technology

Finding the Business Case for Blockchain

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

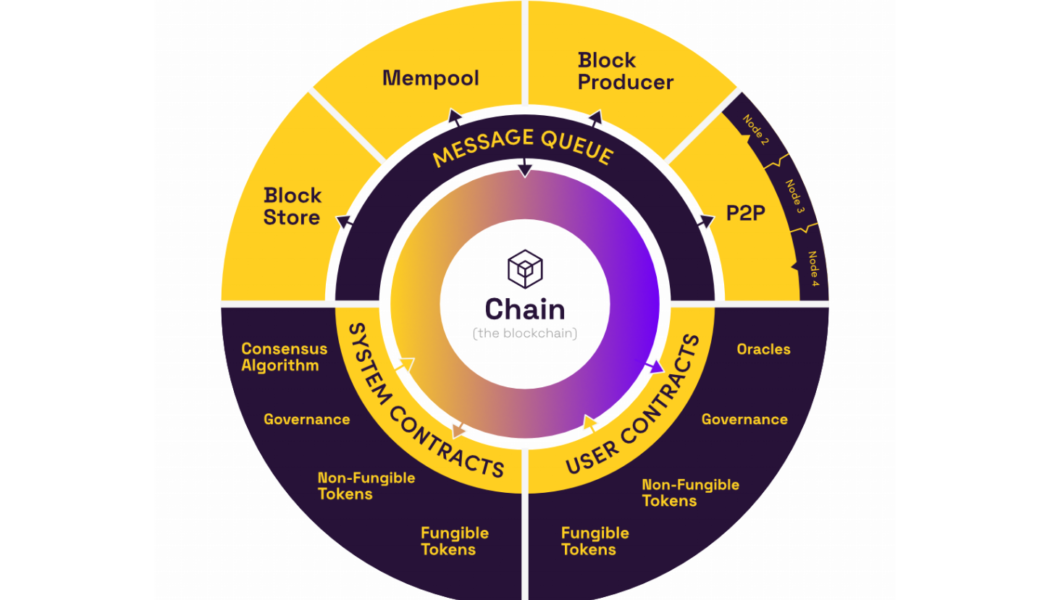

Inside the blockchain developers’ mind: Building truly free-to-use DApps

Cointelegraph is following the development of an entirely new blockchain from inception to mainnet and beyond through its series, Inside the Blockchain Developer’s Mind, written by Andrew Levine of Koinos Group. In myprevious article, I explained from first principles what was needed to build a truly free-to-use social decentralized application (DApp) and how Koinos is that solution. In that article, I explained that to deliver a truly free-to-use DApp, it must be possible for someone other than the end-user to provide the network resources (“mana” in the case of Koinos) required to run a given smart contract. Blockchain mana Now that we understand why Koinos is designed the way it is (to support free-to-use experiences), I’m going to explain in more detail how this works. One of the innov...

Paysend Partners with Afrimoney to Enable Transfers to West Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

MultiChoice Zambia Partners with MTN Mobile Money

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Sweden’s central bank completes second phase of e-krona testing

The Swedish central bank’s digital currency project, a proposed CBDC, known as the e-krona has successfully finished its second phase of trials. According to Riksbank, the nation’s central bank, the asset is now technically ready to be integrated into banking networks and facilitate transactions. During the second phase of the e-krona pilot project — which began in February 2021 — the CBDC was investigated on the matter of its technical ability to function within the country’s existing digital banking infrastructure. Participating banks included Handelsbanken and Tietoevry. The report indicated that the e-krona could indeed be successfully exchanged for fiat money and used in transactions, both online and offline. This phase of testing also brought legal clarity to the project ...

New South African App Lets You Consult Doctors from Your Smartphone

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.