.50-level coincides with RUNE’s multi-month falling trendline resistance, forming a descending triangle, a bearish setup, in conjunction with the lower horizontal support. That could have RUNE’s price correct again to $3.15 after reach...

Terraform Labs donates $1.1B for Luna Foundation Guard‘s reserves

On Friday, Do Kwon, founder and CEO of Terraform Labs, which develops the blockchain ecosystem consisting of Terra Luna (LUNA) and the TerraUSD stablecoin (UST), announced that TFL had donated 12 million LUNA, or $1.1 billion at the time of publication to the Luna Foundation Guard (LFG). LFG launched in January to grow the Terra ecosystem and improve the sustainability of its stablecoins. Kwon noted that the funds, denominated in LUNA, will be burned to mint UST to grow the LFG‘s reserves: “We will keep growing reserves until it becomes mathematically impossible for idiots to claim de-peg risk for UST.” UST is an algorithmic stablecoin with a theoretical exchange rate of 1:1 with the U.S. dollar and is in part maintained by swapping of/for LUNA tokens when its market value deviates from it...