Taxes

The regulatory implications of India’s crypto transactions tax

The Indian crypto landscape lost some momentum this year as the government introduced two laws demanding crippling taxes on crypto-related unrealized gains and transactions. India’s first crypto law, which requires its citizens to pay a 30% tax on unrealized crypto gains, came into effect on April 1. A commotion among the Indian crypto community followed as investors and entrepreneurs tried to decipher the impact of the vague announcement with little or no success. Knowing that India’s second crypto law — a 1% tax deduction at source (TDS) on every transaction — would translate into an even greater impact on trading activities, numerous crypto entrepreneurs from India considered moving bases to friendlier jurisdictions. Following the imposition of additional taxes, Indian crypto exchanges ...

US govt delays enforcement of crypto broker reporting requirements: Report

The provision in the U.S. infrastructure bill signed into law in November, which will require financial institutions and crypto brokers to report additional information, could reportedly be delayed. According to a Wednesday report from Bloomberg, the United States Department of the Treasury and Internal Revenue Service may not be willing to enforce crypto brokers collecting information on certain transactions starting in January 2023, citing people familiar with the matter. The potential delay could reportedly affect billions of dollars related to capital gains taxes — the Biden administration’s budget for the government for the 2023 fiscal year previously estimated modifying the crypto tax rules could reduce the deficit by roughly $11 billion. Under the current infrastructure bill, Sectio...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

Taxes of top concern behind Bitcoin salaries, Exodus CEO says

Major cryptocurrency wallet provider Exodus continues paying its employees in Bitcoin (BTC) despite the ongoing bear market, with the total market cap dropping below $1 trillion on Monday. Since launching its software crypto wallet back in 2015, Exodus has been paying its staff 100% in BTC, Exodus co-founder and CEO JP Richardson told Cointelegraph. The company continued to pay all its 300 employees in BTC even during major market downturns, by providing monthly payroll based on their salary in U.S. dollars. “For example, if Bitcoin is $30,000 per token, and someone makes $15,000 a month, they’ll get half a Bitcoin on the first of that month,” Richardson noted. In addition to converting each salary to BTC each month, Exodus also adds a small percentage to every “paycheck” to account for th...

Buenos Aires to accept crypto for tax payments, launch DLT-backed citizen profiles

The capital of Argentina and an agglomeration with more than 12 million citizens, Buenos Aires will make blockchain a vital part of its digitalization drive. Specifically, the city will accept public financial transactions in crypto. As city Mayor Horacio Rodríguez Larreta revealed in his Steve Jobs-styled presentation on April 25, the 12-step development plan titled “Buenos Aires +” envisions a significant increase in crypto and blockchain adoption. Con Buenos Aires + vamos a dar un paso más en el camino hacia un Estado facilitador que desburocratice y agilice los procesos. Un camino en el que el Estado sea el que se acerca a la gente, y no al revés. pic.twitter.com/yi6fUMmAUI — Horacio Rodríguez Larreta (@horaciorlarreta) April 26, 2022 The city authorities intend to launch a platf...

