Terra

Terra (LUNA) hits record $20B TVL, surpassing Binance Smart Chain

Terra (LUNA), an open-source stablecoin network, hit an all-time high of $20.05 billion in total value locked, or TVL, across its 13 product offerings, according to industry data. On Dec. 1, Terra’s TVL was at $11.9 billion, signifying a 68% increase in less than a month. This means that the platform’s users are investing in large quantities into the protocol to receive staking rewards. The price of LUNA, Terra’s native token, is also steadily trending upwards, trading above $94 with a 31% increase in one week, according to Cointelegraph Markets Pro. The coin now has a total market capitalization of $34.8 billion, placing it in the top 10 crypto projects. LUNA continues to be one of crypto’s hottest performers. Source: Cointelegraph Markets Pro In terms of TVL...

Price analysis 12/22: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

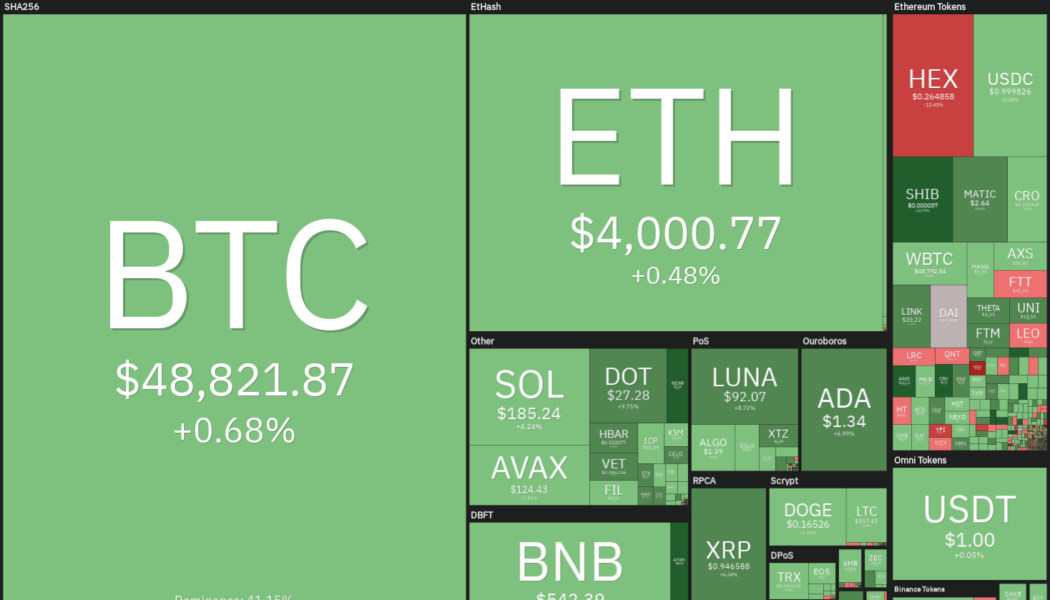

Bitcoin (BTC) is attempting to break above the psychologically critical level at $50,000 and close the year on a strong note. The up-move in Bitcoin has led to a sharp recovery in the value of the Crypto Fear & Greed Index from 27 to 45 within a day, signaling improving sentiment. BlockFi co-founder Flori Marquez said in a recent interview that new talent, regulatory clarity and higher crypto prices could lead to a feeling of FOMO, boosting crypto adoption in 2022. Marquez added that the “majority of Blockfi’s clients—when they receive a BTC reward, they’re not selling that for cash.” Daily cryptocurrency market performance. Source: Coin360 In another positive news that could boost crypto adoption further, popular internet browser Opera announced an integration with Polygon (MATIC), ex...

