Terra Luna

South Korean prosecutors apply to revoke Do Kwon and other Terra employees’ passports

According to local news outlet gynews.kr, the Seoul Southern District Prosecutors’ Office’s Joint Financial Securities Crime Investigation Team says it will be contacting the country’s Ministry of Foreign Affairs to nullify the passports of Terra Luna co-founder Do Kwon and five other project developers. Prosecutors also plan to contact Interpol and escalate the South Korean arrest warrant issued the day prior into an international arrest warrant. All Terra Luna members named in the warrant reside in Singapore, a country that does not have an extradition treaty with South Korea. Targeted individuals on the warrant include Mo Han and Mo Yu, both of whom are Terra Luna employees staying with Do Kwon in Singapore. Another named individual is Greek national Nicholas Pla...

CoinShares reports $21.7M loss tied to Terra implosion

On Tuesday, European cryptocurrency investment firm CoinShares posted its interim Q2 2022 results. Compared to the prior year’s quarter, the firm’s revenue declined from 19.6 million pounds ($23.89 million) to 14.2 million pounds ($17.31 million). At the same time, its net income fell from 26.6 million pounds ($32.42 million) in Q1 2021 to 0.1 million pounds ($0.12 million). CoinShares explained that the losses were largely tied to its exposure to the Terra (LUNA) — now called Terra Classic (LUNC) — ecosystem, which collapsed in May of this year: “While our Asset Management business continued to generate solid profit, the Capital Markets business experienced a one-off loss of £17.7 million following the de-pegging of Terra Luna. The financial impact of this epi...

Investors shifting toward lower-risk crypto yields: Block Earner GM

Block Earner, an Australian fintech company, says the fall of Terra Luna in May has led to “positive surprises” for his company, with investors beginning to find their way toward the lower-risk crypto yield products they offer. Speaking to Cointelegraph, the company’s general manager Apurva Chiranewala revealed that the company has seen a surge of investors previously seeking double-digit returns but now wants a “less risky version” of those returns. “Given that the risks have gone up significantly for those returns, those guys have actually started coming in engaging with us because we look like the less riskier version of those double-digit return products.” Before their collapse, crypto lending platforms such as Celsius and Anchor Protocol offered annual percentage yields (APYs) o...

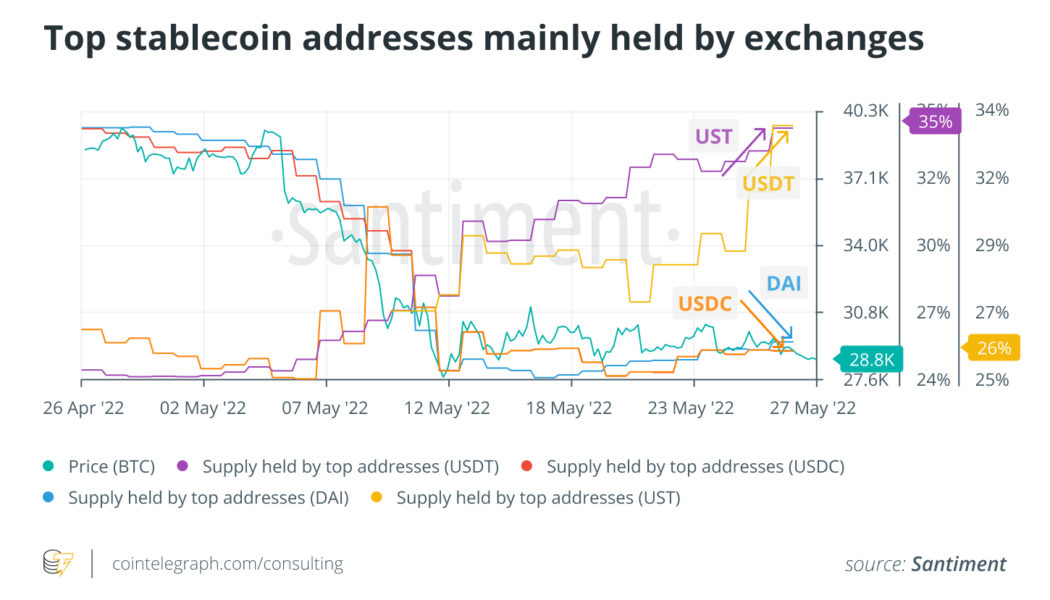

The crypto market dropped in May, but June has a silver lining

May 2022 was not for the faint-hearted. Even the most embattled and experienced crypto traders were tested in the first two weeks of the month on a brutal drop following the United States Federal Reserve’s announcement that interest rates would be rising by 0.5%. Crypto used to exhibit a lower correlation with real-world events and was generally unaffected by capitalistic successes and failures. However, a very steady approximate peg between Bitcoin (BTC) and the S&P 500 index was seen throughout the first five months of 2022. Inflation and war fears have not been kind to both markets either. Crypto mimicking the equity market could be due to the massive market capitalization growth in 2020 and 2021. At unprecedented rates, retail investors from equities have flocked to cryptocurrencie...

Terraform Labs donates $1.1B for Luna Foundation Guard‘s reserves

On Friday, Do Kwon, founder and CEO of Terraform Labs, which develops the blockchain ecosystem consisting of Terra Luna (LUNA) and the TerraUSD stablecoin (UST), announced that TFL had donated 12 million LUNA, or $1.1 billion at the time of publication to the Luna Foundation Guard (LFG). LFG launched in January to grow the Terra ecosystem and improve the sustainability of its stablecoins. Kwon noted that the funds, denominated in LUNA, will be burned to mint UST to grow the LFG‘s reserves: “We will keep growing reserves until it becomes mathematically impossible for idiots to claim de-peg risk for UST.” UST is an algorithmic stablecoin with a theoretical exchange rate of 1:1 with the U.S. dollar and is in part maintained by swapping of/for LUNA tokens when its market value deviates from it...