The new HM Treasury regulations: The good, the bad and the ugly

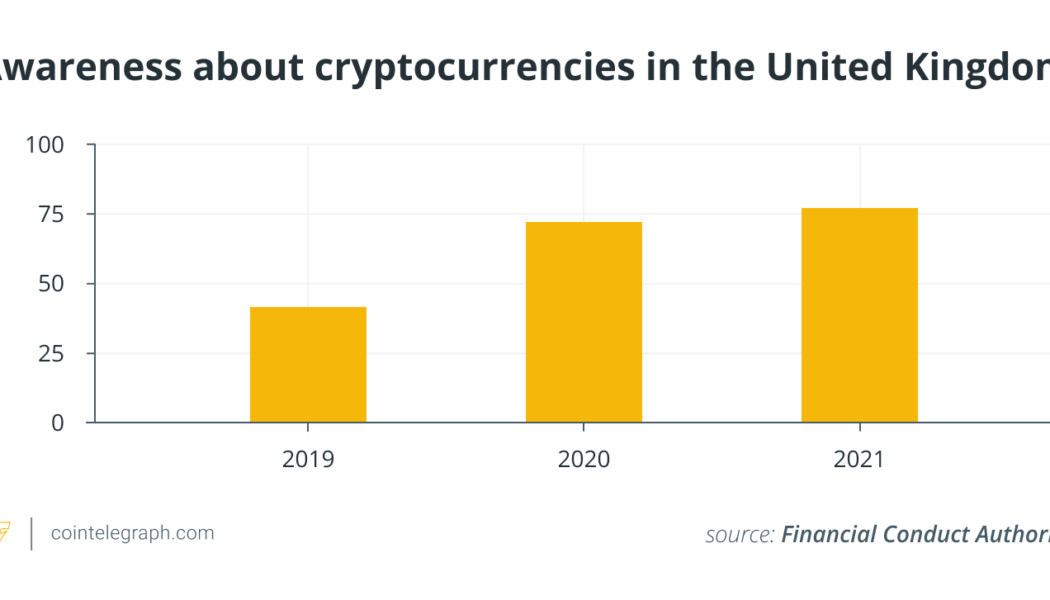

As the 2021-2022 United Kingdom tax year finished on April 5, 2022, Her Majesty’s Treasury announced they were paving the way for the U.K. to become a global crypto asset technology hub. This could mean that the previously not particularly crypto-friendly U.K. is changing its strategy and trying its hand at making crypto investments more attractive. But what are the potential scenarios at play? The Financial Conduct Authority (FCA), a financial regulatory body in the U.K., in its “Cryptoasset consumer research 2021” report, shows that approximately 2.3. million adult U.K. citizens held crypto in 2021, a 21% rise year-over-year. It seems natural that with rising interest and potential crypto mass adoption, HM Treasury would revisit its crypto regulations. This is especially true when ...

Indonesia to impose 0.1% crypto tax starting in May: Report

The Indonesian government is reportedly planning to charge a 0.1% capital gains tax on crypto investments as well as a value-added tax, or VAT, on digital asset transactions starting from May 1. According to a Friday Reuters report, Hestu Yoga Saksama, a spokesperson for Indonesia’s tax office, said the country will be imposing “income tax and VAT” on crypto assets “because they are a commodity as defined by the Trade Ministry” and “not a currency.” The government is still reportedly considering how to implement such taxes, but legislation passed in response to the pandemic laid the groundwork for collecting revenue on cryptocurrency transactions. Indonesia’s Commodity Futures Trading Regulatory Agency, also known as Bappebti, confirmed a report that in February 2022, crypto transactions i...

Law Decoded: Crypto taxes and taxes on crypto, March 21–28.

It was relatively quiet in the digital asset policy department last week, as regulators and lawmakers in most key jurisdictions retreated to their offices to do the necessary homework. In the U.S., federal agencies got on with the various reports that President Joe Biden’s recent executive orders directed them to produce. Over in the United Kingdom, both the central bank and the Financial Conduct Authority also dropped position papers on crypto-related issues. After thorough deliberation, Thailand’s financial authorities spoke out against using crypto as a means of payment, while rumors of potential legal tender adoption of crypto emerged and died in Honduras. One theme that has been conspicuous throughout the week is the relationship between digital assets and taxation. Few would argue th...

