Synthetix

What is CeDeFi, and why does it matter?

Among the advantages of CeDeFi are lower fees, better security, accessibility, speed and lower cost. CeDeFi’s innovative approach to decentralized banking enables users to trade CeDeFi crypto assets without requiring a centralized exchange. This implies that users may transact directly with one another, removing the need for an intermediary. Among CeDeFi’s major advantages is lower fees. CeDeFi transactions cost lower than those on comparable platforms since there are fewer middlemen involved, especially on networks that are not Ethereum-based. Ethereum has very high gas fees, for instance, with DEX transactions running into hundreds of dollars. It also often causes network congestion issues, leading to delays. Binance CeDeFi, on the other hand, has much lower fee...

DeFi summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms

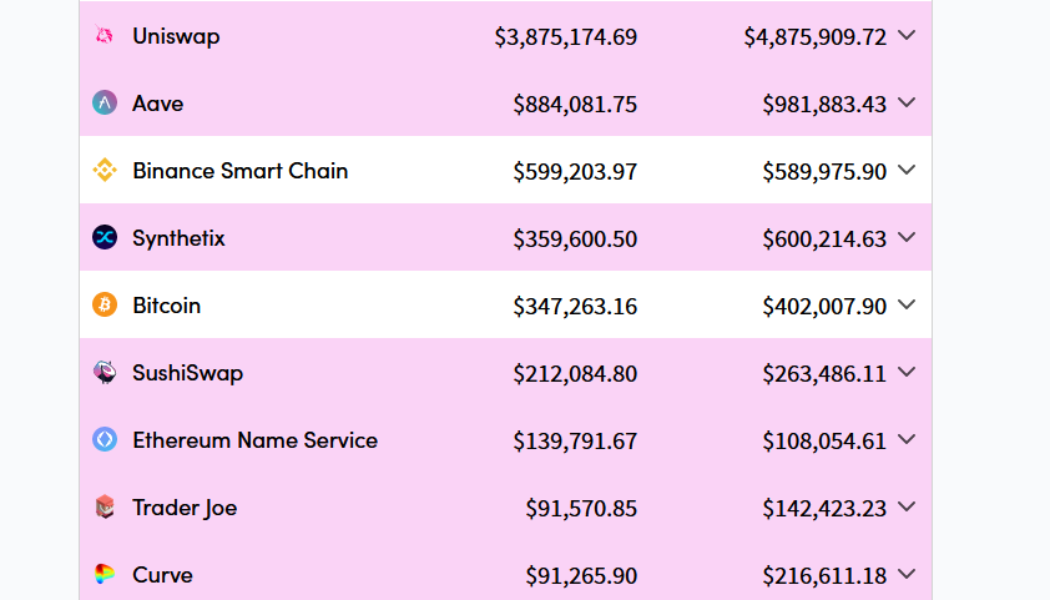

Decentralized exchange (DEX) Uniswap has overtaken its host blockchain Ethereum in terms of fees paid over a seven-day rolling average. The surge appears part of a recent spate of high demand for DeFi amid the current bear market. Decentralized finance (DeFi) platforms such as AAVE and Synthetix have seen surges in fees paid over the past seven days, while their native tokens, and others such as Compound (COMP) have also boomed in price too. According to data from Crypto Fees, traders on Uniswap accounted for an average daily total of $4.87 million worth of fees between June 15 and June 21, overtaking the average fees from Ethereum users which accounted for $4.58 million. Uniswap’s most advanced V3 protocol (based on the Ethereum mainnet) accounted for the lion’s share of the total f...

Synthetix racks up over $1M in daily fees as SNX token value surges 100%

Layer-2 scaling solution Synthetix recently collaborated with liquidity provider Curve Finance to create Curve pools for sETH/ETH, sBTC/BTC, & sUSD/3CRV, allowing investors to cheaply convert synths such as sETH to Ether (ETH). Given the investors’ willingness to hold tokens instead of synths, the protocol racked up over $1.02 million in trading fees — overshadowing Bitcoin’s (BTC) daily performance by five times. Synthetix, Ethereum-based decentralized finance (DeFi) protocol, created a buzz across the crypto ecosystem after witnessing a sudden increase in trading activities and an unprecedented comeback of its in-house token, SNX, during an unforgiving bear market. Crypto fees of popular projects. Source: cryptofees.info As a direct result of the massive trading volumes, the SNX...

Sushi and Synthetix get the boot in Grayscale DeFi fund rebalancing

Digital asset management firm Grayscale, has added three new cryptocurrency assets across three main investment funds, while removing two other assets from its Decentralized Finance Fund as part of this year’s first quarterly rebalance. Grayscale removed tokens from crypto-derivatives decentralized exchange Synthetix (SNX), and decentralized exchange SushiSwap (SUSHI), from its DeFi fund after the two crypto assets failed to meet the required minimum market capitalization. No other cryptocurrencies were removed during the rebalancing. Grayscale’s DeFi fund, which was launched in July last year, currently holds approximately $8 million in assets. The digital assets remaining in the DeFi fund after the quarterly rebalance include Uniswap (UNI), Aave (AAVE), Curve (CRV), MakerDAO (MKR),...