Terra

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

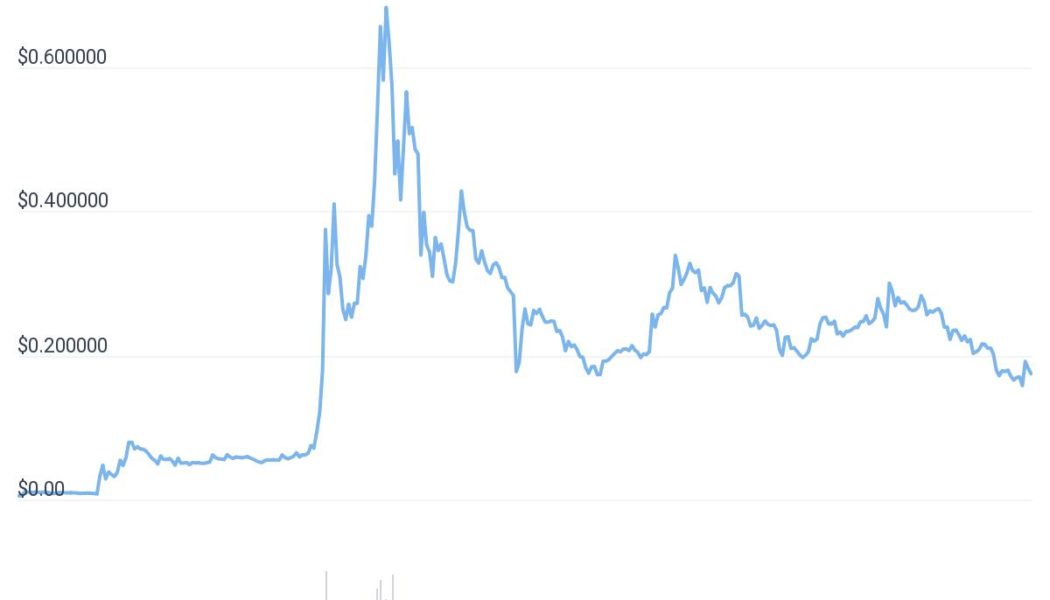

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

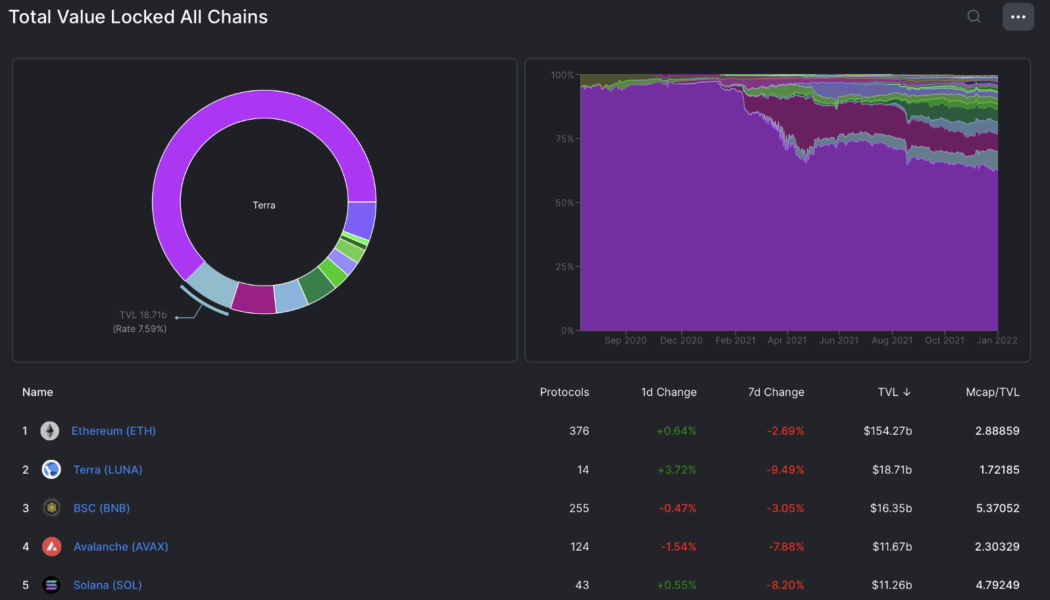

Here’s how Terra traders use arbitrage to profit from LUNA and bLUNA

The end of the year is normally a time to wind down and prepare for the holiday season, but the last few weeks of 2021 saw a crypto market that showed no signs of resting. One of the headline-grabbing stories related to Terra reaching an all-time high in terms of the total value locked (TVL), and the project surpassed Binance Smart Chain (BSC) as the second-largest decentralized finance blockchain after Ethereum. After reaching the $20-billion TVL mark on Dec. 24, Terra’s TVL has come down to around $19.3 billion at the time of writing according to data from Defi Llama, but this is in no way, shape or form a bearish signal. Top 5 total value locked on the top 5 blockchains. Source: Defi Llama Currently, Terra has only 14 protocols built on the chain, compared to the 257 protocols on ...

