Tax

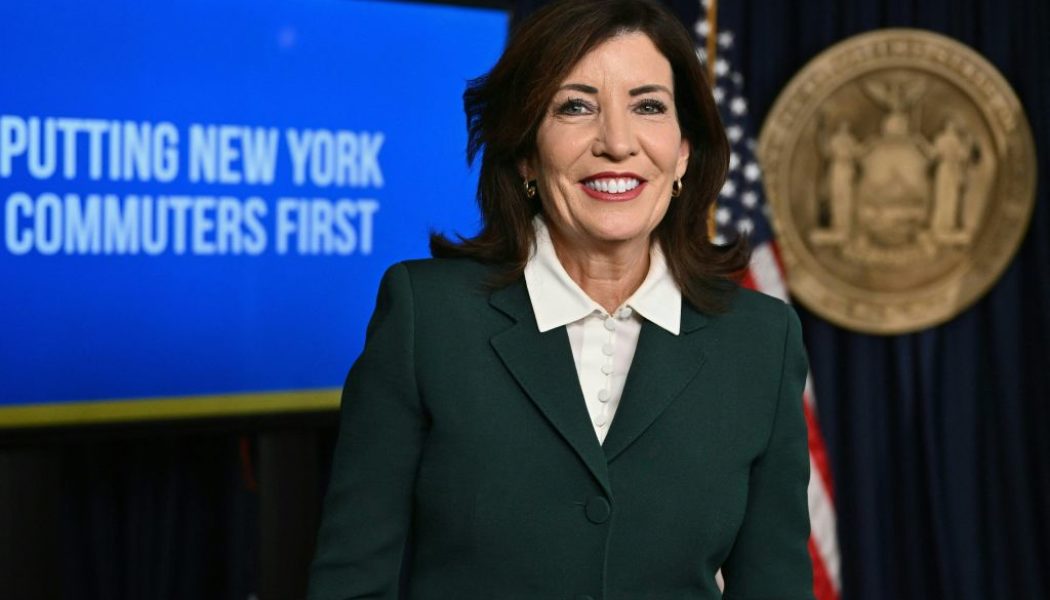

Governor Hochul To Bring Back Congestion Pricing In NYC

Living in the Big Apple is about to get even more expensive. Governor Hochul is about to bring back congestion pricing to New York City. As reported by the New York Times, the politician has announced she is reviving her plan for congestion pricing. Originally announced in April, state officials were aiming to impose an additional […]

Governor Cancels New York City’s Proposed Congestion Pricing

Commuters in the Big Apple are breathing a sigh of relief. New York City’s proposed congestion pricing has been shelved by the state’s governor. As reported by Raw Story, the Metropolitan Transit Authority has put the first ever congestion pricing on pause. Back in April, it was announced that New York City would impose additional tolls […]

IRS introduces broader ‘Digital Assets’ category ahead of 2022 tax year

American taxpayers will find a broader, more defined category encompassing cryptocurrencies and nonfungible tokens (NFTs) in their 2022 IRS tax forms. The draft bill released by the Internal Revenue Service features a well-defined Digital Assets section that outlines if and how taxpayers will account for the use of cryptocurrencies, stablecoins and NFTs. Page 16 of the draft defines Digital Assets as any digital representations of the value recorded on a ‘cryptographically secured distributed ledger or any similar technology.’ 2021’s tax form required taxpayers to indicate whether they had received, sold or exchanged in ‘virtual currency’ – with this term changing in the yet-to-issued 1040 tax form for 2022. Taxpayers are required to answer the Digital Assets s...

