tech startups

Crypto startup employee quits after realizing telltale signs of failure

The startup ecosystem has historically played a vital role in shaping the crypto community into an almost $2 trillion industry. However, numerous players bank on this notion to consistently overpromise and underdeliver the big WAGMI dream. Back in December 2021, Redditor busterrulezzz thought they landed their dream job after being hired by a crypto startup — only to realize that they were now a part of the problem and resigned from the position two months later. Redditor u/busterrulezzz: Source: Reddit As narrated by busterrulezzz: “First of all, the level of disorganization and chaos was absolute madness. Each morning we had a different objective, based on the most recent trend in the market.” The Redditor alleged that the crypto startup, which shall remain unnamed due to an active ...

Blockchain startups grow as global VC funding generated $25.2B in 2021

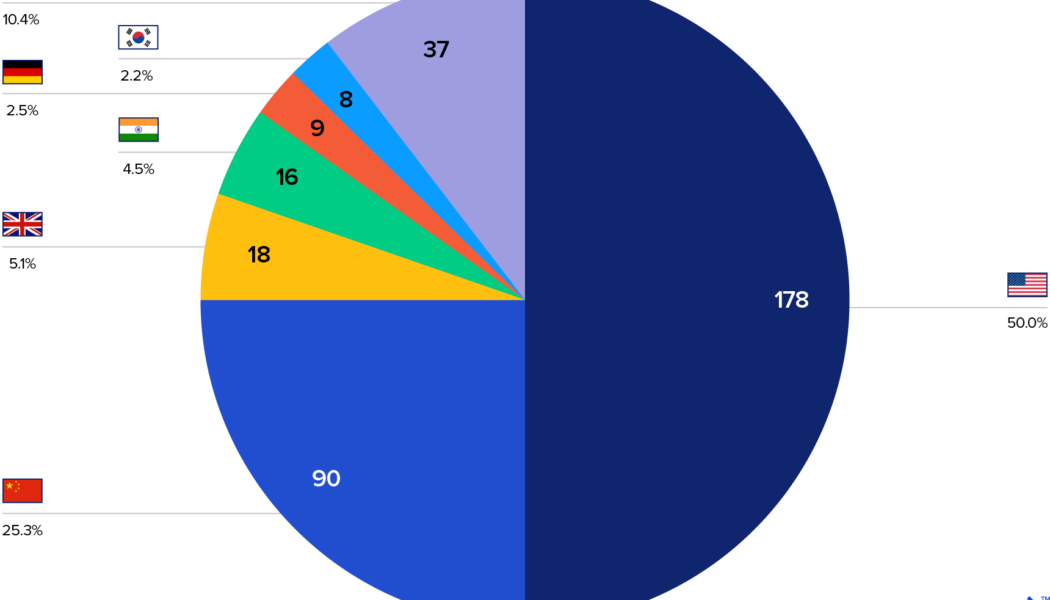

Last year was impressive for blockchain startups, as research from CB Insights found that venture capital funding reached new heights during every quarter of 2021. According to CB Insights’ “State Of Blockchain 2021” report, $25.2 billion worth of venture capital funding went to global blockchain startups last year, demonstrating a 713% increase from $3.1 billion in 2020. The report also found that the United States led the greatest amount of funding deals in Q4 of last year, generating $6.26 billion for 157 deals. The document notes that global growth was driven by increasing consumer and institutional demand for crypto-related products and services. VC funding focused on crypto adoption Chris Bendtsen, a senior analyst at CB Insights, told Cointelegraph that CB Insights’ report con...

How Blockchain and Crypto Can Lessen Financial Exclusion in Developing Countries

/* custom css */ .tdi_4_8ce.td-a-rec-img{ text-align: left; }.tdi_4_8ce.td-a-rec-img img{ margin: 0 auto 0 0; } While the COVID-19 crisis has reversed the recent global poverty reduction, according to the UN and other experts, it has also sped up financial inclusion via mobile financial services apps provided by crypto, blockchain and FinTech startups. Many people worldwide take for granted the services billions of others struggle to access. In their book “Financial Exclusion and the Poverty Trap,” authors Pamela Lenton and Paul Mosley assert that one of the main causes of poverty is financial exclusion, which they define as the inability to access finance from mainstream banks. /* custom css */ .tdi_3_d8d.td-a-rec-img{ text-align: left; }.tdi_3_d8d.td-a-rec-img img{ margin: 0 auto 0 0; } ...