technology

Women’s interest in crypto grows, but education gap persists: Study

Even though female investors are increasingly interested in cryptocurrency and blockchain technology, there is still a significant knowledge gap when it comes to these topics, a new study reveals. BlockFi noted that a third-party survey panel conducted the study on Jan. 28, 2022, and included 1,031 female-identifying Americans between the ages of 18 and 65. According to a recent study by BlockFi focused on the shifting attitudes toward cryptocurrency, 92% of the women surveyed have heard about crypto, with almost one in four (24%) already owning some. In contrast, 80% still find it difficult to understand and 72% believe investing is too risky. Per the study, over one-third of women intend to purchase cryptocurrency in 2022, with 60% of respondents saying they would buy crypto in the next ...

South Korea readies itself for a blockchain future by launching a $186M metaverse project

The government wants to boost the growth of its metaverse ecosystem, with ambitions that it could host businesses in the future Last month, South Korea launched a five-year strategic plan to become the global metaverse leader The government of South Korea is taking significant strides towards evolving into a metaverse future. Yesterday, the nation’s Ministry of ICT, Science, and Future Planning guaranteed a KRW 223.7 billion ($186 million) investment into advancing the country’s metaverse ecosystem. According to an official statement sent out by the ministry, the endgame for this investment is to achieve an all-inclusive metaverse ecosystem, dubbed the ‘Expanded Virtual World.’ It would enable the virtual expansion of cities, education initiatives, and the media. The ministry will channel ...

The DAO is a major concept for 2022 and will disrupt many industries

The blockchain and cryptocurrency rave is not ending anytime soon. And as more people are being introduced to revolutionary technologies in the digital space, new improvements upon these technologies are also being introduced. In the last couple of years, the DeFi and NFT industries have experienced immense levels of growth and, currently, metaverses and Web3 are the technologies making the digital space light up. It is not yet clear where these disruptive technologies will lead us, but we are sure that there will be much value up for grabs. At the convergence of Web3 and NFTs lie many platforms looking to leverage technology and infrastructure to make the NFT ecosystem more decentralized, structured and community-driven. Using both social building and governance, the decentralized a...

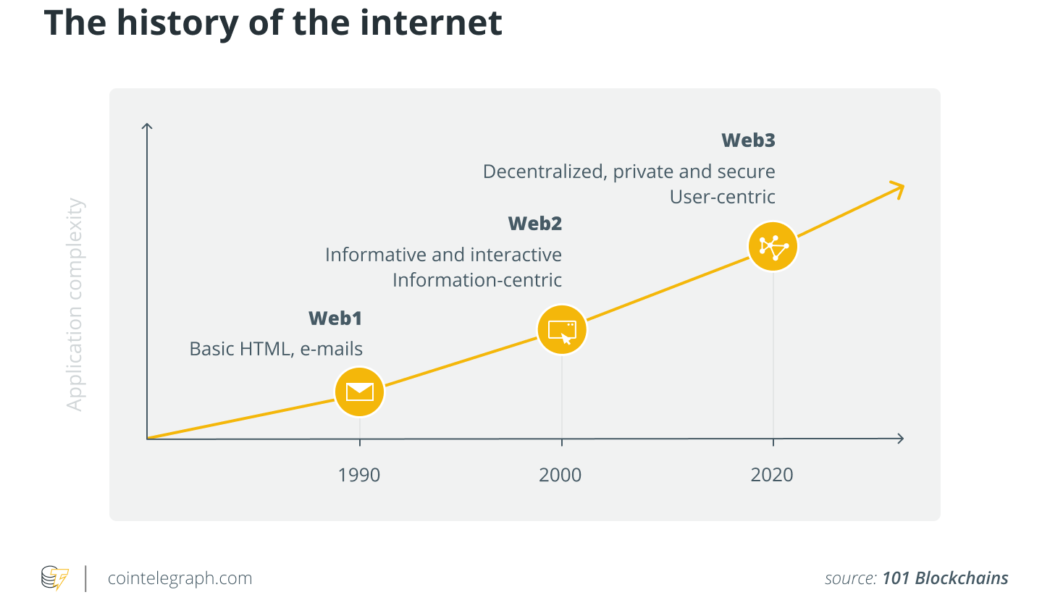

Why decentralization isn’t the ultimate goal of Web3

The transition from Web2 to Web3 is inevitable. Yet, as the demand for decentralization gains momentum, several important questions are being raised about the current state of blockchain technology and its promised “decentralization.” Vitalik Buterin responded with a confession that “a lot of it comes down to limited technical resources and funding. It’s easier to build things the lazy centralized way, and it takes serious effort to ‘do it right.’” Or, Jack Dorsey’s recent tweet where he claimed that it’s actually the venture capitalists who own the networks that exist today. You don’t own “web3.” The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into… — jack⚡️ (@jack) Decembe...