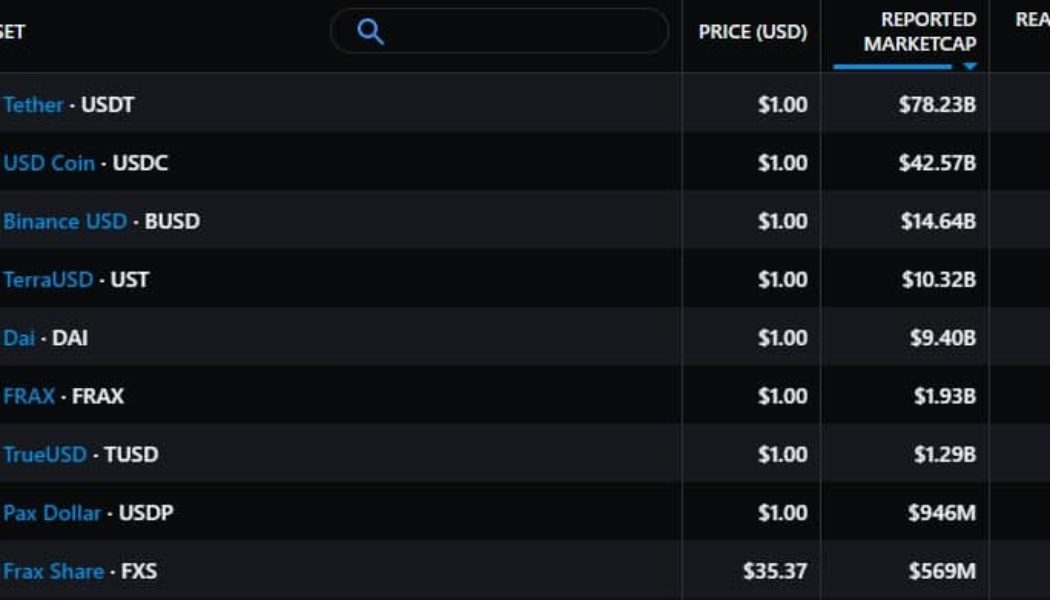

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

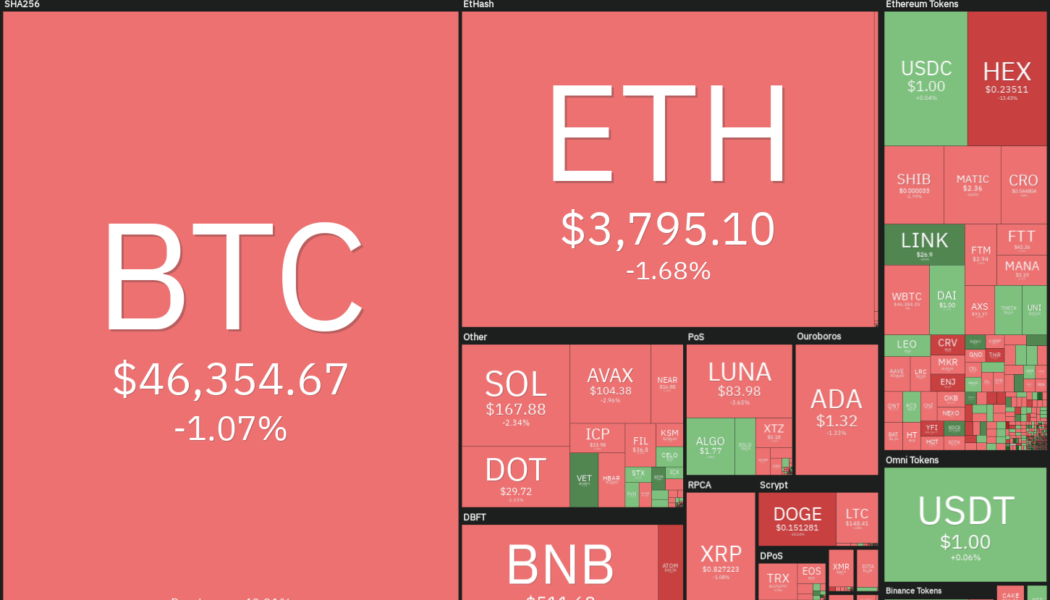

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

