technology

How time-weighted average price can reduce the market impact of large trades

Time-weighted average price is an algorithmic trade execution strategy commonly used in traditional finance tools. The goal of the strategy is to produce an average execution price that is relatively close to the time-weighted average price (TWAP) for the period that the user specifies. TWAP is mainly used to reduce a large order’s impact on the market by breaking it down into smaller orders and executing each one at regular intervals over a period of time. How TWAP can reduce the price impact of a large order Bids can influence the price of an asset in the order books or liquidity in the liquidity pools. For example, order books have multiple buy and sell orders at different prices. When a large buy order is placed, the price of an asset rises because all of the cheapest buy orders are be...

Users need to go under the engine in Web3 — HashEx CEO

Hacking in Web3 is easy because it uses the same pattern that’s been used since the inception of the internet — pretending to be someone else. Due to the complexity and the “cool factor” of Web3 projects, one can easily — and mistakenly — assume that it takes Mr. Robot level of advanced hacking techniques to pull off a successful attack. In truth, however, it only takes a sinister ad placed on Google search results, an impostor Telegram group or a deviously-crafted email to break the security barriers of the Web3 ecosystem. Blockchain projects can use top-notch smart contracts, securely integrate crypto wallets and use best practices in each digital step across the board. But they still need help with the social aspect of user protection. Web3 takes the “ownership” from central entit...

Crypto adoption in 2022: What events moved the industry forward?

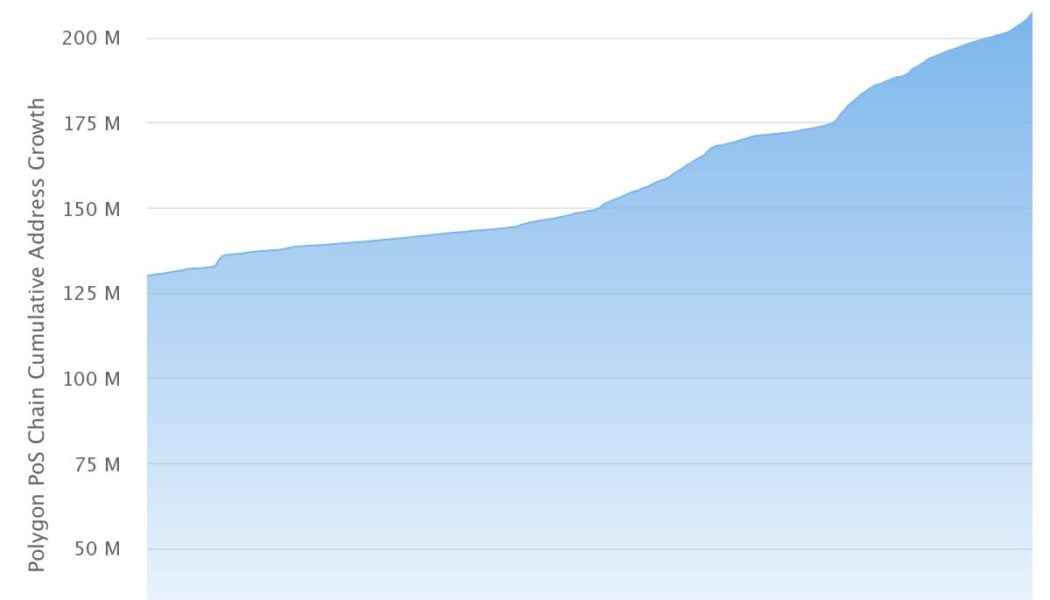

It’s no secret that the crypto market was gripped by bearish pressure for the entirety of 2022. However, amid all the volatility and chaos, many positive news stories appeared as well — especially regarding the global adoption of digital assets and crypto-related technologies in general. Looking back at 2022, here are some key adoption-related events that helped drive the industry last year. Polygon accrues 200 million addresses despite challenging 2022 Even though an air of financial uncertainty has shrouded the crypto market since the end of 2021, Polygon — a layer-2 scaling solution running alongside the Ethereum blockchain, allowing for speedy transactions and low fees — continued to witness a lot of growth in 2022. To this point, the network’s unique address count recently surpassed t...

Ripple CEO optimistic about US ‘regulatory clarity for crypto’

Ripple’s CEO, Brad Garlinghouse, shared in a Jan. 3 Twitter thread he’s “cautiously optimistic” about the United States gaining “breakthrough” regulatory clarity for the cryptocurrency industry in 2023. To mark the first day of the 118th Congress, Garlinghouse shared his hopes of 2023 being the year the U.S. gained regulatory clarity for crypto and added support for regulation is “bipartisan & bicameral.” Today is the first day of the 118th Congress. While prior efforts at regulatory clarity for crypto in the US have stalled, I am cautiously optimistic that 2023 is the year we will (finally!) see a breakthrough. A thread on why… — Brad Garlinghouse (@bgarlinghouse) January 3, 2023 Garlinghouse said the U.S. was not starting with a “blank slate” for regulation, r...

