Terra

Price analysis 4/15: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

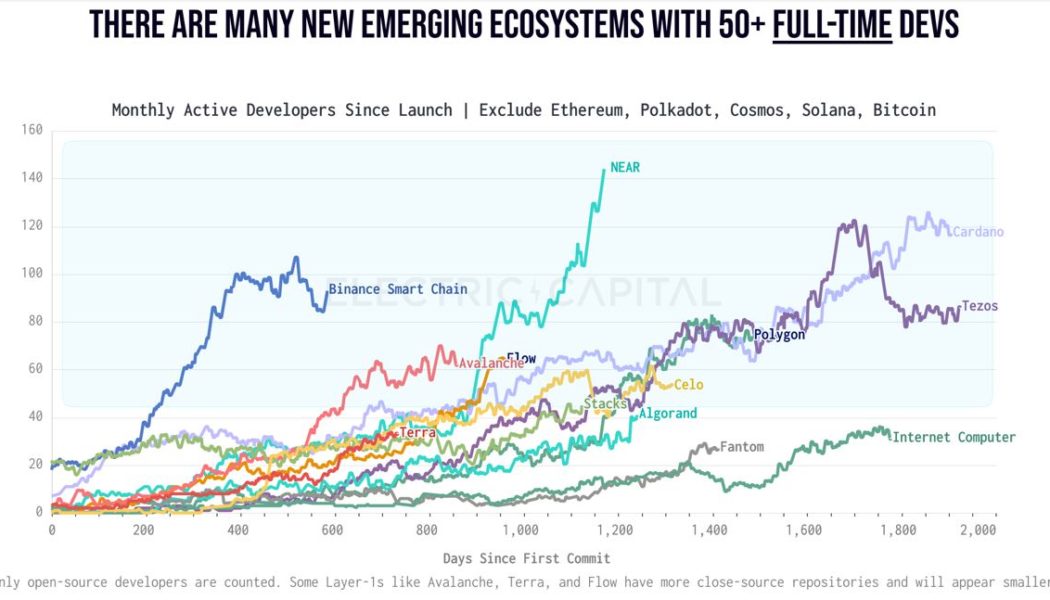

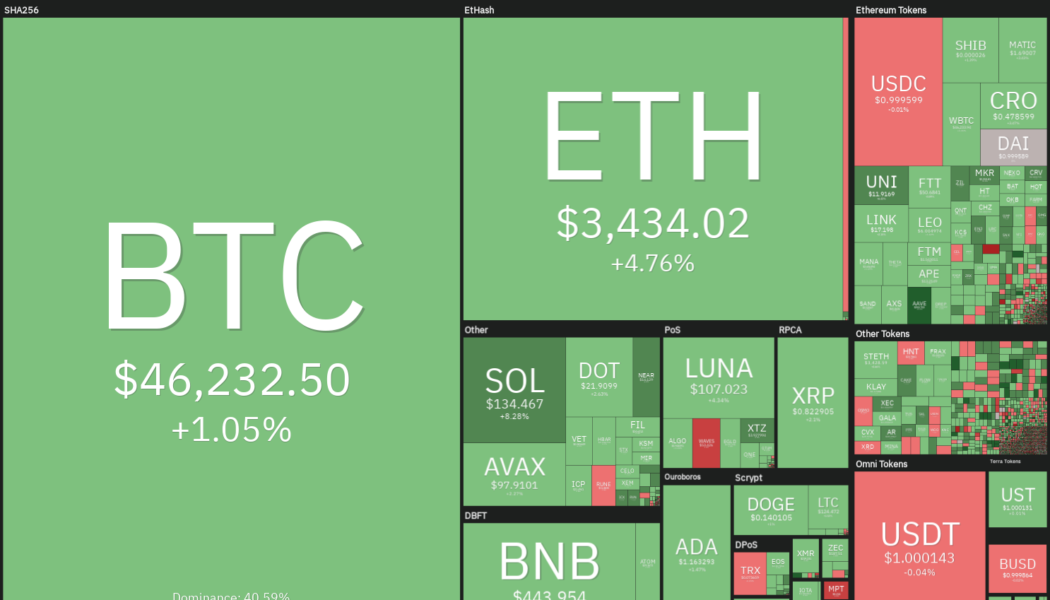

Bitcoin (BTC) remains closely correlated with the S&P 500 but the institutional investors do not seem to be waiting for a turnaround in the United States’ equities market or decoupling to happen before buying more Bitcoin. Notably, 30,000 Bitcoin moved out of Coinbase Pro in a single day, suggesting strong institutional demand. MicroStrategy, the publicly listed company, which is the largest single-wallet holder of Bitcoin, does not seem to be content with its stash of 129,219 Bitcoin. In a letter to shareholders, the firm’s CEO Michael Saylor said that the company aims to “vigorously pursue” and “increase awareness” about its Bitcoin strategy. Daily cryptocurrency market performance. Source: Coin360 Another entity that has been at the forefront of Bitcoin purchases in the p...

Terraform Labs gifts another $880M to Luna Foundation Guard

Terra (LUNA) blockchain developer Terraform Labs (TFL) has gifted the Luna Foundation Guard 10 million LUNA worth around $820 million at current prices. The Luna Foundation Guard (LFG) is a nonprofit organization attached to Terra that is tasked with collateralizing the network’s algorithmic stablecoin Terra USD (UST) to keep it pegged