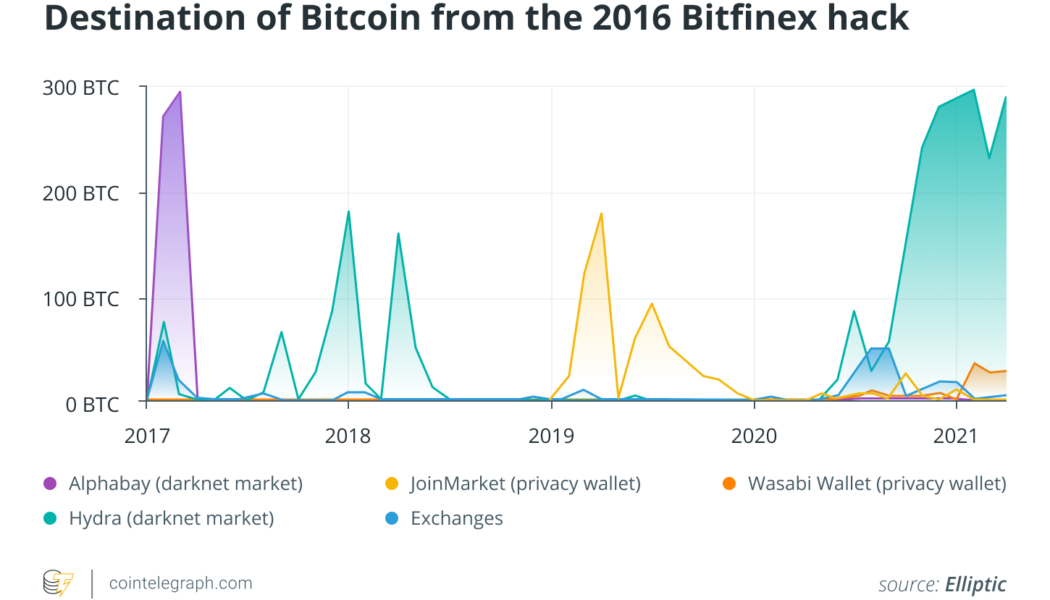

Blockchain forensics is the trusted informant in crypto crime scene investigation

The seizure by the U.S. Department of Justice of $3.6 billion worth of Bitcoin (BTC) lost during the 2016 hack of Bitfinex’s cryptocurrency exchange has all the ingredients of a Hollywood film — eye-popping sums, colorful protagonists and crypto cloak-and-dagger — so much so that Netflix has already commissioned a docuseries. But, who are the unsung heroes in this action-packed thriller? Federal investigators from multiple agencies including the new National Cryptocurrency Enforcement Team have painstakingly followed the money trail to assemble the case. The Feds also seized the Colonial Pipeline ransoms paid in crypto, making headlines last year. The Internal Revenue Service (IRS) seized $3.5 billion worth of crypto in 2021 in non-tax investigations, according to the recently releas...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

BNY Mellon announces Chainalysis partnership to track customer crypto transactions

Bank of New York Mellon has partnered with Chainalysis to enhance its crypto risk management Chainalysis software provides a plethora of services, including flagging high-risk transactions Having added support for Bitcoin back in February last year, America’s oldest bank is now making further moves to enhance its custodial suite of services for crypto. BNY Mellon announced yesterday that it has partnered with blockchain software company Chainalysis to track its customer’s crypto transactions. BNY Mellon, the largest custodian bank globally with $46.7 trillion in assets, sought the services of Chainalysis to track and analyse crypto products easily. The bank believes this will help it manage the legal risks that come with dealing in them. Tracking customers’ crypto A...

Coinbase Wallet now supports Ledger Hardware Wallets as it aims for additional security

The launch also comes with co-branded Nano X Coinbase Edition wallets available for a limited period The partnership is part of Ledger’s push to evolve into a software-focused firm Crypto exchanges have been ramping up security efforts against the threat of losses, and Coinbase, the largest crypto exchange in the US, is the latest name to take action in this regard. The crypto exchange confirmed yesterday that it had added support for the Ledger Hardware Wallets onto its Coinbase Wallet browser extension. Coinbase and Ledger have shown an insistence to enhance security as users can benefit greatly from an additional layer of protection. Hardware wallets such as Ledger’s enable self-custody as they are cold crypto wallets that store user private keys. These wallets can only be accessed offl...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

Mining worldwide: Where should crypto miners go in a changing landscape?

One of the main themes among the crypto community in 2021 was China’s aggressive policy toward mining, which led to a complete ban on such activities in September. While mining as a type of financial activity has not gone away and is unlikely to disappear, Chinese cryptocurrency miners had to look for a new place to set up shop. Many of them moved to the United States — the world’s new mining mecca — while some left to Scandinavia and others to nearby Kazakhstan, with its cheap electricity. Mining activities can’t stay under the radar forever, and governments around the world have begun to raise concerns over electricity capacity and power outages. Erik Thedéen, vice-chair of the European Securities and Markets Authority — who also serves as director general of the Swedish Fina...