Bithumb’s largest shareholder executive found dead following allegations of embezzlement

Mr. Park Mo, the vice president of Vidente, the largest shareholder of South Korean Cryptocurrency exchange Bithumb,was reportedly found dead in front of his home at 4 am, on the morning of Dec. 30. Prior to his death, Mr. Mo had been named as a primary suspect in an investigation launched by South Korean prosecutors for his alleged involvement in the embezzling funds at Bithumb-related companies, as well as, manipulating stock prices. In October 2021, the Financial Investigation Division of the Seoul Southern District Prosecutor’s Office launched an investigation into allegations made against Mr. Park Mo, which led to the seizing of Bithumb-affiliated companies such as Vident, Inbiogen, and Bucket Studio. Vident, a KOSDAQ-listed company, is known to be Bithumb’s la...

Sam Bankman-Fried denies moving funds from Alameda wallets

Sam Bankman-Fried, the former CEO of the now-defunct FTX exchange, has denied moving funds tied to Alameda wallets, days after he was released on a $250 million bond. On Dec. 30, Fried tweeted to his 1.1 million followers, denying any involvement in the movement of funds from Alameda wallets. In response to the allegations that he may have been responsible for moving funds out of Alameda wallets, he shared: “None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.” None of these are me. I’m not and couldn’t be moving any of those funds; I don’t have access to them anymore.https://t.co/5Gkin30Ny5 — SBF (@SBF_FTX) December 30, 2022 SBF’s tweet was in response to a news story published by Coint...

Mark Cuban to Bill Maher: ‘If you have gold, you’re dumb as fuck… Just get Bitcoin.’

Arguments over whether gold or Bitcoin (BTC) is a better store of value continue to occur across the cryptocurrency space and in traditional investment circles. On the latest episode of Bill Maher’s Club Random podcast, which aired on Dec. 26, billionaire owner of the Dallas Mavericks Mark Cuban advocated for Bitcoin being a better store of value than gold. In response to Maher openly admitting that he is “rooting against Bitcoin,” Cuban chimed in with a cheeky agreement, remarking, “I want Bitcoin to go down a lot further so I can buy some more.” Cuban went on to offer some friendly chastisement to Maher, saying, “If you have gold, you’re dumb as fuck,” before encouraging him to “just get Bitcoin.” [embedded content] The two then discussed the pros and cons of both asset catego...

Near Project’s Octopus Network lays off 40% of its staff amid crypto winter

Octopus Network, a decentralized app chain network natively built on NEAR Protocol, has announced that it will be “refactoring” to adapt to current market conditions. As part of its refactoring process, Octopus network will let go of roughly 40% of its team, which accounts for 12 out of 30 members. The remaining staff will also be subjected to a 20% salary cut, while its team token incentive will be suspended indefinitely. According to Louis Liu, the founder of the Octopus Network, although he has lived through previous crypto winters, “this winter is very different from the others.” Liu said he anticipates that this current “crypto winter will last at least another year, perhaps much longer,” adding that “most Web3 startups will not survive.” To survive the crypto winter, the founde...

We Asked the A.I. Program ChatGPT About EDM—It Knew Too Much

Following the release of the now-viral sensation, ChatGPT, it took OpenAI’s eerily sophisticated chatbot just five days to amass over one million users. And it’s become the most successful story at the intersection of artificial intelligence and meteoric tech adoption in the last decade. There’s many reasons why ChatGPT has become an instant hit. Some have called it a creative enhancer, others a search query replacement. But no matter what you think ChatGPT’s future use cases are, there’s no denying it has a tremendous trove of information to draw upon, including niche topics like electronic dance music. Despite our best efforts to stump ChatGPT with absurdly specific questions—and even thought-provoking, nuanced topics—it seems the algorithm has a deeper unde...

Crypto Stories: Dr. Adam Back shares his life of hacks

It’s been a life of hacks for Dr. Adam Back, the CEO and co-founder of Blockstream. One of the few people quoted on the Bitcoin Whitepaper, hacking highlights of Back’s life are brought to life in the latest animated Crypto Story from Cointelegraph’s video team. [embedded content] Over a game of Jenga in a park, Back told Cointelegraph that he’s always had a “kind of security mindset.” From his days as a student, he tinkered with door codes, pin pads and locks, testing out code and gaining access to places he “wasn’t supposed to have access to.” Back talks through the creation of Hash Cash, one of the early attempts at digital money. He uses the “Birthday collision” as an allegory for hash functions, demonstrating his aptitude to breaking down complex functions into intelligible lang...

Crypto community members discuss bank run on Binance

Within the past 24 hours, cryptocurrency exchange Binance has seen outflows of over $1.14 billion due to rising FUD — or fear, uncertainty and doubt — within the crypto ecosystem. According to Binance CEO Changpeng “CZ” Zhao, the exchange has seen this before, and he believes “it is a good idea to ‘stress test withdrawals’ on each CEX [centralized exchange] on a rotating basis”. We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us. I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 1/2 https://t.co/uF9lLPDSyS — CZ Binance (@cz_binance) December 13, 2022 The bank run on Binance comes a month after CZ triggered a bank ...