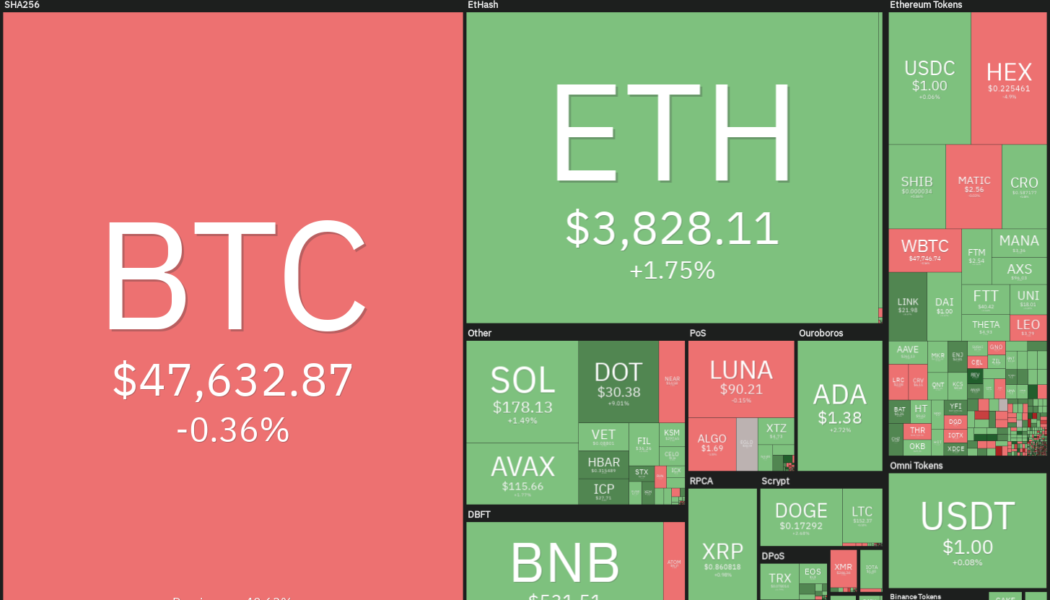

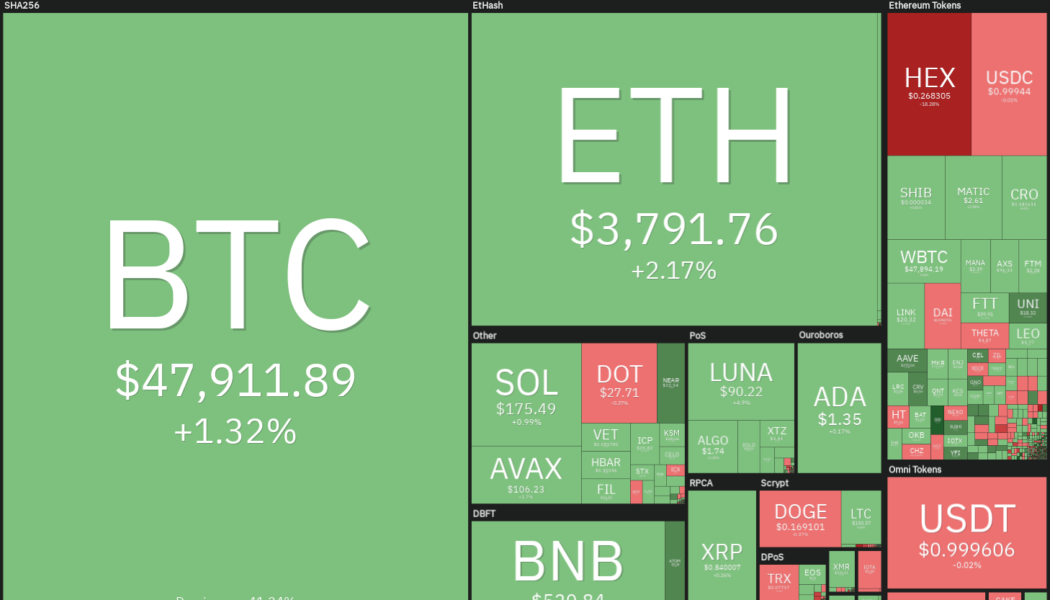

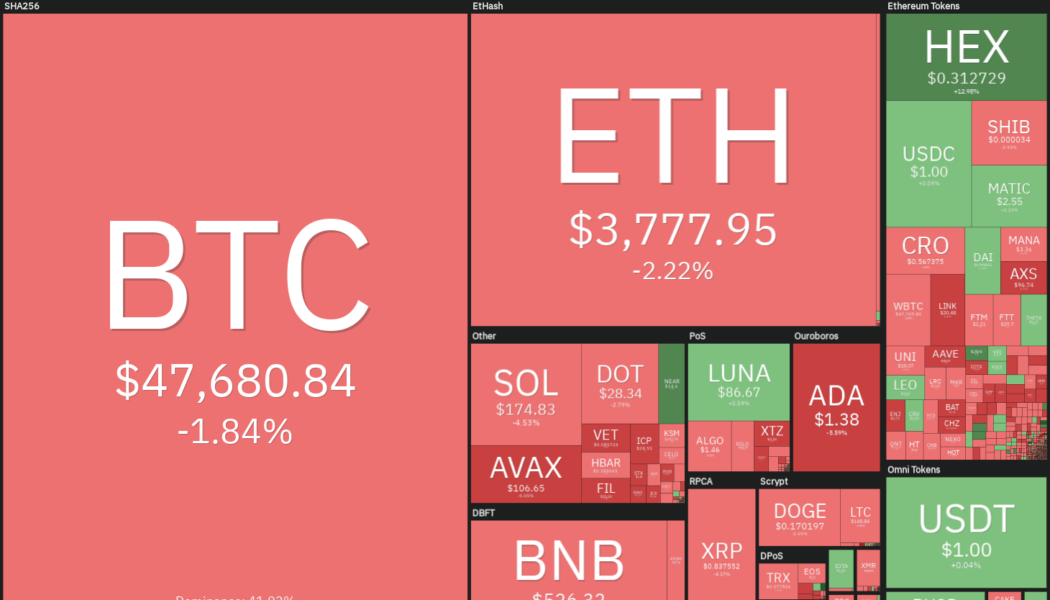

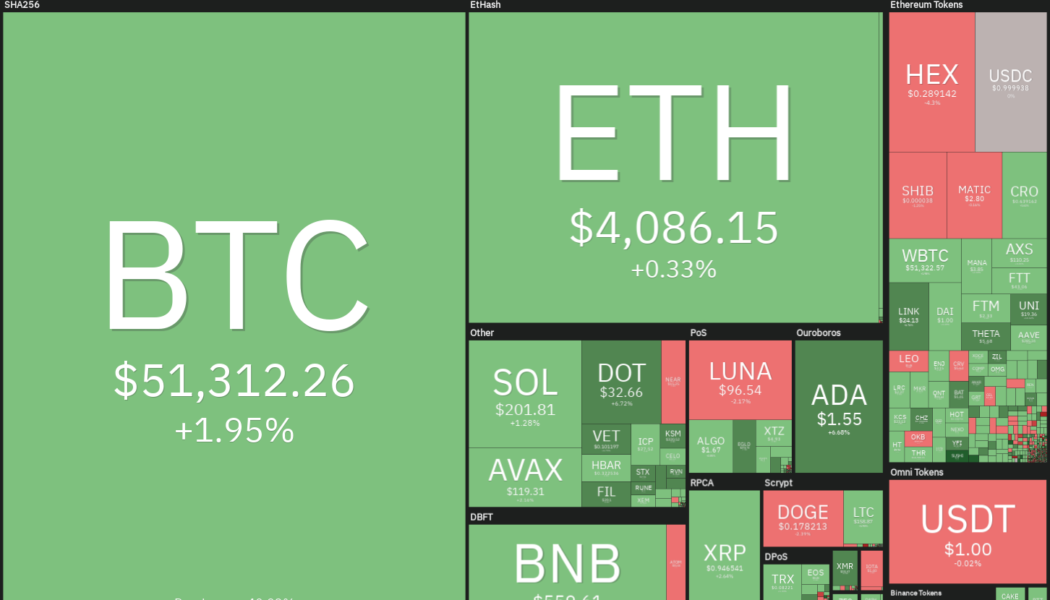

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...

