Terra

Wonky Mars Protocol launch shows ecosystem expansion may not add to network value

New protocols are launching every day on different networks in the crypto space and the trend is likely to continue through this year. When looking at the top five networks by total value locked (TVL) — Ethereum (ETH), Terra (LUNA), Binance Smart Chain (BSC), Avalanche (AVAX) and Solana (SOL) — according to data from DeFiLlama, Ethereum have 579 protocols (including L1 and L2); Terra has 25, BSC has 348, Avalanche and Solana have 187 and 64 protocols, respectively. The low number of protocols and high TVL from Terra surely stand out as the outlier here. Terra’s TVL reached an all-time high at $20 billion in December 2021 before dropping to $13 billion during the January 2022 crash. To date, the ecosystem has managed to boost its liquidity back to $26 billion. With only 25 protoco...

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

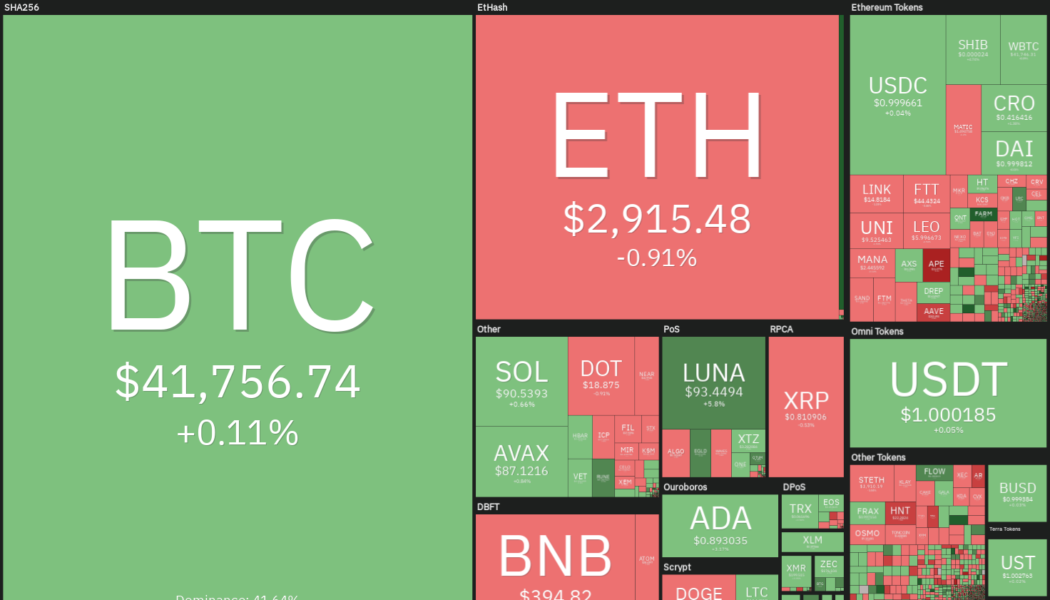

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ETC, EGLD

Bitcoin (BTC) rose above $42,000 on March 19 but the bulls continue to face a strong challenge from the bears at higher levels. Although Bitcoin’s price has recovered from $37,578 on March 13, Cointelegraph market analyst Marcel Pechman highlighted that the long-to-short net ratio of top traders across three major exchanges shows that professional traders have not been buying aggressively. But while Bitcoin struggles at higher levels, select altcoins are showing strength. Twitter account BTCFuel anticipates that altcoins could be entering “the final leg up of the hype phase” and may peak in the Summer. Crypto market data daily view. Source: Coin360 Glassnode data shows that investors have withdrawn roughly 550,000 Ether (ETH) from centralized exchanges year-to-date. Due to the outflo...

Altcoin Roundup: Three layer-1 protocols see inflows amid choppy, volatile market conditions