with the U.S. dollar. Terraform Labs’ latest announcement came via Twitter on April 14, but did not outline what the funds will go towards specifically. However, transaction data from Terra Finder shows that 7.8 million LUNA (roughly $630 million) was promptly transferred out of the LFG’s reserve wallet yesterday. TFL has gifted an additional 10 million $LUNA to the @LFG_org. https://t.co/tNirkgGGm0 — Terra (UST) Powered by LUNA (@terra_money) April 14, 2022...

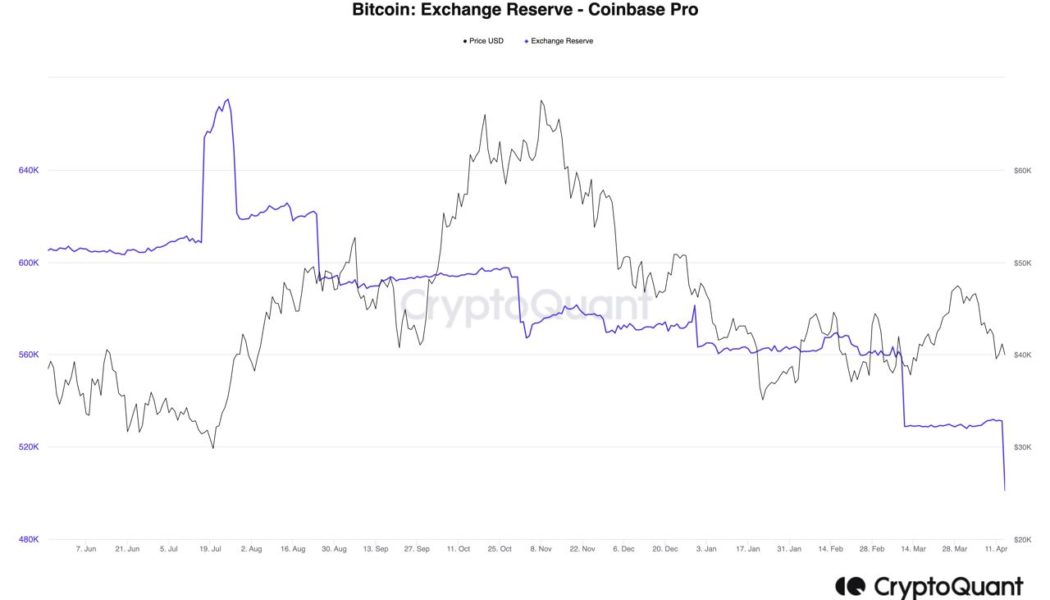

Bitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase

Bitcoin (BTC) may be heading under $40,000 but fresh data shows that demand from major investors is anything but decreasing. For Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, institutional BTC buying “could be the big narrative” in the crypto space once more. Coinbase Pro shifts serious amounts of BTC Ki highlighted figures from Coinbase Pro, the professional trading offshoot of United States exchange Coinbase, which confirm that large tranches of BTC continue to leave its books. Those tranches totalled 30,000 BTC in a single day this week, and the event is not an isolated one, with March seeing similar behavior. Coinbase Pro BTC reserves vs. BTC/USD chart. Source: CryptoQuant “30k BTC flowed out from Coinbase today,” he noted, “Institutional buys might be the bi...

