Terra

Binance CEO CZ to support Terra community but expects more transparency

Changpeng “CZ” Zhao, the CEO of crypto exchange Binance, recently questioned the idea of hard forking the Terra blockchain as a means to revive the once-thriving LUNA and UST ecosystems. Following up on the same, CZ revealed his perspective on the appropriate course of action for falling projects across the crypto community. “This won’t work,” said CZ while dismissing the validators’ idea of a hard forking to TERRA2, which would involve providing a new version of LUNA to all holders based on a snapshot of the holdings before the market collapsed. CZ suggested: “Reducing supply should be done via burn, not fork at an old date, and abandon everyone who tried to rescue the coin. I don’t own any LUNA or UST either. Just commenting.” Instead, he suggested that the Terra community should f...

Terra (LUNA) trading volume surge 200% as market adjusts to death spiral

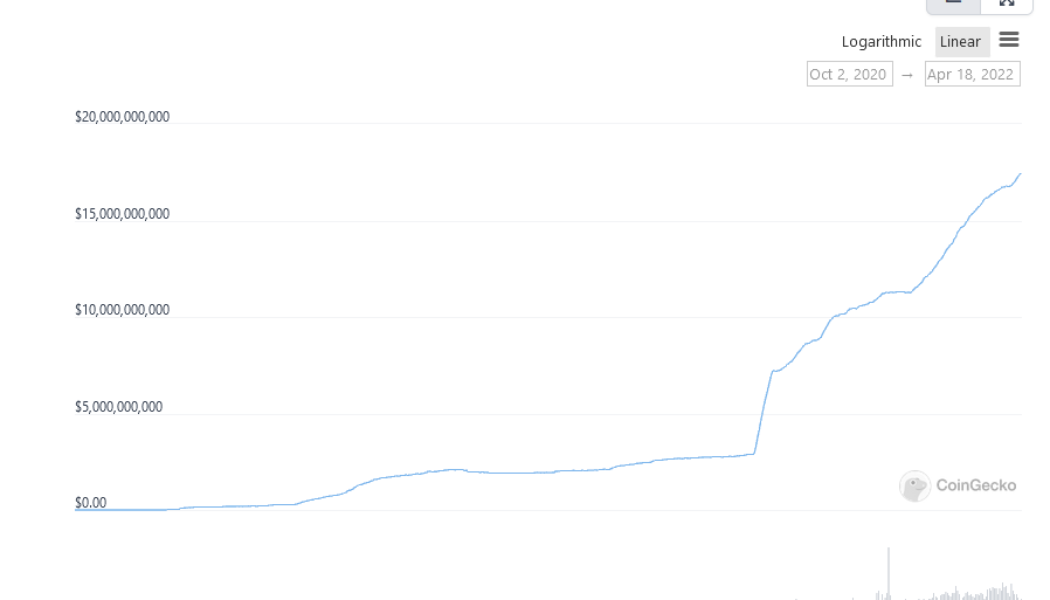

It took just seven days for the Terra (LUNA) ecosystem to spiral down as prices came crashing from $85 on May 5 to nearly $0 on May 12. As the market slowly gained clarity on what transpired, the trading volume of LUNA saw a steep recovery of over 200% over the weekend. As a result of UST de-pegging, which crashed the LUNA market, LUNA investors mirrored the price dip as CoinGecko recorded the decline of trading volumes to $178.6 million on May 13 — a number that was last seen in February 2021. Falling trading volume of LUNA. Source: CoinGecko Terraform Labs CEO and co-founder Do Kwon sought damage control on the same day as he proposed a revival plan for Terra’s comeback, which involves compensating UST and LUNA holders for holding the tokens during the crash. Despite the risks...

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining

This week the crypto market endured a sharp drop in valuation after Coinbase, the leading U.S. exchange, reported a $430 million quarterly net loss and South Korea announced plans to introduce a 20% tax on crypto gains. During its worst moment, the total market crypto market cap faced a 39% drop from $1.81 trillion to $1.10 trillion in seven days, which is an impressive correction even for a volatile asset class. A similar size decrease in valuation was last seen in February 2021, creating bargains for the risk-takers. Total crypto market capitalization, USD billion. Source: TradingView Even with this week’s volatility, there were a few relief bounces as Bitcoin (BTC) bounced 18% from a $25,400 low to the current $30,000 level and Ether (ETH) price also made a brief rally to $2,100 af...

