Technical Analysis

Avalanche price eyes 30% jump in June with AVAX’s classic bullish reversal pattern

Avalanche (AVAX) shows signs of continuing its ongoing rebound move as it paints a classic bullish reversal pattern. AVAX price to $35? Dubbed as “double bottom,” the pattern appears when the price establishes a support level, rebounds, corrects after finding a resistance level, pulls back toward the previous support and bounces back toward the resistance level to pursue a breakout. Since May 27, AVAX’s price trends appear like those typically witnessed during the double bottom formation. Specifically, the AVAX/USD pair on the four-hour chart has bounced twice after testing the same support level near $22.25, and now eyes a breakout above its resistance level — also called “neckline” — near $27.50. AVAX/USD four-hour price chart with “double bottom'...

3 reasons Ethereum price risks 25% downside in June

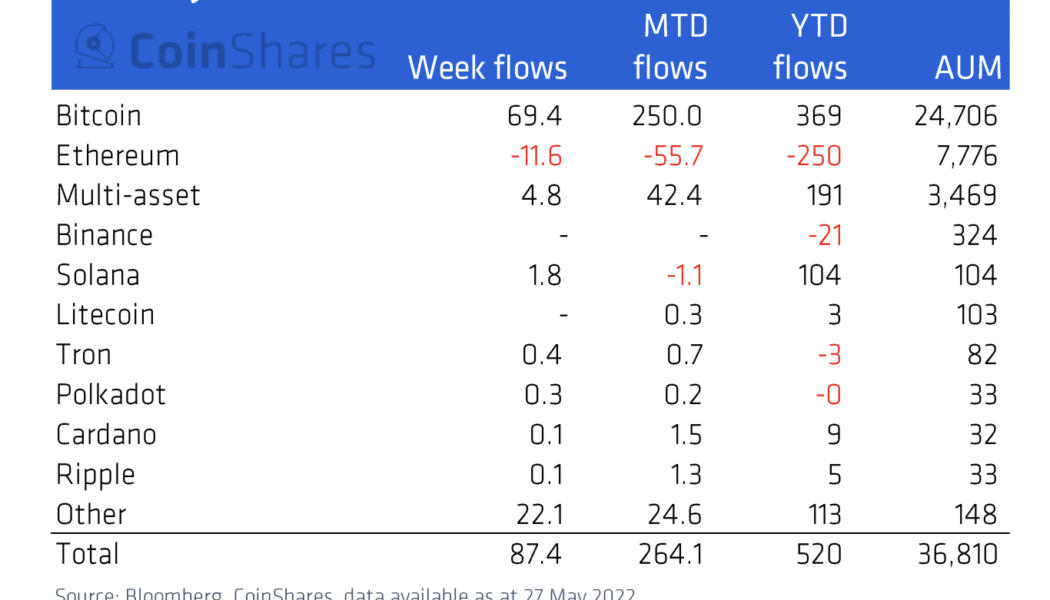

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

Is Solana a ‘buy’ with SOL price at 10-month lows and down 85% from its peak?

Solana’s (SOL) price dropped on June 3, bringing its net paper losses down to 85% seven months after topping out above $260. SOL price fell by more than 6.5% intraday to $35.68, after failing to rebound with conviction from 10-month lows. Now sitting on a historically significant support level, the SOL/USD pair could see an upside retracement in June, eyeing the $40-$45 area next, up around 25% from today’s price. SOL/USD daily price chart. Source: TradingView 60% SOL price decline ahead? However, a rebound scenario is far from guaranteed and Solana faces headwinds from trading in lockstep with Bitcoin (BTC), the top cryptocurrency (by market cap) that typically influences trends across the top altcoins. Notably, the weekly correlation coefficient between BTC and SO...

