Terra

South Korean police request exchanges freeze LFG related funds

Crypto exchanges in South Korea have been issued notices from police requesting the sequestering of funds related to the Luna Foundation Guard. On May 23rd, 2022, Korean authorities sent a request to the top crypto exchanges in the country to prevent funds from being withdrawn. Specifically, the Seoul Metropolitan Police Agency asked to prohibit the Luna Foundation Guard from taking any action. The police claim that clues have been found that may link the organization to embezzlement. The Luna/Terra algorithmic stablecoin crash, which reduced the value of the coin by over 99%, crushed investor portfolios overnight earlier this month. However, this request is not a demand and is not enforceable by law. Each exchange can choose how they would like to respond, but it is not yet known ho...

Do Kwon shares LUNA burn address but warns ‘LUNAtics’ against using it

The recent Terra revival plan announced by Do Kwon, the co-founder and CEO of Terraform Labs, received mixed reactions as many questioned the effectiveness of a hard fork in reviving the fallen prices of Terra (LUNA) and TerraUSD (UST) tokens. Instead, the part of the community recommended burning LUNA as the most plausible way to achieve a comeback. Kwon’s proposal to preserve the Terra ecosystem involves hard forking the existing Terra blockchain without the algorithmic stablecoin and redistributing a new version of the LUNA tokens to investors based on a historical snapshot before the death spiral. However, several crypto entrepreneurs, including Changpeng “CZ” Zhao, opined that: “Reducing supply should be done via burn, not fork at an old date, and abandon everyone who tried to rescue ...

Finance Redefined: Lifeline for Terra projects, proposed Terra hard fork and more

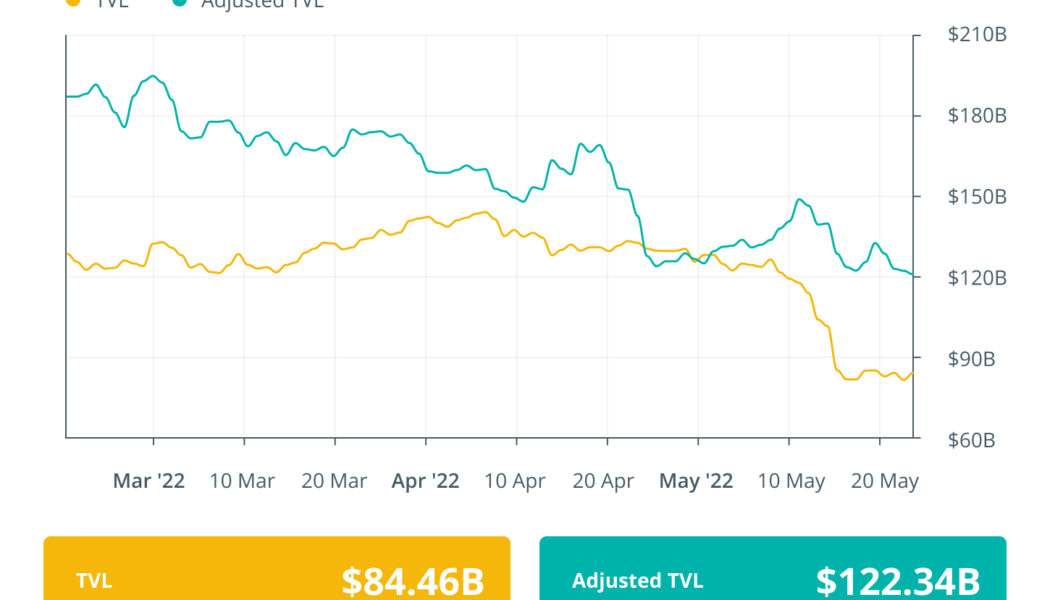

The past week in the decentralized finance (DeFi) ecosystem was dominated by Terra’s collapse and its aftermath on various ecosystems it was connected. Now BNB chain has come to the rescue of several stranded projects on Terra by offering financial and technical assistance. After its spiral collapse, Terra co-founder Do Kown proposed a revival plan and a hard fork to revive the blockchain. Chainalysis introduced new tools to monitor and track stolen funds across multiple blockchains. Swiss asset manager Julias Baer is eyeing crypto and DeFi potential. Top DeFi tokens saw another week of bleeding, with the majority of these tokens trading in red over the past week. Do Kwon proposes Terra hard fork to save the ecosystem Do Kwon, co-founder of the troubled Terra Luna blockchain, announc...

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

Terra fallout: Stablegains lawsuit, Hashed loses billions, Finder wrong and more

Fallout from the collapse of the Terra ecosystem continues to unfold with the United States-based yield generation application Stablegains facing potential legal action over its losses from the event. Users believe that Stablegain has allegedly lost up to $44 million worth of deposited funds, based on a post on a Terra forum by co-founder Kamil Ryszkowski asking for relief funding. He disclosed that a day before TerraUSD (UST) had lost its peg with the U.S. dollar, its users’ funds totaled over 47.6 million UST from 4,878 depositors. Currently, the price of UST is trading at $0.075, according to data from CoinGecko. A letter from class action law firm Erickson Kramer Osbourne (EKO) sent to Stablegains, dated May 14, demands a record of customer accounts, marketing materials and any co...