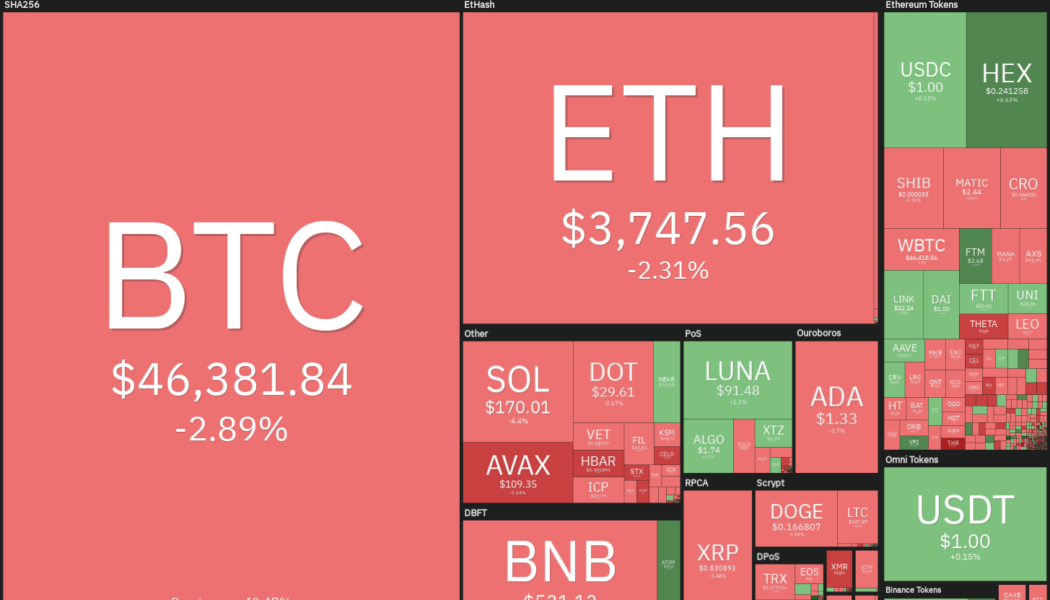

Price analysis 1/3: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100. On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.” Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials. Daily cryptocurrency market performance. Source: Coin360 Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hung...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, FTM, ATOM, ONE