Price analysis 12/20: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

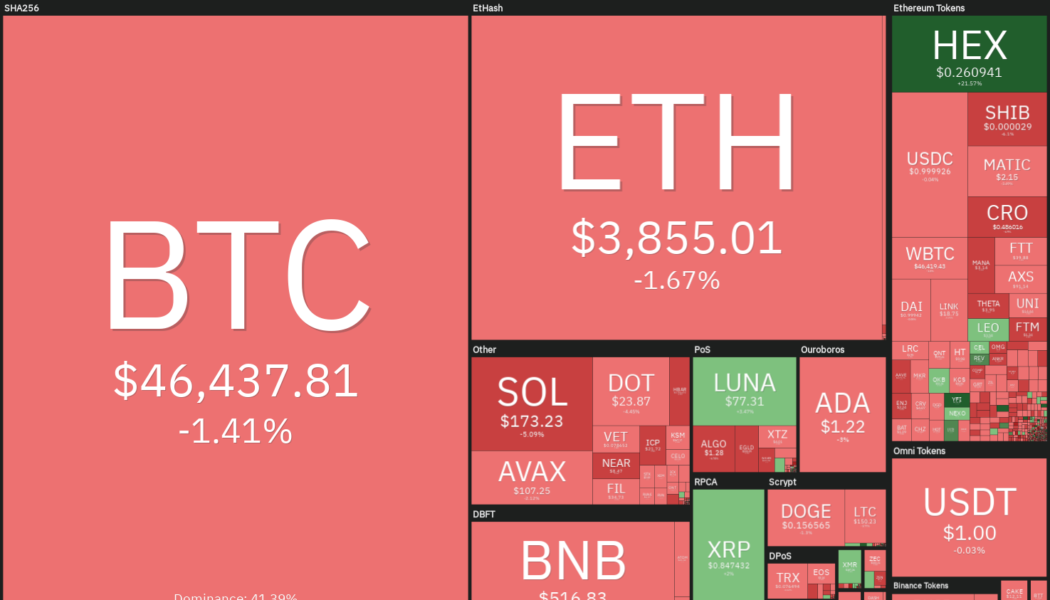

Bitcoin (BTC) continues to lose ground in December, a signal that traders may be locking in their gains before the end of the year. The lack of a Santa rally in the U.S. equity markets indicates that the risk-off sentiment prevails due to the uncertainty regarding the spread of the COVID-19 omicron variant in several parts of the world. Even after the sharp drop in Bitcoin’s price, the demand from institutional investors remains tepid, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), is trading at a discount of more than 20%. Daily cryptocurrency market performance. Source: Coin360 Veteran trader Peter Brandt said that “high volume panic capitulations” usually signal a bottom in Bitcoin and that has not yet happened during the current decli...

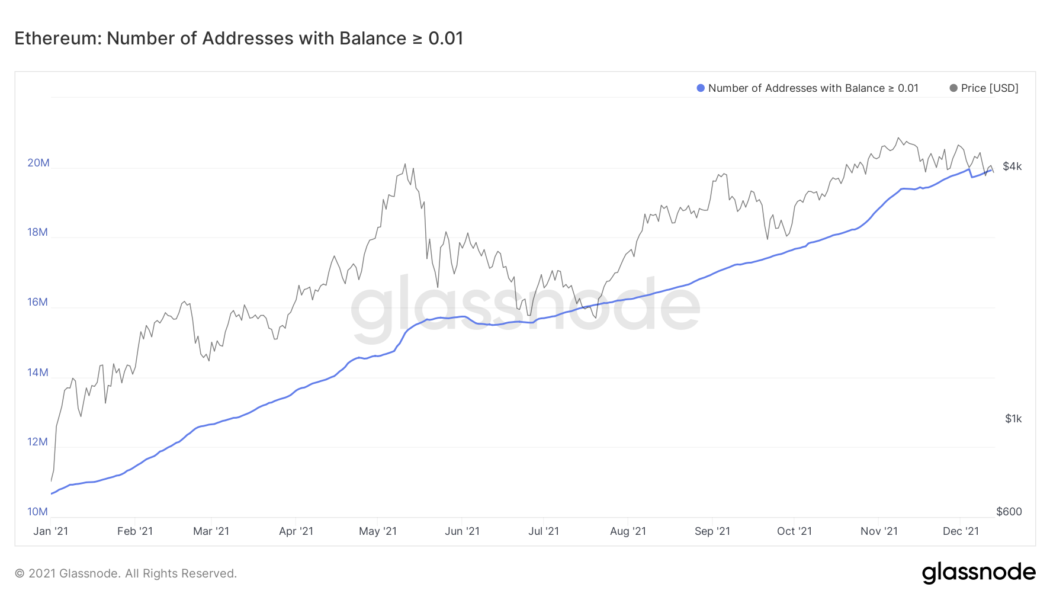

Small Ethereum investors increase exposure as ETH loses $4K level

Ethereum’s native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities. According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4, the day ETH dropped to as low as $3,575 (data from Coinbase). Ethereum addresses with balances less than or equal to 0.01. Source: Glassnode Meanwhile, the number of Ethereum wallets with balances of at least 0.1 ETH also kept climbing despite Ether’s correction from $4,867 to $3,575, eventually hitting a new all-time high of 6.37 million...