‘Zone of heavy opportunity’: Analysts tip Bitcoin will stage a comeback

Several popular cryptocurrency analysts believe the future looks green for Bitcoin (BTC) as it reclaimed the $40,000 mark in a 3.5% swing following a week-long dip. Popular Bitcoin technical analyst on Twitter TechDev issued a prediction to his 381,000 followers that the general direction for the largest cryptocurrency by market cap will be up for the foreseeable future. His April 14 chart drew a comparison between the tremendous rise of the Dow Jones Industrial Average in the ’80s and ’90s to Bitcoin’s price over the past six years. Past performance is no guarantee of future returns but there are some similarities to the historic price action that if repeated, would suggest the Bitcoin price will rise from here. The analyst said “Times change. Assets chain. Macro aggrega...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

Price analysis 4/8: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to defend the immediate support levels, indicating that bears sense an opportunity and are looking to take control of the price action. The short-term price action does not seem to worry the long-term Bitcoin bulls who expect a massive return in the next few years. While speaking at the Bitcoin 2022 conference in Miami, ARK Invest CEO Cathie Wood reiterated her Bitcoin price target of $1 million by 2030. Meanwhile, telecom billionaire Ricardo Salinas said during the conference that BTC and Bitcoin equities form 60% of his liquid investment portfolio. That is a massive increase from his Bitcoin exposure in 2020, which formed just 10% of his liquid assets. Daily cryptocurrency market performance. Source: Coin360 While the long-term may be ...

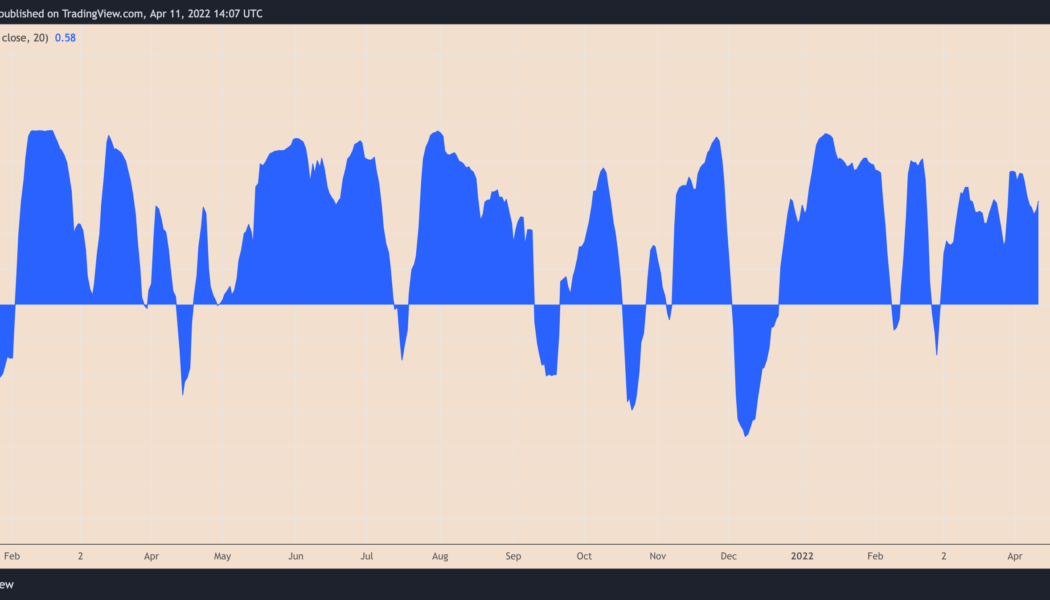

Bitcoin plumbs April lows as US dollar strength hits highest since May 2020

Bitcoin (BTC) neared new price lows for April on April 8’s Wall Street open amid a fresh surge in the U.S. dollar. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $43,000 hangs in the balance Data from Cointelegraph Markets Pro and TradingView captured another day of gloom for BTC bulls as the largest cryptocurrency slipped back under $43,000. In a classic move, BTC/USD reacted unfavorably to a resurgent dollar, with the U.S. dollar currency index (DXY) returning above 100 for the first time since May 2020. Coming on the back of tightening measures from the Federal Reserve, the greenback also spelled a headache for stocks, which opened down on the day. U.S. dollar currency index (DXY) 1-week candle chart. Source: TradingView While some considered the DXY event a temp...

