Terra

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years. Numerous unconfirmed reports surfaced on June 11, claiming Kwon’s participation in draining liquidity out of LUNA and UST before the crash to purchase US dollar-pegged stablecoin such as Tether (USDT). Rumors about Kwon cashing out LUNA and UST reserves surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity. Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: th...

Solana price just one breakdown away from a 40% slide in June — here’s why

Solana (SOL) is nearing a decisive breakdown moment as it inches towards the apex of its prevailing “descending triangle” pattern. SOL’s 40% price decline setup Notably, SOL’s price has been consolidating inside a range defined by a falling trendline resistance and horizontal trendline support, which appears like a descending triangle—a trend continuation pattern. Therefore, since SOL has been trending lower, down about 85% from its November 2021 peak of $267, its likelihood of breaking below the triangle range is higher. As a rule of technical analysis, a breakdown move followed by the formation of a descending triangle could last until the price has fallen by as much as the triangle’s maximum height. This puts SOL’s bearish price target at $22.50 ...

South Korea ramps up crypto investigations and regulations

On Friday, June 3, South Korea’s Financial Supervisory Service (FSS) began an investigation into payment gateway services that work with digital assets. The FSS is South Korea’s financial regulator that operates under the Financial Services Commission (FSC), both of which are government institutions. As reported by local news outlet Money Today Co., the FSS had recently demanded reports from 157 payment gateways about any service related to crypto, their plans for the future, and disclosure of digital assets. But an FSS report stated that only 6 held any digital assets. Related: How Terra’s collapse will impact future stablecoin regulations Although the FSS is currently the primary financial regulator, on May 31st, 2022, South Korea announced the upcoming launch of the Digital Assets Commi...

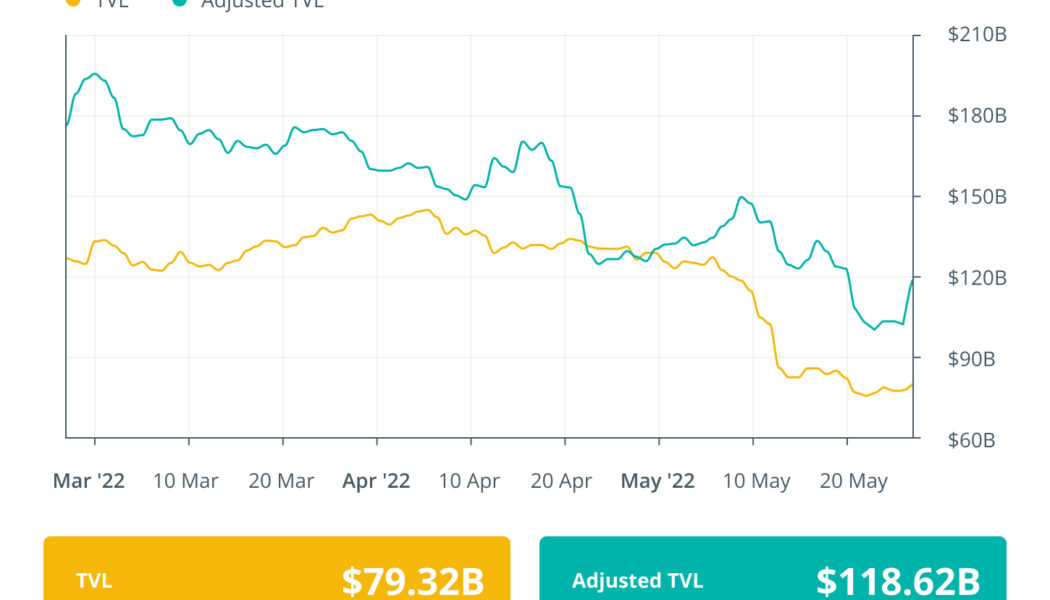

Finance Redefined: Maker founder proposes endgame, Singapore explores DeFi and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments, including the rebirth of the Terra 2.0 blockchain. Meanwhile, Binance’s incubation platform Binance Labs launched a $500 million fund to support and promote Web3 adoption. Singapore’s central bank partnered with JP Morgan to explore DeFi applications in wholesale funding markets by establishing tokenized bonds. KuCoin launched its very decentralized wallet with DeFi and nonfungible token support. The top-100 DeFi tokens showed signs of a breakout from a month-long bearish trend, with most of the tokens showing overall gains in the past seven days. Maker founder proposes MetaDAOs and synthetic ETH in ‘Endgame Plan’ MakerDAO co-founder Rune Christensen has issued a new monumental proposal to push the proje...

3 reasons why Ethereum price is pinned below $2,000

Ether’s (ETH) market structure continues to be bearish despite the failed attempt to break the descending channel resistance at $2,000 on May 31. This three-week-long price formation could mean that an eventual retest of the $1,700 support is underway. Ether/USD 4-hour price at Bitstamp. Source: TradingView On the non-crypto side, a number of equities-related factors are translating to negative sentiment in the crypto market. This week Microsoft (MSFT) lowered its profit and revenue outlook, citing challenging macroeconomic conditions. The U.S. Federal Reserve signalled in its periodic “Beige Book” that economic activity may have cooled in some parts of the country and the Fed is about to reduce its $9 trillion asset portfolio to combat persistent inflation. On the bright ...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

Binance’s CZ says he is ‘skeptical’ about the Terra relaunch

Binance CEO Changpeng Zhao, also known as CZ, expressed skepticism around the revival plan for the Terra ecosystem and the launch of the new LUNA token. “I try not to predict what the community will do. […] Many are skeptical. I’m one of those guys,” said CZ in an exclusive interview with Cointelegraph. Following the collapse of TerraUSD (USD), the Terra ecosystem’s stablecoin, CZ criticized its team for not handling the crisis properly and pointed at the project’s flaws that led to the crash. Still, Binance is now actively participating in Terra’s revival plan by hosting the airdrop of its new LUNA token. As CZ pointed out, despite the widespread skepticism around the Terra relaunch, Binance has a responsibility to help users affected by the crash of LUNA. “We still need to ensure c...