Spooky Solana breakdown begins with SOL price facing a potential 45% drop — Here’s why

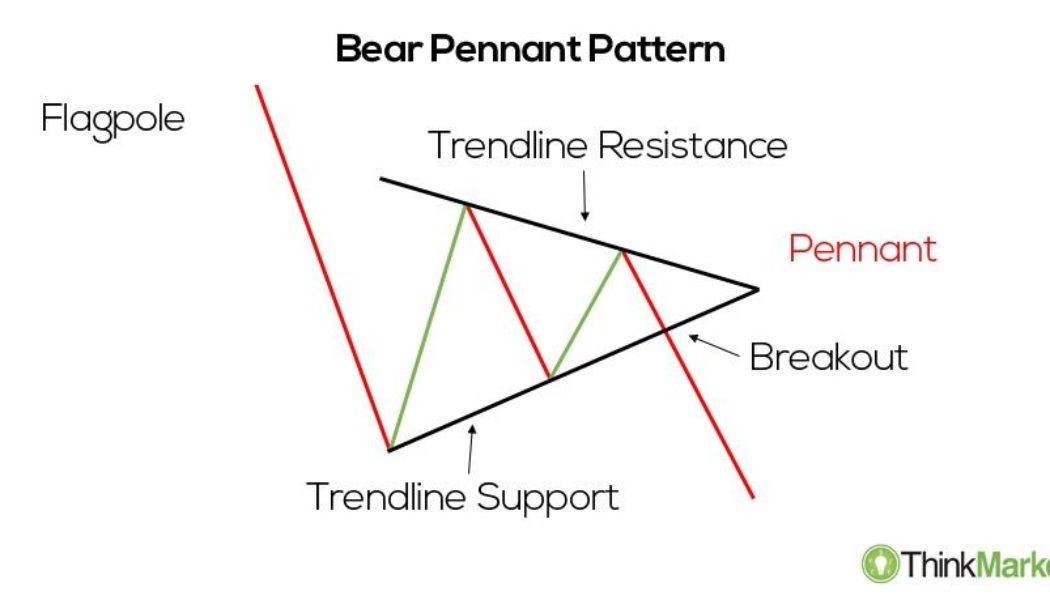

Solana (SOL) dropped on May 26, continuing its decline from the previous day amid a broader retreat across the crypto market. SOL price pennant breakdown underway SOL price fell by over 13% to around $41.60, its lowest level in almost two weeks. Notably, the SOL/USD pair also broke out of what appears to be like a “bear pennant,” a classic technical pattern whose occurrences typically precede additional downside moves in a market. In detail, bear pennants appear when the price trades inside a range defined by a falling trendline resistance and rising trendline support. Bear pennant pattern. Source: ThinkMarkets These patterns resolve after the price breaks below the lower trendline, accompanied by higher volumes. As a rule of technical analysis, traders decide the pennant’...

Ethereum preparing a ‘bear trap’ ahead of the Merge — ETH price to $4K next?

Ethereum’s native token, Ether (ETH), continues to face downside risks in a higher interest rate environment. But one analyst believes that the token’s next selloff move could turn into a bear trap as the market factors in the possible release of the Merge this coming August. ETH to $4K? Ether’s price could reach $4,000 by 2022’s end, according to a technical setup shared on May 20 by Wolf, an independent market analyst. The analyst envisioned ETH moving inside a multi-month ascending triangle pattern, which comprises a horizontal trendline resistance and rising trendline support. Notably, ETH’s latest retest of the structure’s lower trendline could initiate a big rebound toward its upper trendline, which sits around the $4,000-level, as s...

