technology

Sponsored: What is CBD and How Can it be Beneficial to Your Health?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

The Zero Trust Security Framework Explained: What it Means to Your Organization

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

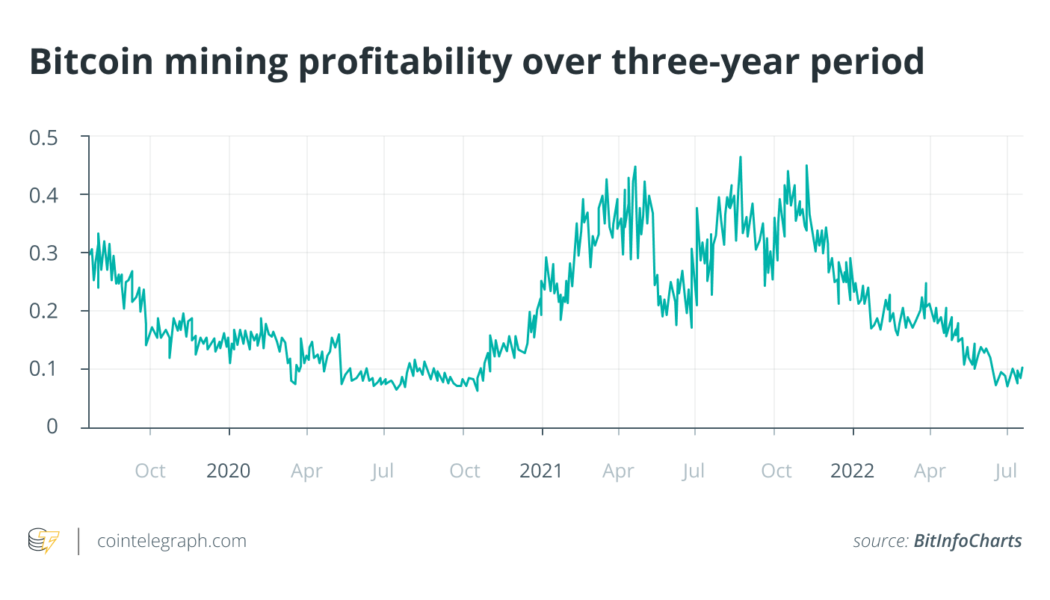

Not just Bitcoin price: Factors affecting BTC miner profitability

The ongoing cryptocurrency bear market has triggered a massive decline in Bitcoin (BTC) mining profitability as BTC mining expenses outpace the price of Bitcoin. Closely tied to the drop in the BTC price, Bitcoin mining profitability has been tanking since late 2021 and reached its lowest multi-month levels in early July 2022. According to data from crypto tracking website Bitinfocharts, BTC mining profitability tumbled to as low as $0.07 per day per 1 terahash per second (THash/s) on July 1, 2022, touching the lowest level since October 2020. The decline in BTC mining profitability has caused some big changes in the crypto mining industry. Lower Bitcoin prices fueled selling pressure as miners were pushed to sell their BTC to continue mining and pay for electricity. The majority of big cr...