Stocks

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Bitcoin declines with US stocks as nuclear threat ripples through markets

Bitcoin (BTC) bulls saw no relief at the Wall Street open on March 4 as the $40,000 support appeared on the horizon. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: Markets “shaky,” but BTC could bounce Data from Cointelegraph Markets Pro and TradingView revealed new March lows of $40,551 for BTC/USD on Bitstamp, taking two-day losses to 10.2%. Fears over the security of Ukraine’s nuclear infrastructure drove not just crypto but traditional markets lower on the day, with the S&P 500 following European indexes to decline by 1.4%. “Bitcoin correcting as tensions around Ukraine are increasing, and fear is increasing too as Gold is rushing upwards,” Cointelegraph contributor Michaël van de Poppe explained in his latest Twitter update. “Might be seeing a b...

Bitcoin traders say $34K was the bottom, but data says it’s too early to tell

Bitcoin (BTC) price traded down 23% in the eight days following its failure to break the $45,000 resistance on Feb. 16. The $34,300 bottom on Feb. 24 happened right after the Russian-Ukraine conflict escalated, triggering a sharp sell-off in risk assets. While Bitcoin reached its lowest level in 30 days, Asian stocks were also adjusting to the worsening conditions, a fact evidenced by Hong Kong’s Hang Seng index dropping 3.5% and the Nikkei also reached a 15-month low. Bitcoin/USD at FTX. Source: TradingView The first question one needs to answer is whether cryptocurrencies are overreacting compared to other risk assets. Sure enough, Bitcoin’s volatility is much higher than traditional markets, running at 62% per year. As a comparison, the United States small and mid-cap stock ...

NY stock exchange owner ICE buys stake in tZero security token platform

The Intercontinental Exchange (ICE) has announced a strategic investment in private digital securities marketplace and crypto asset liquidity platform tZero. ICE, which owns and operates 12 global exchanges including the New York Stock Exchange (NYSE), made the announcement on Feb. 22, however, there was no mention of the terms or details of the investment other than ICE becoming a “significant minority shareholder” in tZero. It did state that as part of the investment, ICE’s Chief Strategy Officer David Goone will join tZero as its new CEO serving on the board of directors. tZero operates a blockchain-based alternative trading system (ATS) upon which companies can list tokenized versions of their stocks. The firm is fully regulated with the Securities and Exchange Commission (SEC) and act...

BTC price returns to $43K — 5 things to watch in Bitcoin this week

Bitcoin (BTC) is in a fighting mood this week as the weekly close buoys bulls’ cause and wipes out several weeks of downside — can it continue higher? After challenging $42,000 over the weekend, there was a cautious sense of optimism as higher levels remained in play. Sunday saw a fresh push, with overnight progress attacking $43,000 before fresh consolidation. With Monday’s Wall Street open primed to deliver more of the turbulence in big tech stocks seen late last week, the environment for crypto traders is an interesting one in February. With its notable positive correlation, Bitcoin is thus sensitive to moves up and down — but equities refuse to move unanimously in the same direction. Looking for guidance, hodlers will still remember January’s lows, and these are also fresh in the mind ...

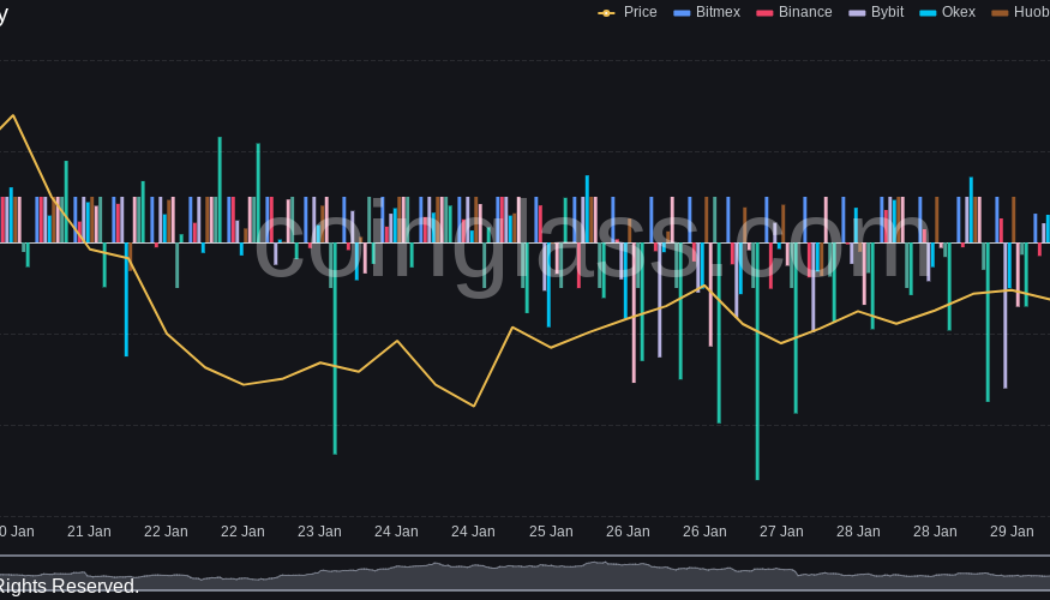

Bitcoin returns to $40K, liquidating over $50M of shorts in hours

Bitcoin (BTC) returned to $40,000 for the first time in two weeks during Feb. 4 as Wall Street volatility proved a boon for BTC bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Liquidations mount for BTC shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD suddenly jumping past the $40,000 on Feb. 4, just two hours after the Wall Street open produced rapid gains. At the time of writing, the pair was up $3,000 in two hours — an unexpectedly strong performance, which naturally caused short sellers significant pain. According to on-chain monitoring resource Coinglass, BTC liquidations were $50 million over the most recent four-hour period, with cross-crypto liquidations passing $100 million. BTC liquidations chart. Source: Coinglass Analysts, who we...