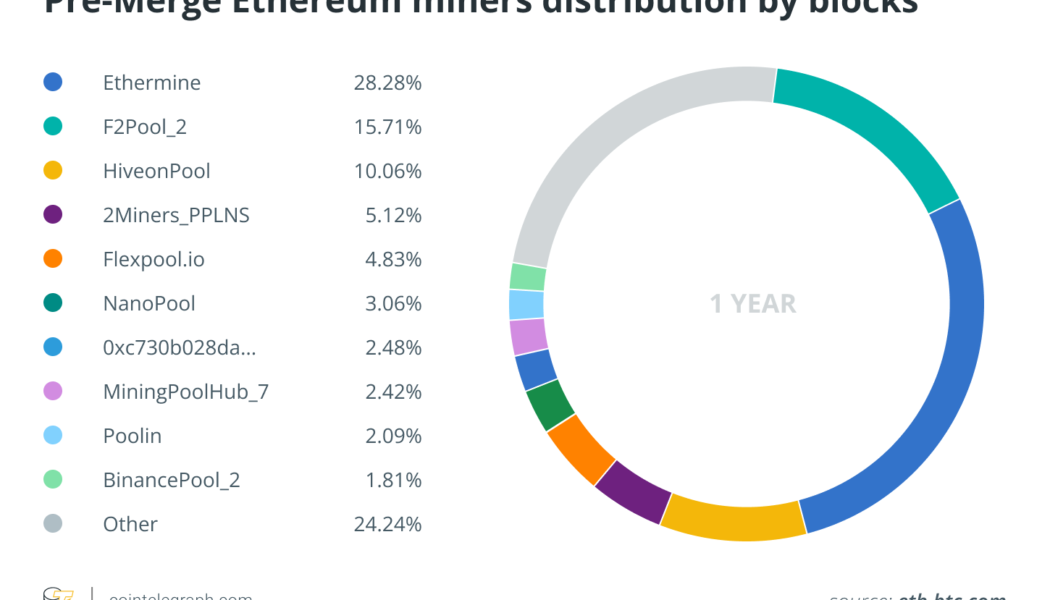

Tax on income you never earned? It’s possible after Ethereum’s Merge

After much buildup and preparation, the Ethereum Merge went smoothly this month. The next test will come during tax season. Cryptocurrency forks, such as Bitcoin Cash, have created headaches for investors and accountants alike in the past. While there has been progress, the United States Internal Revenue Service rules still weren’t ready for something like the Ethereum network upgrade. Nonetheless, there seems to be an interpretation of IRS rules that tax professionals and taxpayers can adopt to achieve simplicity and avoid unexpected tax bills. How Bitcoin Cash broke 2017 tax returns Because of a disagreement over block size, Bitcoin forked in 2017. Everyone who held Bitcoin received an equal amount of the new forked currency, Bitcoin Cash (BCH). But when they received it caused some issu...

P2E gamers, minors not any safer from the tax man, says Koinly

Modern parents are going to need to keep an even closer eye on their kids’ gaming habits, as some of them may be accumulating a hefty tax bill, according to a crypto tax specialist. Speaking to Cointelegraph during last week’s Australian Crypto Convention, Adam Saville-Brown, regional head of tax software firm Koinly said that many don’t realize that earnings from play-to-earn (P2E) games can be subject to tax consequences in the same way as crypto trading and investing. This is particularly true for play-to-earn blockchain games that offer in-game tokens that can be traded on exchanges and thus have real-world financial value. “Parents were once worried about their kids’ playing games like GTA, with violence […] but parents now need to be aware of a whole new level […] tax complexit...

UK police seize $249.5 million worth of cryptocurrency

The British police on Tuesday said they have seized £180 million ($249.5 million) of an undisclosed cryptocurrency, as part of a money laundering investigation launched against organised crime groups that moved into cryptocurrencies in order to clean their money. The latest seizure happened in less than three weeks after the London police made a £114 million haul on June 24 as part of its money laundering investigation. By this, a cryptocurrency payload totalling £294 million ($408 million) has been reportedly seized so far under the money laundering investigation. “While cash still remains king in the criminal world, as digital platforms develop we’re increasingly seeing organised criminals using cryptocurrency to launder their dirty money,” Reuters quoted Graham McNulty, a metropolitan P...