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

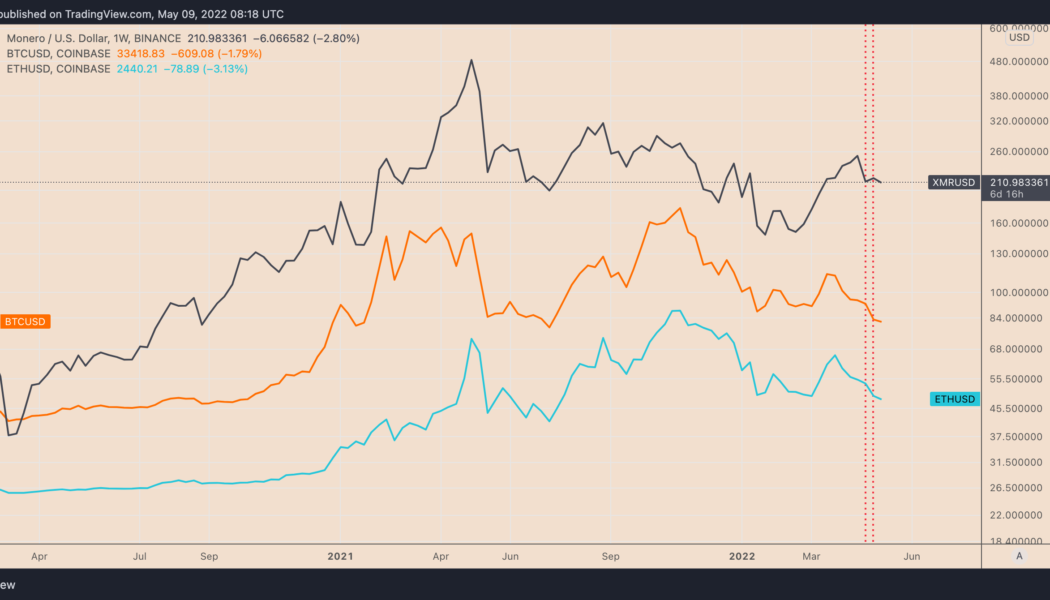

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

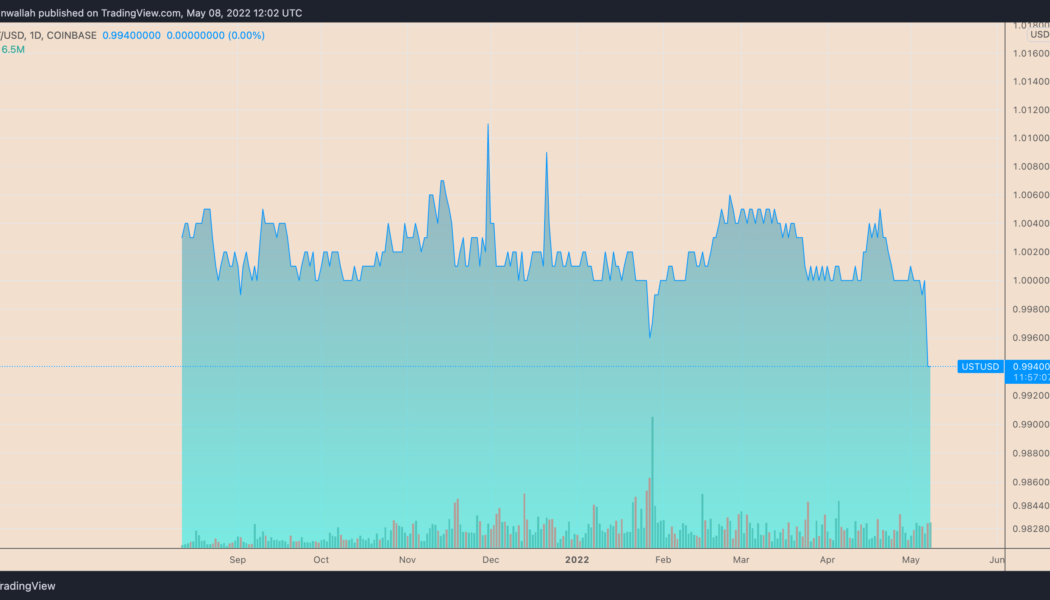

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

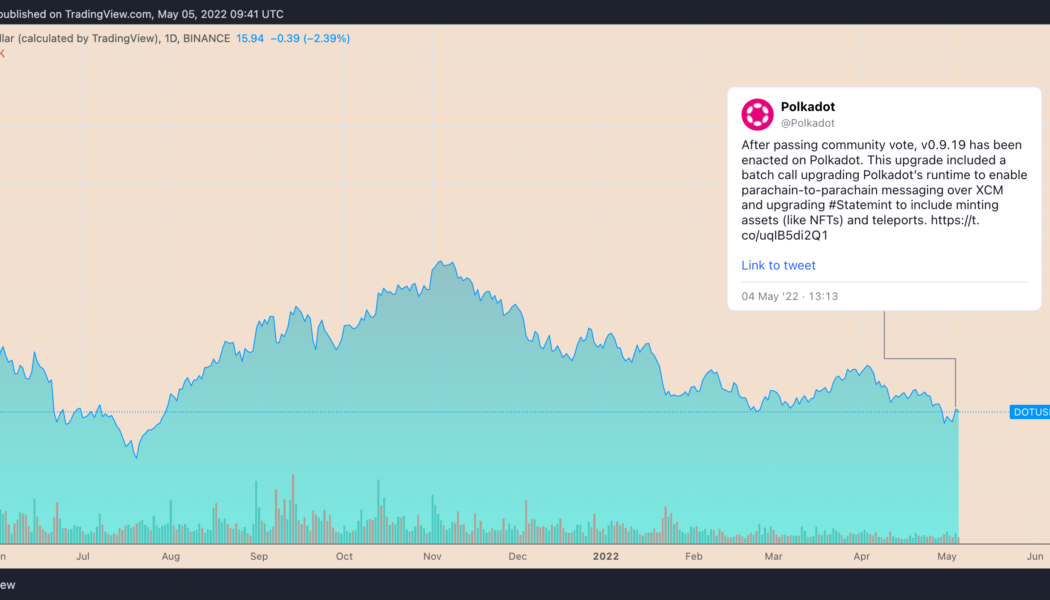

DOT rallies 12% in a day as Polkadot gears up to solve a major blockchain hacking problem

Polkadot (DOT) price ticked higher in the past 24 hours on anticipations that its new cross-chain communications protocol would solve a long-standing problem in the blockchain sector. DOT price gains 12% on XCM launch Bulls pushed DOT’s price to $16.44 on May 5 from $14.72 a day before, gaining a little over 12% as they assessed the launch of XCM, a messaging system that allows parachains — individual blockchains that operate in parallel inside the Polkadot ecosystem — to communicate with each other. DOT/USD daily price chart. Source: TradingView As Cointelegraph reported, future updates in the XCM protocol would see parachains exchanging messages without relying on Polkadot’s central blockchain, the Relay Chain. That expects to eliminate bridge hacks that have cost the in...

Ethereum risks 35% drop by June with ETH price confirming ‘ascending triangle’ fakeout