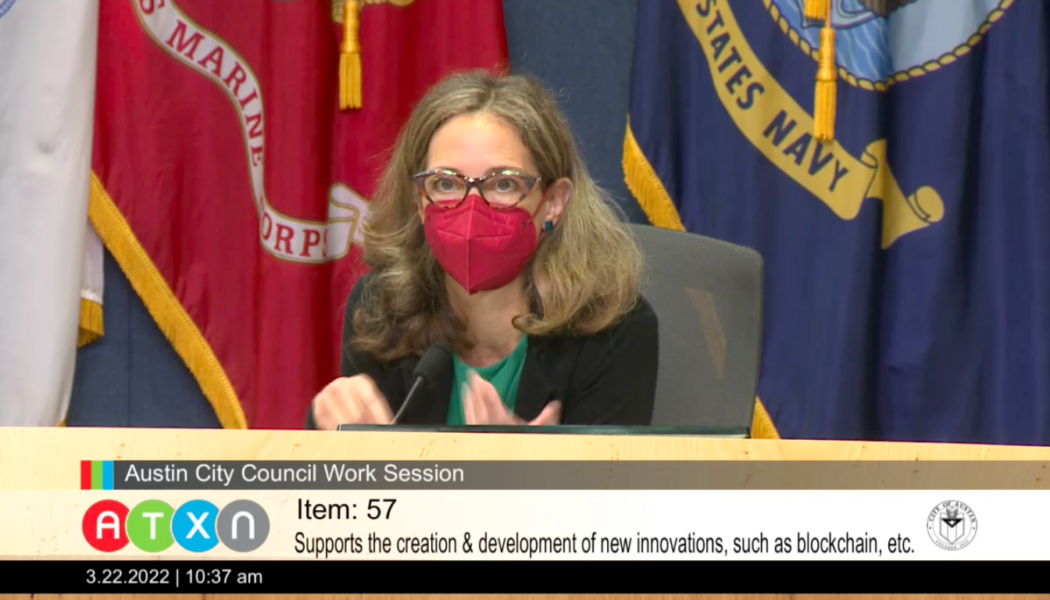

Is Austin the next US crypto hub? Officials approve blockchain resolutions

Innovative cities across America are racing to become the next hot spot for cryptocurrency and blockchain adoption. Miami was the first city to adopt its own part of CityCoins last year, allowing it to implement its own cryptocurrency called “MiamiCoin” to be used for civic engagement. New York City has also made a name for itself as a crypto-friendly city by implementing educational initiatives and withMayor Eric Adams receiving his paycheck in Bitcoin (BTC) in January this year. Austin takes a strong stance Most recently, Austin — the state capital of Texas that goes by the slogan “Keep Austin Weird” — has taken a strong interest in cryptocurrency and blockchain technology. While Texas’ desire to lead the way for crypto innovation was established about a year ago when G...

Rio de Janeiro to accept Bitcoin for real estate taxes from 2023

The Brazilian city of Rio de Janeiro will officially start accepting Bitcoin (BTC) payments for taxes related to urban real estate within their city limits, a.k.a. Imposto sobre a propriedade predial e territorial urbana (IPTU). As reported by Cointelegraph Brazil, the new pro-crypto tax laws will be implemented from 2023, which was announced by the Secretary of Economic Development, Innovation and Simplification, Chicão Bulhões. Work from anywhere = Rio! Welcome @binance… Rio on blockchain! @eduardopaes https://t.co/NJEArEvEXV — Chicão (@ChicaoBulhoes) March 26, 2022 Supporting this cause led by the Brazilian Mayor Eduardo Paes, Binance CEO Changpeng Zhao announced to open a new office in the region stating that “He’s done his part. We are working on ours.” 9 days ago, I made a hand...

Crypto tax policy framework passes India’s parliament despite pushback from lawmakers

A tax framework on cryptocurrencies introduced by India’s Finance Minister Nirmala Sitharaman will become law in the country after being passed as an amendment to the Finance Bill. On Friday, India’s lower house of parliament, the Lok Sabha, passed the 2022 Finance Bill, which included 39 amendments proposed by Sitharaman. The amendment on crypto established a 30% tax targeting digital asset and nonfungible token transactions and did not allow for deductions from trading losses while calculating income. In addition, taxpayers in India will have an additional 1% tax deducted at source, or TDS. As per the new amendment proposed in the Finance bill 2022 to sections of crypto tax. Loss cant be set off against any profit. Similar to betting tax rules. #reducecryptotax — Aditya Singh (@CryptooAd...