Bitcoin (BTC) continues to languish below the psychological level at $50,000 in the first few days of the New Year, indicating a lack of aggressive buying by traders. Former BTCC CEO Bobby Lee said the exodus of the Chinese traders who had until Dec. 31 to exit Chinese exchanges may have kept prices lower into the year-end. However, President Nayib Bukele of El Salvador, the first country to adopt Bitcoin as legal tender, believes that Bitcoin could rally to $100,000 this year. President Bukele also said that two more countries will accept Bitcoin as legal tender in 2022. Crypto market data daily view. Source: Coin360 The increased crypto adoption by institutional investors in 2021 is another long-term positive. According to CoinShares, net inflows into crypto funds in 2021 were more than ...

Price analysis 12/31: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting a rebound off their respective support levels, indicating that buyers continue to accumulate on dips. Data from Coinglass shows that 9,925 Bitcoin left Coinbase Pro, the professional trading arm of Coinbase, on Dec. 30, a possible sign of institutional buying. This is in sharp contrast to the strong inflows seen in Binance and OKEx. Several analysts believe that institutional buying could pick up in January. Economist and trader Alex Krüger expects a Bitcoin rally in early January based on fund flows. He also highlighted that January has produced positive results for Bitcoin between 2018 and 2021, with gains ranging from 7% to 36%. Daily cryptocurrency market performance. Source: Coin360 While investors debate about the next possible dir...

Price analysis 12/29: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

The S&P 500 is trading near its all-time high but Bitcoin (BTC) has plunged about 30% from its all-time high at $69,000. Even after the sharp drop, Bitcoin is up 63%, year-to-date, outperforming the S&P 500, which is up about 30% in 2021. Gold, which is popular as a hedge against inflation, is down roughly 7% this year. Arcane research said in its report that Bitcoin’s outperformance in the high inflationary environment shows that “Bitcoin has proven itself to be an excellent inflation hedge.” Daily cryptocurrency market performance. Source: Coin360 Real Vision CEO Raoul Pal said in an interview with Vlad from The Stakeborg Talks that the recent selling in Bitcoin may have been due to institutional investors booking profits but he believes the selling may be coming to an end. Howev...

Price analysis 12/27: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins have bounced off their immediate support levels, indicating that the sentiment is improving and traders are buying on minor dips. Billionaire and Mexico’s third-richest person Ricardo Salinas Pliego said in his Christmas and New Year message to stay away from fiat money, terming it as “fake money made of paper lies.” Instead, he advised people to “invest in Bitcoin.” Veteran trader Peter Brandt warned that “chart pattern breakouts should be viewed with great suspicion” during the thinly traded holiday period in the last half of December. Daily cryptocurrency market performance. Source: Coin360 Analysts remain bullish for 2022. Crypto analyst and pseudonymous Twitter user DecodeJar believes that Bitcoin could surpass $100,000 and reach the conservative ...

Top crypto winners and losers of 2021

The year 2021 has undoubtedly been a bull market with Bitcoin (BTC) raising the all-time high price bar several times this year. But not all crypto assets have performed equally. There have been a number of losers in addition to the majority of winners in terms of price gains. Since the beginning of 2021, total crypto market capitalization has gained 190% from just under $800 million to over $2.3 trillion today. It hit an all-time high of just over $3 trillion in early November. Top 3 crypto gainers in 2021 The crypto top-ten in terms of market capitalization looked a little different on Jan. 1, 2021, as it contained Litecoin (LTC), Chainlink (LINK), and Bitcoin Cash (BCH). These have dropped out and have given way to Solana (SOL), USDC, and Avalanche (AVAX) by the year’s end. Dogecoin (DO...