No rescue for Terra: Swiss asset manager denies $3B LUNA/UST bail-out talks

GAM Investments has quashed fake news reports that surfaced on Friday that claimed the Swiss asset manager would invest some $3 billion to aid in the recovery of the Terra ecosystem, including LUNA and TrueUSD (UST) stablecoin. An announcement published on May 12 claimed that the firm was engaging in talks with Terraform Labs to assist in recovery attempts after Terra’s algorithmic stablecoin UST lost its $1 peg — causing a cataclysmic crash of the acclaimed blockchain protocol which had become a darling of the Decentralized Finance space. Cointelegraph has confirmed with GAM Investments that the press release was fabricated — with head of communications and investor relations Charles Naylor categorically labeling the release as fake news – which even included fake quotes from ...

Untethered: Here’s everything you need to know about TerraUSD, Tether and other stablecoins

The crypto winter could be claiming more casualties among the stablecoin camp. The de-pegging of TerraUSD (UST) on Tuesday triggered market sell-offs, and now Tether (USDT) appears to be losing its footing, having slipped against the U.S. dollar. The algorithmic stablecoin UST is, as the name implies, algorithmically backed. LUNA, the ecosystem’s corresponding token, has sunk over 95% since Tuesday, while UST continues to languish around the $0.50 mark. Cointelegraph’s resident experts shared their explanations for why UST crashed in a special edition of “The Market Report” yesterday. The plan for Terraform Labs’ algorithmic stablecoin continues to roll out, but UST is still struggling. [embedded content] Data from Cointelegraph Markets Pro confirmed that various stable...

Bitcoin falls below $27K to December 2020 lows as Tether stablecoin peg slips under 99 cents

Bitcoin (BTC) fell out of its long-term trading range on May 12 as ongoing sell pressure reduced markets to 2020 levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tether wobbles as UST stays under $0.60 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it exited the range in which it had traded since the start of 2021. At the time of writing, the pair circled $26,700 on Bitstamp, marking its lowest since Dec 28, 2020. The weakness came as fallout from the Terra stablecoin meltdown continued to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues due to losses on LUNA and UST. “People are still processing this but this is the Lehman moment for crypto” Hearing about a lo...