Terra (LUNA) 2.0 relaunches according to Do Kwon’s revival plan

Do Kwon, the co-founder and CEO of Terraform Labs, confirmed the relaunch of Terra’s new chain, Terra 2.0, which aims to revive the fallen Terra (LUNA) and TerraUSD (UST) ecosystem. Kwon’s revival plan for Terra involves hard forking the existing blockchain and reissuing LUNA tokens to existing investors based on a snapshot before the death spiral bled the LUNA and UST markets — effectively resulting in unrecoverable losses for investors. Pheonix-1 mainnet is now live and producing blocks – public node services, wallets and explorers should be going live shortly. pic.twitter.com/cpxiNKl6aX — Do Kwon (@stablekwon) May 28, 2022 Dubbed Phoenix-1, the Terra 2.0 mainnet went live today, May 28, as per the original timeline set by Terra developers and started producing blocks. ...

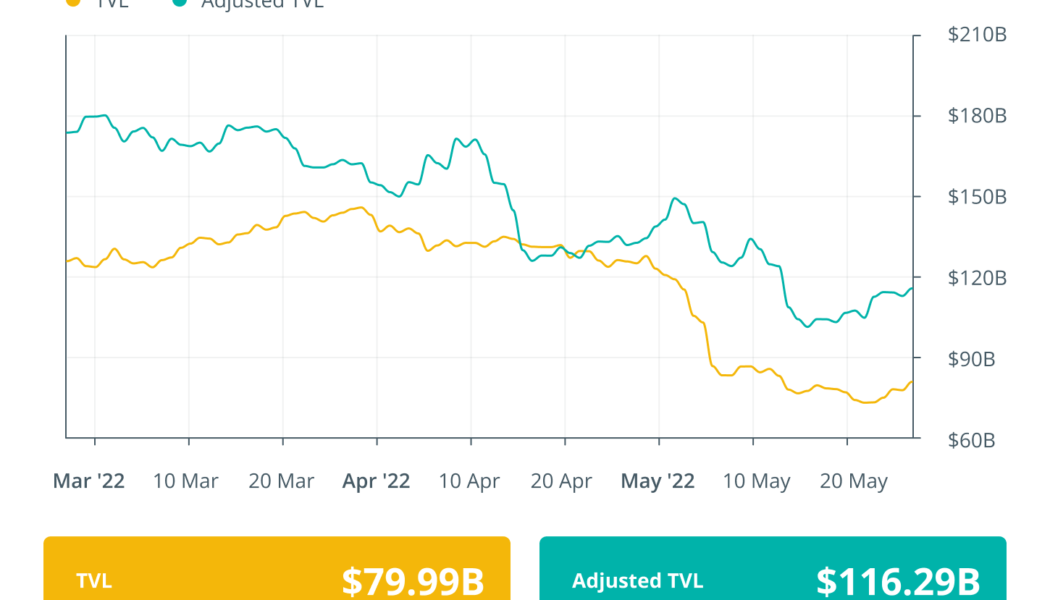

Finance Redefined: Uniswap breaches $1T volume, WEF 2022 discussion on Terra, and more

The decentralized finance (DeFi) ecosystem continues to struggle with the ongoing market volatility and after-effects of the Terra ecosystem collapse. Over the past week, major DeFi protocols showed signs of increased trading activity, with Uniswap breaching the $1 trillion trading volume mark. Terra remained the focus of most of the discussions around blockchain and crypto at the World Economic Forum (WEF), with analysts suggesting Terra was offering unsustainable yields. DeFi insurance protocol to pay out millions after Terra collapse, while interest in Ethereum Name Services (ENS) shattered new records. Top DeFi tokens by market cap had a mixed week of price action, with several tokens in the top 100 registering double-digit gains over the past week, while many others continue to trade ...

Bitcoin price stuck below $29K as Terra LUNA comes back from the dead

Bitcoin (BTC) analysts faced another day of frustration on May 28 as BTC/USD refused to offer volatility up or down. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView “Not the decoupling we wanted” Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency sticking in a narrow short-term range into the weekend. Previously forecast support levels to avoid a deeper correction managed to hold in the May 27 Wall Street trading session, but a bounce higher was similarly absent as commentators looked for fresh cues. “Short resistance and long support until one of them breaks. Keep it simple in ranges as they are there to engineer liquidity for trend continuation or reversals,” popular trading account Crypto Tony summarized in part ...

Two key takeaways from Nansen’s UST stablecoin depeg report

As the dust settles on the cataclysmic collapse of the Terra ecosystem, an on-chain deep-dive carried out by blockchain analytics firm Nansen highlights two major takeaways. The cryptocurrency ecosystem was awash with varying speculatory theories around the cause of Terra’s algorithmic stablecoin UST’s decoupling from its $1 peg. The who and why seemed a mystery but the outcome was catastrophic, with UST dropping well below $1 while the value of Terra’s stablecoin token plummeting in value as a result. Nansen undertook an investigation leveraging on-chain data from the Terra ecosystem to the Ethereum blockchain in an effort to chart the chain of events that led to the UST depeg. [embedded content] It is worth noting that the report does not include potential off-chain events that cou...