Ethereum’s native token Ether (ETH) faces the possibility of a 35% price correction in Q2 as it comes closer to breaking below its “ascending triangle” pattern. ETH price breakdown ahead? Ether’s price swung between profits and losses on May 2 while trading around $2,825, showing indecisiveness among traders about their next bias. Interestingly, the Ethereum token wobbled in the proximity of a rising trendline that constitutes an ascending triangle pattern in conjugation with a horizontal line resistance. To recap, ascending triangles are typically continuation patterns. That being said, Ether’s price was trending lower before forming its ascending triangle, raising its chances of a breakdown in the next few weeks. Another bearish sign comes from Ether&#...

Everything you need to know about Ethereum 2.0 & The Merge!

Quick facts about The Merge… Ethereum 2.0 is the transition from the proof of work (PoW) consensus mechanism to the proof of stake (PoS) model. PoW is used by a handful of blockchains, the most notable of which is the father of cryptocurrencies—Bitcoin (BTC). Ethereum also started out using the PoW method, but as its popularity grew, PoW was found to be too labour intensive for Web 3.0, too slow, and too environmentally unfriendly. PoS on the other hand completes transactions more efficiently, uses less power, and benefits from much lower transaction fees. Network stakeholders validate transactions and are rewarded for their efforts with the native currency of the platform—in this case, ETH. Why do people call The Merge Ethereum 2.0? Ethereum 2.0, Eth2 or The Merge are all the same thing u...