Novogratz says LUNA tattoo is a constant reminder investing ‘requires humility’

Mike Novogratz, the billionaire founder of crypto asset management firm Galaxy Digital, has told his followers that his LUNA-inspired tattoo will serve as a reminder to remain humble in the world of venture capital investing. Following the fallout of the recent LUNA / UST meltdown, Novogratz penned an open letter on Wednesday, telling his followers that: “My tattoo will be a constant reminder that venture investing requires humility.” It was on Jan. 5 tha Novogratz first showed off his wolf-themed tattoo to his 461,000 Twitter followers in an enthusiastic demonstration of his support for the now-collapsed Terra ecosystem. pic.twitter.com/GBZ6qq4kdr — Mike Novogratz (@novogratz) January 5, 2022 Terra’s UST stablecoin, which relied on an algorithm to maintain a peg to the U.S. dollar...

Early polling from Terra vote indicates 91% are in favor of ‘rebirth’

Terraform Labs CEO Do Kwon’s plan to create a new blockchain “without the algorithmic stablecoin” TerraUSD (UST) has the support of 85 million community votes. In a proposal opened to the Terra (LUNA) community on Wednesday, more than 91% of votes at the time of publication were in favor of “rebirthing” the Terra network — roughly 85 million out of 93 million, with up to 284 million votes yet to be cast. The proposal needs roughly 188 million votes in favor to pass before the window closes on May 25. At the time of publication, the biggest validator to come out in support of the proposal is Terra infrastructure provider Orbital Command, holding 1.39% of the voting power. Major validators with more than 2% of voting power have not yet made a decision, including cross-chain stablecoin bank O...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...

Crypto users react to Terraform Labs legal team purportedly leaving company

The ongoing saga with Terraform Labs, the blockchain developer behind Terra (LUNA), took a turn following a supposed change in employment status for many on the firm’s legal team. According to their LinkedIn profiles, Terraform Labs general counsel Marc Goldich, chief litigation and regulatory counsel Noah Axler and chief corporate counsel Lawrence Florio have all stopped working for the blockchain firm as of May 2022. Goldich started at Terraform Labs in August 2021 while Axler and Florio joined in January 2022. The change in employment status for three members of Terraform Labs’ legal team followed major volatility in the crypto market after the price of LUNA collapsed to $0.00 within two weeks. Stablecoins including Tether (USDT) depegged from the U.S. dollar, while the price of TerraUS...

Bitcoin is discounted near its ‘realized’ price, but analysts say there’s room for deep downside

There are early signs of the “dust settling” in the crypto market now that investors believe that the worst of the Terra (LUNA) collapse looks to be over. Viewing Bitcoin’s chart indicates that while the fallout was widespread and quite devastating for altcoins, BItcoin (BTC) has actually held up fairly well. Even with the May 12 drop to $26,697 marking the lowest price level since 2020 multiple metrics suggest that the current levels could represent a good entry to BTC. BTC/USDT 1-day chart. Source: TradingView The pullback to this level is notable in that it was a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to cryptocurrency research firm Delphi Digital, this metric has historically “served as a key area for prior...

MakerDAO price rebounds as DAI holds its peg and investors search for stablecoin security

Its been a rough couple of weeks for the cryptocurrency market. Bitcoin (BTC) price is nowhere near the price estimates of most analysts, multiple stablecoins lost their peg and the demise of one of the top decentralized finance (DeFi) platforms sparked an event that resulted in $900 billion vanishing from the total crypto market capitalization. In the midst of the widespread fallout, MakerDAO (MKR) managed to turn crisis into opportunity and the collapse of TerraUSD (UST) has brought renewed attention to DAI, the longest-running decentralized stablecoin. Data from Cointelegraph Markets Pro and TradingView shows that as the collapse of Terra (LUNA) price accelerated from May 9 to May 12, MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587. MKR/USDT 1-da...

Polygon and others extend helping hand to Terra blockchain projects

Numerous developers have been left in uncertainty in the aftermath of the Terra (LUNA) collapse. These Terra-based projects, which are already under a lot of pressure, may be able to save their communities and projects by migrating to other networks. In a move that is expected to benefit both the Polygon (MATIC) community and Terra projects, Polygon Studios’ CEO Ryan Wyatt tweeted on Monday that Polygon is working with a number of Terra projects to assist them migrating to the Polygon Network. The Polygon community, according to Wyatt, “is ready to welcome the developers and communities of these Terra projects.” He also stated that Polygon would provide the capital and resources needed to assist them in their migration. Polygon founder Sandeep Nailwal added his two cents ...