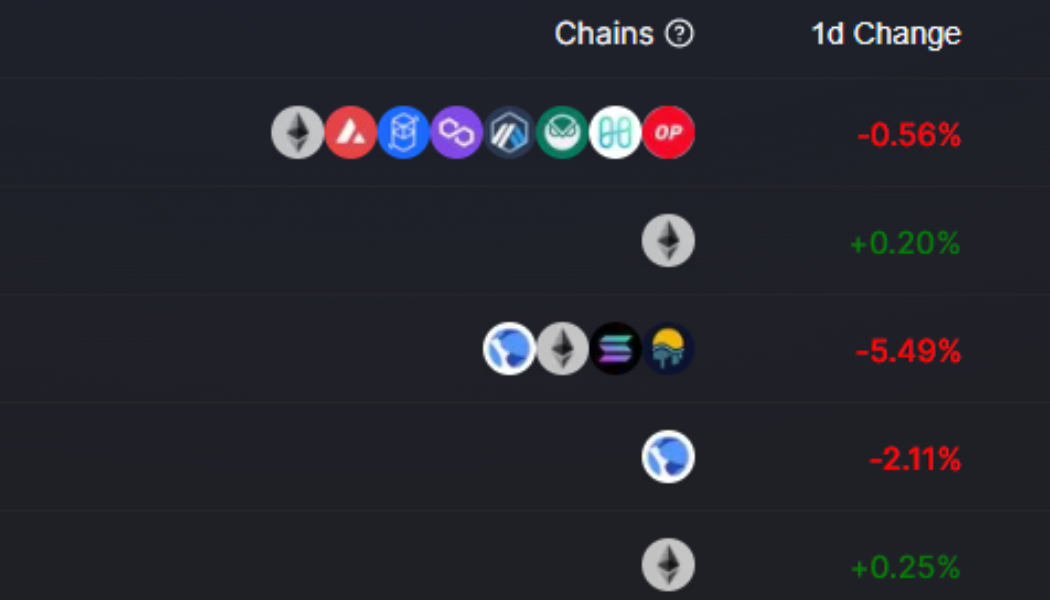

Layer-1 (L1) protocols are the foundation of the decentralized application ecosystem, with the Ethereum network dominating the landscape in terms of the number of protocols launched on-chain and total value locked (TVL), followed by BNB Chain and Fantom. As the sideways market of 2022 drags on and serious projects use the time away from the frenzy of bull markets to work on development, several L1 protocols have been outperforming the field and making gains despite weakness in the wider crypto market. Here’s a look at three L1 protocols that are seeing growth in their decentralized finance (DeFi) communities and an influx of TVL on their networks. Waves Waves is a multi-purpose blockchain protocol that was originally launched in 2016 and has since undergone several transformations al...

Price analysis 3/18: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

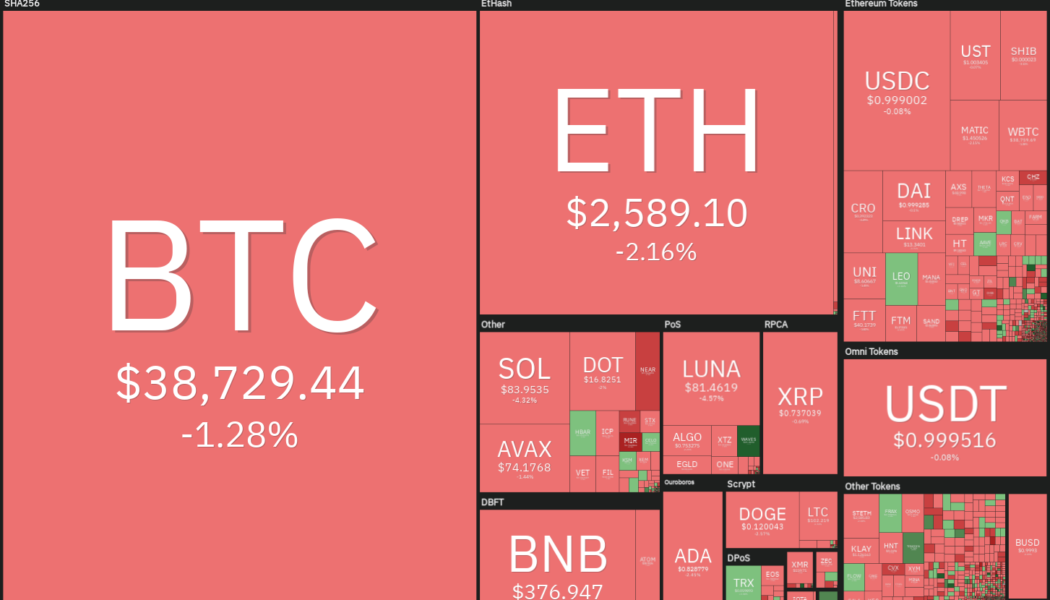

Bitcoin (BTC) is facing a challenging environment in 2022 due to the surging inflation and geopolitical turmoil. Although gold has outperformed Bitcoin year-to-date, Bloomberg Intelligence senior commodity strategist Mike McGlone believes that Bitcoin could make a strong comeback. McGlone expects the current circumstances to “mark another milestone in Bitcoin’s maturation.” Another bullish sign for the long term is that the Bitcoin miners have been increasing their Bitcoin holdings since 2021. Compass Mining founder and CEO Whit Gibbs said to Cointelegraph that Bitcoin mining companies are “taking more of a bullish approach to Bitcoin.” Daily cryptocurrency market performance. Source: Coin360 Terraform Labs founder Do Kwon said that its stablecoin TerraUSD (UST) will be backed by mor...

Price analysis 3/16: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) is witnessing a see-saw battle near $40,000 with both the bulls and the bears trying to gain the upper hand. The volatility could remain high as the markets await the United States Federal Reserve’s policy decision due on March 16. Analyst Willy Woo suggests that Bitcoin could witness a capitulation event based on a cost basis, a metric that indicates the transfer of Bitcoin from inexperienced to experienced traders. Such sharp declines usually suggest the formation of market bottoms. Daily cryptocurrency market performance. Source: Coin360 However, Glassnode believes that a capitulation has been avoided because the sell-offs have been absorbed by a relatively strong market. Although 82% of the short-term holders’ coins are in loss, Glassnode considers this to be a late...

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

Which Terra-based coins have the most explosive potential? | Find out now on The Market Report live

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss which Terra-based coins you should be looking out for in 2022. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they debate which Terra-based coin has the most explosive potential. Will it be Bourgi’s pick of StarTerra, which capitalizes on blockchains’ biggest trends — play-to-earn, nonfungible tokens (NFTs) and staking — basically combining multiple multibillion-dollar industri...

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...