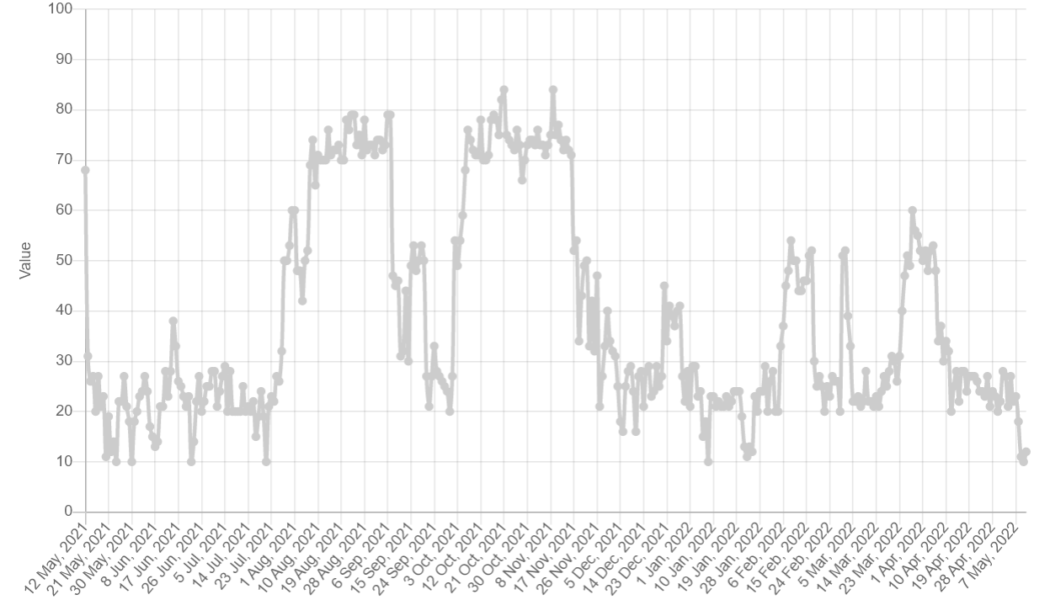

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

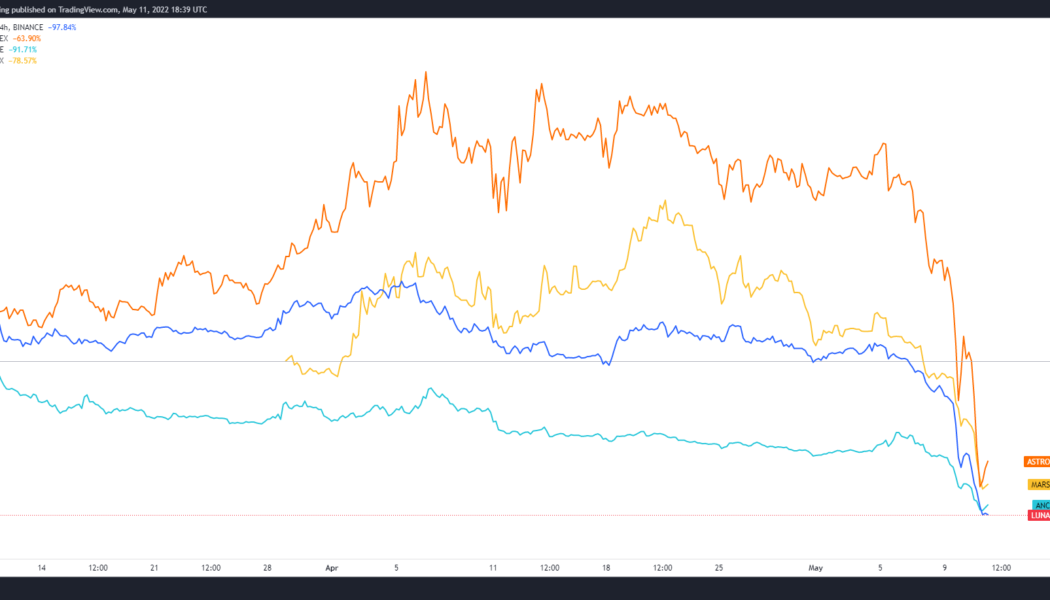

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

Terra ‘rescue plan’ still at large as LUNA falls below $5, Bitcoin spikes to ‘$138K’ in UST

Panic appeared to set in on crypto markets overnight on May 11 as Blockchain protocol Terra failed to steady its bleeding cryptoassets. Data from Cointelegraph Markets Pro and TradingView showed both the firm’s in-house token, LUNA and stablecoin, TerraUSD (UST) seeing fresh heavy losses on the day. A dubious new “all-time high” for Bitcoin After a mass sell-off which some argued was “coordinated” to destroy the Terra ecosystem, UST lost its peg to the U.S. dollar. Attempts to shore up the peg with both LUNA and Bitcoin (BTC) reserves failed, and as uncertainty gripped the market, both UST and LUNA dived to levels unimaginable just days previously. Getting close … stay strong, lunatics — Do Kwon (@stablekwon) May 10, 2022 Co-founder Do Kwon said that a “recove...

‘Kwontitative easing’ — BTC price hits $43K in UST as Terra empties $2.2B BTC bag

Bitcoin (BTC) fell below $30,000 for the first time in ten months on May 10 as turmoil at Blockchain protocol Terra continued. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price bounces at $29,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD plumbing lows of $29,731 on Bitstamp. The first trip under the $30,000 mark since July 2021, overnight BTC price performance came amid both declining stock markets and fresh trouble for Terra’s United States dollar stablecoin, TerraUSD (UST). As Cointelegraph continues to report, UST saw an attack involving mass-selling this week, which culminated in Terra using its giant 750 million BTC reserves to prop up its USD peg. Initial liquidity steps to mitigate the impact of the threat proved insufficient, ho...

Binance temporarily suspends LUNA, UST withdrawals citing network congestion

As the crypto community still tries to decipher Terra’s ongoing pegging-de-pegging fiasco in relation to its stablecoin offering TerraUSD (UST), major crypto exchange Binance temporarily suspended the withdrawals for Terra (LUNA) and UST on Tuesday. The market value of UST, Terra’s stablecoin offering, recently fell below the expected $1.00 price point as LUNA’s price witnessed a sharp decline owing to a major selloff. At the same time, the BTC/UST trading pair on Binance reached highs of more than $42,000, while other Bitcoin dollar markets struggled to preserve $30,000, as reported by Cointelegraph. Which has caused a massive surge in BTCUST (Not Bitcoin valued in dollars, but valued in the UST stablecoin). pic.twitter.com/Xn7qcy4VMZ — Blockchain Backer (@BCBacker) May 10, 202...