US crypto executive order looms — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with a bang — but not in the right direction for bulls. A promising weekend nonetheless saw BTC/USD attract warnings over spurious “out of hours” price moves, and these ultimately proved timely as the weekly close sent the pair down over $1,000. At $37,900, even that close was not enough to satisfy analysts’ demands, and the all-too-familiar rangebound behavior Bitcoin has exhibited throughout January thus continues. The question for many, then, is what will change the status quo. Amid a lack of any genuine spot market recovery despite solid on-chain data, it may be an external trigger that ends up responsible for a shake-up. The United States’ executive order on cryptocurrency regulation is due at some point in February, for ex...

Terra (LUNA) at risk of 50% drop if bearish head-and-shoulders pattern plays out

Terra (LUNA) may fall to nearly $25 per token in the coming weeks as a head-and-shoulders (H&S) setup develops, indicating a 50% price drop, according to technical analysis shared by CRYPTOPIKK. H&S patterns appear when the price forms three peaks in a row, with the middle peak (called the “head”) higher than the other two (left and right shoulders). All three peaks come to a top at a common price floor called the “neckline.” Traders typically look to open a short position when the price breaks below the H&S neckline. However, some employ a “two-day” rule where they wait for the second breakout confirmation when the price retests the neckline from the downside as resistance, before entering a short position. Meanwhile, the ideal short ta...

House members call for an end to lawmakers trading stocks — is crypto next?

Congresspeople currently HODLing or actively trading in crypto may have to stop doing so while in office if recent pushes to ban lawmakers from investing in stocks gain enough support. In a Monday letter addressed to Speaker Nancy Pelosi and Minority Leader Kevin McCarthy, 27 members of the U.S. House of Representatives called for action “to prohibit members of Congress from owning or trading stocks.” Among the bipartisan group of lawmakers who signed onto the letter was Illinois congressperson Bill Foster, who is also a member of the Congressional Blockchain Caucus. In addition, the letter seems to have support from politicians diametrically opposed on major issues like Progressive Democrat Rashida Tlaib and Republican Matt Gaetz, who is reportedly under investigation by the Justice Depar...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...

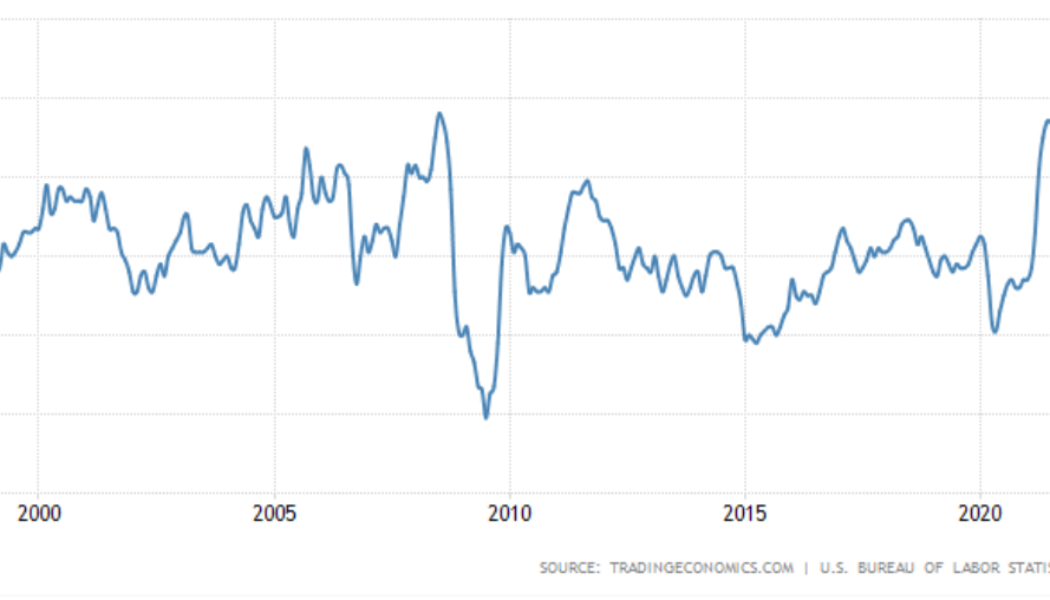

New year, same ‘extreme fear’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) begins its first full week of 2022 in familiar territory below $50,000. After ending December at $47,200 — far below the majority of bullish expectations — the largest cryptocurrency has a lot to live up to as signs of a halving cycle peak remain nowhere to be found. With Wall Street set to return after stocks conversely ended the year on a high, inflation rampant and interest rate hikes looming, 2022 could soon turn out to be an interesting market environment, analysts say. So far, however, all is calm — BTC/USD has produced no major surprises for weeks on end. Cointelegraph takes a look at what could change — or continue — the status quo in the coming days. Stocks could see 6 months of “up only” Look no further than the S&P 500 for an example of the state of...