xASTRO staking and upcoming ‘Terra wars’ send Astroport price to new highs

Projects that launch on up-and-coming blockchain networks can often benefit from a low competition environment that allows them to attract new users and liquidity at a faster rate than crowded networks like Ethereum. A recent example of this is Astroport (ASTRO), an automated market maker (AMM) on the Terra (LUNA) network that has seen an influx of activity alongside the increased attention that is being focused on the Terra ecosystem and its Terra USD (UST) stablecoin. . Data from CoinGecko shows that since hitting a low of $1.28 on March 7, the price of ASTRO has exploded 194% to hit a new all-time high of $4.80 on April 5. ASTRO/USDT 4-hour chart. Source: TradingView Three reasons for the price appreciation seen in ASTRO include the increased attention the Terra ecosystem ha...

Terra buys $200M in AVAX for reserves as rival stablecoins emerge

Terraform Labs (TFL) and the Luna Foundation Guard (LFG) have announced they have purchased a combined $200 million worth of AVAX tokens from the Avalanche Foundation. TFL, the company responsible for the development of the Terra blockchain, swapped $100 million worth of Terra’s native token, LUNA for AVAX tokens, in order to “strategically align ecosystem incentives”, according to Terra’s twitter. LFG, a non-profit organization mandated to build reserves for Terra’s algorithmic stablecoin UST, used its own holdings of UST to purchase an additional $100 million worth of AVAX from the Avalanche Foundation. These purchases are meant to reinforce the stability of Terra’s native UST stablecoin, which currently has a market cap of $16.7 billion. Do Kwon, the founder of Terraform Labs, tol...

Price analysis 4/1: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) has clawed back much of the losses that took place in January and now the focus of traders shifts to April, which has historically been a strong month for the cryptocurrency. According to Coinglass data, Bitcoin has closed April in the red on onlthree occasions and the worst monthly loss was a 3.46% drop in 2015. Although history favors the bulls, the Whale Shadows indicator has noticed that more than 11,000 Bitcoin has left a wallet in which it had been lying dormant for seven to ten years. The movement of similar-sized quantities from dormant accounts has generally resulted in a major top, according to independent market analyst Phillip Swift. Daily cryptocurrency market performance. Source: Coin360 Along with keeping an eye on the crypto markets, traders should ...

Crypto Biz: Proof of integrity? Gold industry wants blockchain to solve its biggest problems, March 25–31, 2022

As Bitcoin (BTC) continues to eat away at gold’s market share, the bullion industry is looking to blockchain — the technology first made famous by BTC — to solve its most enduring challenges. How’s that for irony? Someone should really check on Peter Schiff. Speaking of Bitcoin, a MicroStrategy subsidiary confirmed this week that it plans to buy more “digital gold” through a crypto-collateralized loan. Terraform Labs CEO Do Kwon also ramped up his Bitcoin purchases to provide solid backing for Terra’s UST stablecoin. This week’s Crypto Biz takes a deep dive into the gold industry and the latest business developments surrounding Bitcoin. Gold industry taps blockchain for supply chain management and fraud prevention Blockchain has been identified as a potential game-changer for the gol...

Bitcoin hits 3-day low as Terra BTC buy-ins dry up below $48K

Bitcoin (BTC) hinted at a welcome retracement overnight into March 30 after relentless upside failed to flip $48,000 to support. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: BTC still on target to crack $50,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $46,572 on Bitstamp as Wednesday began — its lowest since March 27. A susbequent rebound alleviated some of the losses, and at the time of writing, the pair traded at around $47,400. The change of tack followed a cooling of the narratives which had surrounded Bitcoin’s initial push beyond its yearly open price of $46,200 — a significant achievement which ended the cryptocurrency’s multi-month trading range. Blockchain protocol Terra, on its way to amassing an inital ...