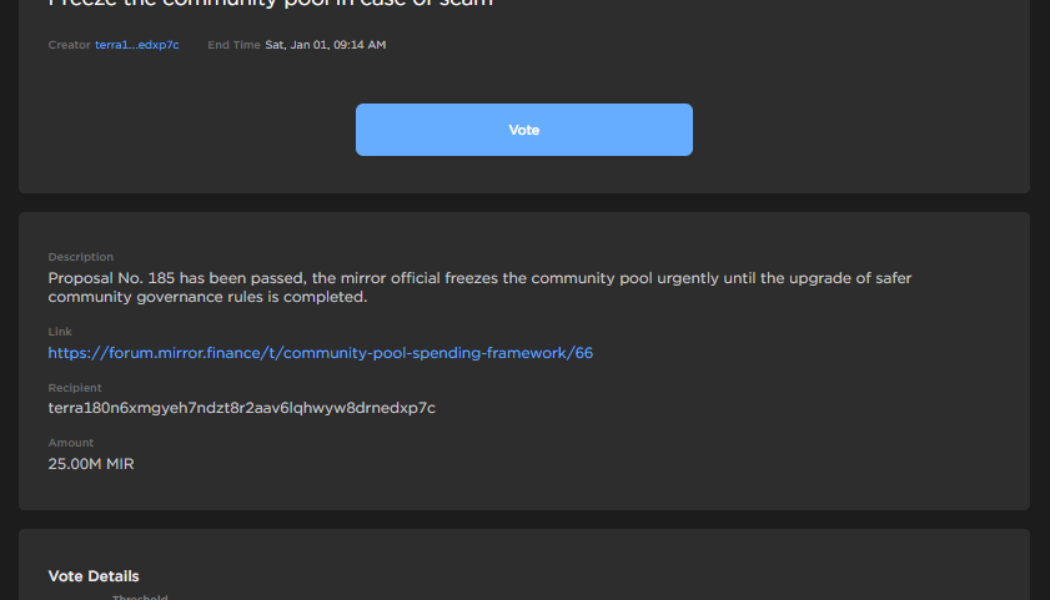

Terra’s Mirror protocol warns community against governance attack

Public blockchain network Terra has confirmed an ongoing scam attack via an official governance poll on Mirror, an in-house synthetic assets protocol. According to Mirror, the attacker launched a public poll on Mirror’s official website, which proposes a freeze on the community pool in case of a scam. NEW MIRROR POLL! ALERT: Poll 211 is SCAM — sending 25,000,000 MIR to itself … #vote on 212: https://t.co/FH6RqTbJ2j $MIR $LUNA #terra — Mirror Polls (@mirror_polls) December 25, 2021 According to Poll ID: 211, named “Freeze the community pool in case of scam”, the scammer proposes an upgrade of safer community governance rules in case of a hack. If the hacker manages to get a positive majority on the poll, 25 million MIR tokens (worth $24.1 million at the time of writing) wi...

Price analysis 12/24: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) bounced back above the psychological level at $50,000 and the S&P 500 hit a new all-time closing high on Dec. 23, suggesting that the panic selling caused due to the omicron variant is subsiding and the much-awaited “Santa rally” may have started. Data from on-chain analytics firm Glassnode shows that about 100,000 Bitcoin are going from “liquid” to “illiquid” state every month, which means that the coins are being sent to addresses “with little history of spending.” This suggests accumulation by investors. Daily cryptocurrency market performance. Source: Coin360 In another sign that investors are not dumping their coins on small corrections, data from CryptoRank shows that the total Bitcoin on crypto exchanges has dropped from 9.5% of the total Bitcoin supply in October ...